Global Markets Recap

U.S. Markets:

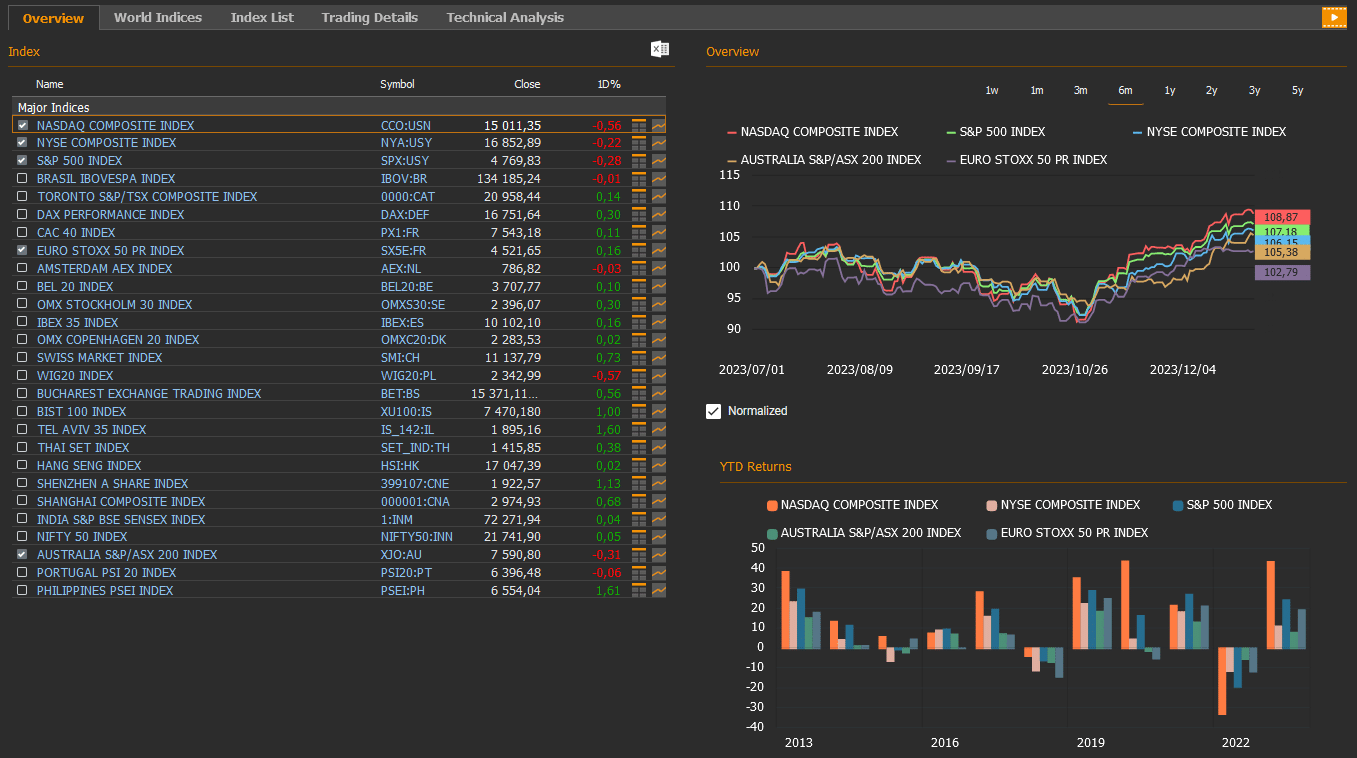

- On Friday, the daily performance of key U.S. indices showed a decline with the Nasdaq index closing down by 0.56%, the NYSE composite index was down 0.22%, the S&P 500 index by 0.28%, and the Dow Jones index by 0.05%.

- The Dollar index concluded last week with a 0.4% decrease, closing at 101.3.

- The barrel price of Brent crude oil closed the previous week at 77 USD, reflecting a 2.2% decrease.

- The price of gold per ounce closed last week with a 0.5% rise, settling at 2,063 USD.

- The 10-year U.S. Treasury yield completed the week with a 2 basis points decrease, reaching a level of 3.88%. The 2-year U.S. Treasury yield, particularly responsive to Federal Reserve policy rates, closed the week at 4.25% after a 7 basis points decrease.

European Markets:

- European stocks closed the Friday session with gains, concluding a positive finish to a robust year. The Stoxx Europe 600 index SXXP, added 0.20% to 479.02. The German DAX index was up by 0.30% to 16,751.44, the French CAC 40 indexrose 0.11% to 7,543.18 and the FTSE 100 index UKX up by 0.14% to 7,733.24.

Asian Markets:

- Stocks in the Asia-Pacific region mostly rose Friday, Dec 29. Hong Kong stocks were flat, with the Hang Seng index gained 0.02% to 17,047.39, while the Nikkei 225 index weakened 0.22% to 33,464.17. China’s Shanghai Composite index added 0.68% to 2,974.93.

- S&P/ASX 200 Benchmark index in Australian stock market weakened 0.31% to 7,590.80.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US Last Week

The past week saw limited data flow due to the holiday season. However, key macroeconomic indicators shed light on economic conditions:

- PCE Deflator Dips and Core PCE Declines in November

November’s Personal Consumption Expenditure (PCE) deflator, despite expectations of remaining flat, recorded a 0.1% decline following October’s 0% level. This marks the first decrease since February 2022. The annual rate dropped from 2.9% to 2.6%, the lowest since February 2021.

Core PCE deflator, both monthly and yearly, experienced decreases of 0.1% and 3.2%, respectively, reaching the lowest level since mid-2021.

- Surging Durable Goods

Durable goods orders for November showed a 5.4% increase, surpassing expectations, particularly driven by a significant rise in non-defense aircraft and parts orders.

- Consumer Confidence Rises

The final reading of the University of Michigan Consumer Confidence Index for December edged up to 69.7, the highest in the last five months.

- Employment Market Signals

Surveys from regional Federal Reserve banks hinted at a potential slowdown in U.S. employment markets in 2024. The Philadelphia Fed survey showed the weakest employment expectations indicator since 2009, while the Dallas Fed survey indicated that 30% of employers believed they had reached ideal staffing levels.

- Slowing Growth in Housing

October’s S&P/Case-Shiller 20 City Home Price Index showed a slowing monthly growth rate of 0.6%, the lowest in the last seven months.

- Stagnation in Pending Home Sales and Positive Signs in Economic Activity

Pending home sales, representing contracts signed but not yet closed, remained flat in November, after a 1.2% decline in October, staying at the lowest level in the last 22 years.+4

Economic activity data in the U.S. provided positive signs, with the Chicago Fed National Activity Index rebounding to 0.03 in November, indicating a return to growth, and the Philadelphia Fed Non-Manufacturing Activity Index rising from -11 to 6.3 in December.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Overview of Key Economic Indicators in the US

The past week saw limited data flow due to the holiday season. However, key macroeconomic indicators shed light on economic conditions:

- PCE Deflator Dips and Core PCE Declines in November

November’s Personal Consumption Expenditure (PCE) deflator, despite expectations of remaining flat, recorded a 0.1% decline following October’s 0% level. This marks the first decrease since February 2022. The annual rate dropped from 2.9% to 2.6%, the lowest since February 2021.

Core PCE deflator, both monthly and yearly, experienced decreases of 0.1% and 3.2%, respectively, reaching the lowest level since mid-2021.

-

- Surging Durable Goods

Durable goods orders for November showed a 5.4% increase, surpassing expectations, particularly driven by a significant rise in non-defense aircraft and parts orders.

- Consumer Confidence Rises

The final reading of the University of Michigan Consumer Confidence Index for December edged up to 69.7, the highest in the last five months.

- Employment Market Signals

Surveys from regional Federal Reserve banks hinted at a potential slowdown in U.S. employment markets in 2024. The Philadelphia Fed survey showed the weakest employment expectations indicator since 2009, while the Dallas Fed survey indicated that 30% of employers believed they had reached ideal staffing levels.

- Slowing Growth in Housing

October’s S&P/Case-Shiller 20 City Home Price Index showed a slowing monthly growth rate of 0.6%, the lowest in the last seven months.

- Stagnation in Pending Home Sales and Positive Signs in Economic Activity

Pending home sales, representing contracts signed but not yet closed, remained flat in November, after a 1.2% decline in October, staying at the lowest level in the last 22 years.

Economic activity data in the U.S. provided positive signs, with the Chicago Fed National Activity Index rebounding to 0.03 in November, indicating a return to growth, and the Philadelphia Fed Non-Manufacturing Activity Index rising from -11 to 6.3 in December.

Take the guesswork out of investing: Backtest your strategies with ease!

U.S. Economic Data Highlights for the Week

- Fed Insights and Manufacturing PMI Trends: Deciphering the December FOMC Meeting and Economic Signals

This Wednesday, the focal point for U.S. markets will be the release of the Federal Reserve’s meeting minutes for the December FOMC meeting. The minutes are expected to provide insights into the central bank’s stance, projections, and discussions on potential future policy shifts, especially in light of recent statements by Fed Chair Powell.

In addition, key economic signals for the current economic activity will be provided by the final S&P Global Manufacturing PMI data for December today, followed by the ISM Manufacturing Purchasing Managers’ Index (PMI) on Wednesday.

Furthermore, on Thursday, the final S&P Global Services PMI data for December will be released, and on Friday, the focus will shift to the ISM Non-Manufacturing PMI.

According to preliminary data, the Manufacturing PMI for December declined from 49.4 to 48.2, indicating an increased contraction in the manufacturing sector, maintaining its downward trend below the growth threshold of 50 for the second consecutive month.

The ISM Manufacturing Purchasing Managers’ Index for November remained at 46.7, signaling continued contraction in the manufacturing sector for the fourteenth consecutive month. However, the Services PMI for December unexpectedly increased from 50.8 to 51.3, suggesting a slight acceleration in growth in the services sector, reaching its highest level in the last five months.

The ISM Non-Manufacturing Index for November rose from 51.8 to 52.7, indicating an acceleration in growth in non-manufacturing sectors.

- Durable Goods and Factory Orders: Examining November’s Rebound

The final data for durable goods orders in November and factory orders will be observed on Friday.

In November 2023, new orders for manufactured durable goods experienced a robust surge, increasing by 5.4% month-over-month. This marked a notable reversal from the 5.1% decline observed in October and exceeded market expectations of a 2.2% increase. The substantial growth, the largest since July 2020, was primarily driven by a significant rise of 15.3% (14.3 billion USD) in transportation equipment, which led the overall increase to reach 107.8 billion USD. Excluding transportation, new orders showed a solid 0.5% increase, while excluding defense, the growth in new orders reached 6.5%.

- Factory Orders Experience Sharp Contraction in October 2023

In October 2023, there was a notable 3.6% month-over-month decline in factory orders.

This followed a downwardly revised 2.3% increase in September and fell short of market expectations, which anticipated a 2.8% decrease. This substantial drop, the most significant since April 2020, suggests challenges in the industrial sector due to elevated interest rates and inflation. Notably, orders for transportation equipment saw a sharp decline of 14.7%, primarily driven by a significant drop in nondefense aircraft and parts (-49.6%).

- JOLTS, ADP, Non-Farm Payrolls, and More in December

Various employment market indicators will be closely watched to gauge the impact on the Federal Reserve’s policy. This includes the JOLTS Job Openings for November on Wednesday, ADP private sector employment, and weekly initial jobless claims on Thursday, followed by non-farm payrolls, unemployment rate, and average hourly earnings for December on Friday.

JOLTS Job Openings in November declined from 9.35 million to 8.73 million, the lowest level since March 2021, indicating a gradual cooling of the labor market with the Fed’s tightening measures.

ADP private sector employment increased by 103,000 in November, slightly below expectations, and the annual wage growth rate decreased from 5.7% to 5.6%, the lowest since September 2021.

Weekly initial jobless claims increased slightly to 218,000 but remained historically low, reflecting continued tightness in the labor market.

Non-farm payrolls for November increased by 199,000, exceeding expectations, while the unemployment rate declined to 3.7%, the lowest since July, and average hourly earnings showed strong growth.

- Anticipated Employment Data for This Week

JOLTS Job Openings are expected to rise from 8.73 million to 8.86 million in November, and ADP private sector employment is anticipated to increase from 103,000 to 115,000 in December.

Non-farm payrolls for December are expected to slightly decline from 199,000 to 170,000, with the unemployment rate increasing from 3.7% to 3.8%.

Average hourly earnings are expected to slow from 0.4% to 0.3% on a monthly basis and decrease from 4% to 3.9% annually in December.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Outlook and Economic Events

Last week, in Europe where there was no significant data flow, let’s take a look at the macro indicators in light of the latest readings:

- Eurozone CPI: November Sees Sharpest Monthly Decline Since January 2020

In the Eurozone, after the headline CPI recorded an increase of 0.1% on a monthly basis in October, the downward revision from a 0.5% decrease to a 0.6% decrease in November was announced, marking the sharpest monthly decline since January 2020. On a yearly basis, it reached 2.4%, maintaining its lowest levels since July 2021.

On the other hand, core CPI in the Eurozone, after showing a monthly increase of 0.2% in October, recorded a 0.6% decrease in November, in line with the preliminary data. On a yearly basis, it decreased from 4.2% to 3.6%, hitting the lowest level since April of the previous year. Core CPI had reached a record level of 5.7% in March.

- Eurozone Consumer Confidence: Modest Recovery Amid Inflation Slowdown

The preliminary consumer confidence index for December in the Eurozone rose from -16.9 to -15.1, reaching its highest level in the last five months but still maintaining a weak trend in the negative zone. Optimism about interest rates in the region starting to fall soon, thanks to the continued slowdown in inflation, played a decisive role in the recovery in consumer confidence.

- German Consumer Confidence and PPI: Mixed Signals Amid Economic Concerns

In Germany, the GfK consumer confidence index for January increased slightly from -27.6 to -25.1, showing a partial recovery in the last two months and reaching its highest level since August. However, it continued its weak trend in negative territory.

Looking at the details, the purchasing tendency index increased from -15 to -8.8, and the income expectations index recovered from -16.7 to -6.9, while the economic situation expectations index increased from -2.3 to -0.4.

The producer price index (PPI) in Germany showed a monthly decrease of 0.5% in November, continuing its decline for the third consecutive month. Expectations were for a 0.3% decrease on a monthly basis. On a yearly basis, the rate of decline in November slowed from 11% to 7.9%, extending its decline for the fifth month. Particularly, the significant decreases in PPI on a yearly basis are influenced by the base effect due to energy prices last year.

- IFO Business Climate Index: German Companies Express Pessimism for Year-End and Beyond

For companies operating in the manufacturing, construction, wholesale, and retail trade sectors in Germany, the IFO business climate index, reflecting evaluations of the current and next 6-month period in the economy, was announced for December. The IFO business climate index fell from 87.2 to 86.4, despite expectations of a slight increase, reaching its lowest level in the last three months.

Looking at the details, the current conditions index fell from 89.4 to 88.5, the lowest since August 2020, while the expectations index fell from 85.1 to 84.3, reaching the lowest level in the last three months. This indicates that companies’ pessimism about the coming months has increased to some extent, influenced by the continued weak performance of the national economy towards the end of the year and the persistence of demand issues, along with a weakening of expectations for economic recovery next year.

- UK CPI and Economic Growth: Challenges Persist with Lower-than-Expected Figures

In the UK, the headline CPI in October remained at 0%, showing a horizontal trend, and then recorded a 0.2% decrease in November, contrary to expectations of a 0.1% increase. On a yearly basis, the headline CPI decreased from 4.6% to 3.9%, hitting the lowest level since September 2021.

Core CPI, after a 0.3% monthly increase in October, recorded a 0.3% decrease in November, marking the first decrease since January, contrary to expectations of a 0.2% increase. On a yearly basis, core CPI in November decreased from 5.7% to 5.1%, hitting the lowest level since January 2022.

The UK economy’s quarterly growth rate slowed from 0.3% to 0% in Q2, indicating a stagnant trend. In Q3, it recorded a 0.1% contraction (expectation: 0%), and the annual growth rate, after slowing from 0.4% to 0.3% in Q2, remained at 0.3% in Q3, contrary to expectations of 0.6% growth.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- European Manufacturing and Services PMI Trends in December

Across Europe, the final PMI data for the manufacturing sector from HCOB for December was released on Monday.

The HCOB Eurozone Manufacturing PMI increased slightly to 44.4 in December, surpassing preliminary estimates of 44.2. Despite the improvement, the sector continued to contract, with ongoing output and job losses for the seventh consecutive month. Some positive indicators included a moderation in the decline of new orders and purchasing activity, along with an eight-month high in business confidence.

The HCOB Germany Manufacturing PMI for December 2023 was revised slightly higher to 43.3 from a preliminary of 43.1, indicating signs of stabilization in the manufacturing sector. Despite remaining in contraction, the data showed solid decreases in output and employment, with forward-looking indicators suggesting an upward trajectory. New orders dropped at the slowest rate in eight months, and business expectations turned positive for the first time since April.

In December 2023, the HCOB France Manufacturing PMI fell to 42.1, the lowest reading on record (excluding the pandemic-induced crash in Q2 2022), revised slightly upwards from the preliminary reading of 42. This marked the 11th consecutive decline in French manufacturing activity, attributed to slowing conditions in key markets and heightened competition abroad.

New orders continued to decline, leading to the 19th straight month of output contraction and decreased outstanding orders.

The HCOB Italy Manufacturing PMI rose to 45.3 in December, the highest since August and above market expectations of 44.4. However, the sector still experienced a ninth consecutive month of contraction, with subdued demand impacting both output and new orders, albeit at a softer pace. New exports declined at the slowest rate in five months, while production decreased the least in three months.

- Service PMIs in December: Contraction Continues, Except in the UK

Final PMI data for the service sector will be followed on Thursday. Service PMIs across the region declined from 49.6 to 48.4 in Germany, from 45.4 to 44.3 in France, and from 48.7 to 48.1 in the Eurozone, indicating a slight increase in the contraction rate in the service sector. In contrast, it increased from 50.9 to 52.7 in the UK, indicating a slight acceleration in growth in the service sector.

- Inflation Indicators for ECB: CPI Data in Germany and Eurozone

Inflation data that will guide the ECB’s monetary policy will be followed by preliminary CPI for December in Germany on Thursday and for the Eurozone on Friday.

In Germany, the headline CPI, after remaining flat at 0% on a monthly basis in October, recorded a 0.4% decrease in November, marking the sharpest decline since December, and on a yearly basis, it decreased from 3.8% to 3.2%, hitting the lowest level since June 2021. Also, on a yearly basis, core CPI decreased from 4.3% to 3.8% in November, maintaining its lowest level since August 2022.

Preliminary data suggests that in December, the headline CPI in Germany is expected to show a 0.2% increase on a monthly basis and rise from 3.2% to 3.7% on a yearly basis.

In the Eurozone, after the headline CPI recorded an increase of 0.1% on a monthly basis in October, it recorded a 0.6% decrease in November, marking the sharpest monthly decline since January 2020, and on a yearly basis, it reached 2.4%, maintaining its lowest levels since July 2021.

Core CPI in the Eurozone, after showing a monthly increase of 0.2% in October, recorded a 0.6% decrease in November, in line with the preliminary data. On a yearly basis, it decreased from 4.2% to 3.6%, hitting the lowest level since April of the previous year.

Preliminary data suggests that in December, the headline CPI in the Eurozone is expected to show a 0.2% increase on a monthly basis and rise from 2.4% to 3% on a yearly basis, while core CPI is expected to decrease from 3.6% to 3.4%.

- Producer Price Index (PPI) Update for Eurozone in November

On Friday, the producer price index (PPI) for November will be released in the Eurozone. In October, PPI increased by 0.2% on a monthly basis, in line with expectations, and thus continued to increase for the third consecutive month. On a yearly basis, the rate of decrease slowed from 12.4% to 9.4%.

In November, PPI is expected to show a 0.2% decrease on a monthly basis and a slowing of the annual decline rate from 9.4% to 8.6%.

Take the guesswork out of investing: Backtest your strategies with ease!

Economic Indicators in Asia for the Week

- A Divergence in Manufacturing and Non-Manufacturing Sectors

In December, the official manufacturing Purchasing Managers’ Index (PMI) in China declined from 49.4 to 49, indicating an acceleration in the contraction of the manufacturing sector and continuing contraction for the third consecutive month. Meanwhile, the official non-manufacturing PMI, which provides insight into the performance of the service and construction sectors, increased from 50.2 to 50.4 in December, indicating a slight acceleration in growth in non-manufacturing sectors. However, the non-manufacturing sector has been in the growth zone for the twelfth consecutive month.

- Caixin China Manufacturing PMI: Mixed Signals Amidst Growing Output and New Orders

The December Caixin manufacturing PMI data, signaling the trend of activities of small and medium-sized enterprises, increased from 50.7 to 50.8, indicating a slight acceleration in growth in the manufacturing sector. This marks the second consecutive month of growth in manufacturing sector activities.

Key highlights include:

- Output and Orders: Output experienced the most significant growth in seven months, while new orders showed the fastest pace since February. New export orders declined at the slowest rate in six months.

- Employment and Backlogs: Employment declined for the fourth consecutive month, at the fastest rate in seven months. Backlogs of work dropped for the first time since May.

- Purchasing and Supply Chain: Purchasing activity stagnated, and supply chain performance deteriorated due to raw material shortages and strained supplier capacity.

- Prices and Cost Pressures: Cost pressures remained subdued, with input costs rising modestly to a four-month low. Output costs increased fractionally, reflecting companies’ reluctance to pass on higher expenses amid heightened market competition.

- Sentiment: Business sentiment weakened, remaining below the series average.

Overall, the readings suggest a mixed picture for China’s manufacturing sector in December 2023, with positive indicators in output and new orders but challenges in employment and supply chain performance. The subdued cost pressures and cautious pricing strategies indicate market competition.

- Continued Growth in December Signals Resilience in the Service Sector

On Thursday, investor attention will be to the Caixin Services PMI data for December, providing signals about the activities of small and medium-sized enterprises.

In November, the Caixin Services PMI in China exceeded expectations, rising from 50.4 to 51.5, indicating an acceleration in growth in the service sector and marking the eleventh consecutive month of growth in service sector activities. It is expected that the index remain stable at 51.5 in December.

- Industrial Profits Surge in China: November Sees Strong Rebound

In the first 11 months of 2023, China’s total industrial profits experienced a notable improvement, with a 4.4% year-on-year decrease compared to a more significant 7.8% fall in the previous period. State-owned firms showed a smaller decline of 6.2%, contrasting with the private sector, which saw a 1.6% rise in profits.

The surge in total industrial profits by 29.5% in November, the fourth consecutive month of growth, was driven by government stimulus measures, reflecting a positive trend in certain sectors despite challenges in others.

- Bank of Japan’s (BOJ) Monetary Policy Outlook: Wage Negotiations to Influence Interest Rate Decisions

The summary of the December meeting of the Bank of Japan (BOJ) strengthened the possibility of waiting for the conclusion of wage negotiations before considering an interest rate hike.

Market speculation about the continuation of negative interest rate policies is expected to decrease after the central bank’s meeting in January next year. However, a significant portion of market players predicts that after evaluating the results of expected wage negotiations in March next year, the Bank may end its negative interest rate policy in April.