With the 2024 U.S. presidential election just a day away, political debates and policy promises are intensifying and drawing the public’s focus. Key topics like jobs, taxes, and healthcare dominate the campaigns, leaving many people wondering how the election results might impact their personal finances and investments. While it may seem that elections heavily influence economic and market trends, historical data paints a different picture.

Do Elections Really Influence the Market?

Presidential elections are often perceived as crucial moments, with newly elected leaders set to shape the nation’s policy direction for the next four years. However, while these elections can trigger short-term market fluctuations and generate significant media attention, their long-term effects on the stock market tend to be surprisingly minimal.

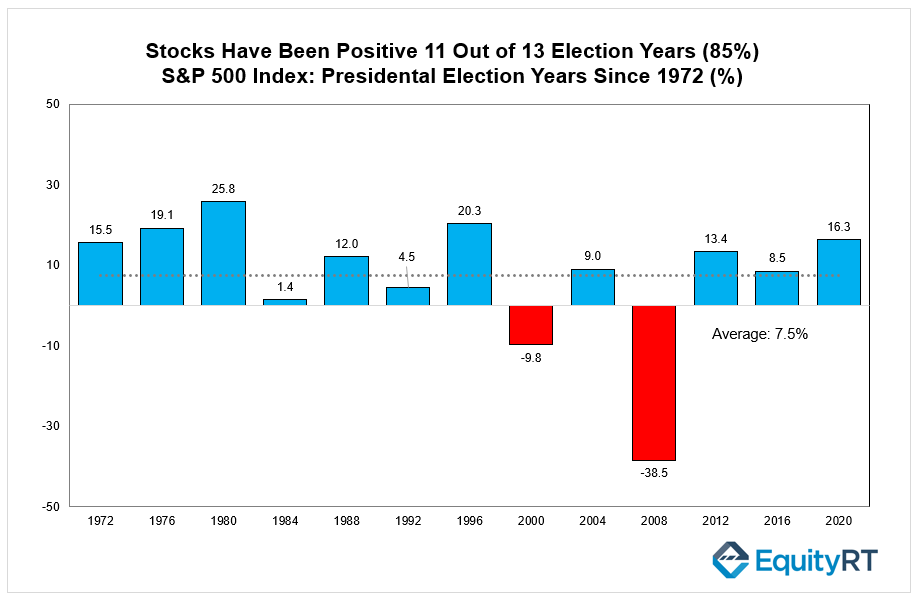

The chart below shows the annual performance of the S&P 500 during U.S. presidential election years since 1972, indicating whether the index gained or lost value in each election year. The S&P 500 is widely regarded as a benchmark for the overall U.S. stock market. Its performance reflects investor sentiment, economic expectations, and confidence in the future.

The S&P 500 has posted positive returns in 11 out of 13 presidential election years from 1972 to 2020, despite the uncertainty surrounding these election cycles. During these 13 election years, the index averaged a 7.5% annual return.

Blue bars in the chart represent election years with positive returns, showing that 85% (11 out of 13) of election years saw gains, with a strong historical trend of market performance during these periods.

Red bars mark the two election years with negative returns: 2000 and 2008. Both years coincided with major economic downturns—the dot-com bubble in 2000 and the global financial crisis in 2008—explaining the market’s significant losses. Most election years have resulted in moderate to strong positive gains, except during times of severe economic crises.

The chart supportively indicates that U.S. election years have generally been favorable for the S&P 500. However, notable market drops occurred during broader economic distress, independent of the election itself. This shows that while political events may cause short-term market fluctuations, broader economic factors play a far more critical role in shaping long-term market performance.

Economic Fundamentals Matter More Than Election Outcomes

It is important for investors to focus on long-term market fundamentals rather than get swept up in the short-term volatility often triggered by political events. While elections can create temporary swings in the stock market, as history shows, the long-term drivers of market success are deeply rooted in economic conditions.

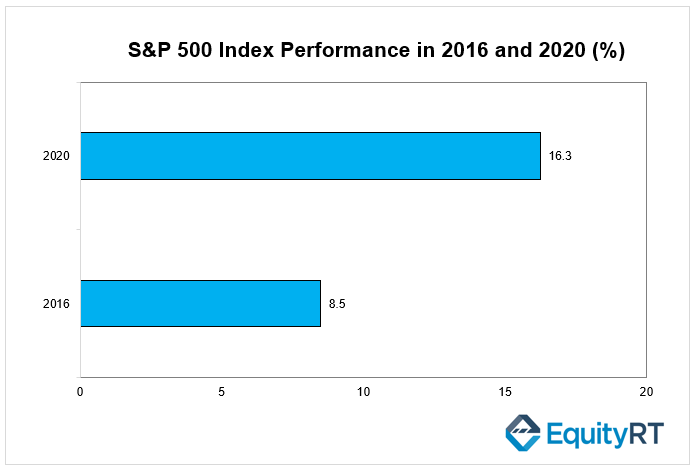

For example, in 2020, under a highly contentious presidential election and the backdrop of the COVID-19 pandemic, the stock market experienced notable volatility. However, despite the uncertainty and challenges, the S&P 500 ended the year up over 16%. This robust performance was largely fueled by a recovering economy, central bank interventions, and strong corporate earnings, rather than the political outcome itself. The Federal Reserve’s monetary policy and fiscal stimulus measures helped stabilize markets, showing that broader economic forces held more weight than the political climate.

Similarly, in 2016, during another polarizing election cycle, the stock market initially reacted with volatility when Donald Trump was elected. Within a short time, market sentiment shifted as investors focused on corporate earnings and pro-business policies, such as tax cuts and deregulation. By the end of 2016, the S&P 500 had gained approximately 8.5% for the year, underscoring the fact that long-term performance hinges more on economic fundamentals than election results alone.

The Broader Economic Picture Investors Should Watch

Here are the economic indicators that will shape the 2024 elections:

Inflation is a main issue in the 2024 election, particularly following the inflationary pressures experienced in the post-pandemic period. Candidates’ policies that address inflation—whether through adjustments to interest rates, government spending, or regulations—are key talking points. A candidate who prioritizes aggressive inflation control is likely to boost market confidence once the election results are clear, reflecting investor expectations for economic stabilization.

Investors are focusing primarily on how the broader economic environment responds to global conditions, such as international trade, and central bank policies. When the economic outlook shows signs of stability and steady growth, it tends to reassure the markets. In such a case, the outcome of the election has a reduced long-term impact on market trends, with fundamentals continuing to drive performance.

Employment always remains a critical concern for voters, and the state of the labor market heavily influences policy discussions as well as market sentiment. A strong labor market signals resilience to investors, which drives positive market performance. On the other hand, rising unemployment or the potential for job losses often triggers higher market volatility, as concerns about consumer spending and overall economic stability intensify.

In this election cycle, as in previous ones, currency fluctuations are reflecting the uncertainty surrounding future trade policies and economic strategies. Protectionist policies, such as those by Donald Trump in 2016, tend to cause volatility in the U.S. dollar, especially in relation to trade-sensitive currencies like the Mexican peso and Chinese yuan. If fiscal expansion is expected—like what was seen during Joe Biden’s 2020 campaign—the dollar is likely to weaken due to fears of increasing government debt.

Market movements around the U.S. dollar in 2024 closely mirror market sentiment about the election. Fiscal expansion typically leads to a weaker dollar, as concerns about rising debt increase, while policies centered around tax cuts or deregulation—related to Trump’s approach in 2016—can strengthen the dollar.

In both cases, the key factors influencing market direction remain tied to expectations about economic growth and inflation control.

These broader economic indicators—rather than the election result itself—are what will continue to shape market outcomes. Investors should focus on these larger drivers, as they have a more deep and lasting impact on market trajectories than any single election.