To curtail the current high levels of inflation, the U.S. Federal Reserve (the Fed) raised its short-term interest rate on 16 March 2022 for the first time since 2018. The Fed also indicated an aggressive path with rate increases coming at the next six meetings and readiness to reduce the size of its balance sheet as soon as May. The Fed will sell bonds to help control the money supply and the quantity of money in circulation and therefore, prevent high inflation.

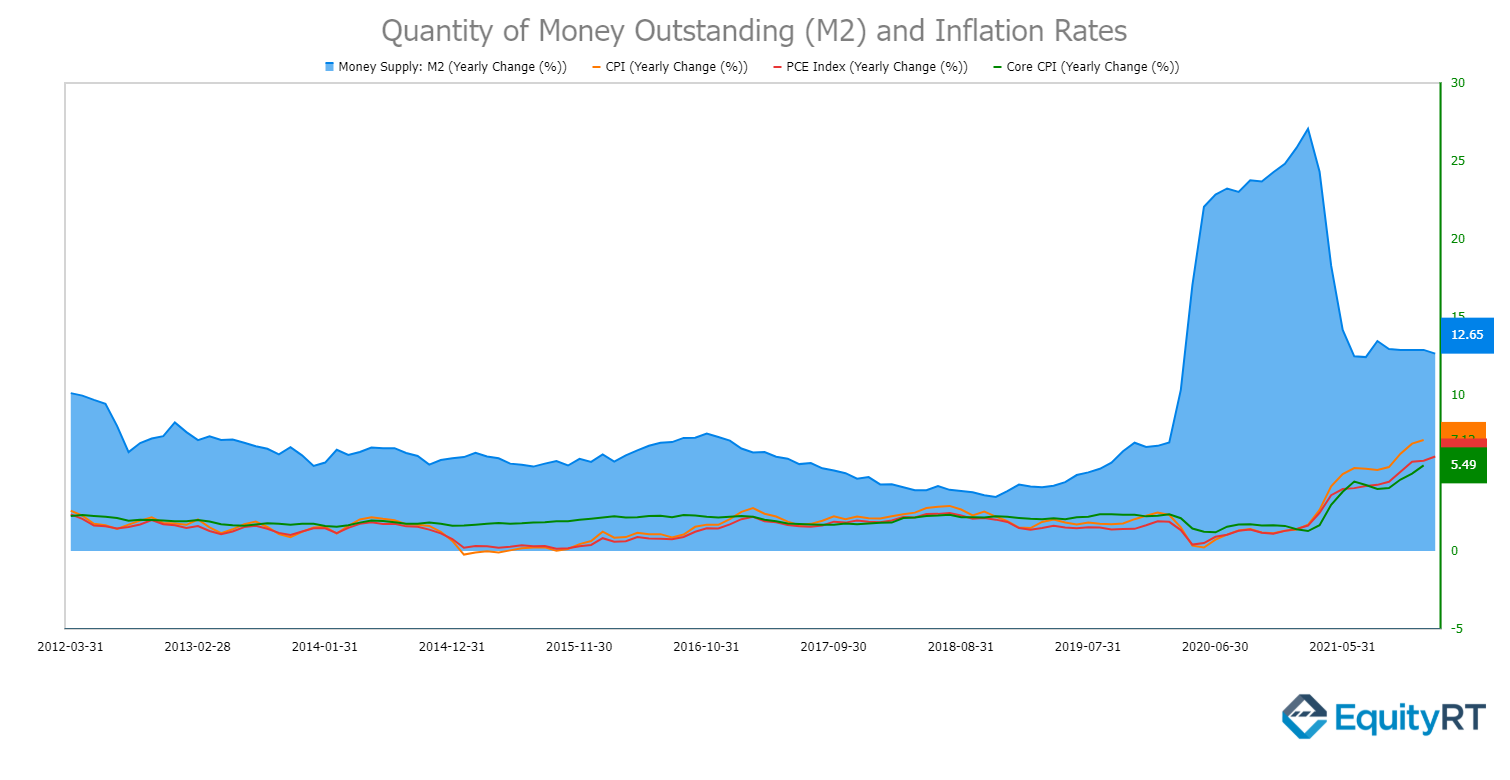

Inflation is a big concern among economists especially given the unprecedented growth in money creation. Between December 2019 and January 2022, the Fed’s broadest measure of the money supply (M2) expanded by $6.5 trillion, a stunning 43% increase in almost two years and a half, primarily driven by large-scale asset purchases. Money growth has eased from its peak a year ago but it is still robust.

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

History shows that an increase in the money supply (M2) has typically led to an increase in the inflation rate, even though the relationship between these two is not always perfect. During the high inflation period back to the 1970s, the monetary aggregates were reliable indicators of economic activity and inflation. Over the past 30 years, money supply as a leading economic indicator has been neglected by the Fed, when shaping monetary stance. The Fed has monitored prices and the labor market rather than the money supply. The policymakers in the Fed still review the money aggregates but just as a part of a basket of financial and economic indicators.

Let me conclude the article with a famous saying by monetary economist M.Friedman “inflation is always and everywhere a monetary phenomenon” which implies that a massive increase in the quantity of money can bring a steady and sustained rise in prices and replace deflation with inflation.

EquityRT’s economic section provides relevant economic indicators including, money supply, central bank total assets, price indices, and more to those who would like to make a complete analysis on the U.S economy.

Report by Özge Gürses | Macro Research at EquityRT

Disclaimer:

The information in the publication is not an investment recommendation and it is not investment or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but EquityRT does not represent that it is accurate or complete. EquityRT does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author, as of the date of the publication and are subject to change without notice.