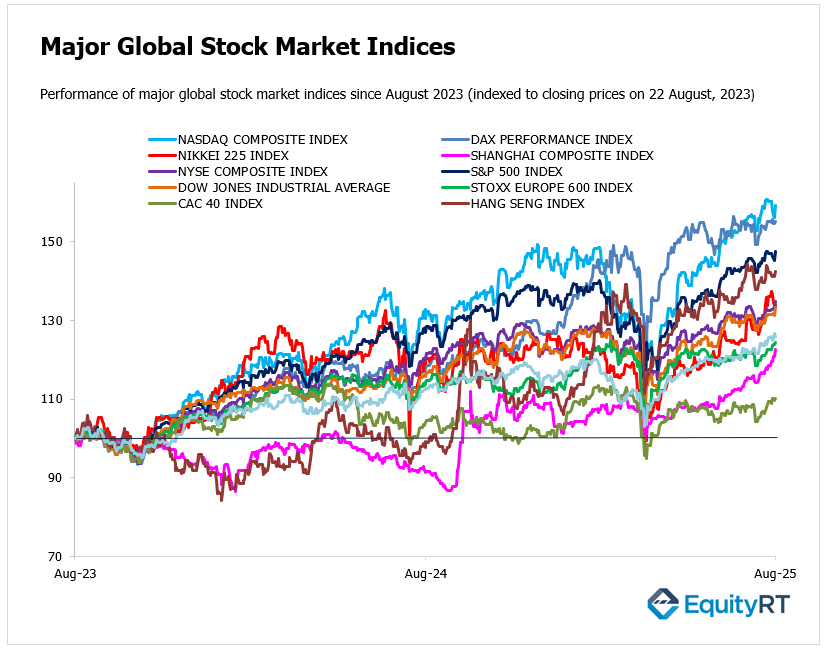

Global Stock Market Highlights

On Friday, US stocks rallied after Fed Chair Powell signalled a possible September rate cut at Jackson Hole. Tech led the rebound, with Tesla up 6.2%, Meta, Alphabet, and Amazon rising over 2%, Nvidia up 1.7%, and Intel jumping 5.5% on reports of a potential 10% Trump administration stake.

- Nasdaq Composite Index closed at 21,496.54, up 1.88% on the day and down 0.58% for the week.

- NYSE Composite Index closed at 21,150.11, up 1.59% on the day and up 1.67% for the week.

- S&P 500 Index closed at 6,466.91, up 1.52% on the day and up 0.27% for the week.

- Dow Jones Industrial Average EW closed at 14,296.49, up 1.53% on the day and up 1.39% for the week.

European stocks closed higher, supported by expectations of a potential interest rate cut by the U.S. Federal Reserve.

- Stoxx Europe 600 Index closed at 561.30, up 0.40% on the day and up 1.40% for the week.

- DAX Performance Index closed at 24,363.09, up 0.29% on the day and up 0.02% for the week.

- CAC 40 Index closed at 7,969.69, up 0.40% on the day and up 0.58% for the week.

**UK markets were closed today for a public holiday.

In the Asia-Pacific region, investors stayed cautious ahead of Powell’s speech, seeking clues on the Federal Reserve’s interest rate outlook. Regional markets showed a mixed performance, with optimism from China’s gains tempered by caution elsewhere, reflecting a wait-and-see approach.

- Nikkei 225 Index closed at 42,633.29, up 0.05% on the day and down 1.72% for the week.

- Hang Seng Index closed at 25,339.14, up 0.93% on the day and up 0.27% for the week.

- Shanghai Composite Index closed at 3,825.76, up 1.45% on the day and up 3.49% for the week.

Australia S&P/ASX 200 Index closed at 8,967.40, down 0.57% on the day and up 0.32% for the week.

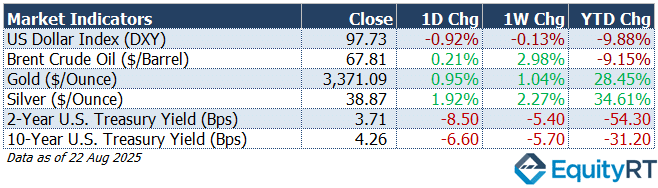

Market Snapshot: Dollar, Gold, Oil & U.S. Yields Update

The Dollar Index (DXY) dipped to 97.73, sliding to 0.92% today, 0.13% this week, and down 9.88% YTD, reflecting broad dollar weakness.

Brent crude edged higher to $67.81/barrel, up 0.21% today and 2.98% weekly, yet still down 9.15% YTD amid mixed demand signals.

Gold surged to $3,371/oz, rising 0.95% daily, 1.04% weekly, and an impressive 28.45% YTD, signaling a strong safe-haven trend. Silver followed suit, climbing to $38.87/oz, up 1.92% on the day, 2.27% weekly, and a remarkable 34.61% YTD.

On the bond front, the 2-year U.S. Treasury yield eased to 3.71%, down 8.5 bps in a day, 5.4 bps this week, and 54.3 bps YTD, showing sensitivity to Fed rate policy. The 10-year yield fell to 4.26%, dropping 6.6 bps in a day, 5.7 bps weekly, and 31.2 bps YTD, signaling lower long-term borrowing costs.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

All eyes in the US will be on Nvidia’s earnings, seen as the ultimate barometer for AI-driven demand across global markets. With the chip giant already boasting the world’s largest market cap and a 31% surge year-to-date, analysts expect a 47% jump in profits, plus guidance on datacenter demand, chip supply, and trade restrictions with China.

On the macro side, the Personal Income and Outlays report (July) will headline the week. Economists forecast 0.4% growth in income and 0.5% growth in spending.

The revised data for the annualized quarterly Personal Consumption Expenditures (PCE) price indexes, a key inflation gauge closely monitored by the Fed, will be released for the second quarter of this year. Both headline and core PCE inflation are expected to rise 0.3%. On an annualized quarterly basis, the headline PCE price index slowed to 2.1% in Q2 from 3.7% in Q1, hitting a three-month low. Core PCE also eased to 2.5% from 3.5% in Q1, signalling reduced inflationary pressures in the second quarter.

Investors will also parse the Q2 GDP second estimate (first reading showed a 3% rebound), alongside durable goods orders, expected to contract by 4%.

Housing data (new home sales, Case-Shiller index, pending sales) and consumer confidence gauges from the CB and Michigan surveys will further shape sentiment.

In Canada, markets await Q2 GDP and current account figures, while Mexico and Brazil will update on trade balance and unemployment.

- Keynote:

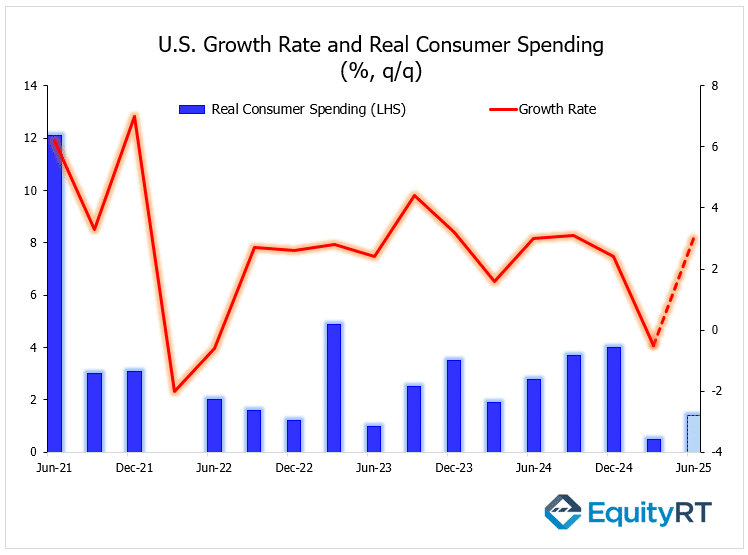

U.S. Q2 2025 GDP – Second Estimate Ahead

Investors are waiting for the release of the second estimate of U.S. GDP and Real Consumer Spending for Q2 2025 this Thursday.

The first estimate indicated a moderate rebound in the U.S. economy following a weak Q1, with growth supported by declining imports and steady consumer demand. By contrast, the first Q2 estimate showed a stronger-than-expected 3% rebound versus forecasts of 2.6%, helped by falling imports, and firmer consumer spending. Consumption, which accounts for most of U.S. output, accelerated to 1.4% from 0.5% in Q1, though just shy of expectations.

A stronger revision on Thursday would signal resilience and support confidence in U.S. growth, while a weaker figure could revive concerns about slower momentum and shape expectations for the Fed’s next policy steps.

Will consumer demand continue to drive growth amid inflationary pressures?

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

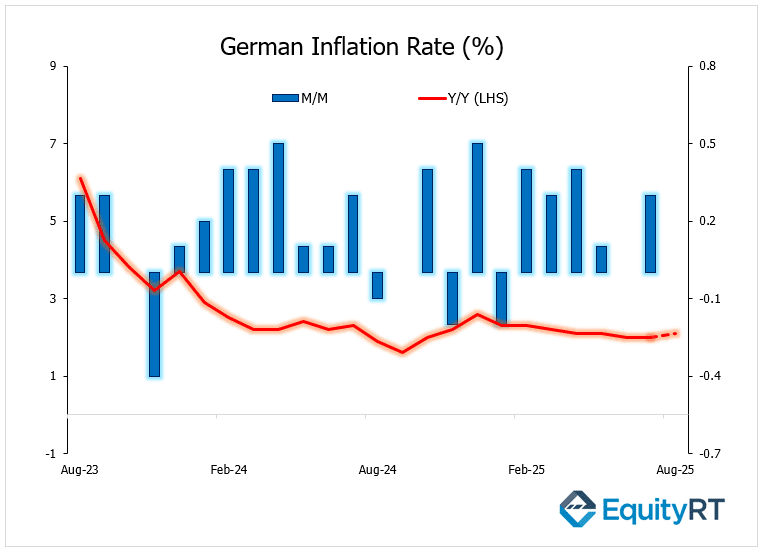

Upcoming Economic Indicators in Europe to Watch This Week

Focus shifts to the ECB’s July meeting minutes, where investors seek clarity on whether the central bank has finally paused after eight consecutive rate cuts since 2022. Inflation prints across the Eurozone’s biggest economies will be key: Germany’s CPI is forecast to edge up to 2.1%, Spain to 2.8%, while Italy (1.7%) and France (1%) are seen unchanged.

Germany will also release fresh sentiment indicators. The GfK consumer climate may recover slightly. Germany’s GfK consumer confidence index for August fell by 1.2 points to -21.5 from -20.3, hitting its lowest level in four months amid ongoing economic uncertainty.

Germany’s Ifo Business Climate Index climbed to 89 in August from 88.6 in July, marking the highest level since May 2024 and beating market expectations of 88.6.

Labor data should show unemployment steady at 6.3%, with jobless totals nearing 3 million. Retail sales are projected to extend their rebound.

Elsewhere, Switzerland will release Q2 GDP and KOF leading indicators, and the UK faces a lighter week with distributive trades and housing price reports.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming Economic Indicators in Asia- Pacific to Watch This Week

In China, official PMI readings will be the top event, alongside industrial profit figures that could reveal the toll of capacity cuts. Japan has a packed calendar, with data on industrial production, retail sales, unemployment, consumer confidence, and Tokyo inflation.

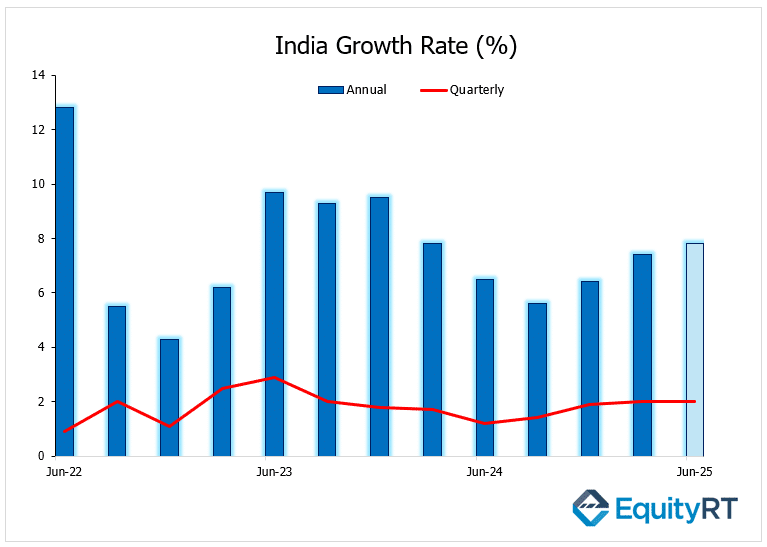

India’s Q2 GDP will be a highlight for emerging market investors, complemented by industrial production and budget updates.

While the domestic economy shows resilience, the external trade environment remains a critical factor.

In Australia, the RBA’s meeting minutes may strengthen expectations of a rate cut next month, with monthly CPI and capital expenditure data also in focus.

Across the region, South Korea and the Philippines are expected to keep rates unchanged, while Singapore publishes fresh inflation data. Trade updates are also due from Hong Kong, Thailand, and the Philippines.