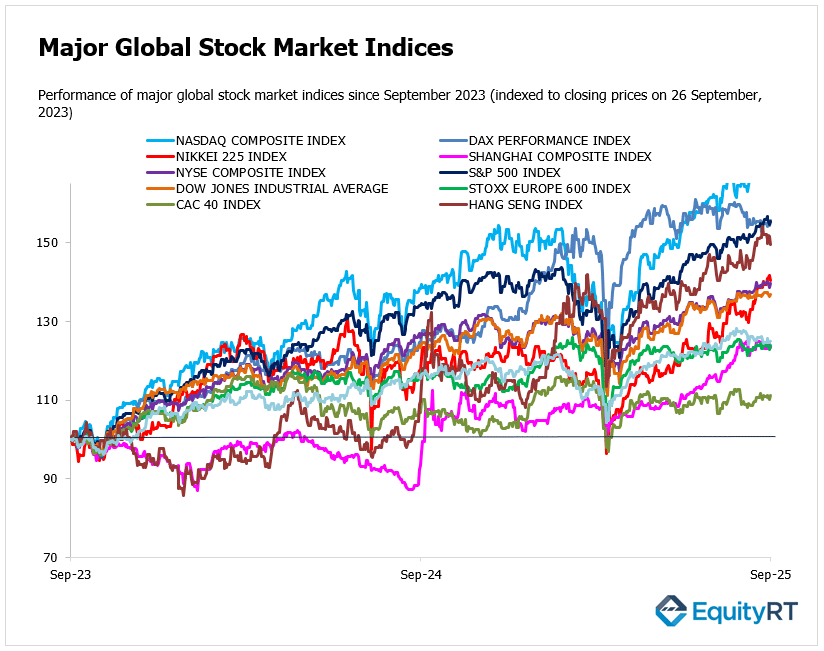

Global Stock Market Highlights

On Friday, Wall Street indexes closed higher, supported by assessments that the U.S. headline and core PCE deflator data for August, coming in line with expectations, would favor at least one more Fed rate cut by the end of the year.

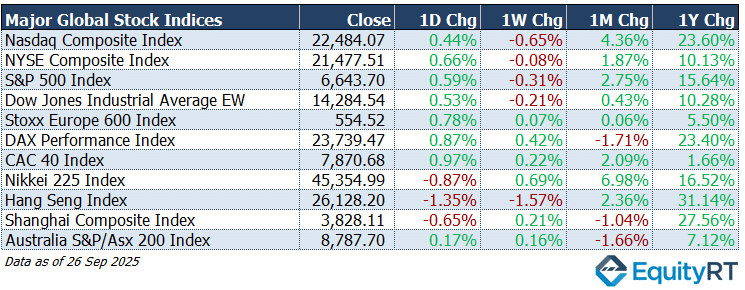

- Nasdaq Composite Index closed at 22,484.07, up 0.44% on the day, down 0.65% for the week, 4.36% higher over the month, and 23.60% higher year-to-date.

- NYSE Composite Index closed at 21,477.51, up 0.66% on the day, down 0.08% for the week, 1.87% higher over the month, and 10.13% higher year-to-date.

- S&P 500 Index closed at 6,643.70, up 0.59% on the day, down 0.31% for the week, 2.75% higher over the month, and 15.64% higher year-to-date.

- Dow Jones Industrial Average EW closed at 14,284.54, up 0.53% on the day, down 0.21% for the week, 0.43% higher over the month, and 10.28% higher year-to-date.

European stock markets saw a modest rebound after weaker performances earlier in the week. The rebound suggests investors were digesting tariff and policy risks and rotating into sectors perceived as less vulnerable or better leveraged to near-term catalysts.

- Stoxx Europe 600 Index closed at 554.52, up 0.78% on the day, 0.07% higher for the week, 0.06% higher over the month, and 5.50% higher year-to-date.

- DAX Performance Index closed at 23,739.47, up 0.87% on the day, 0.42% higher for the week, down 1.71% over the month, and 23.40% higher year-to-date.

- CAC 40 Index closed at 7,870.68, up 0.97% on the day, 0.22% higher for the week, 2.09% higher over the month, and 1.66% higher year-to-date.

Friday’s session in Asia reversed earlier optimism, as markets digested both escalating U.S. trade tensions and a renewed doubt over aggressive Fed easing

- Nikkei 225 Index closed at 45,354.99, down 0.87% on the day, 0.69% higher for the week, 6.98% higher over the month, and 16.52% higher year-to-date.

- Hang Seng Index closed at 26,128.20, down 1.35% on the day, down 1.57% for the week, 2.36% higher over the month, and 31.14% higher year-to-date.

- Shanghai Composite Index closed at 3,828.11, down 0.65% on the day, 0.21% higher for the week, down 1.04% over the month, and 27.56% higher year-to-date.

- Australia S&P/ASX 200 Index closed at 8,787.70, up 0.17% on the day, 0.16% higher for the week, down 1.66% over the month, and 7.12% higher year-to-date.

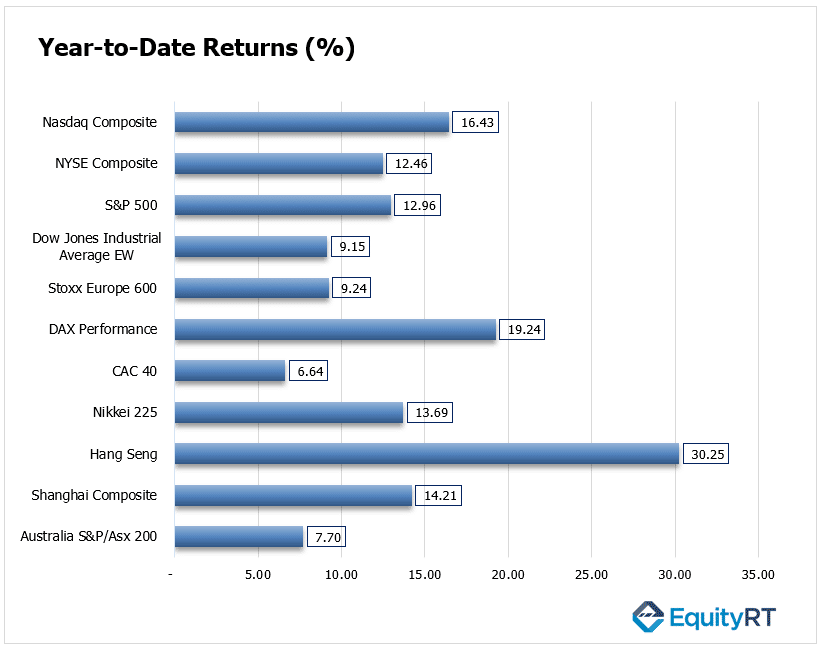

Stock Market Snapshot: Year-to-Date Performance Review

Global equity markets have delivered mixed performances year-to-date. The Hang Seng Index leads with an impressive 30.25% gain, reflecting strong momentum in Hong Kong equities. It is followed by Germany’s DAX Performance Index at 19.24%, and the Nasdaq Composite at 16.43%, supported by technology-driven gains.

Among other major indices, the S&P 500 (12.96%), NYSE Composite (12.46%), and Nikkei 225 (13.69%) also posted solid double-digit returns, while the Shanghai Composite advanced 14.21%. In contrast, Europe’s CAC 40 (6.64%) and Australia’s S&P/ASX 200 (7.70%) lagged, showing more modest growth.

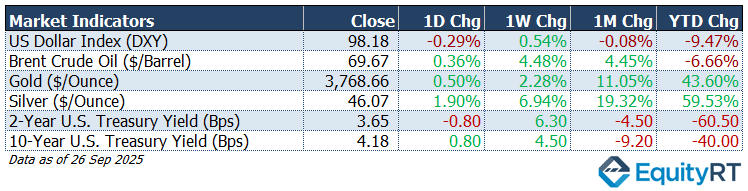

Market Snapshot: Dollar, Gold, Oil & U.S. Yields Update

- US Dollar Index (DXY) closed at 98.18, down 0.29% on the day, 0.54% higher for the week, down 0.08% over the month, and 9.47% lower year-to-date.

- Brent Crude Oil closed at $69.67 per barrel, up 0.36% on the day, 4.48% higher for the week, 4.45% higher over the month, and 6.66% lower year-to-date.

- Gold closed at $3,768.66 per ounce, up 0.50% on the day, 2.28% higher for the week, 11.05% higher over the month, and 43.60% higher year-to-date.

- Silver closed at $46.07 per ounce, up 1.90% on the day, 6.94% higher for the week, 19.32% higher over the month, and 59.53% higher year-to-date.

- The 2-Year U.S. Treasury Yield closed at 3.65 bps, down 0.80 bps on the day, 6.30 bps higher for the week, 4.50 bps lower over the month, and 60.50 bps lower year-to-date.

- The 10-Year U.S. Treasury Yield closed at 4.18 bps, up 0.80 bps on the day, 4.50 bps higher for the week, 9.20 bps lower over the month, and 40.00 bps lower year-to-date.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Key Economic Indicators to Watch This Week

Americas

In the US, the spotlight will be on labor market dynamics after last month’s weak payroll report stirred concerns about a sharper cooling in employment conditions.

Markets’ attention now turns to Thursday’s non-farm payrolls, expected to show a modest rebound with a 39,000 gain in September after August’s weak 22,000 increase, though hiring remains far from the pace seen earlier this year.

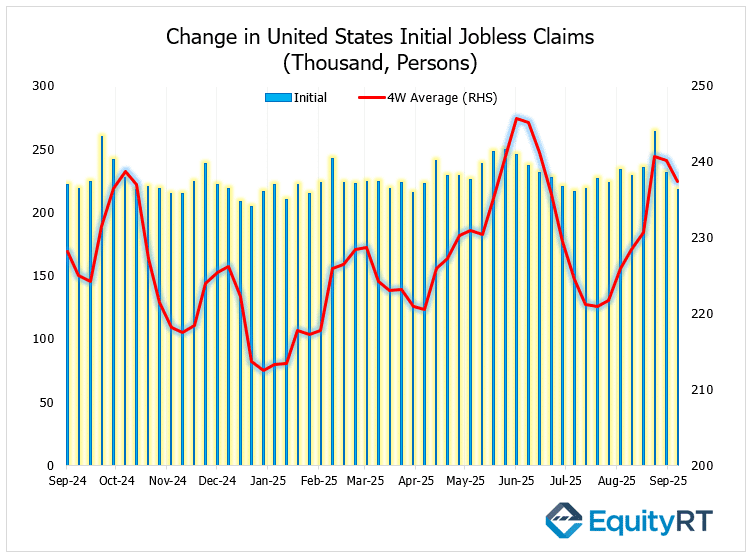

Jobless claims in the US offered a dose of relief last week, easing fears of a sharper downturn in the labor market.

Initial claims fell by 14,000 to 218,000, marking a two-month low and coming in well below expectations for an uptick. Continuing claims also edged down to 1.93 million, the lowest since late May, while the four-week average slipped to 237,500.

These figures push back against recent concerns that employment conditions were deteriorating more aggressively, concerns that had already prompted the Fed to restart its rate-cutting cycle despite lingering inflation pressures.

This release is being closely watched because the Fed uses PCE as its preferred gauge of underlying inflation, and the outcome will shape expectations for the pace of rate cuts into year-end.

The unemployment rate is forecast to hold steady at 4.3%, while average hourly earnings are expected to climb 0.3%, reinforcing the picture of sticky wage growth despite softer hiring. Additional labor signals will come from JOLTS job openings, ADP private payrolls, and job cuts, which together should provide clarity on whether recent weakness is temporary or indicative of a broader slowdown.

Beyond jobs, ISM surveys are expected to show manufacturing is still contracting but at a slower pace, while services should remain resilient. Housing and consumer data, including home prices, pending sales, construction spending, and consumer confidence, will be key for gauging household sentiment and spending power. Meanwhile, government funding negotiations continue to pose a headline risk, with markets wary of a potential shutdown on October 1st.

In Latin America, unemployment releases from Brazil and Mexico, along with PMI surveys, will help shape expectations for regional growth.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Europe

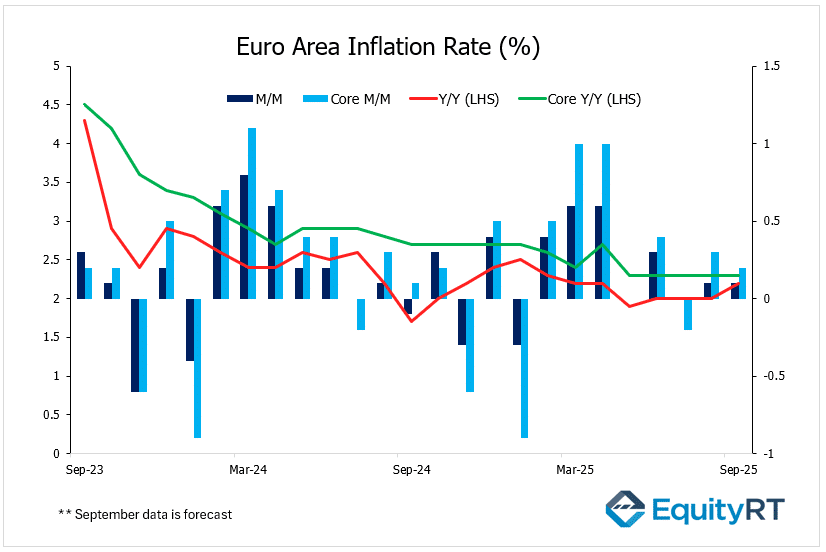

For Europe, inflation takes center stage. September’s Eurozone CPI is projected at 2.3%, with country-level data expected to confirm sticky price pressures across Spain, Germany, Italy, and France. This will be closely watched for implications on the ECB’s policy trajectory, especially as recent data has hinted at a stalling disinflation trend.

Switzerland’s CPI is expected to edge up to 0.3%, reinforcing the view of muted inflation in the country. Labor market trends across Europe are also in focus, with stability in Germany contrasted by slight upticks in unemployment for Italy and Spain.

Retail sales data will offer an important read on household demand, particularly in Germany, where a rebound is anticipated after the sharpest fall in nearly two years. Industrial activity is also expected to recover modestly in France. PMI surveys from Italy and Spain are seen confirming softer momentum in both manufacturing and services, signaling that growth headwinds remain.

In the UK, Chancellor Rachel Reeves’ speech at the Labour Party conference will be closely followed for policy direction, while final GDP, mortgage lending, and housing data provide fresh insight into the economy’s resilience.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asia-Pacific

In Asia, China’s PMI data will dominate attention, with forecasts pointing to ongoing weakness in manufacturing and sluggish momentum in services. Industrial profit figures ahead of the Golden Week holiday will add another layer of insight into the challenges facing the corporate sector.

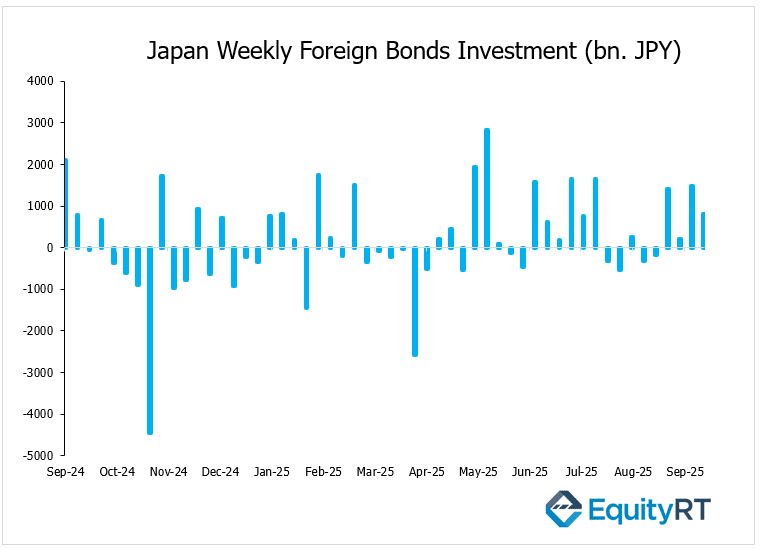

Japan’s Q3 Tankan survey is expected to show only a modest improvement in business sentiment, reinforcing the cautious tone from the Bank of Japan’s latest Summary of Opinions. Industrial production, unemployment, and retail figures will further shape the growth outlook. Japan’s weekly bond investments result will be out on Wednesday.

Elsewhere, central banks in Australia and India are widely expected to leave policy rates unchanged, with markets watching incoming trade, housing, and credit data for signs of shifting demand conditions. Australia’s trade surplus is forecast to widen modestly, underlining the role of commodity exports in supporting the economy.

Across the region, inflation releases from South Korea and Indonesia, alongside PMI surveys, will give a broader view of how Asian economies are navigating weaker global demand and elevated cost pressures.