In the dynamic world of finance, asset managers, portfolio managers, and financial advisors play crucial roles in guiding clients toward their investment objectives. They are experts who assist individuals and organizations in enhancing their wealth over time by acquiring, maintaining, and trading investments that possess the potential to appreciate in value.

In their daily work routine, they interact with clients to understand their financial goals and risk tolerance, and create portfolios that align with their targets. They also supervise and update portfolios on a day-to-day basis and suggest investments that meet clients’ expectations.

To make data-driven decisions, these professionals require access to financial and economic data. They collect this information from various sources such as financial statements, market data providers, and news agencies. They then analyze it employing various tools and techniques to identify trends and make predictions about the future performance of investments.

In this blog, we will explore how leveraging financial research and analysis software or platform can enhance these professionals’ efficiency. Then we will delve into the specific features of EquityRT, a leading financial analysis platform, and how it caters to the needs of subscribers in the investment arena.

The Role of Financial Research and Analysis Software

Financial research and analysis software are powerful tools that can significantly enhance the efficiency and effectiveness of asset managers, portfolio managers, and financial advisors. Let’s explain how:

- Data Aggregation and Analysis:: These software solutions streamline the collection and analysis of financial and economic data from multiple sources. By automating the data aggregation process, professionals save valuable time. With access to comprehensive market data, they can analyze trends, evaluate company fundamentals, and efficiently assess investment opportunities.

- Advanced Analytics and Tools: Financial analysis software offers a range of sophisticated tools and analytics. Professionals can leverage advanced charting capabilities, conduct financial modeling, and utilize backtesting features to evaluate investment strategies and assess risks. These advanced tools empower users to make informed decisions based on comprehensive analysis.

Portfolio Tracking and Reporting: Through the use of software solutions professionals can effortlessly track portfolio performance, monitor asset allocation, conduct risk analysis, and generate professional reports for clients or internal use. By automating these processes, financial research and analysis software enable professionals to focus on strategic decision-making and client relationships

All the important information you need in one place. Add EquityRT to your toolkit for quality investment research.

Unleashing the Potential of Financial Professionals with EquityRT

EquityRT is a leading financial analysis platform designed to empower asset managers, portfolio managers, and financial advisors with valuable features and data content.

Here are three specific features that it offers to financial professionals:

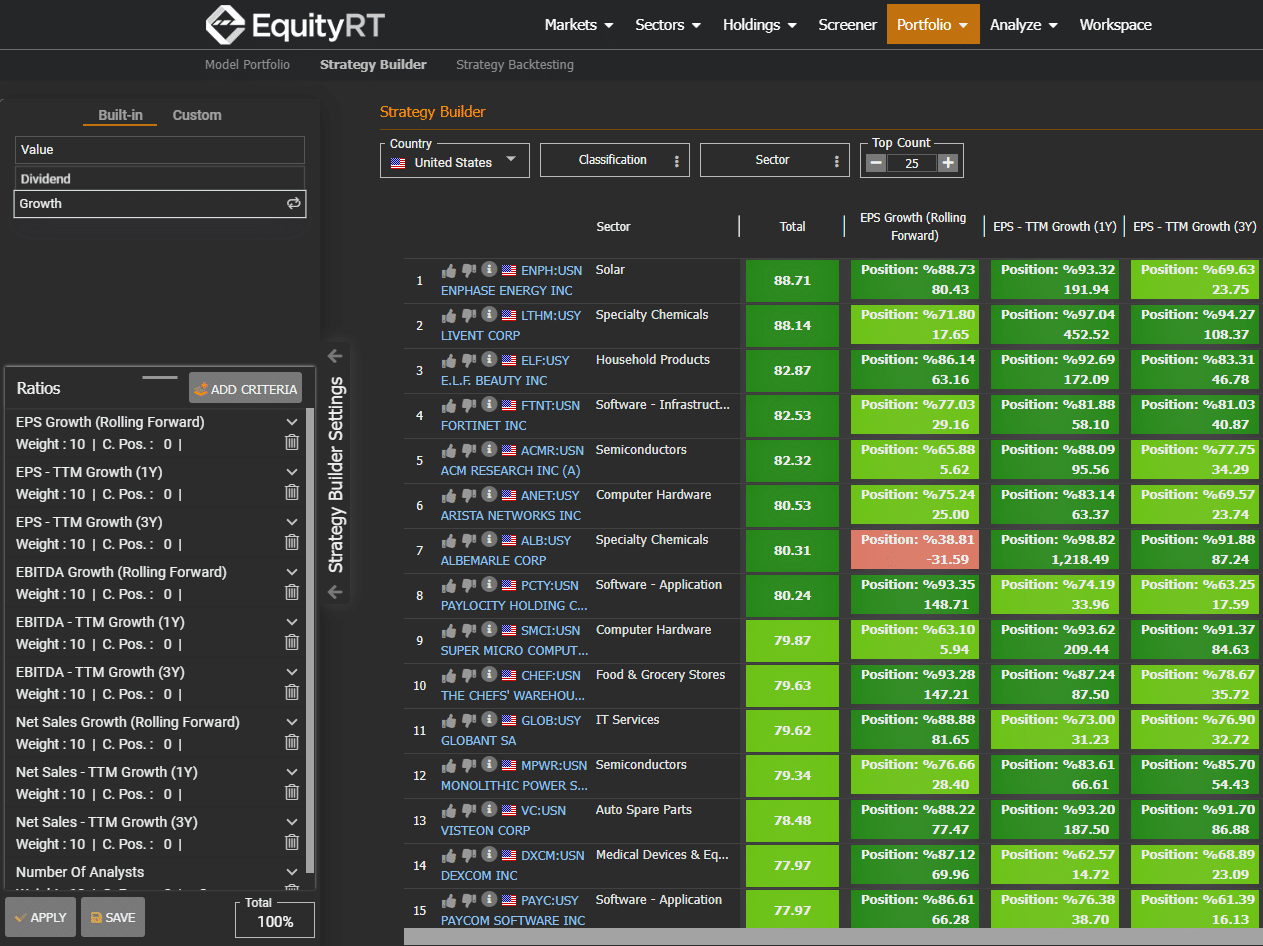

- Strategy Builder and Backtesting: The “Strategy Builder and Backtesting” feature in EquityRT allows users to build fundamental-based investment strategies and backtest their success. To perform a backtest, users first need to define the rules of their investment strategy. This includes specifying the criteria for buying and selling assets, as well as any other conditions that must be met for a trade to occur. The user can then apply these rules to historical data to see how the strategy would have performed over the specified time period. Backtesting can provide valuable insights into the potential performance of an investment strategy. However, it’s important to note that past performance is not necessarily indicative of future results. Users should use backtesting as one tool among many when evaluating their investment approach.

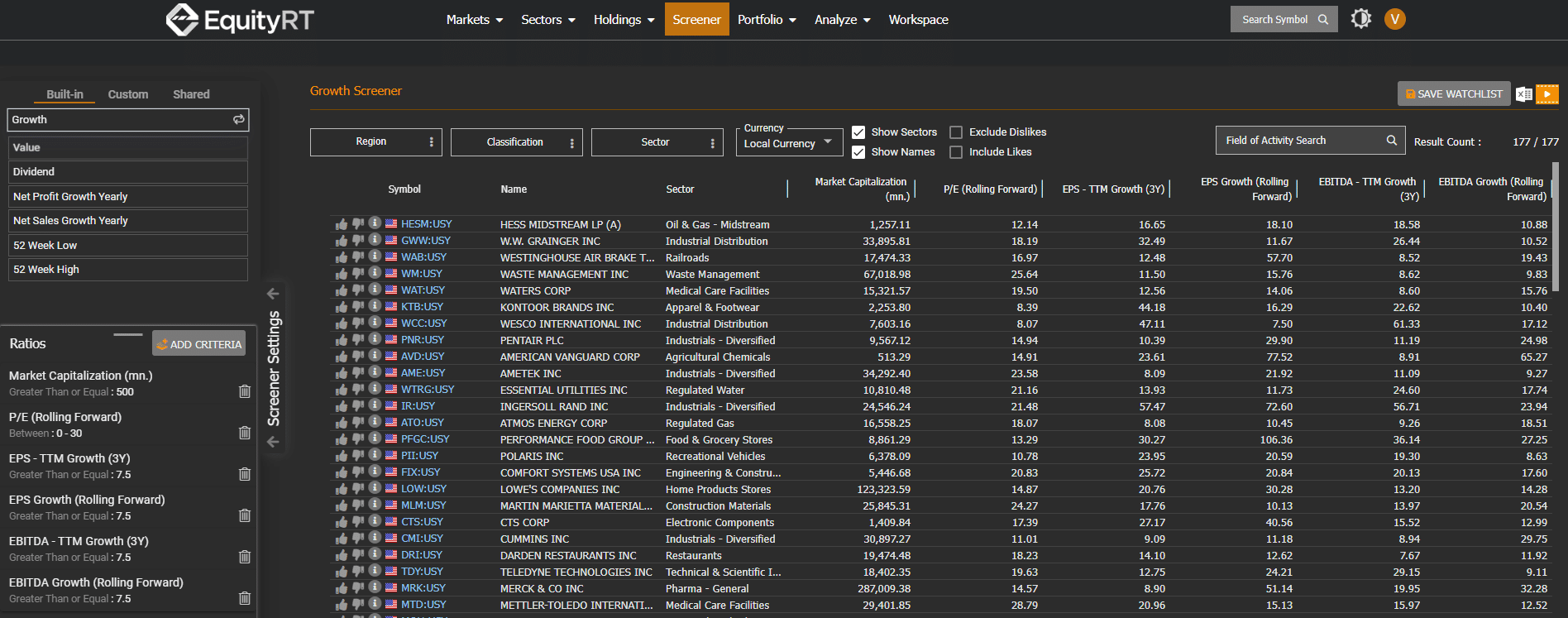

- Stock Screening and Investment Ideas: Customizable stock screening tools, in-depth peer comparisons, and insightful shareholder analysis are powerful features of EquityRT that can help users identify potential investment opportunities. Stock screening tools allow users to filter stocks based on various criteria such as market capitalization, dividend yield, and price-to-earnings ratio to find stocks that meet their investment goals. EquityRT allows financial professionals to perform comprehensive peer comparisons for stocks. By comparing the performance, financial metrics, and key ratios of a stock with its industry peers, they can gain insights into its relative strength and identify potential outperformers. This feature assists users in making informed decisions based on a stock’s performance within its peer group. EquityRT offers insightful shareholder analysis, providing users with information about the ownership structure of a stock. By understanding the composition of shareholders and their holdings, analysts can identify potential catalysts that may influence the stock’s price movements.

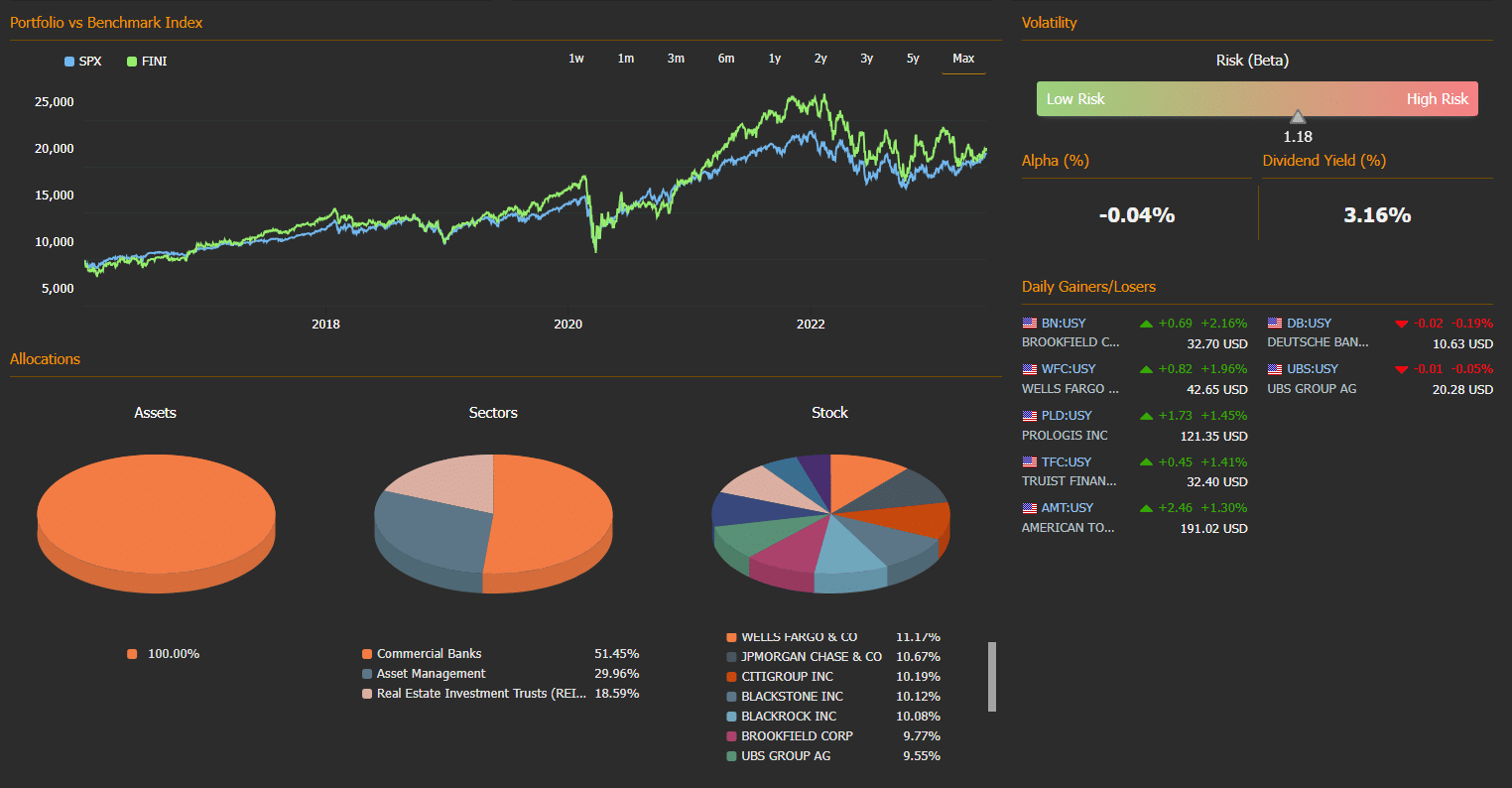

- Model Portfolio Tracking: A model portfolio is a hypothetical portfolio of investments that are used to represent a particular investment strategy or objective. To utilize model portfolio tracking and setup, financial advisors or portfolio managers first need to define the rules of their investment strategy and create a model portfolio that reflects this strategy. This can include specifying the asset allocation, selecting individual investments, and defining any other conditions that must be met. Once the model portfolio has been set up, the user can track its performance over time monitoring the portfolio’s returns, asset allocation, and volatility. EquityRT simplifies the setup and tracking of model portfolios. Users can monitor portfolio returns, asset allocation, and portfolio volatility through visually appealing dashboards. These dashboards provide a clear overview of the model portfolio’s performance and allow for easy identification of trends, strengths, and areas for improvement.

Conclusion

EquityRT empowers the way financial professionals operate in today’s dynamic financial landscape by providing an array of analytical tools and live dashboards. Professionals can analyze financial statements, track company earnings, and utilize advanced charting capabilities for visual analysis and trend identification.

As the industry continues to evolve, financial advisors who harness the potential of EquityRT will be well-positioned to thrive and achieve success in their advisory practice.