Global Markets Recap

U.S. Markets:

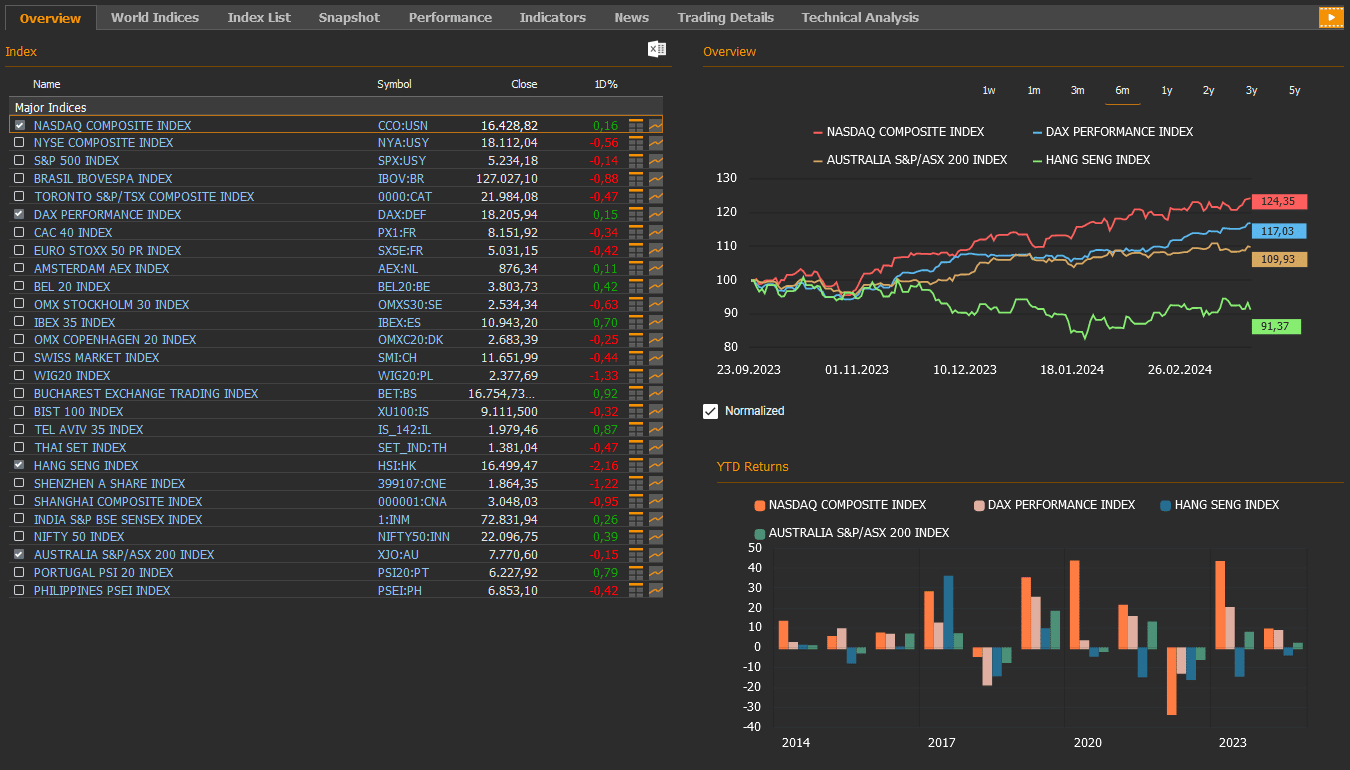

- On Friday, the Nasdaq composite index (CCO:USN) closed the day with a 0.16% gain to 16,428.82, the NYSE composite index (NYA:USY) decreased by 0.56% to 18,112.04, the S&P 500 index (SPX:USY) dropped by 0.14% to close at 5,234.18, and the Dow Jones Industrial Average index (DJI:DJ) declined by 0.77% to 39,475.90.

- The US stock market will be closed on Friday in observance of the Good Friday holiday.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 104 marking a 0.6% weekly increase.

- The Brent crude oil (LCO07:USC) closed the previous week at USD 85.4 per barrel, reflecting a weekly 0.1% rise.

- The price of gold (XAU/USD:USC) closed last week with a 0.4% rise, settling at USD 2,165 per ounce.

-

The 10-year U.S. Treasury yield (USGG10YR:BND) completed the week with a 11 basis points decrease, settling at 4.20%. The 2-year U.S. Treasury yield (USGG2YR:BND), particularly responsive to Federal Reserve policy rates, closed at 4.60% down by 14 basis points.

European Markets:

- European stocks finished mostly down Friday, as the Stoxx Europe 600 index (SXXP:FR) lost 0.03% to 509.64. The German DAX index (DAX:DEF) rose 0.15% to 18,205.94, and the French CAC 40 index(PX1:FR) lost 0.34% to 8,151.92.

Asian Markets:

- Stocks in the Asia-Pacific region mostly down on Friday, March 22. Hong Kong stocks decreased with the Hang Seng index (HSI:HK) lost 2.16% at 16,499.47, while the Nikkei 225 index (100000018:JPT) rose by 0.18% to 40,888.43 and China’s Shanghai Composite index (000001:CNA) lost 0.95% to 3,048.03.

- The S&P/ASX 200 Benchmark index (XJO:AU) in the Australian stock market lost 0.15% to 7,770.60.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

- Federal Reserve Decision and Policy Stance

The Fed kept the federal funds rate range unchanged at 5.25% to 5.50%, consistent with expectations, marking the fifth consecutive meeting without any changes to interest rates. The decision was made unanimously. Additionally, the Fed stated that it would not consider lowering the policy rate until there is more confidence that inflation will sustainably decrease to 2%, emphasizing the need for greater confidence in inflation before considering any rate cuts.

Fed Chair Powell noted in his post-meeting speech that while inflation has significantly moderated, it remains high. He reiterated that if the economy continues to perform as expected, it may be appropriate to begin reducing interest rates at some point this year.

- Interest Rate Path and Projections

The Fed also released its new interest rate path and macroeconomic projections. According to the median forecasts, while the federal funds rate is expected to remain unchanged for this year, it has been slightly revised upwards for the next two years. Specifically, the year-end rate is expected to remain at 4.6% for this year, revised from 3.6% to 3.9% for 2025, and from 2.9% to 3.1% for 2026.

Economic growth forecasts for the next three years have been revised upwards. In particular, the growth forecast for this year has been significantly revised upwards from 1.4% to 2.1%, while it has been revised from 1.8% to 2% for 2025 and from 1.9% to 2% for 2026.

Unemployment rate forecasts have been slightly revised downwards for this year and 2026, while they remain unchanged for 2025. Accordingly, the unemployment rate has been revised downwards from 4.1% to 4% for this year and 2026, while it remains at 4.1% for 2025.

When looking at the Fed’s preferred inflation gauge, the PCE inflation, forecasts for this year remain at 2.4%, while they have been slightly revised upwards from 2.1% to 2.2% for 2025. The forecast for 2026 remains at 2%.

Core PCE inflation forecasts have been slightly revised upwards from 2.4% to 2.6% for this year, while they remain at 2.2% for 2025 and 2% for 2026.

- Economic Activity in Manufacturing and Services Sectors

In the US, the S&P Global manufacturing and services sector PMI data for March released last week. Accordingly, the manufacturing sector PMI for March increased from 52.2 to 52.5, indicating a slight acceleration in growth in the manufacturing sector.

The services sector PMI for March, decreased from 52.3 to 51.7, indicating a slight slowdown in growth in the services sector and the slowest growth level in the last three months. However, growth continued in the expansionary territory for the 14th consecutive month.

The Philadelphia Fed Manufacturing Index in the US decreased to 3.2 in March 2024 from 5.2 in February but came above market estimates of -2.3.

- Labor Market and Housing Data

In the US, labor market data, weekly initial jobless claims for the week ending March 16, despite expectations of a slight increase, decreased from 212,000 to 210,000, remaining below historical averages and indicating a tight labor market. Meanwhile, continued jobless claims remained largely unchanged at 1,807,000 for the previous week. The slight increase in the four-week moving average, up by 2,500 to 211,250, smoothened out short-term fluctuations.

Additionally, housing market data, following a 3.1% increase in existing home sales in January, February saw a further 9.5% increase, surpassing expectations of a decrease, marking the strongest increase in the past year.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

U.S. Economic Data Highlights for the Week

This week in the United States, all eyes will be on Friday’s Fed Chair Powell’s speech.

Tuesday will see the release of the February preliminary data for durable goods orders, providing insights into the trajectory of manufacturing activity. After a significant decline of 6.1% in January following a 0.3% drop in December, analysts anticipate a partial rebound with a projected 1% increase in durable goods orders for February. Notably, the sharp decline in January was primarily attributed to notable decreases in orders for transportation equipment, including non-defense aircraft and parts.

- Consumer Confidence Index

The Conference Board Consumer Confidence Index for March will also be released on Tuesday. In February, the index declined from 110.9 to 106.7, marking the end of a three-month upward trend. The decline was driven by increasingly pessimistic assessments of current conditions and future job market prospects. Specifically, the index reflecting current conditions decreased from 154.9 to 147.2, while the expectations index dropped from 81.5 to 79.8, falling below the recessionary threshold of 80 for the first time in two months. Analysts anticipate the index to remain steady at 106.7 in March.

- GDP Growth and Personal Income

The final data for annualized quarterly GDP growth for Q4 2023 will be released on Thursday. Following a slight deceleration from 2.2% in Q1 to 2.1% in Q2, the US economy witnessed robust growth, with a surge to 4.9% in Q3. However, growth moderated slightly to 3.2% in Q4 with downward revisions attributed to factors including private inventory investment and federal government spending. Overall, the US economy expanded by 2.5% in 2023, following a 1.9% growth in 2022.

- Personal Income and Spending

Also on Thursday, data for personal income and spending in February will be released. Expectations include a 0.4% increase in the PCE deflator on a monthly basis, maintaining a steady annual rate of 2.5%. Core PCE deflator is projected to slow down slightly from 0.4% to 0.3% on a monthly basis, with an annual rate remaining at 2.8%.

Analysts anticipate personal income growth to decelerate from 1% to 0.4% monthly, while personal spending is expected to increase from 0.2% to 0.4%.

- Other Data Releases in the U.S.

The final data for the Michigan Consumer Sentiment Index for March will be released on Thursday. In March, consumer sentiment dipped slightly to 76.5, marking its lowest level in three months, down from 76.9 in February and falling short of the expected 76.9. Initial estimates revealed that while there were minor enhancements in personal finances, these were overshadowed by slight decreases in expectations regarding business conditions.

Thursday will also see the release of the weekly initial jobless claims data. The previous week saw a decline in claims to 210,000, indicating continued strength in the labor market.

New home sales for February, the S&P/Case-Shiller Home Price Index for January, and pending home sales data for February will be released throughout the week, providing insights into the dynamics of the housing market.

Take the guesswork out of investing: Backtest your strategies with ease!

European Economic Outlook and Economic Events

- Business Sentiment in Germany

In Germany, the IFO Business Climate Index for March surpassed expectations by rising from 85.7 to 87.8, marking its highest level since June 2023.

- Economic Activity in Europe

Preliminary Purchasing Managers’ Index (PMI) data for the manufacturing and services sectors in Europe provided insights into the current economic landscape. Manufacturing PMIs remained below the 50 threshold indicating contraction due to tightening financial conditions and sluggish demand. Services PMIs in the region, except for the UK and Eurozone, continued to show contraction below the 50 threshold.

- Consumer Confidence in the Eurozone

Preliminary consumer confidence data for March in the Eurozone showed a slight improvement, albeit remaining negative at -14.9, indicating ongoing weakness in the region.

- Producer Prices in Germany

Germany’s Producer Price Index (PPI) for February recorded a higher-than-expected decrease of 0.4% from the previous month, resulting in an eighth consecutive month of decline. Producer prices fell by 4.1% year-on-year in February, following a 4.4% fall in January and compared with market expectations of a 3.8% decline. This marked the eighth consecutive month of producer deflation in Germany driven by slump in energy costs (-10.1%).

- Inflation Figures in the UK

February’s Consumer Price Index (CPI) in the UK showed a moderate increase of 0.6% from January, falling slightly below expectations. The annual CPI slowed to 3.4% from 4% in January, falling below the market expectation of 3.5% and reaching its lowest level since September 2021. The annual core inflation rate, which excludes energy and food, fell to 4.5%, the lowest rate since January 2022 and slightly below the market expectation of 4.6%

- Trade Balance in the Eurozone

In January, the Eurozone’s trade surplus decreased to 11.4 billion euros from 16.8 billion euros, its lowest level in three months, as exports rose by 3.5% monthly while imports increased by 6.5% monthly.

- Central Bank Meetings

The Bank of England (BoE) maintained its policy interest rate at 5.25%, consistent with expectations, marking the fifth consecutive meeting without a change and sustaining rates at their highest level in 15 years.

The Central Bank of Norway kept its policy interest rate steady at 4.50%, in line with expectations, signaling that the rate would remain at its current level until autumn.

Contrary to expectations, the Swiss National Bank unexpectedly reduced its policy interest rate by 25 basis points to 1.50% from 1.75%, marking its first rate cut in nine years amid rising inflation pressures.

The Central Bank of Russia kept its policy interest rate steady at 16%, consistent with expectations, maintaining its highest level since April 2022. Despite signs of easing inflation pressure in the country, the Bank emphasized the ongoing high level of inflation and the continued surpassing of production capacities by domestic demand.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

The upcoming week will see a light economic data activity in Europe due to the Easter break, as all major stock exchanges will be closed for both Good Friday and Easter Monday.

- Consumer Confidence Data in Germany and Eurozone

On Tuesday, Germany will release the GfK Consumer Confidence Index for April, reflecting outlooks for the upcoming month. The GfK Consumer Confidence Index for March in Germany showed a slight improvement from the lowest level in 11 months, reaching -29, in line with expectations, but still indicating weak sentiment in the negative territory.

On Wednesday, the Eurozone will publish the final Consumer Confidence Index for March.

In the Eurozone, the preliminary Consumer Confidence Index for March also saw a slight recovery from -14.9, remaining in the negative territory, indicating ongoing weak sentiment.

- UK Gross Domestic Product (GDP) Growth

On Thursday, the final GDP growth data for the Q4 2023 will be released for the UK.

Following a 0.2% quarterly growth rate in Q1, the UK economy showed stagnation with 0% growth in Q2, followed by a 0.1% contraction in Q3. The preliminary data for Q4 indicated a sharper-than-expected contraction of 0.3%, pushing the economy into a recession. Details of Q4 GDP data revealed a 0.1% decline in private consumption, a 0.3% decrease in public spending, and a 1.4% increase in fixed capital investment, alongside a 2.9% decline in exports and a 0.8% drop in imports.

On an annual basis, the economy contracted by 0.2% in Q4, following a 0.2% growth in Q3. This indicates the fourth month of no annual growth.

- Monetary Policy Meeting of the Swedish Central Bank

Wednesday will also see the monetary policy meeting of the Swedish Central Bank. In its February meeting, the bank maintained its policy interest rate at 4%, as expected, citing a moderation in concerns about high inflation resulting from previous rate hikes. It is expected that the bank will maintain its policy interest rate at 4% in this week’s meeting.

Take the guesswork out of investing: Backtest your strategies with ease!

Upcoming Economic Highlights Across Asia-Pacific

- China’s Economic Updates

The People’s Bank of China (PBoC) maintained the benchmark one-year Loan Prime Rate (LPR) at 3.45% for short-term loans, and the benchmark five-year LPR at 3.95% for long-term loans.

- Foreign Investment Trend in China

Foreign direct investment (FDI) inflows into China dropped by 19.9% year-on-year to CNY 215.1 billion or $30 billion in the first two months of 2024. Notably, approximately CNY 71.44 billion was directed into high-tech industries, including high-tech manufacturing.

Meanwhile, foreign investment in the construction sector surged by 43.6% year-on-year, with investments in wholesale and retail industries also increasing by 14.5%.

- Japan’s Monetary Policy Shift

The Bank of Japan (BOJ) announced the end of its negative interest rate policy, citing the emergence of a stable 2% inflation target supported by an efficient wage cycle.

Consequently, the BOJ raised its policy interest rate from the range of -0.10% to 0% to the range of 0% to 0.10%, marking the first interest rate hike since 2007 and signaling the conclusion of its ultra-loose monetary policy stance.

- Industrial Production in Japan

Industrial production in Japan experienced a significant decline of 6.7% month-over-month in January 2024, compared to the previously reported 7.5% drop and a downwardly revised 1.2% increase in the previous month. This marked the sharpest decrease in industrial output since May 2020.

- Australia’s Monetary Policy Decision

The Reserve Bank of Australia (RBA) kept its policy interest rate unchanged at 4.35%, in line with market expectations, maintaining its stance for the third consecutive meeting.

- Malaysia’s Inflation Increase

In a surprising turn, Malaysia’s annual inflation rate climbed to 1.8% in February, up from 1.5% in the previous month, surpassing market expectations of 1.4%. This marked the highest level recorded since last October.

- Upcoming Economic Data Releases

In Japan, attention will be on the unemployment rate, industrial production, and retail sales data for February. Meanwhile, India is set to release its current account figures, South Korea will update its confidence indicators and Australia anticipates a rise in February’s inflation rate.