Now that we have covered the fundamentals of stocks, let’s examine how to leverage EquityRT’s Stock Screener for your investment strategy. This user-friendly tool allows you to filter stocks based on customizable criteria, making it easy to pinpoint potential investments.

Stock Screening is a process of filtering stocks based on specific criteria to identify potential investment opportunities. It involves using various financial metrics and technical indicators to narrow down a large pool of stocks to a smaller list.

Stock screening helps investors to analyze different stocks in less time. It enables investors to focus on stocks that match their specific goals and consider their level of risk tolerance. Additionally, using objective criteria helps reduce biases in investment decisions, encouraging more rational and informed choices. This approach can lead to better long-term investment outcomes.

How EquityRT’s Stock Screener Simplifies Stock Selection

The Screener tool is designed to help investors efficiently identify securities from a long list. By allowing users to set specific criteria based on various financial ratios and metrics, the Screener simplifies the often-complex process of finding companies that match their unique investment strategies. This tool not only saves time but also enhances decision-making by filtering through large volumes of data to highlight the most relevant investment opportunities. You can decide on the region and market type:

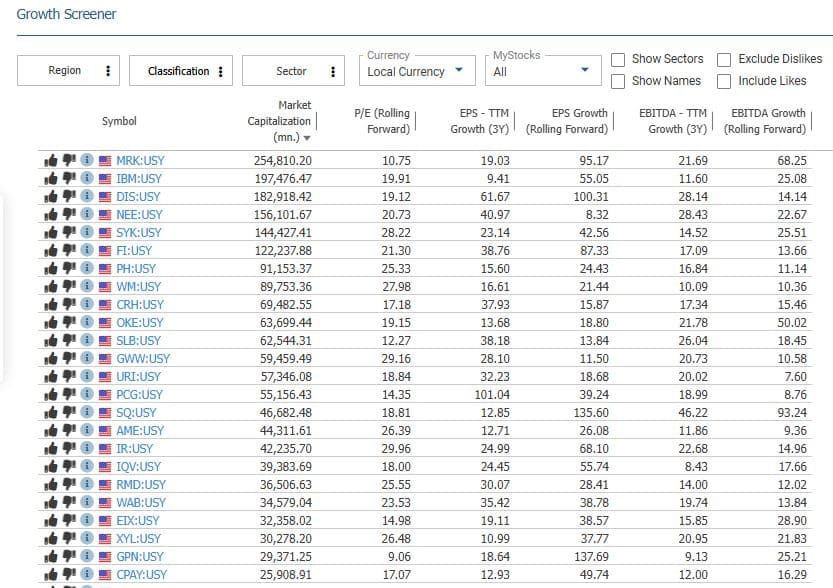

For example, you can decide on the region setting from several options such as: Europe, Africa, Emerging, Middle East, Frontier, and Developed. Setting the region offers you an extensive view of its countries, and to combine countries from different regions, for example: You can select Emerging and Frontier countries.

You can select the country of origin, and sector-private or public. Moreover, our ‘Classification’ feature allows for a detailed breakdown by market capitalization, categorizing companies into 5 distinct tiers: Mega Cap (exceeding $75 billion), Big Cap (ranging from $5 billion to $75 billion), Mid Cap ($1 billion to $5 billion), Small Cap ($50 million to $1 billion), and Microcap (below $50 million).

In this example, we can see the sectors selected as Automative, IT Services, Software-Application, and Electronic Gaming & Multimedia. and the enterprises are classified in terms of their market capitalization, based on the region selected, which each user can decide on based on their preferences.

You have the freedom to tailor your own criteria through the Built-in tool, allowing you to decide on different ratios to your analysis such as:

Valuation Ratios

- P/BV (Price-to-Book Value): allows us to compare a company’s market value to its book value.

- ROA (Return on Assets): it measures how efficiently a company is using its assets to generate profits.

- ROE (Return on Equity): it measures how efficiently a company is using shareholders’ equity to generate profits.

Financial Risk Ratios

- Debt to Asset: it measures the proportion of a company’s assets financed by debt.

- Net Debt/EBITDA: it measures a company’s ability to service its debt with its operating cash flow.

Dividend

- Dividend Yields: are measurements of the annual dividend per share as a percentage of the stock price.

You can also save the selected combination as your Watchlist, for a quicker grasp of their updates and performance.

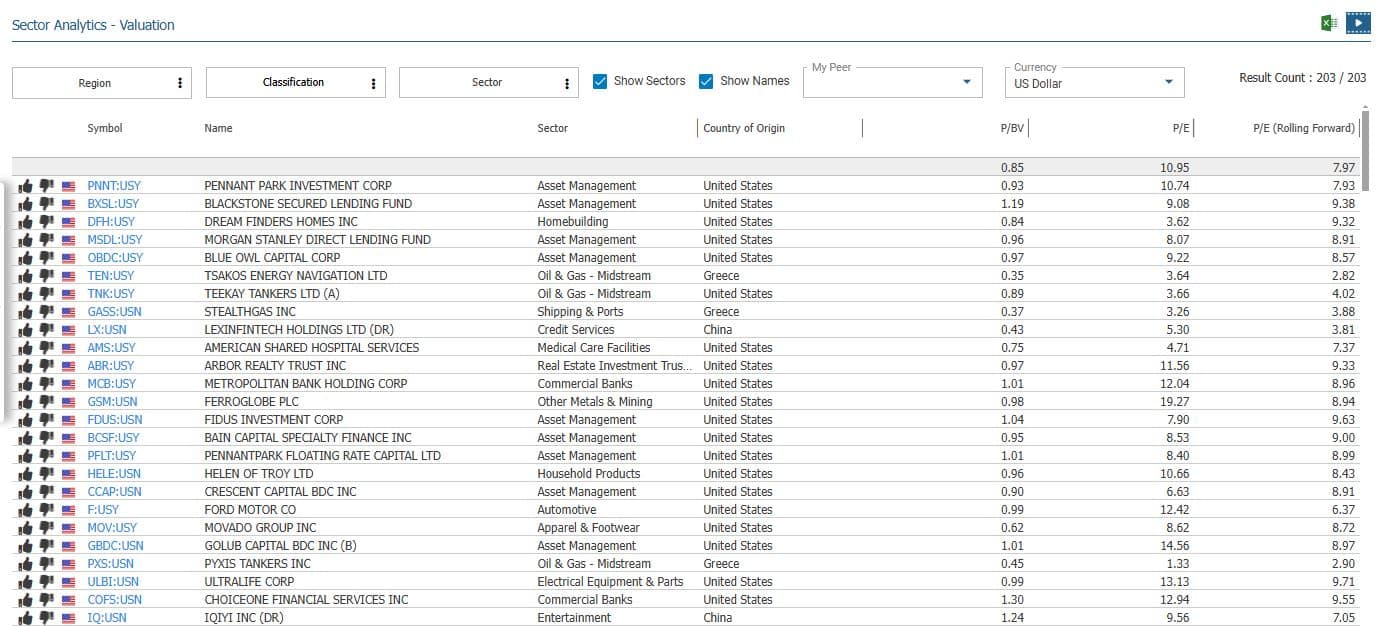

Sector-Based Analysis

After you get an overview through the screener page, you can move further by selecting your preferred sectors to get a deeper understanding of their performance. To do this, the Sector Analytics page delivers an in-depth comparison of a selected stock relative to its industry peers. You can still utilize the wide set of financial ratios.

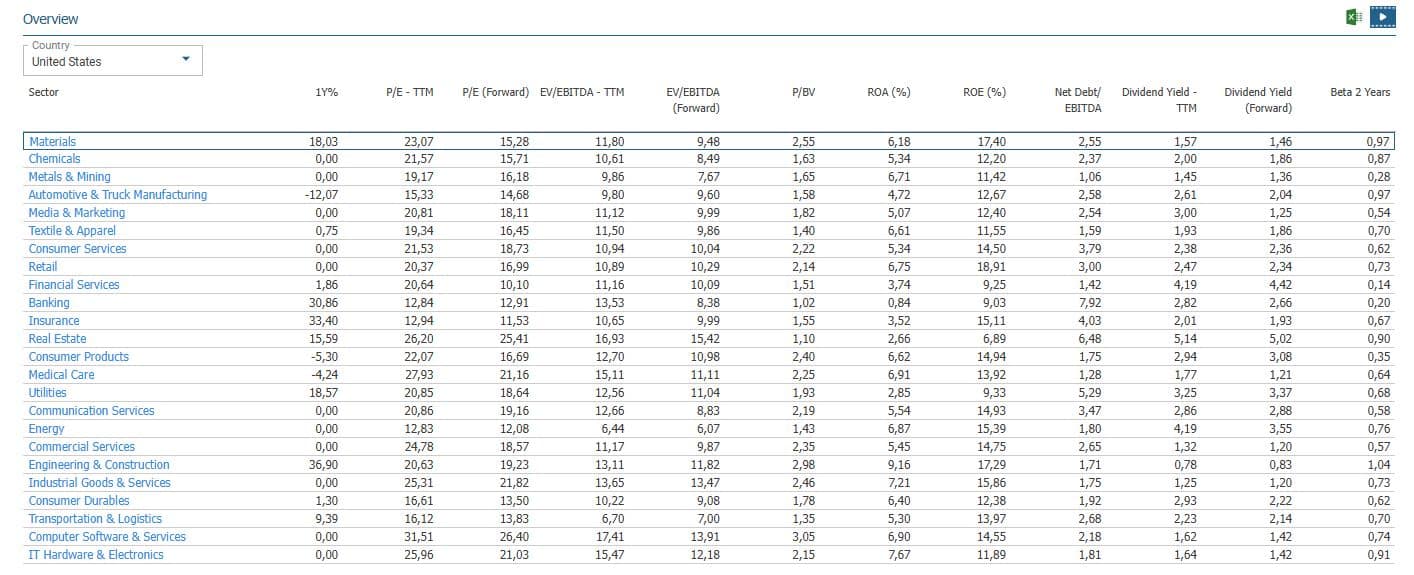

A single screen shows the key metrics for comparative analysis within a selected country’s sectors, where it displays major statistics. Upon selecting a sector, users can explore sub-sectors with the same critical metrics.

You can select a single country, and check the top performing sectors, by checking their main ratios and statistics, using the Overview Page by EquityRT.

You Can Build Your Own Portfolio

EquityRT allows for a thorough analysis of asset allocation across various sectors and financial instruments, providing clarity on your portfolio’s structure. By recognizing how different sectors contribute to overall returns, you can improve diversification and manage risk more effectively.

The “Portfolio” feature includes tools for creating model portfolios, developing strategies, and backtesting them over time, giving you a comprehensive view of your holdings while enabling performance tracking against benchmarks to refine your investment approach.

Compare Stock Performance with Ease

Understanding how individual stocks perform within their sectors is vital for assessing investment opportunities. EquityRT simplifies this process, enabling easy comparisons against industry medians or custom peer groups. This helps investors gain a clearer perspective on a stock’s financial health relative to its competitors.

Follow Market Trends and Gain New Insights

Staying updated on market trends can improve stock analysis. By reviewing fund holdings by stock or sector, investors can better understand stock selection. Identifying stocks favored by fund managers and insiders helps gauge industry performance expectations.

For additional information on financial markets, consider checking out EquityRT or requesting a free trial to explore the platform.