Global Markets Recap

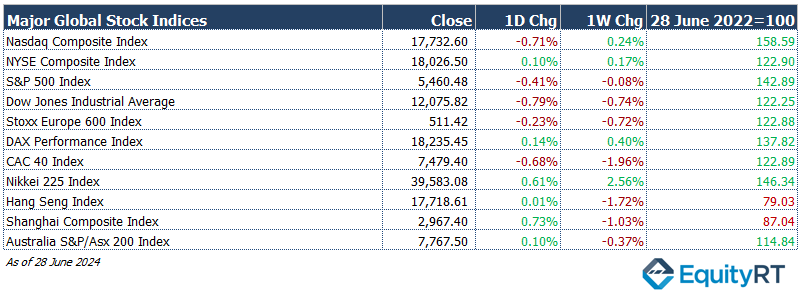

On Friday, despite a slowdown in the headline and core PCE deflator for May, which the Fed closely monitors, and a decline in both short and long-term inflation expectations in the Michigan University consumer sentiment index, Wall Street indices closed lower.

This week in the US, stock and bond markets will close early on Wednesday and remain closed on Thursday in observance of Independence Day.

On Friday, European stocks finished lower except for Germany’s DAX, while Asia-Pacific stocks mostly rose. Today, Hong Kong markets were closed due to a holiday.

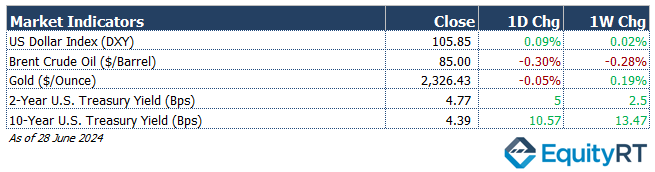

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 105.85 marking a 0.02% weekly rise.

The Brent crude oil (#LCO07) closed the previous week at USD 85.00 per barrel, reflecting a 0.28% weekly loss.

The price of gold (#XAU) closed last week with a 0.19% gain, settling at USD 2,326.43 per ounce.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, closed at 4.77% with a 2.5 basis points weekly gain. The 10-year U.S. Treasury yield (#USGG10YR) completed the week with a 13.5 basis points gain, settling at 4.39%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Key Economic Indicators Released Last Week in the US

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

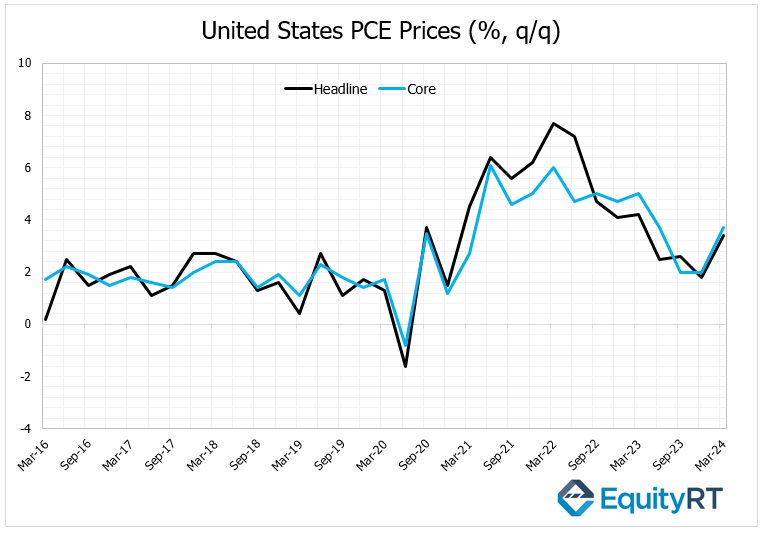

In May, the monthly Personal Consumption Expenditures (PCE) deflator showed a slowdown, decreasing from 0.3% to 0%, marking its lowest level in six months. The annual rate also dipped slightly from 2.7% to 2.6%, the lowest in three months.

Similarly, the monthly core PCE deflator slowed from 0.3% to 0.1%, the lowest since November, with the annual rate decreasing from 2.8% to 2.6%, the lowest since March 2021.

-

In Q1 2024, the annualized quarterly PCE price index was revised up from 3.3% to 3.4%, while the core PCE price index rose from 3.6% to 3.7%, indicating modest price pressure increases.

Personal income growth accelerated from 0.3% to 0.5% monthly, and personal spending rose from 0.1% to 0.2%

The Michigan University consumer sentiment index for June was revised up from 65.6 to 68.2, exceeding expectations.

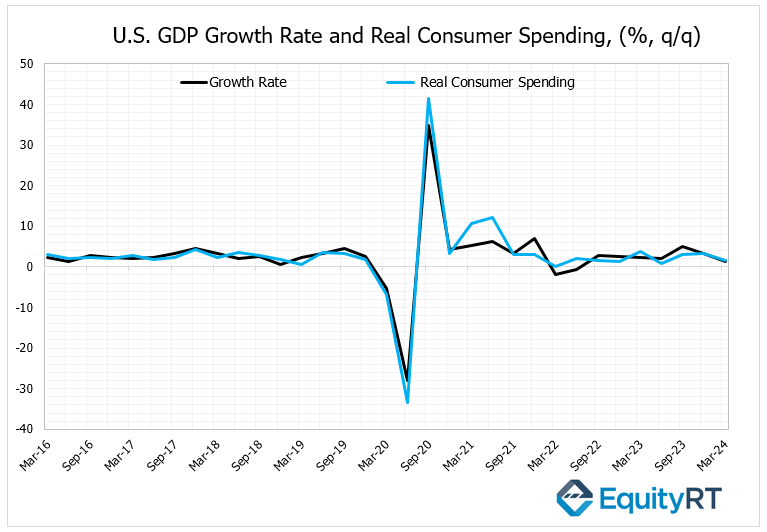

Looking at economic growth, the annualized quarterly GDP growth rate for Q1 2024 was revised upward from 1.3% to 1.4%. This revision, despite a downward adjustment in consumption growth from 2% to 1.5%, was driven by gains in housing and non-housing fixed investments, government spending, private inventory investments, and net exports.

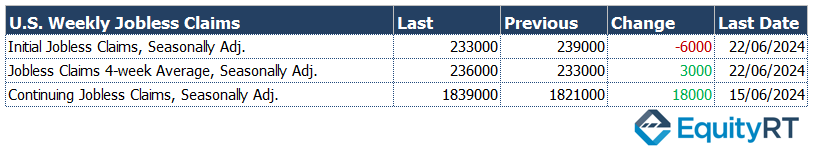

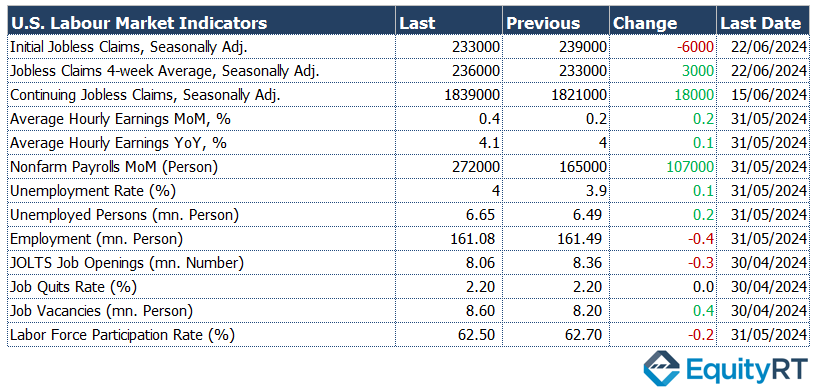

Weekly initial jobless claims for the week ending June 22 decreased from 239,000 to 233,000, surpassing expectations and indicating a relatively tight labor market, with levels remaining historically low.

Pending home sales in the U.S. fell by 2.1% in May, following a 7.7% decline in April, indicating continued weakness in the housing market.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Key U.S. Economic Indicators to Watch This Week

This week is packed with key economic events and data releases. Tomorrow, market attention will be on Fed Chair Powell’s speech, where investors await insights into future monetary policy and potential rate adjustments. Additionally, the minutes from the June Federal Open Market Committee (FOMC) meeting will be unveiled on Wednesday.

During the June meeting, the Fed maintained the federal funds rate range at 5.25%-5.50% for the seventh consecutive time, with a unanimous decision. Powell emphasized that while recent inflation data showed improvement, the Fed requires more positive economic signals before considering easing monetary policy.

Other significant releases include final PMI data for manufacturing and services sectors today and Wednesday, alongside the closely watched ISM manufacturing and non-manufacturing indexes for June.

On Wednesday, final durable goods orders and factory orders for May will be published. Durable goods orders saw consecutive monthly increases of 0.8% in March and 0.6% in April. Meanwhile, factory orders exceeded expectations with growth of 0.7% in both March and April.

Wednesday will also see the release of May’s trade balance data, where April’s deficit widened to $74.6 billion, the highest since October 2022, driven by a rise in imports.

Today, May’s construction spending data will be released, following a slight decline in April. Tomorrow, JOLTS job openings data for May will provide insights into labor market trends, following a slight decline in April to 8.06 million openings.

Wednesday will also feature the ADP private sector employment report for June and weekly initial jobless claims data.

Finally, Friday brings the highly anticipated non-farm payrolls, unemployment rate, and average hourly earnings data for June. In May, non-farm payrolls exceeded expectations at 272,000 new jobs, with the unemployment rate rising slightly to 4%, and average hourly earnings showing robust growth.

For June, analysts expect non-farm payrolls to slow to 190,000, with the unemployment rate remaining at 4% and average hourly earnings growth moderating to 0.3%.

Take the guesswork out of investing: Backtest your strategies with ease!

Key Economic Indicators From Europe Last Week

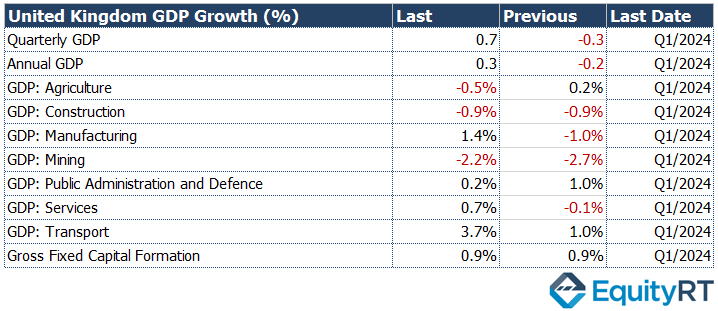

The UK’s economic performance for the first quarter of 2024 shows signs of recovery after a period of contraction. Following two consecutive quarters of economic decline—0.1% in Q3 and 0.3% in Q4 of the previous year—the final GDP growth data has been revised upward from an initial estimate of 0.6% to 0.7%. This revision marks a positive shift, indicating that the UK has exited recession.

Key sector performances include a 0.6% growth in industrial production and a 0.7% expansion in the services sector. However, the construction sector saw a contraction of 0.9% during the same period.

On an annual basis, after a 0.2% contraction in Q4 of the previous year, the annual growth rate for the first quarter of this year was revised upward from 0.2% to 0.3%.

The final consumer confidence index for June in the Eurozone was confirmed at -14, matching the preliminary figure and marking the highest level since February 2022, though still in negative territory.

The Swedish Central Bank kept its policy rate unchanged at 3.75% in its latest meeting, after a 25 basis point cut in May.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Outlook: Key Market-Driving Events and Growth Insights This Week

This week, market watchers eagerly anticipate the release of the European Central Bank’s (ECB) June meeting minutes, offering crucial insights into upcoming monetary policy decisions, potentially including new rate cuts. In a significant move, the ECB slashed interest rates by 25 basis points in June, marking its first cut in nearly five years following five consecutive meetings of unchanged rates.

ECB President Lagarde’s speeches scheduled for today through Wednesday will also be closely monitored for any hints on future monetary policy directions.

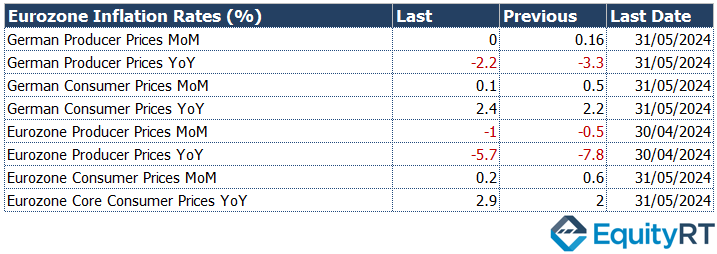

Additionally, preliminary Consumer Price Index (CPI) data for June will be unveiled today in Germany and tomorrow across the Eurozone. In May, Germany recorded a slowdown in monthly CPI growth from 0.5% to 0.1%, marking a five-month low, while the annual rate edged up marginally from 2.2% to 2.4%. The core annual CPI in Germany held steady at 3%, its lowest since March 2022.

Meanwhile, the Eurozone’s monthly CPI growth decelerated from 0.6% to 0.2% in May, reaching its lowest point in four months, while the annual rate saw a slight increase from 2.4% to 2.6%. The core annual CPI for the Eurozone rose from 2.7% to 2.9% during the same period.

Producer Price Index (PPI) data for May in the Eurozone is set to be released on Wednesday.

On Thursday, attention will be on Germany’s factory orders for May, followed by industrial production data on Friday. Concurrently, retail sales figures for May will also be released on Friday.

Take the guesswork out of investing: Backtest your strategies with ease!

Asian Economic Indicators

June’s official Purchasing Managers’ Index (PMI) data in China reveals that the manufacturing PMI held steady at 49.5, marking a second consecutive month of contraction. Meanwhile, the non-manufacturing PMI dipped from 51.1 to 50.5, reaching its lowest point since December but maintaining expansion for the 18th straight month.

In contrast, the Caixin manufacturing PMI for June edged up slightly from 51.7 to 51.8, signaling a modest acceleration in manufacturing growth and hitting its highest level since May 2021.

Turning to Japan, the consumer confidence index rose to 36.4 in June 2024 from a six-month low of 36.2 in May, albeit slightly below market expectations of 36.5.

Upcoming Asian Data

This week, market attention will focus on several key economic indicators. On Wednesday, the Caixin services PMI for China in June will be unveiled. In May, the services PMI surged from 52.5 to 54, signaling robust growth, the strongest since November and continuing 17 months of expansion. However, expectations point to a slight dip in June to 53.4, suggesting a minor slowdown in growth.

Additionally, upcoming data releases include June FX reserves for China and India, along with June inflation figures for Indonesia.