Global Stock Market Highlights

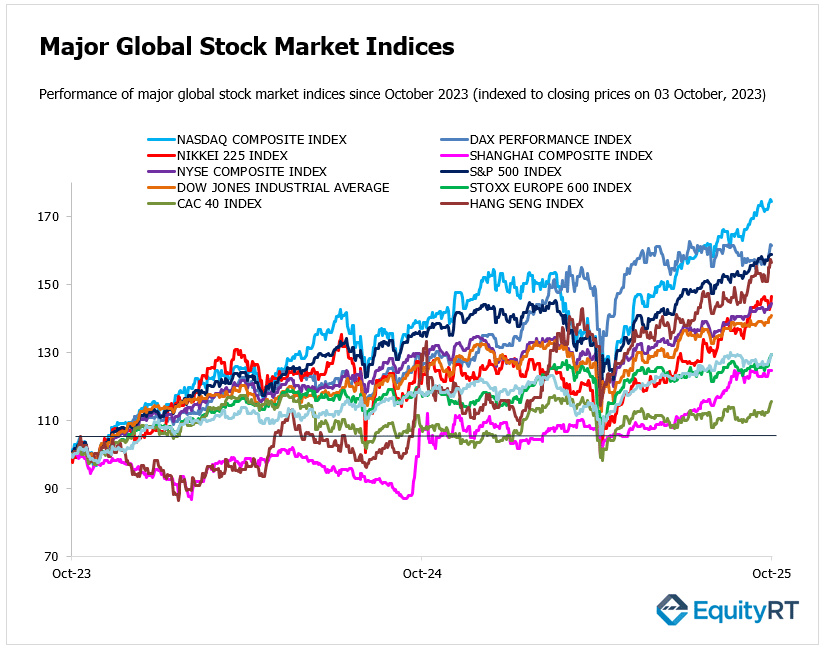

On Friday, U.S. September nonfarm payrolls and unemployment rate data were not released due to the ongoing government shutdown, while September final services PMI and ISM non-manufacturing indices sent mixed signals. In this context, Wall Street indices closed Friday with a mixed performance.

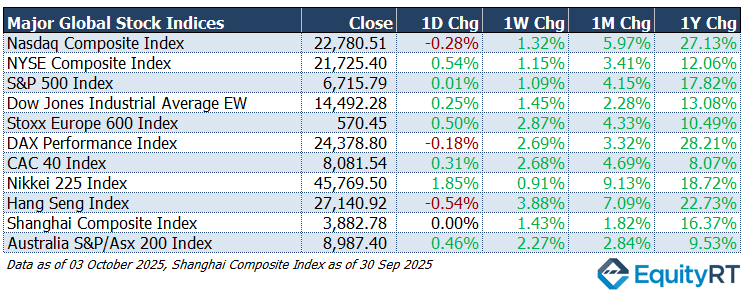

- Nasdaq Composite Index closed at 22,780.51, down 0.28% on the day, 1.32% higher for the week, 5.97% higher over the month, and 27.13% higher over the year.

- NYSE Composite Index closed at 21,725.40, up 0.54% on the day, 1.15% higher for the week, 3.41% higher over the month, and 12.06% higher over the year.

- S&P 500 Index closed at 6,715.79, flat at 0.01% on the day, 1.09% higher for the week, 4.15% higher over the month, and 17.82% higher over the year.

- Dow Jones Industrial Average EW closed at 14,492.28, up 0.25% on the day, 1.45% higher for the week, 2.28% higher over the month, and 13.08% higher over the year.

In Europe, equity markets closed the week on a positive note, continuing a solid weekly rally. Markets were relatively calm as economic data was light, though investors monitored industrial production and trade figures from Germany, Italy, and France, which reinforced optimism about steady growth in the region.

- Stoxx Europe 600 Index closed at 570.45, up 0.50% on the day, 2.87% higher for the week, 4.33% higher over the month, and 10.49% higher over the year.

- DAX Performance Index closed at 24,378.80, down 0.18% on the day, 2.69% higher for the week, 3.32% higher over the month, and 28.21% higher over the year.

- CAC 40 Index closed at 8,081.54, up 0.31% on the day, 2.68% higher for the week, 4.69% higher over the month, and 8.07% higher over the year.

In the Asia-Pacific region, market performance was mixed but largely resilient. Japan’s Nikkei surged on optimism about potential central bank rate cuts and upcoming corporate earnings, while China’s Shanghai Composite gained modestly despite the Mid-Autumn Festival holidays limiting liquidity. Australia’s ASX ended the day higher, supported by positive consumer and business sentiment indicators.

- Nikkei 225 Index closed at 45,769.50, up 1.85% on the day, 0.91% higher for the week, 9.13% higher over the month, and 18.72% higher over the year.

- Hang Seng Index closed at 27,140.92, down 0.54% on the day, 3.88% higher for the week, 7.09% higher over the month, and 22.73% higher over the year.

- Shanghai Composite Index closed at 3,882.78, unchanged on the day, 1.43% higher for the week, 1.82% higher over the month, and 16.37% higher over the year.

- Australia S&P/ASX 200 Index closed at 8,987.40, up 0.46% on the day, 2.27% higher for the week, 2.84% higher over the month, and 9.53% higher over the year.

** China’s financial markets are still closed due to the National Day and Mid-Autumn Festival holidays, and trading will resume on Thursday.

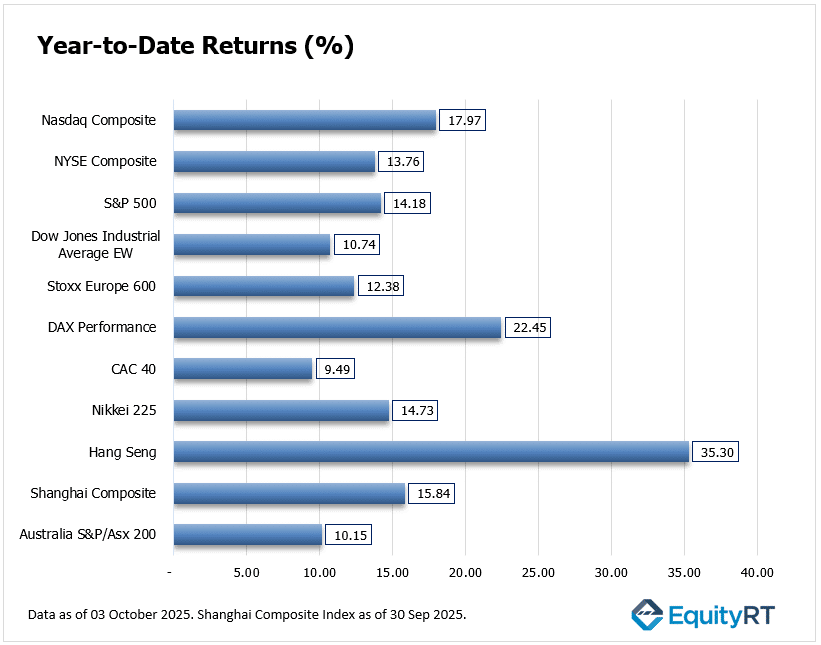

Stock Market Snapshot: Year-to-Date Performance Review

Asia-Pacific markets are leading global gains, with Hong Kong’s Hang Seng Index showing a remarkable 35.3% year-to-date (YTD) return. Shanghai Composite and Japan’s Nikkei 225 also posted solid gains at 15.84% and 14.73%, respectively, highlighting strong performance in the region.

In Europe, Germany’s DAX Performance Index is the top performer at 22.45% YTD, well ahead of France’s CAC 40 at 9.49% and the broader Stoxx Europe 600 at 12.38%, showing Germany’s market strength.

U.S. markets show steady gains, with the Nasdaq Composite leading at 17.97%, followed by the S&P 500 at 14.18%, NYSE Composite at 13.76%, and Dow Jones Industrial Average EW at 10.74%.

Australia’s S&P/ASX 200 shows more modest growth, up 10.15% YTD.

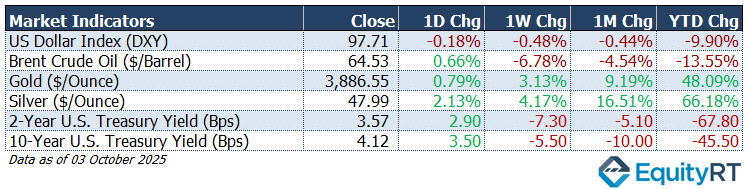

Market Snapshot: Dollar, Gold, Oil & U.S. Yields Update

The US Dollar Index (DXY) closed at 97.71, down 0.18% on the day and nearly 10% YTD. The dollar has been weakening over the year, with a modest decline observed during that week.

Brent Crude Oil closed at $64.53/barrel, up 0.66% for the day but down 6.78% over the week and 13.55% YTD. Oil has faced downward pressure over the medium term, likely due to supply factors or weaker demand expectations, despite minor daily gains.

Gold ended the week at $3,886.55/oz, up 0.79% on Friday and a remarkable 48% YTD. Similarly, Silver closed at $47.99/oz, up 2.13% on Friday and 66% YTD. Silver’s particularly strong performance may reflect both speculative interest and industrial demand.

US Treasury yields showed that the 2-year yield was 3.57 bps, slightly up 2.90 on Friday but down 67.80 bps YTD. The 10-year yield was 4.12 bps, up 3.50 on Friday but down 45.50 bps YTD.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Key Economic Indicators to Watch This Week

In the United States, the big story is the ongoing government shutdown. Lawmakers are struggling to agree on how to fund government operations. The Senate is set to vote on two different proposals, but neither looks likely to pass. This means some important economic reports, like trade data, jobless claims, and the federal budget numbers, could be delayed.

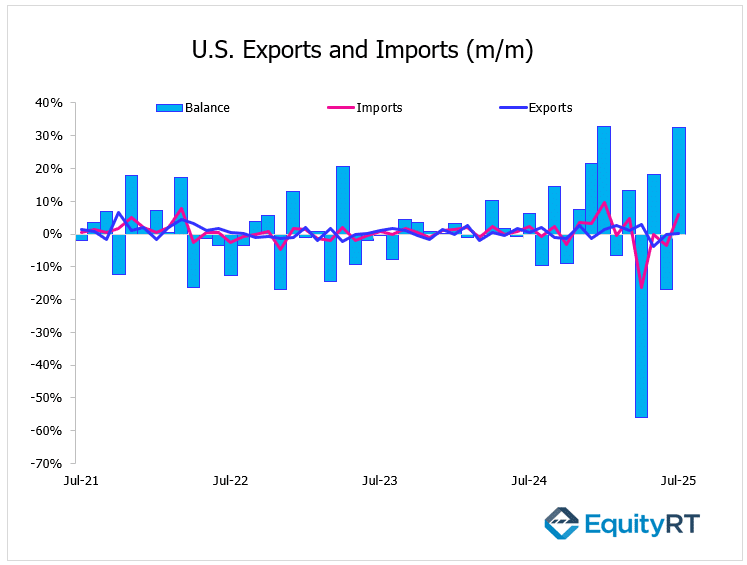

The US trade deficit widened sharply to $78.3 billion in July 2025, up from $59.1 billion in June and above forecasts of $75.7 billion. Exports rose slightly by 0.3% while imports jumped 5.9%. In August, the monthly trade deficit is expected to narrow to 61.4 billion USD.

Investors will turn their attention to the Michigan Consumer Sentiment Survey, which is expected to show confidence slipping to its weakest level since May.

The Federal Reserve will also be in focus, with the release of meeting minutes and several speeches, including one from Fed Chair Jerome Powell, offering clues about interest rate policy for the rest of the year.

Elsewhere in the region, Canada will publish jobs data, trade numbers, and the Ivey PMI, while Mexico will release consumer confidence and inflation figures. Brazil will also report on inflation and trade, both key for tracking the health of Latin America’s largest economy.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Europe

European markets will focus on the ECB’s Monetary Policy Meeting Accounts, as investors search for guidance following the central bank’s decision to keep rates steady for a second consecutive meeting.

The region’s data calendar is relatively thin:

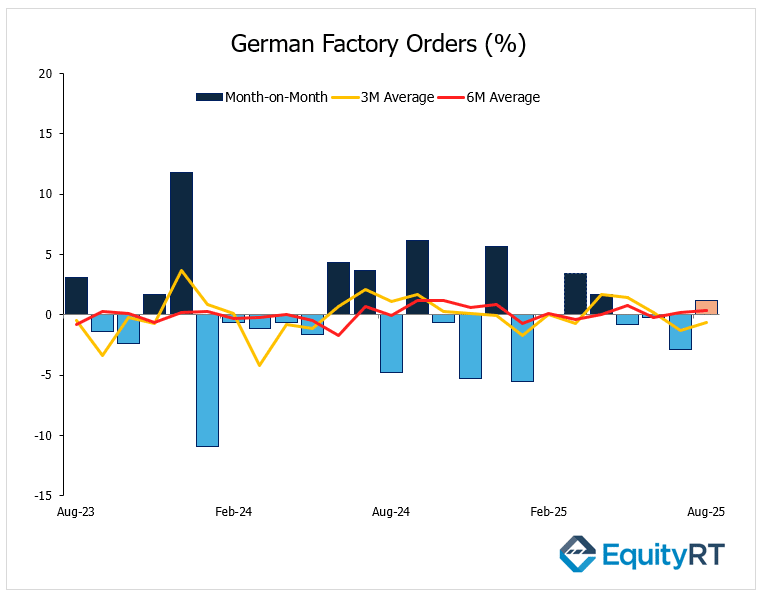

German industrial production is forecast to decline, underlining persistent manufacturing weakness even after an uptick in factory orders. In Germany, factory orders fell by 2.9% in July, following a 0.2% decline in June, marking the third consecutive monthly drop and the steepest decline since January. Industrial production in Germany, however, exceeded expectations in July, rising 1.3% month-on-month and signaling a potential rebound despite ongoing uncertainties related to U.S. trade policies.

Eurozone retail sales showed a modest rebound, suggesting consumption remains subdued.

Trade data from Germany, France, and Italy will provide further context on the bloc’s external demand.

In the UK, the spotlight will be on the housing market through the Halifax and RICS reports, as property prices remain a pressure point for households and banks alike.

Russia’s inflation figures will shed light on monetary stability there. Poland’s central bank is widely expected to pause after three consecutive cuts, signaling a more cautious approach as inflation risks persist.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asia Pacific

Chinese markets remain shut for the Mid-Autumn Festival holidays until Wednesday, keeping liquidity relatively thin across the region.

In Japan, a heavy data release includes household spending, current account balances, producer prices, and labor market indicators. The expected marginal rise in household spending (+0.1%) underscores weak consumer demand, while an improving current account surplus highlights support from external trade.

Producer prices, edging higher after recent declines, could indicate renewed cost pressures. The ruling Liberal Democratic Party’s leadership election this weekend also carries weight, as it will determine Prime Minister Shigeru Ishiba’s successor, shaping policy direction after recent electoral setbacks.

In India, attention will be on final PMI readings as investors monitor growth momentum. Australia’s calendar includes updates on consumer and business sentiment, job ads, and inflation expectations, all critical for gauging domestic resilience amid global uncertainty.

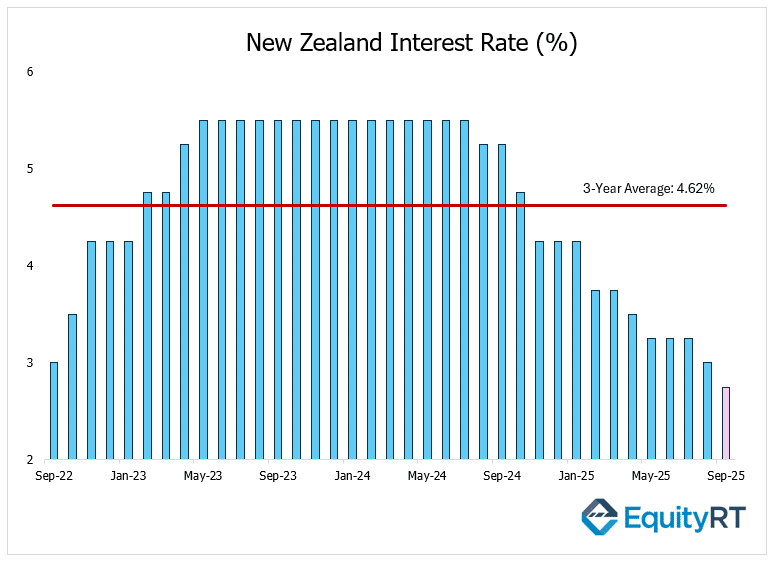

The Reserve Bank of New Zealand (RBNZ) is widely expected to cut rates by 25 basis points to 2.75%, taking a more accommodative stance as economic growth slows. Markets are digesting the recent 25 bp cut to 3.00%, the lowest in three years, with economists warning that further easing could push rates to 2.5% by early 2026. Key economic data is set for release on Wednesday.

Thailand and the Philippines will also announce monetary policy decisions, with inflation data from Vietnam, Thailand, the Philippines, and Taiwan. Trade figures from Vietnam and Taiwan will round out the week, giving investors a clearer picture of Asia’s export engine in a slowing global economy.