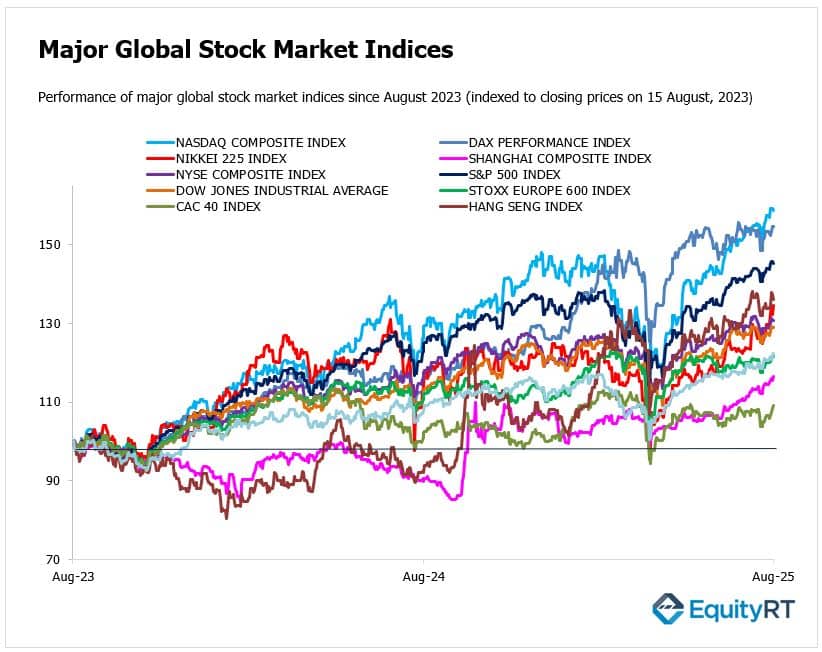

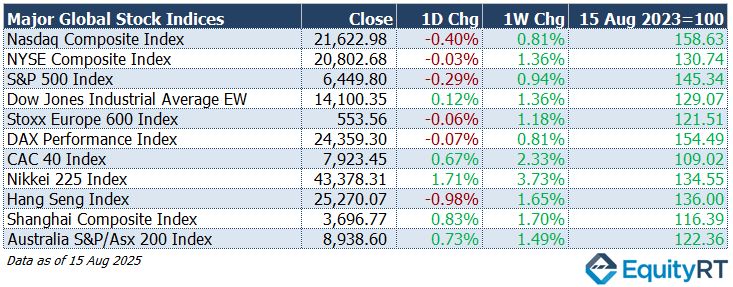

Global Stock Market Highlights

On Friday, U.S. President Trump met with Russian President Putin in Alaska. Trump stated that they had made significant progress with Putin but had not reached a final agreement. U.S. stocks ended mixed that day. Economic data showed July retail sales up 0.5%, in line with forecasts, but consumer sentiment weakened on inflation worries.

- Nasdaq Composite Index closed at 21,622.98, down 0.40% on the day and up 0.81% for the week.

- NYSE Composite Index closed at 20,802.68, down 0.03% on the day and up 1.36% for the week.

- S&P 500 Index closed at 6,449.80, down 0.29% on the day and up 0.94% for the week.

- Dow Jones Industrial Average EW closed at 14,100.35, up 0.12% on the day and up 1.36% for the week.

European markets ended the day on a cautious tone. The STOXX 600 slightly retreated despite earlier optimism. While key indices in Germany and the UK marginally declined, France’s CAC 40 and Switzerland’s SMI advanced.

- Stoxx Europe 600 Index closed at 553.56, down 0.06% on the day and up 1.18% for the week.

- DAX Performance Index closed at 24,359.30, down 0.07% on the day and up 0.81% for the week.

- CAC 40 Index closed at 7,923.45, up 0.67% on the day and up 2.33% for the week.

In the Asia-Pacific region, Japan’s markets shone on strong growth data, while China and Hong Kong lagged. Australia posted modest gains, and the region reflected caution overall amid renewed inflation concerns from U.S. data.

- Nikkei 225 Index closed at 43,378.31, up 1.71% on the day and up 3.73% for the week.

- Hang Seng Index closed at 25,270.07, down 0.98% on the day and up 1.65% for the week.

- Shanghai Composite Index closed at 3,696.77, up 0.83% on the day and up 1.70% for the week.

- Australia S&P/ASX 200 Index closed at 8,938.60, up 0.73% on the day and up 1.49% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, fell to 97.86, down 0.36% on the day, 0.41% lower for the week, and 9.76% weaker year-to-date.

- The Brent crude oil, the global oil price benchmark, slipped to $66.16 per barrel, declining 1.02% on the day, 0.65% over the week, and down 11.36% since the start of the year.

- The Gold held steady at $3,335.60 per ounce, unchanged on the day, down 1.86% for the week, but still up 27.10% year-to-date.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, rose to 3.76%, up 2.20 basis points on the day, down 0.60 basis points for the week, and lower by 48.90 basis points year-to-date.

- The 10-year U.S. Treasury yield, an indicator of long-term borrowing costs, climbed to 4.32%, increasing 3.10 basis points on the day, 3.50 basis points for the week, and down 25.50 basis points year-to-date.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

Monetary policy will be in focus in the U.S. this week. The Federal Reserve will release minutes from its latest FOMC meeting, where rates were left unchanged, but two members dissented. These minutes will set the stage for the Jackson Hole Economic Policy Symposium, where Fed Chair Jerome Powell is scheduled to speak against a backdrop of economic uncertainty, geopolitical risks, and political pressure for sharper rate cuts. Additional context may come from remarks by FOMC members Waller and Bowman, who opposed the last decision and are seen as contenders for the Chair role.

On the data front, housing indicators will be closely monitored, starting with the NAHB Housing Market Index, followed by building permits, housing starts, and existing home sales, which are expected to remain steady.

Investors will also parse the August S&P flash PMIs after last month’s strong performance, as well as the Philadelphia Fed Manufacturing Index.

Earnings season continues with major U.S. retailers, Walmart, TJX, Lowe’s, Target, and Home Depot, alongside tech names Salesforce and Analog Devices.

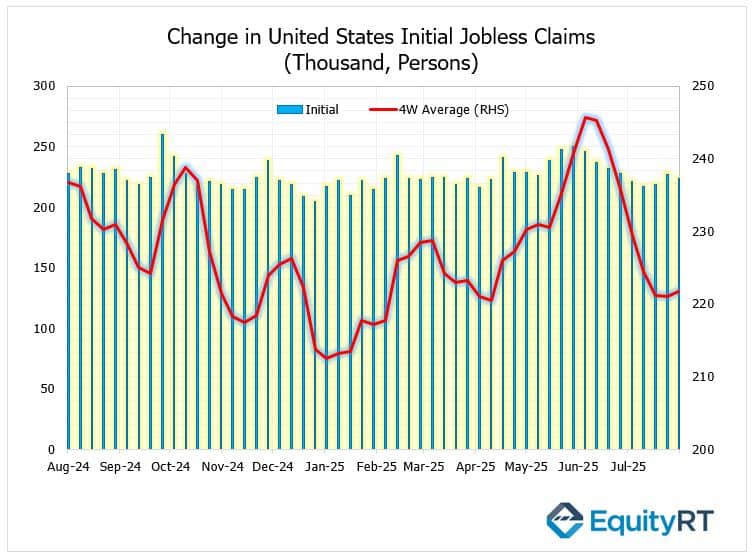

On Thursday weekly jobless claims data will be released. In the first week of August, US initial jobless claims fell slightly by 3,000 to 224,000, below expectations of 228,000, while continuing claims eased by 15,000 to 1,953,000, also below forecasts. The 4-week average edged up slightly to 221.75 thousand.

The labor market remains relatively strong but shows signs of softening, with elevated continued claims suggesting a slowdown in hiring despite recent payroll revisions. Federal employee claims also declined modestly to 637.

In Canada, attention will turn to inflation, expected to stay near the Bank of Canada’s target. Other key releases include producer prices, retail and wholesale sales, the CFIB Business Barometer, housing starts, and new home prices.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming Economic Indicators in Europe to Watch This Week

Flash PMIs from the Euro Area Germany, France, and the UK will headline this week. In the Euro Area, services growth is forecast to cool while manufacturing contraction deepens. Conversely, UK services activity is expected to accelerate, with manufacturing contraction easing.

The Euro Area will also publish consumer confidence, which is likely to weaken, and trade figures, with June’s surplus seen narrowing from last year. In Germany, producer prices are projected to rise for a second month, while in France the manufacturing climate may slip to a 10-month low.

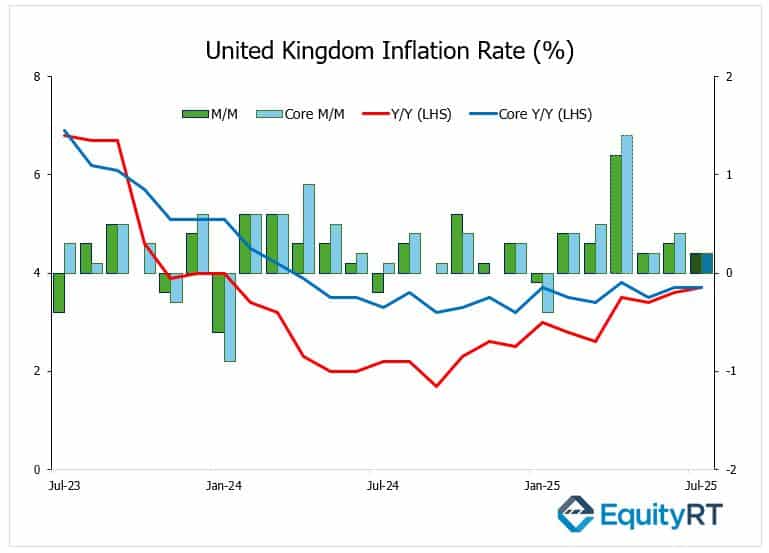

The UK will release CPI, retail sales, GfK consumer confidence, and CBI industrial orders. Annual inflation is forecast to climb to 3.7%, the highest since January 2024, while core inflation should remain steady.

Retail sales may rise 0.6%, extending gains for a second month.

Other reports include Switzerland’s trade and industrial production, and Sweden’s Riksbank rate decision following June’s 25 bp cut.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming Economic Indicators in Asia- Pacific to Watch This Week

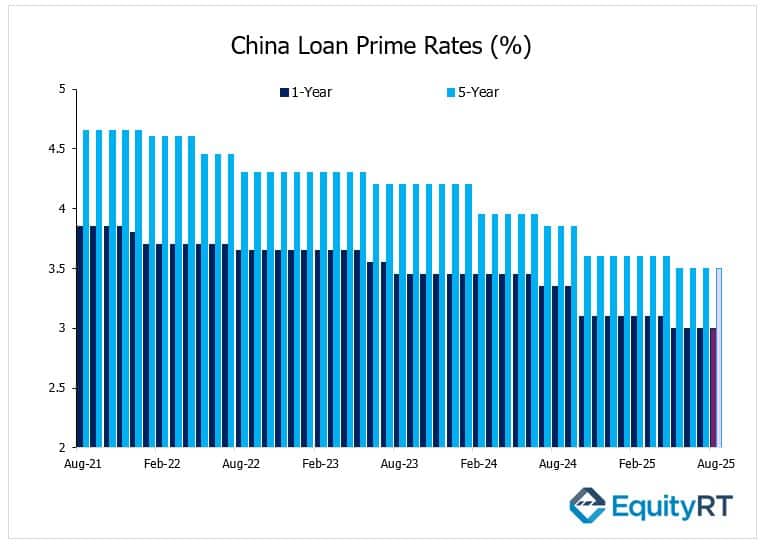

The People’s Bank of China is expected to keep its one- and five-year loan prime rates unchanged at 3% and 5% as it continues supporting liquidity and subsidizing consumer loans.

In Japan, July CPI is likely to show easing inflation, while trade data should reveal a swing back to surplus despite early U.S. tariff impacts. Additional releases include machinery orders, set to contract for a third straight month—and flash PMIs.

India will publish flash PMIs and new unemployment data. In Australia, attention will be on the Westpac consumer confidence index, inflation expectations, and PMI readings.

The Reserve Bank of New Zealand is expected to cut rates by 25 bps to 3%, while Indonesia’s central bank is likely to hold steady at 5.25%.

Elsewhere, the region will see trade data from New Zealand, Singapore, Malaysia, and Taiwan, along with inflation releases from Singapore, Malaysia, and Hong Kong, and GDP figures from Thailand.