In this post, we provide a guide for beginners to understand what stock markets are, and how they work.

What Are Stock Markets?

Stock markets are those marketplaces where all parties interested in stocks and securities follow to sell and buy stocks and securities. These can be buyers, sellers, traders, and investors.

Owing to the latest technological developments, the world’s stock markets are now more interconnected, where people can follow numerous exchanges operating in different countries, at different time zones, each of these stock exchanges have unique trading regulations, and listings.

The Importance of Stock Market and How They Operate

On a domestic level, every country has a financial system that can either include financial intermediaries such as banks, or financial markets, including bond markets and stock markets. Financial markets are the institutions through which savers can directly provide funds to borrowers, within a goal to reduce risk for both investors and traders.

Stock markets offer investors and the public a regulated environment where they can sell and buy stocks and shares. Such financial markets aim to achieve the efficient allocation of capital to investments needed for the country’s economic growth. For example, through offering shares of their equity for sale, a process called “equity financing”, companies can get capital needed for expansion, and investors buy stocks for economic profit.

Stock represents a claim to partial ownership in a business selling shares. Therefore, it is a claim to the profits that the firm makes, but also it carries some risk, as investors as entitled to both profits and losses.

Stock markets where transactions take place can be either primary or secondary. In the primary market, stocks and shares are created and sold for the first time. An example of a primary market transaction is the Initial Public Offerings (IPOs). In a secondary market, stocks and shares that were previously issues are sold and bought among investors.

Main Global Stock Markets and Stock Indices

These are the main stock exchange markets, which play a significant role in the world’s financial system:

The New York Stock Exchange (NYSE) is known for its high trading volume and rigorous listing requirements, which guarantees the NYSE holds a prominent position in the world of finance. Furthermore, it hosts numerous top-tier global corporations.

NYSE Composite Index includes all common stocks in NYSE, offering a comprehensive view of the U.S. market. The S&P 500 Index tracks the performance of the large-capital U.S. corporations, representing about 80% of the U.S. market’s total capitalization. The Dow Jones Industrial Average Index is another known index offering a narrower view of the U.S market, as it has only thirty largest, publicly owned blue-chip enterprises, compared to the S&P 500 Index and NYSE Composite Index.

NASDAQ is a stock market focusing on technology-related companies. It has giant technology corporations such as Apple, Microsoft, and Amazon. Nasdaq Composite Index is a main index including all stocks listed on NASDAQ.

The London Stock Exchange (LSE) is a prominent center for global trade, with a particular focus on European markets. It is one of the oldest exchanges in the world, with a diverse portfolio of listed securities.

Hong Kong Stock Exchange (HKEX) is an important stock exchange market known for its strategic location linking the East and West. Hang Seng Index tracks the performance of the largest companies listed on the Hong Kong Stock Exchange.

Shanghai Stock Exchange (SSE) is the primary stock exchange in China. It holds significant importance and provides valuable insights into market movements in the country. Shanghai Composite Index includes A-shares and B-shares listed on the SSE.

Tokyo Stock Exchange (TSE) is the largest stock exchange in Japan and is a significant one in the Asian markets. This exchange market includes several

Japanese corporations. Nikkei 225 Index, comprising 225 of the biggest corporations in TSE.

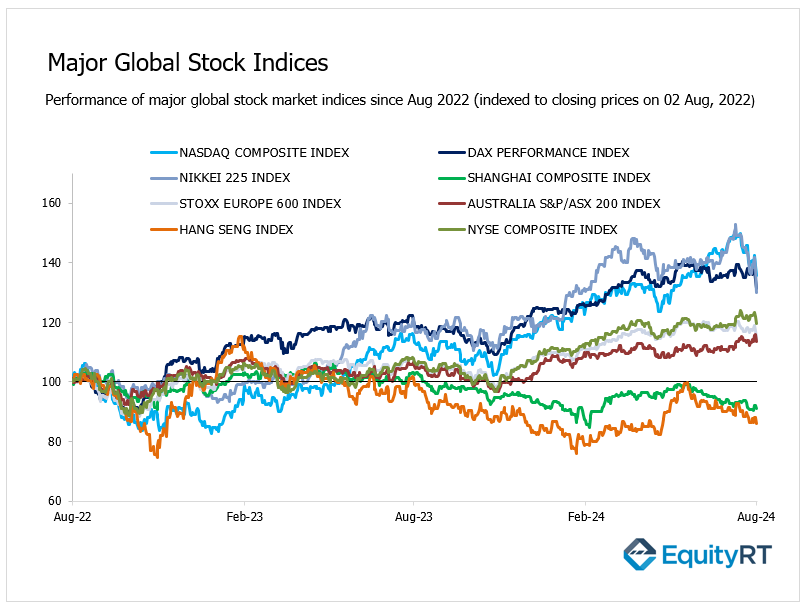

In addition to the indices listed above, the European stock market can be tracked also through indices such as the Stoxx Europe 600 Index, covering the biggest six thousand enterprises by market capitalization in 17 European countries. Additionally, those interested in the German economy can follow DAX Performance Index, tracking the performance of largest 40 German companies in the Frankfurt Stock Exchange. Similarly, the Paris Stock Exchange can be followed through CAC 40 Index, listing the largest 40 French enterprises.

Following Major Global Stock Indices with EquityRT

EquityRT provides an interface to follow main global stock indices, globally, and domestically. You can see movements of related stocks and follow up with how indices of the major global stock indices of global markets above behave.

You can build dynamic charts, add details and distinct functions, which will provide deep insights into your preferred stocks.

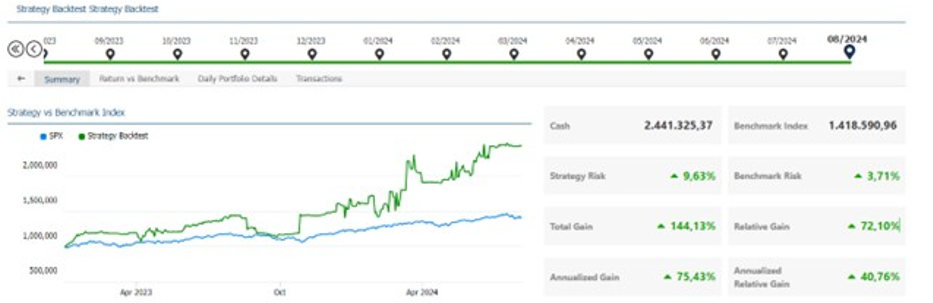

Additionally, EquityRT’s unique “Strategy Builder” gives you the easiest way to design a fundamental based investment strategy. Classify your portfolio based on “MCap”, and narrow your search based on “Sector”. Accelerate your strategy-building process with our “built-in” strategies, categorized by investment styles such as “Value,” “Dividend,” and “Growth.”

Enjoy a comprehensive view of main indicators showing the performance of selected company. Use the ‘Classification’ tab to select companies based on their capital: micro, small, mid, big, or mega capital. Select the sector at which your companies operate. You are ready to go.

Have you decided on your portfolio and strategy?

Using tools like the ‘Model Portfolio,’ you can effectively define and manage your investments. Select a benchmark, set the rebalance frequency, and specify the initial investment date and amount. Add stocks and their weightings to your portfolio and effortlessly track your returns.

After creating your strategy, now back assess your strategy’s degree of effectiveness, using “Strategy Back Testing”. You can always check your strategy’s historical returns, risk, total gain, and compare it to your benchmark index.

Should You Invest in Stock Markets?

Investing in the stock market offers the potential for profit through dividend payments or selling stocks at a higher price than the initial price. It means a potential for your money to grow in value over time due to company growth and the economy’s general economic health. However, it is important to note that there is also a possibility that the value of your investment may decrease. You are entitled to gains and losses incurred by the company’s stocks that you invested in.

For more information on financial markets, and our products, click here.