Global Markets Recap

U.S. Markets:

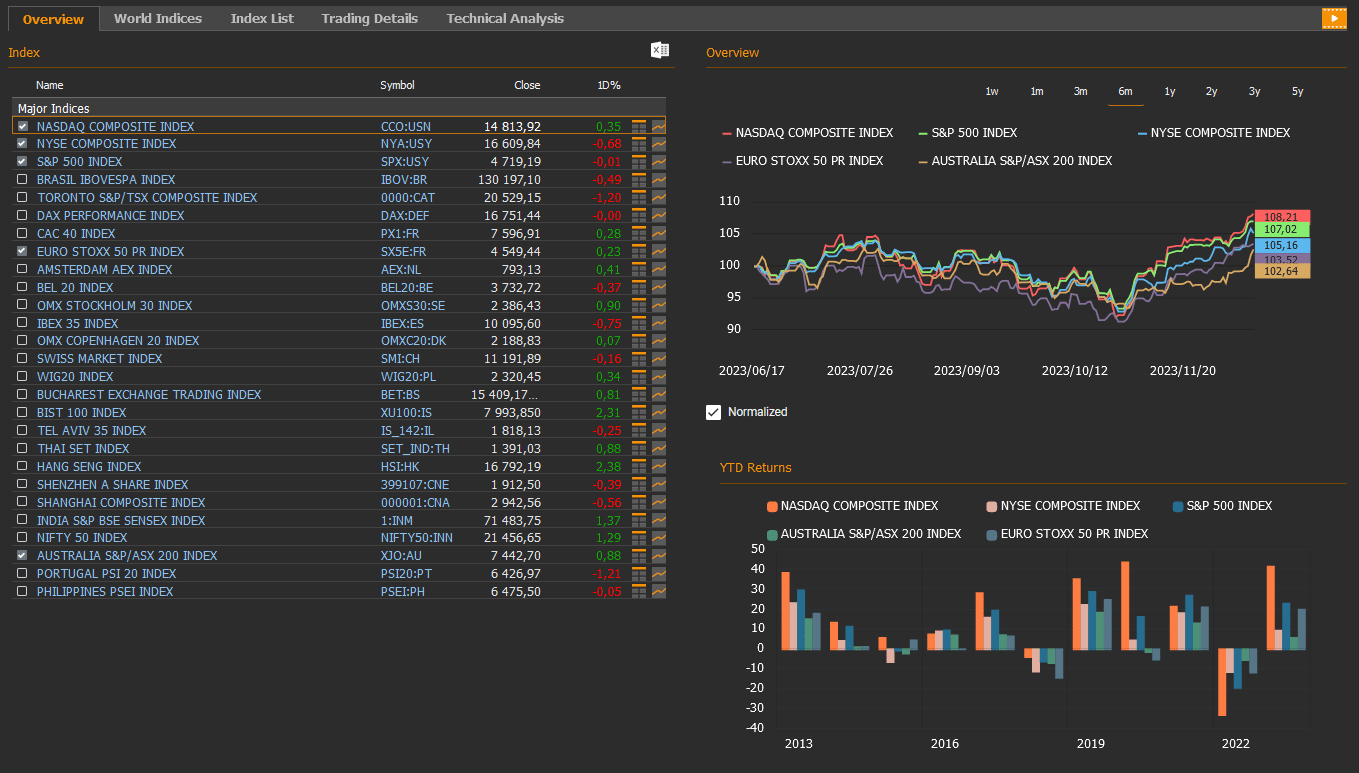

- After some Federal Reserve members hinted on Friday that the Fed would begin interest rate cuts next year, statements that weakened the optimistic atmosphere, Wall Street indices closed the day with a mixed performance. On a daily basis, the Nasdaq index ended the day with a daily increase of 0.35%, the NYSE composite index was down 0.68%, the S&P 500 index concluded the day with a01% decrease, and the Dow Jones index rose by 0.15%.

- The Dollar index closed last week with a 1.4% decline, settling the level of 102.4.

- The barrel price of Brent crude oil closed the previous week at 76.6 USD, reflecting a 0.9% weekly increase.

- The price of gold per ounce closed last week with a 0.7% rise, settling at 2,018 USD.

- The 10-year U.S. Treasury yield completed the week with a 33 basis points decrease, reaching a level of 3.91%. The 2-year U.S. Treasury yield, particularly responsive to Federal Reserve policy rates, closed the week at 4.79% after a 28 basis points decrease.

European Markets:

- European stocks remained steady Friday, as the Stoxx Europe 600 index SXXP, added 0.01% to 476.61. The German DAX index was flat at 16,751.44, the French CAC 40 indexrose 0.28% to 7,596.91 and the FTSE 100 index UKX dropped 0.95% to 7,576.36.

Asian Markets:

- Stocks in the Asia-Pacific region mostly grew Friday, Dec. 15. Hang Seng index gained 2.4% to 16,792.19, while the Nikkei 225 index increased 0.9% to 32,970.55. China’s Shanghai Composite index declined 0.6% to 2,942.56.

- S&P/ASX 200 Benchmark index in Australian stock market gained 0.9% to 7,442.70.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Overview of Key Economic Indicators in the US Last Week

- Consumer Expectations Survey by the New York Fed

According to the November Consumer Expectations Survey by the New York Fed, the short-term median inflation expectation for the next 12 months decreased by 0.2 points to 3.4%, the lowest level since April 2021. The median inflation expectation for the next 3 years remained unchanged at 3%, and the expectation for the next 5 years stood at 2.7%.

- Consumer Price Index (CPI) Data for November

The November CPI data showed a monthly acceleration in the headline CPI from 0% to 0.1%, exceeding expectations, while the annual rate slightly declined from 3.2% to 3.1%. Factors contributing to the monthly increase included a slowdown in the monthly rise in food prices, a significant increase in used car prices, and a rise in the inflation rate for services.

- Food prices, although slowing from 0.3% to 0.2% in November, remained above the monthly headline inflation, supporting the overall increase.

- Used car prices experienced a notable increase of 1.6% in November after a 0.8% decline in October, contributing to the monthly inflation.

- Service prices saw an increase, with the inflation rate rising from 0.3% to 0.5% in November, further supporting the overall inflation.

However, monthly decreases in energy product prices (2.3%), clothing prices (1.3%), and a slight decline in new car prices (0.1%) limited the overall monthly CPI increase.

The core CPI, excluding food and energy, showed a monthly increase from 0.2% to 0.3%, aligning with expectations. On an annual basis, it remained at 4%, maintaining its lowest levels in the past two years.

- Federal Reserve (Fed) Actions and Projections

The Fed, in line with expectations, maintained the federal funds rate range at 5.25% to 5.50% for the third consecutive meeting. The decision was unanimous.

- The Fed emphasized extreme caution regarding inflation risks and stated that additional tightening would be considered if necessary.

- Despite a slowdown in economic growth in the third quarter, inflation was noted to have slowed throughout the year but remained elevated.

- Employment gains have slowed since the beginning of the year but have remained robust, and the unemployment rate continues to stay low.

Additionally, the Fed released new interest rate projections, indicating a downward revision for the next two years:

The year-end interest rate for 2023 is expected to decrease from 5.6% to 5.4%, with further downward revisions for 2024 and 2025. The projections anticipate a total of 250 basis points in interest rate cuts over the next three years, with 75 basis points expected in 2024, 100 basis points in 2025, and 75 basis points in 2026.

The growth forecast for the US economy for this year has been upwardly revised from 2.1% to 2.6%, indicating increased optimism. However, slight downward revisions were made for 2024, from 1.5% to 1.4%, while the forecast for 2025 remained at 1.8%. The growth projection for 2026 was mildly revised upward from 1.8% to 1.9%.

Unemployment rate predictions remain at 3.8% for this year and 4.1% for 2024 and 2025. The unemployment rate forecast for 2026 saw a slight upward revision from 4% to 4.1%.

Projections for PCE inflation, a key inflation indicator for the Fed, were revised downward. Expectations for this year decreased from 3.3% to 2.8%, while forecasts for 2024 and 2025 were lowered from 2.5% to 2.4% and from 2.2% to 2.1%, respectively. The 2026 estimate remained at 2%.

Forecasts for core PCE inflation show a downward revision for this year from 3.7% to 3.2%, for 2024 from 2.6% to 2.4%, and for 2025 from 2.3% to 2.2%. The 2026 estimate for core PCE inflation remains at 2%.

- Federal Reserve Chairman Powell’s Remarks

- Assessment of Inflation: Fed Chairman Powell, following the interest rate decision, mentioned that inflation has slowed down but remains elevated. He acknowledged that reaching the 2% inflation target would take time. Powell expressed the belief that the policy rate in the tightening cycle is likely at or near its peak.

- Policy Outlook and Rate Cuts: Powell stated that discussions about the timing of interest rate cuts have taken place. He emphasized that the timing of rate cuts would be carefully considered and that decisions regarding rate cuts would be approached with caution. Powell noted that they are at the beginning of the debate on easing policy, and while they are prepared to tighten policy further if necessary, they do not want to rule out the possibility of additional rate hikes.

- Uncertainty and Future Path: Powell highlighted the uncertainty regarding the future path and stated that the full effects of tightening have not been fully realized. He mentioned that the path forward is unclear, and the complete impact of tightening is yet to be seen.

- Risk Monitoring and Caution: Expressing vigilance in monitoring the risks posed by high inflation, Powell reiterated their commitment to keeping policy restrictive until inflation is sustainably brought down to 2%. He emphasized that a cautious stance will continue, and further tightening might be considered if necessary.

- Data-Driven Decision-Making: Powell affirmed that decisions would be made from meeting to meeting and stressed that future decisions would be entirely data-driven. He emphasized the importance of evaluating all data, not relying on a single indicator. Powell mentioned that if strong growth is observed, it could mean a more extended period to bring down inflation, and above-trend growth might necessitate raising interest rates again.

- Progress in Core Inflation: Powell stated that real progress has been seen in core inflation, and reasonable progress has been observed in non-housing service inflation.

- Labor Market and Economic Activity: Powell considered the fact that inflation easing without an increase in unemployment is good news. He noted that the labor market is still tight but has achieved a better balance. Powell mentioned that nominal wage growth has started to slow down, and members expect the labor market to continue rebalancing.

- Impact of Restrictive Stance: Powell acknowledged that the restrictive stance is exerting downward pressure on economic activity and inflation.

- Conclusion and Future Decision-Making: Powell concluded by reiterating that future decisions would be made based on data, the evolution of the outlook, and emerging risks. He underscored the comprehensive evaluation of all factors and the ongoing commitment to adapt policy based on the economic landscape.

- Producer Price Index (PPI) Data for November

In November, the Producer Price Index (PPI) exhibited a flat monthly trend after a 0.4% decline in October. The annual rate decreased from 1.2% to 0.9%, reaching its lowest level since June.

- Food prices increased monthly (0.1% decrease to 0.6% increase).

- Energy product prices declined monthly by 1.2%.

- Core PPI, excluding food and energy, remained flat monthly (expectations were for a 0.2% increase) and decreased annually from 2.3% to 2%, reaching the lowest level since January 2021.

- S&P Global Manufacturing and Services PMI for December

The preliminary S&P Global Manufacturing PMI for December decreased from 49.4 to 48.2, signaling an accelerated contraction in the manufacturing sector. Conversely, the Services PMI increased from 50.8 to 51.3, indicating a slight acceleration in the growth of the service sector.

Additionally, industrial production showed a partial recovery in November with a 0.2% increase after a sharp 0.9% contraction in October.

Capacity utilization rate increased by 0.1 points to 78.8% in November (expectations were for a slight increase to 79.1%).

- Manufacturing Sector, Retail Sales and Jobless Claims

In December, the New York Fed Empire State Manufacturing Index declined from 9.1 to -14.5, indicating a return to contraction territory and marking the lowest level in the past four months. Expectations were for the index to decrease to 3.8, remaining in the growth zone.

Retail sales in November defied expectations of a continued decline, recording a 0.3% increase despite the anticipated decline following a 0.2% decrease in October. This suggests a recovery in domestic demand, particularly during the holiday season.

Weekly initial jobless claims for the week ending December 9 fell to 202,000, the lowest level in the past two months, indicating continued tightness in the labor market.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming US Economic Indicators

- Fed’s Focus on Interest Rates and Powell’s Speech

This week, the focal point in the U.S. markets will be the Federal Reserve’s interest rate decision and the speech by Fed Chair Powell on Wednesday. Additionally, the Fed’s new macroeconomic projections will be released.

In the November meeting, the Fed kept the federal funds rate range unchanged at 5.25%-5.50%, aligning with expectations for the second consecutive meeting. The decision, made unanimously, emphasized the persistence of high inflation and the careful monitoring of inflation risks. Members highlighted the consideration of cumulative tightening in monetary policy, taking into account the delayed effects.

Powell, in his post-decision speech, mentioned that despite inflation being above the target, there was still a path to achieving the target sustainably. He expressed the intention to keep rates at these levels until they are sure inflation is approaching the target.

- Inflation Data

Data crucial for shaping the Fed’s monetary policy will be closely watched, with November Consumer Price Index (CPI) expected on Tuesday and Producer Price Index (PPI) on Wednesday.

In October, headline CPI remained unchanged, with expectations for a 0.1% monthly increase. Year-on-year, headline CPI decreased from 3.7% to 3.2%, below the anticipated 3.3% increase. Core CPI slowed from a 0.3% monthly increase to 0.2%, with the year-on-year rate dropping from 4.1% to 4%, the lowest in the last two years.

In October, headline Producer Price Index (PPI) showed a 0.5% monthly decline, with the year-on-year rate decreasing from 2.2% to 1.3%.

- Anticipated Movements in November Inflation Data

For November, the headline CPI is expected to remain flat on a monthly basis, maintaining a slight decrease in the year-on-year rate from 3.2% to 3.1%. Core CPI is projected to see an increase in the monthly growth rate from 0.2% to 0.3%, with the year-on-year rate staying at 4%.

Headline PPI is anticipated to register a 0.2% monthly increase in November, with a decrease in the year-on-year rate from 1.3% to 1.0%. Core PPI is expected to show a 0.2% monthly increase, with a year-on-year decrease from 2.4% to 2.3%.

- Retail Sales

Thursday will see the release of November retail sales data, providing signals about the trend in domestic demand. After a 0.1% decline in October, retail sales are expected to decrease by 0.1% again in November.

- Weekly Unemployment Claims

Thursday will also bring the weekly new jobless claims data, offering insights into the employment market. The historically low levels seen recently indicate continued tightness in the labor market.

- Manufacturing and Service Sector PMIs

On Friday, S&P Global Manufacturing and Services PMI data for December will be released, providing signals about the current state of economic activity.

Manufacturing PMI is expected to show a slight acceleration in contraction, decreasing from 49.4 to 49.2. Services PMI is expected to indicate a mild slowdown in growth, declining from 50.8 to 50.7.

- New York Fed Empire State Manufacturing Index

The December data for the New York Fed Empire State Manufacturing Index, signaling the trajectory of manufacturing, will be observed on Friday. While the index is expected to decrease from 9.1 to 6, it is anticipated to remain in the growth zone.

- Industrial Production and Capacity Utilization

Friday will also bring data on industrial production and capacity utilization for November, providing insights into the trajectory of production. After a significant contraction in October, a partial rebound is expected in November with a 0.2% increase in industrial production. Capacity utilization is projected to show a slight uptick from 78.9% to 79.0%.

- Bank of Canada’s Interest Rate Decision

The Bank of Canada kept its policy rate steady at 5%, the highest level since 2001, aligning with expectations and signaling a pause in rate hikes for the past three months. The Bank acknowledged signs that the policy has moderated spending and eased price pressures but expressed ongoing concerns about inflation risks, stating readiness to further increase the policy rate if necessary.

Take the guesswork out of investing: Backtest your strategies with ease!

U.S. Economic Data Highlights for the Week

The week’s economic indicators cover key aspects such as GDP growth, PCE indices, consumer confidence, jobless claims, durable goods orders, and the housing market.

Housing data for November, including housing starts and building permits, will be released on Tuesday. Wednesday will feature existing home sales data for November. Friday’s economic calendar includes new home sales data for November.

The final figures for the annualized quarterly GDP growth rate in Q3 will be published on Thursday. Following a slight deceleration from 2.2% in Q1 to 2.1% in Q2, the growth rate for Q3 was revised upwards from 4.9% to 5.2%, indicating the strongest growth since Q4 2021. The upward revision was particularly influenced by non-residential fixed investments and upward revisions in local government expenditures, despite a downward revision in the growth rate of consumption expenditures (from 4% to 3.6%).

The final data for the annualized quarterly Personal Consumption Expenditures (PCE) price indices for Q3 will be disclosed on Thursday. The PCE price index is expected to undergo a slight downward revision from 2.9% to 2.8%, and the core PCE price index from 2.4% to 2.3%.

The Conference Board Consumer Confidence index, which rose from 99.1 to 102 in November, will be released on Wednesday. The current conditions index slightly decreased from 138.6 to 138.2, while the expectations index increased from 72.7 to 77.8.

Preliminary data for the University of Michigan Consumer Confidence Index for December, which increased from 61.3 to 69.4 in November, will be published on Friday. Inflation expectations for the next year decreased from 4.5% to 3.1%, marking the lowest level since March 2021.

The weekly new jobless claims will be reported on Thursday, with the last release reaching the lowest level in the past two months (202,000).

Friday will see the release of the preliminary data for November’s durable goods orders, reflecting a 5.4% decrease following a 4% increase in September.

Key data on the PCE deflator for November will also be released on Friday, with expectations of a slight downward revision in monthly and yearly rates (from 3% to 2.8%). Personal income monthly growth is expected to increase from 0.2% to 0.4%, and personal spending from 0.2% to 0.3%.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Outlook and Economic Events

- ZEW Indices in Germany: Cautious Improvement in December

In December, the ZEW current conditions and expectations indices were announced, shedding light on the trajectory of the economy in Germany. Accordingly, the ZEW current conditions index in December slightly improved from -79.8 to -77.1, recording the highest level in the last four months but maintaining its weak trend in the negative zone.

The ZEW expectations index increased from 9.8 to 12.8 in December, extending its positive trajectory for the second consecutive month and maintaining its highest levels since March.

The rise in current conditions and expectations indices in December was influenced by survey participants’ expectations of a future interest rate cut by the ECB in the medium term.

- European Economic Overview: PMI Data Reflects Contraction

In the broader context of the economic outlook in Europe, December’s preliminary PMI data for manufacturing and services sectors, provided by HCOB, were monitored.

Manufacturing PMIs in the region continued their contraction below the 50 growth threshold, reflecting the impact of tightening financial conditions and weakening demand following the ECB’s interest rate hikes.

Service PMIs also continued their contraction trend in December, except for the UK.

Manufacturing PMIs indicated a slight increase in the pace of contraction in the manufacturing sector in December for France (42.9 to 42) and the UK (47.2 to 46.4), while the Eurozone (44.2) and Germany (42.6 to 43.1) maintained their contraction pace.

Examining the details of manufacturing PMIs in the Eurozone, December witnessed a sharp decline in production, extending its decline for the ninth consecutive month. Manufacturers reduced input stocks at the sharpest rate since November 2009 due to decreased orders, and decreases were observed in the rates of increase in input and output prices.

In the service sector, December marked the fifth consecutive month of contraction, with new orders declining at the sharpest rate in the last three years.

- Eurozone Industrial Production: Contractions Persist in October

Regarding industrial production in the Eurozone for October, there was a monthly decline of 0.7%, exceeding expectations, and the annual rate of decline slowed from 6.8% to 6.6%, persisting in contraction for the eighth consecutive month.

- ECB’s Monetary Policy Decisions: Balancing Act

The European Central Bank (ECB) decided to maintain interest rates, pausing interest rate hikes in the last two meetings. Additionally, the ECB announced a faster reduction in its balance sheet. The key refinancing rate remained at 4.50%, the marginal lending rate at 4.75%, and the deposit facility rate at 4.00%.

The ECB emphasized that future decisions would ensure that policy interest rates are sufficiently restrictive as needed, and a data-dependent approach would continue to determine the appropriate level and duration of the restrictive stance.

The ECB also decided to accelerate the normalization of its balance sheet, indicating a faster exit from the 1.7 trillion Euro Pandemic Emergency Purchase Program (PEPP). The reinvestment of income obtained under PEPP will be reduced by an average of 7.5 billion Euro per month from the second half of 2024, and reinvestment under PEPP will not continue after the end of 2024.

- ECB’s Macroeconomic Projections: Downward Adjustments

The ECB’s new macroeconomic projections were published, revealing a downward adjustment in inflation expectations for the next two years, along with reduced growth expectations.

The ECB’s new macroeconomic projections indicated a reduction in headline inflation expectations for 2023 (from 5.6% to 5.4%) and 2024 (from 3.2% to 2.7%). The 2025 inflation forecast remained at 2.1%.

Core inflation forecasts were lowered for 2023 (from 5.1% to 5%) and 2024 (from 2.9% to 2.7%) and slightly revised upward for 2025 (from 2.2% to 2.3%). Consequently, the ECB is expected not to reach the 2% inflation target by 2025.

As for growth forecasts for the Eurozone, they decreased for 2023 (from 0.7% to 0.6%) and 2024 (from 1% to 0.8%), while the 2025 growth forecast remained at 1.5%.

- Bank of England’s Policy Stability: Holding Firm at 5.25%

The Bank of England (BoE) kept its policy rate at 5.25%, consistent with expectations. The minutes indicated that the conditions for the policy rate were to remain at 5.25% until the third quarter of 2024, gradually reducing to 4.25% by the end of 2026.

Inflation returning to the 2% target by the end of 2025 was anticipated. BoE Governor Bailey expressed the view that interest rates should remain at current levels for a long time, stating that it is too early to consider reducing interest rates, and he could not guarantee that rates have peaked.

- Swiss National Bank’s Policy: Stability at 1.75%

The Swiss National Bank kept its policy rate at 1.75%, noting a slight easing of inflationary pressures, maintaining the rate at its highest level since April 2002.

- Norwegian Central Bank’s Surprising Move: 25 Basis Point Increase

Contrary to expectations, the Norwegian Central Bank raised its policy rate by 25 basis points to 4.50%, signaling an intention to keep it at this level for some time.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Economic Indicators in Focus This Week in the European Region

- IFO Business Climate Index in Germany

The IFO Business Climate Index for December, reflecting the evaluations of firms in manufacturing, construction, wholesale, and retail sectors in Germany, was released.

The index unexpectedly fell to a three-month low of 86.4 in December 2023, down from a revised 87.2 in November and below market expectations of 87.8. This decline was driven by increased pessimism among companies regarding both their expectations for the coming months (84.3 vs 85.1) and their current business situation (88.5, the lowest since August 2020, vs 89.4). Analyzing the data by industry, sentiment deteriorated among manufacturers (-17.2 vs -13.8), traders (-26.6 vs -22.2), and constructors (-33.3 vs -29.5), although it showed a slight improvement among service providers (-1.7 vs -2.5). Top of Form

- Final CPI Data for November in the Eurozone

Crucial inflation data influencing the ECB’s monetary policy decisions will be unveiled on Tuesday with the release of the final Consumer Price Index (CPI) for November in the Eurozone.

Expectations are centered around a decline in both the monthly and annual inflation rates compared to October.

- CPI Data for November in the UK

In the UK, Consumer Price Index (CPI) data for November will be released on Wednesday, offering insights into the Bank of England’s future monetary policy decisions.

October saw a higher-than-expected decline in both monthly and annual inflation rates, reaching the lowest levels since October 2021.

- German Producer Price Index (PPI) Decline: November Overview

Germany’s Producer Price Index (PPI) for November will also be disclosed on Wednesday.

Following a 0.2% monthly decline in September, German PPI showed a further 0.1% decrease in October, marking a consecutive two-month decline. On a yearly basis, the decline rate accelerated from 14.7% in October, reaching 11%, extending the downward trend for the fourth consecutive month. Notably, the significant declines in the annual PPI were influenced by the base effect of energy prices from the previous year.

- Eurozone Consumer Confidence and Germany’s GfK Data Release

On Wednesday, preliminary consumer confidence data for December in the Eurozone and GfK Consumer Confidence data for January in Germany will also be released.

In the Eurozone, consumer confidence for November recorded a level of -16.9, reaching the highest level in the past three months.

As for Germany, the GfK Consumer Confidence data for December showed a slight increase from -28.3 to -27.8, recovering modestly from the lowest levels since April. However, it continued to exhibit a weak trend in the negative zone.

A closer look at the details revealed that the Consumer Purchase Intention Index slightly recovered from -16.3 to -15, while the Consumer Income Expectations Index decreased from -15.3 to -16.7. The index for Consumer Economic Situation Expectations showed a slight increase from -2.4 to -2.3, remaining close to flat.

- Final GDP Growth Data for Q3 in the UK

On Friday, the final Gross Domestic Product (GDP) growth data for Q3 in the UK will be released, providing a comprehensive overview of the economic performance during that period.

According to preliminary figures, the UK economy’s quarterly growth rate slowed from 0.2% to 0%, indicating a stagnant trend. The yearly growth rate remained at 0.6%, similar to the previous quarter.

Take the guesswork out of investing: Backtest your strategies with ease!

Economic Indicators in Asia for the Week

- China’s Monetary Measures

China’s Central Bank (PBoC) has maintained the reference interest rate for one-year Medium-Term Lending Facility (MLF) at 2.50%. Additionally, the Bank executed the largest-ever consistent net cash injection of 800 billion yuan through a one-year policy tool. With these measures, more resources will be provided to banks for purchasing government bonds issued to support infrastructure spending.

In China, the year-on-year growth rate of industrial production for November rose from 4.6% to 6.6%, surpassing expectations. However, the growth rate for retail sales increased from 7.6% to 10.1%, falling below expectations, and the growth rate of fixed capital investment remained at 2.9%, similar to the previous month.

- Upcoming Central Bank Meetings

On the Asian front, the meetings of the Bank of Japan (BOJ) on Tuesday and the People’s Bank of China (PBoC) on Wednesday will be closely watched.

It is expected that BOJ will keep the policy interest rate at -0.10% at tomorrow’s meeting, and signals regarding its monetary policy for the coming year will be of particular interest.

With headline inflation in the country consistently above the 2% target for over a year, many market participants assess that BOJ might end its negative interest rate policy next year.

On Wednesday, during PBoC’s meeting, it is anticipated that the Bank will keep the 1-year Loan Prime Rate (LPR) at 3.45% and the 5-year LPR for long-term loans such as housing loans at 4.20%, opting to observe the effects of previous interest rate cuts and other supports.