When we think of the stock market, we often conjure images of bustling stock exchange floors, suit-clad individuals making phone calls, and flashing financial indicator panels. However, the stock market encompasses more than just these elements.

This article delves into the question of whether the stock market is solely about trading, investors, and listed companies.

In reality, the stock market resembles a public market, where instead of trading fruits like lemons or apples, shares of companies are bought and sold.

While stocks persist as long as the company exists, serving as a form of savings and investment rather than fulfilling immediate consumption needs, the example of an apple’s falls short. Investors purchase stocks with the expectation of increasing their value over time, a contrast to the insignificance of an apple’s price once bought.

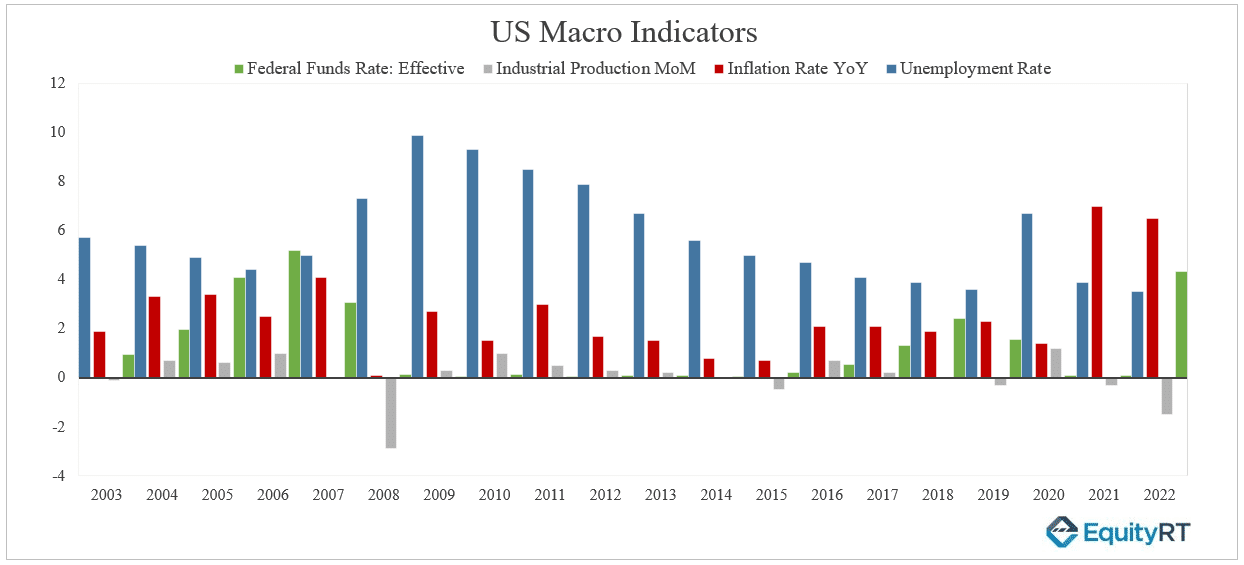

Understanding the stock market reveals that it is a complex system reliant on future predictions, extending beyond a simple platform for buying and selling goods. The valuation or devaluation of stocks depends on mechanisms tied to transaction volume but also remains significantly influenced by external factors. Changes in the economic conditions of the country where the stock market operates play a crucial role. Evaluating a stock market involves considering the economies of the countries where the listed companies are located or conduct business. Macroeconomic indicators like GDP growth, interest rates, employment, and exchange rates, become pivotal in determining stock prices. These factors collectively shape the intricate workings of the stock market.

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

Why Are Macroeconomic Indicators Important?

Stock markets are influenced by various factors, including decisions made by central banks, labour market trends, and a country’s current account situation. These factors have a significant impact on the level of trust investors have in companies, as I mentioned earlier.

Central banks play a crucial role in setting interest rates to maintain employment levels and ensure price stability. When interest rates rise in a country, it serves as an indication of the challenges companies may face when borrowing. Higher interest rates increase the cost of borrowing for companies, leading them to be more cautious in seeking additional funds.

When a company faces difficulties in borrowing, it often makes decisions to slow down or even halt its investments. This can result in a slowdown or decline in the company’s growth, including its sales and profit increases. As a result, companies with lower sales and expected lower profits may experience a decrease in their stock prices.

The Reflection of Interest Decisions in Financial Statements

Companies rely on various assets to sustain their operations, including land, machinery, equipment, and buildings (known as fixed assets). They also need cash and cash equivalents (referred to as current assets) to cover the expenses associated with these assets.

The question is: How do companies finance these assets?

While it is possible for entrepreneurs to solely rely on equity to finance these assets, it is not very common. Companies, in addition to their internal sources of funding, require external sources, which means they need to take on debt. Through borrowing from different instruments, institutions, and organizations, companies aim to increase their value and finance their assets, enabling them to continue their production and sales activities and generate profits.

However, an increase in interest rates has implications for companies traded in the stock market. It leads to higher borrowing costs and imposes production constraints. The impact is felt on both long-term and short-term debts (loans) taken by the company, causing the company’s debt burden to increase. Moreover, higher interest rates also result in a decrease in consumer spending, affecting the overall economy.

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

How Does a Company’s Financial Statement Get Affected If Consumers Reduce Their Spending?

As inflation rises, consumers are often compelled to shift towards high-interest bank deposits, sacrificing a portion of their consumption. While interest rate hikes aimed at curbing inflation may mitigate price increases to some extent, they can pose significant challenges for companies.

Primarily, such interest rate hikes can trigger price reductions, leading to a decrease in companies’ net sales as their selling prices decline. Coupled with an increase in debt obligations, companies may be compelled to sacrifice a substantial portion of their profits. Consequently, they may face difficulties in maintaining their production levels or encounter challenges in seeking new sources of production.

Sectors That Benefit from Interest Rate Increases

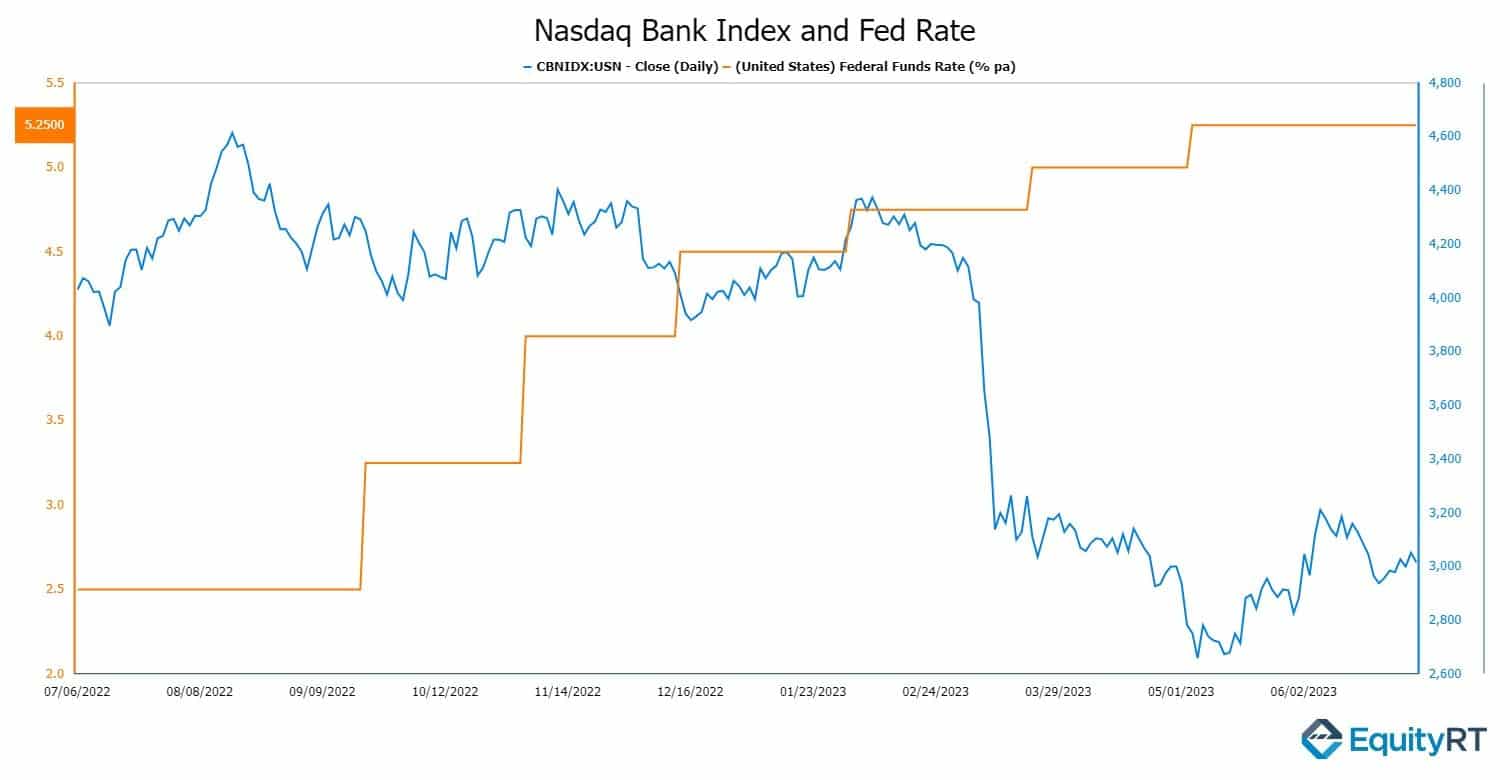

Interest rate increases have a positive impact on the financial sector, particularly benefiting insurance companies, banks, and brokerage firms. These institutions directly generate revenue from interest, and higher interest rates contribute to the growth of their balance sheets by collecting more interest on loans. Banks also attract customers seeking higher returns by offering competitive interest rates for their deposits, and the funds obtained through these deposits can be utilized for asset acquisitions.

However, when banks require immediate cash, an interest rate hike poses challenges in finding liquidity, potentially leading them to borrow more from the central bank at a higher cost. This has implications for their balance sheets and increases the risk associated with the interest rates on their loan portfolios. Higher interest rates raise banks’ operational costs and impact their ability to collect deposits, which can affect their profit margins.

Interest rate increases can result in a slowdown in economic activity, reduced demand, and constrained credit growth. These factors have the potential to impact banks’ revenues and limit their growth prospects. It is important to consider these dynamics as interest rate adjustments can have significant implications for the financial sector, shaping the profitability and operations of insurance companies, banks, and brokerage firms.

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

How Does This Process Work for Banks?

Interest rate increases can have mixed outcomes for banks. While they can lead to higher returns and the opportunity to invest in various financial assets, there are risks involved. Banks’ returns depend on the ability of borrowers to repay their debts. If borrowers struggle to make payments, banks not only miss out on expected profits but also face potential losses. Moreover, interest rate hikes can negatively impact companies in the market, eroding market confidence and leading to poor resource management.

Another concern is the potential losses banks may experience due to their use of customer deposits. Banks make investments using funds collected from customers, which are tied to repayment obligations, including interest. When banks offer the profits from their investments as interest to customers without earning sufficient returns, it can lead to financial difficulties. In high-interest periods where borrowing becomes more expensive, banks relying on borrowing to sustain operations may face significant challenges.

The recent banking crisis in the US serves as an example, where many banks failed due to their attempts to cover repayment difficulties through further borrowing, ultimately increasing their debt burdens. This highlights the importance of prudent management during periods of high interest rates to avoid financial instability and increased debts.

Examining Financial Risk Ratios

Let’s move on to how to examine financial risk ratios after discussing what financial risk is and how it is influenced by macroeconomic indicators.

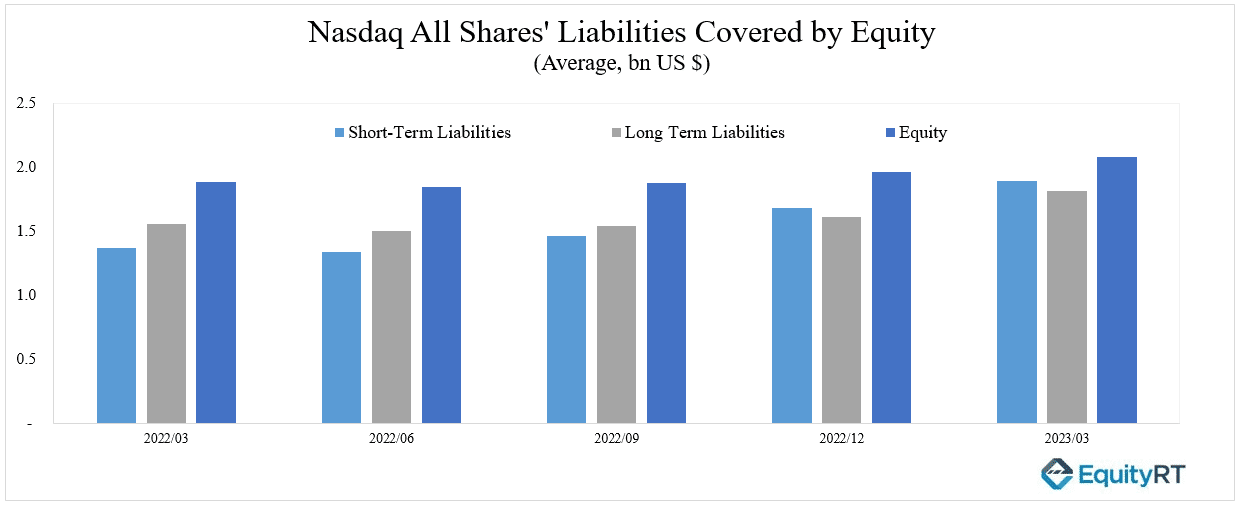

The financial indebtedness of companies serves as an indicator of their potential financial risks. If a company continues to borrow without being able to convert it into investments and continues to deplete its own equity, this situation is not sustainable. The company must either find a way to reduce the costs that led to its borrowing or increase its sales revenues (which is difficult without investment). Financial statements are like tables that indicate the health status of a company. If a company has a high (or increasing) debt burden and there is no significant increase in its equity or assets, warning signs begin to sound.

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

What Are The Ratios Used In Risk Analysis Of Companies?

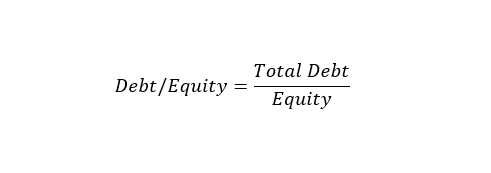

One of the most commonly used ratios in the analysis of financial risk is the “debt ratio” (debt to equity ratio). This ratio shows how much of the debt can be covered by equity, and it is widely used to assess the ability to repay debts.

In addition to equity, company assets play a crucial role in debt repayment. Ratios like “assets to debts” help us understand the relationship between a company’s debts and assets, providing insights into how the company manages its debts, the extent of its asset ownership, and its ability to repay debts using the income generated from these assets.

Several ratios are commonly used to assess a company’s financial position, including the current ratio, cash ratio, and liquidity ratio. These ratios provide valuable information about a company’s liquidity and its ability to meet its short-term obligations.

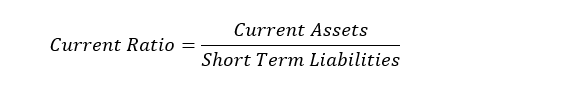

The “Current Ratio” is determined by dividing current assets (assets readily available) by current liabilities (debts due in the current period).

The “Current Ratio” shows how much of the debts can be covered by cash and assets that can be quickly converted into cash. In this regard, it is desirable for current assets to exceed short-term liabilities. The greater the difference between current assets and short-term debts, the higher the working capital of the company. Generally, this ratio should be maintained above 1, preferably between 1.5 and 1.

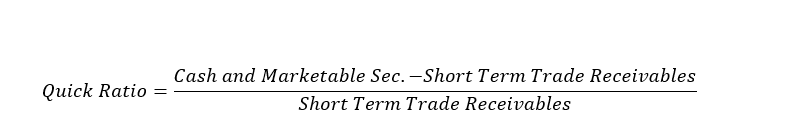

The “Liquidity Ratio” (quick ratio) is calculated by subtracting the inventory, which is the item most difficult to convert into cash, from current assets and then dividing the result by short-term liabilities. This ratio provides a more sensitive version of the current ratio by excluding the portion of inventory from total current assets.

It should be noted that the conversion rates of subcategories within the inventory item (finished goods, work in progress, raw materials, and supplies) differ from one another. Although it is generally sufficient for this ratio to be around 1, it is an important aspect in the context mentioned above. A company that holds a significant amount of inventory at the finished goods level will have a higher inventory conversion ratio compared to companies with predominantly work in progress inventory.

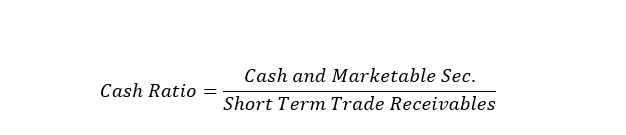

The “Cash Ratio” is calculated by dividing a company’s cash equivalents and marketable securities by short-term liabilities. As the name suggests, it is a ratio that demonstrates the company’s ability to repay current debts using its cash values (the values that can be most quickly converted into cash).

If this ratio is 1 or above, it indicates that the company can easily repay its debts in cash. It means that even if the company does not make any sales or completely foregoes its receivables throughout the period, it will still be able to repay its debts. While high liquidity is not always desirable, it is expected that this ratio should not be below 10-15%.

Within the indicators of financial risk, the ability to repay debts quickly is also of great importance. In this regard, dividing the debts by EBITDA (earnings before interest, taxes, depreciation, and amortization) or dividing the interest-bearing obligations minus cash or cash equivalents by EBITDA shows us how long a company can repay its debt (assuming no changes).

If this ratio is negative, it means that the company does not hold enough cash to repay its debts. If it is greater than 3 or 4, it indicates that the debts have become unpayable.

Conclusion

I aim to clarify the concepts of increasing and decreasing financial risks, their impact on company financial statements, and provide insights for shaping your investment strategies. While it is commonly believed that high-risk areas yield higher returns, it is not always the case. To maximize your returns in this field, it is essential to generate unique ideas and interpretations. Time plays a critical role in investments, as it does in every aspect of life.

Leveraging fin-tech tools like EquityRT Financial Analysis Platform that save time can be your greatest asset in this field.