The complex world of investing simplified to a single financial data platform

Experience innovation in investment research with a complete financial data platform that lets you research, build and backtest your investment strategies.

EquityRT simplifies investment research by giving you a complete financial data platform that lets you research, build and test investment strategies before taking the plunge.

Trusted by leading organisations across the globe

Your financial research and analysis needs in one place

Turn information into insights

Easily conduct investment research with access to a rich coverage of financial market data, latest company earnings, analyst estimates and recommendations, funds data and much more.

Boost productivity with automated analysis

Save time and improve your productivity with a range of intuitive analysis tools from advanced charting, online custom data grids to a robust excel addin.

Generate Investment Ideas

Detailed sector analysis, peer comparisons, shareholder analysis and flexible stock screening helps you easily identify the best investment opportunities.

Build and Backtest your Investment Strategy

Easily conduct investment research with access to a rich coverage of financial market data, latest company earnings, analyst estimates and recommendations, funds data and much more.

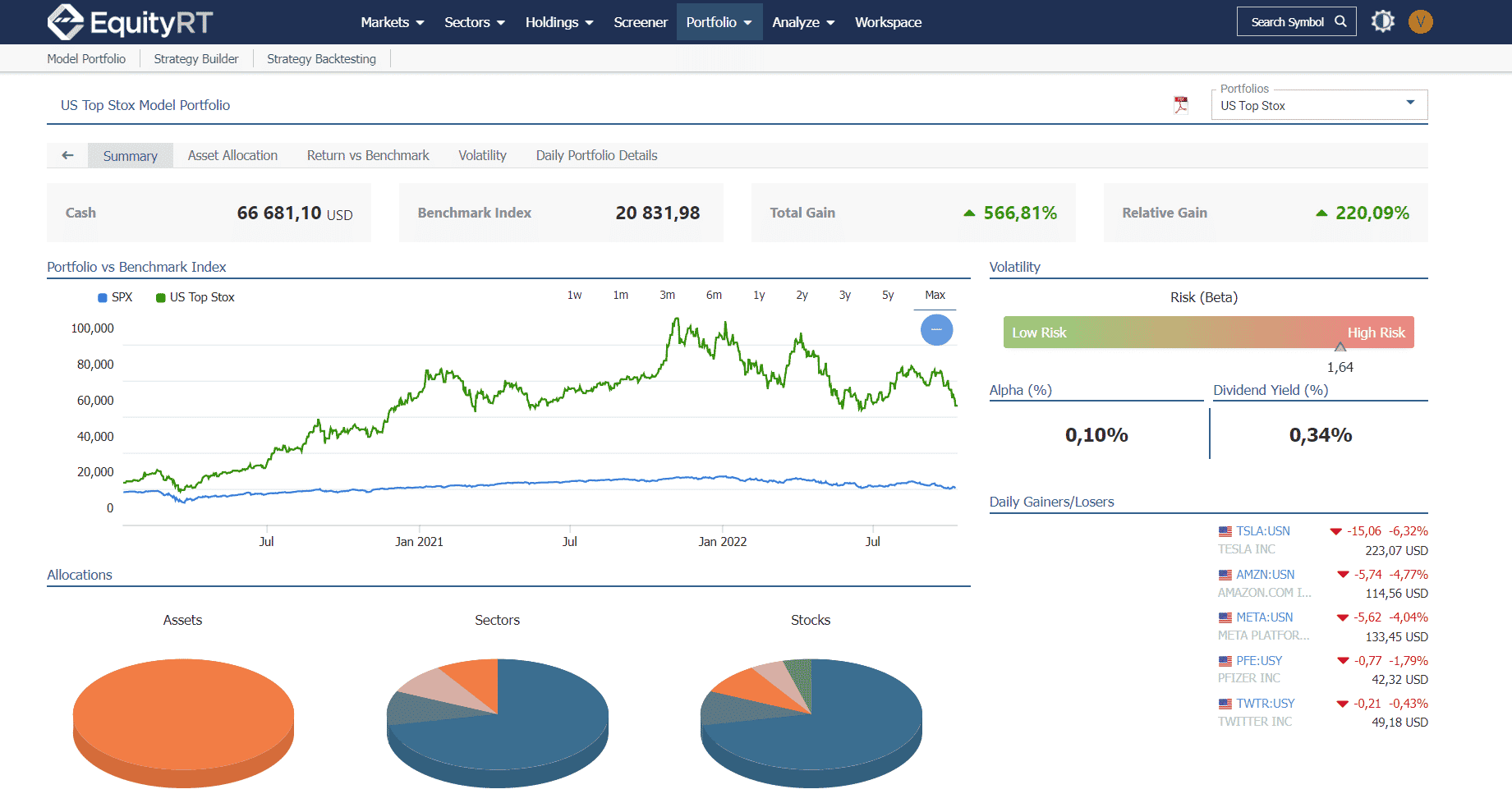

Take control of your Model Portfolios

Setup and monitor and track the performance of your model portfolios with ease.

Investment Research just got easier and faster

Next generation of intuitive financial analysis tools that do the heavy lifting for you.

Strategy Builder and Backtesting

EquityRT’s unique algorithm uses fundamental ratio rankings, weightings and country positions to score stocks and build your investment strategy.

Backtest your strategy and assess its success before making an investment.

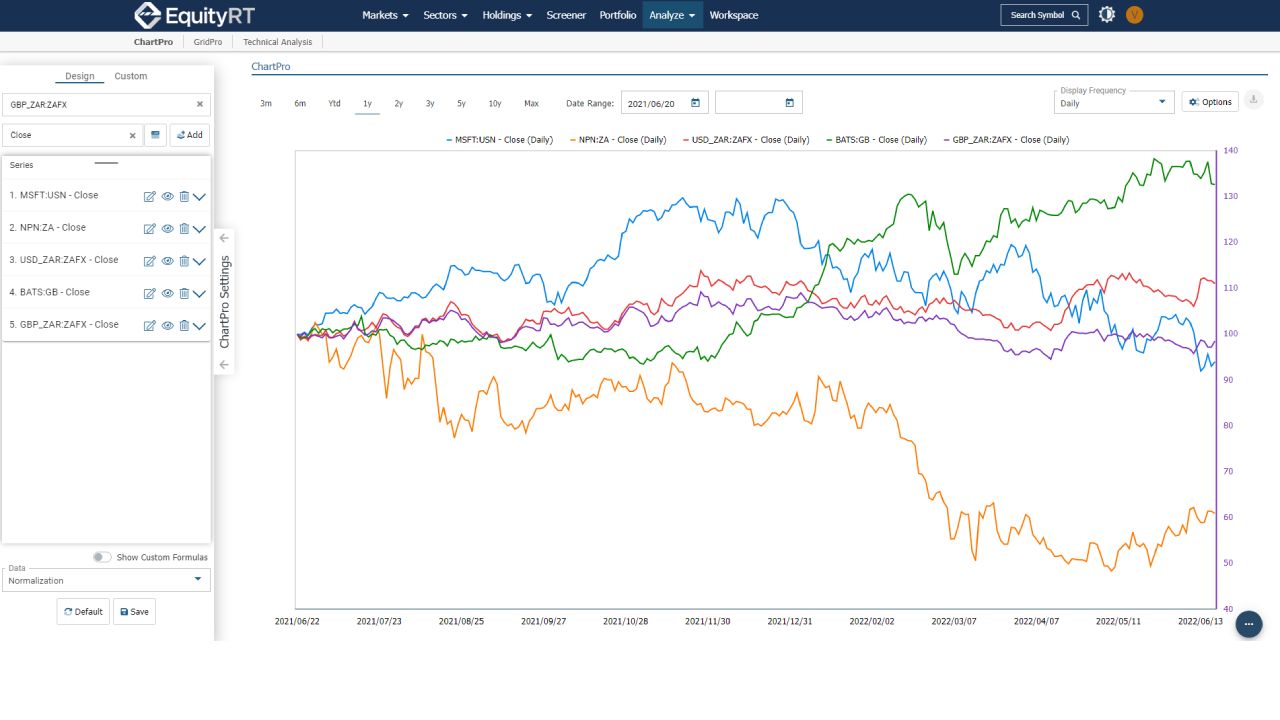

Advanced Charting

Enhanced charting capabilities enables you to charts any data type from daily market data to fundamental or economic data.

Build and chart custom formulae easily.

Model Portfolio

Setup your model portfolio and monitor its performance through a series of visually insightful dashboards giving you information on your portfolio volatility, asset and sector allocations.

Analyse Industries

Gain insights into industry sectors and peer stock performance and estimates.

Benchmark a stocks key fundamental metrics against its industry peers.