In the world of investment, understanding the interconnectedness of commodity prices is essential. Gold and oil, two of the most widely traded commodities, often serve as indicators for the overall health of the global economy. The fluctuations in their prices can provide valuable insights into the macroeconomic factors at play. As investment professionals, recognizing the correlations between gold and oil prices and how they are impacted by interest rates, exchange rates, growth, and inflation is crucial for making informed decisions in the market. By delving into these relationships, we can better navigate the complexities of commodity markets and maximize investment opportunities.

Petroleum and gold are strategic commodities crucial for global economic stability; hence, any changes in their prices have widespread effects.

Petroleum is a significant energy source that holds financial and political sway and impacts the world economy on many levels. Serving as the backbone of modern industry, petroleum plays a vital role in sectors like transportation, energy production, manufacturing, and agriculture. Since petroleum is a primary input for many industries, an increase in oil prices often negatively affects economic growth. Petroleum prices fluctuate continuously due to factors such as geopolitical tensions, production disruptions, and weather conditions. The Organization of the Petroleum Exporting Countries (OPEC) primarily determines oil prices through its production decisions. OPEC’s decisions regarding oil production can cause significant fluctuations in the market. Additionally, policies related to oil production in countries outside of OPEC, such as the United States, Canada, and Russia, also affect oil prices.

The Safe Haven Role of Gold

Gold, the most traded precious metal with various historical uses, has always been considered a safe haven during crises, revered as a secure refuge by investors in times of turmoil. With attributes of both a valuable metal and a monetary asset, gold prices fluctuate due to various factors such as the value of the dollar, geopolitical risks, inflation concerns, and global financial instability. Central banks often hold gold in their reserves, which is a significant factor influencing the value of gold. Economic growth contributes to increased demand for gold, while periods of stagnation cause fluctuations in gold prices due to the market’s tendency to avoid risks.

Especially during periods of increased geopolitical risks and market stress, it’s essential to note that gold doesn’t react uniformly to every uncertainty and crisis in the short term. This effect can vary depending on the type, magnitude, and global economic conditions of the event. Understanding how geopolitical events can affect gold prices can help investors build a more resilient portfolio against future uncertainties. The fundamental reasons for gold prices responding positively to geopolitical tensions are its absence of default risk, its value-preserving nature, and its generally inverse relationship with the US dollar. It’s important to note that although gold is referred to as a safe haven, it doesn’t promise constant and unlimited gains.

The Relationship Between Gold and Oil and Inflation

Gold and oil are strongly linked because they are both priced in US dollars. Although the relationship between gold and oil prices is complex and multifaceted, inflation plays a significant role at its core. An increase in oil prices raises fuel prices and indirectly affects the prices of all goods and services, thereby increasing inflation. Sudden increases in oil prices can hinder economic growth since many industries depend on fuel and its derivatives.

An increase in oil prices also affects gold prices in the same direction. High oil prices may raise inflation concerns and lead investors to assets that can hedge against inflation. In this case, traditional safe-haven assets like gold become attractive to investors.

Gold-Oil Ratio and Crisis Periods

Simply put, the Gold-Oil Ratio measures the relative value of gold and crude oil. Essentially, it’s a calculation anyone can make to determine how many barrels of oil can be bought with one ounce of gold or vice versa.

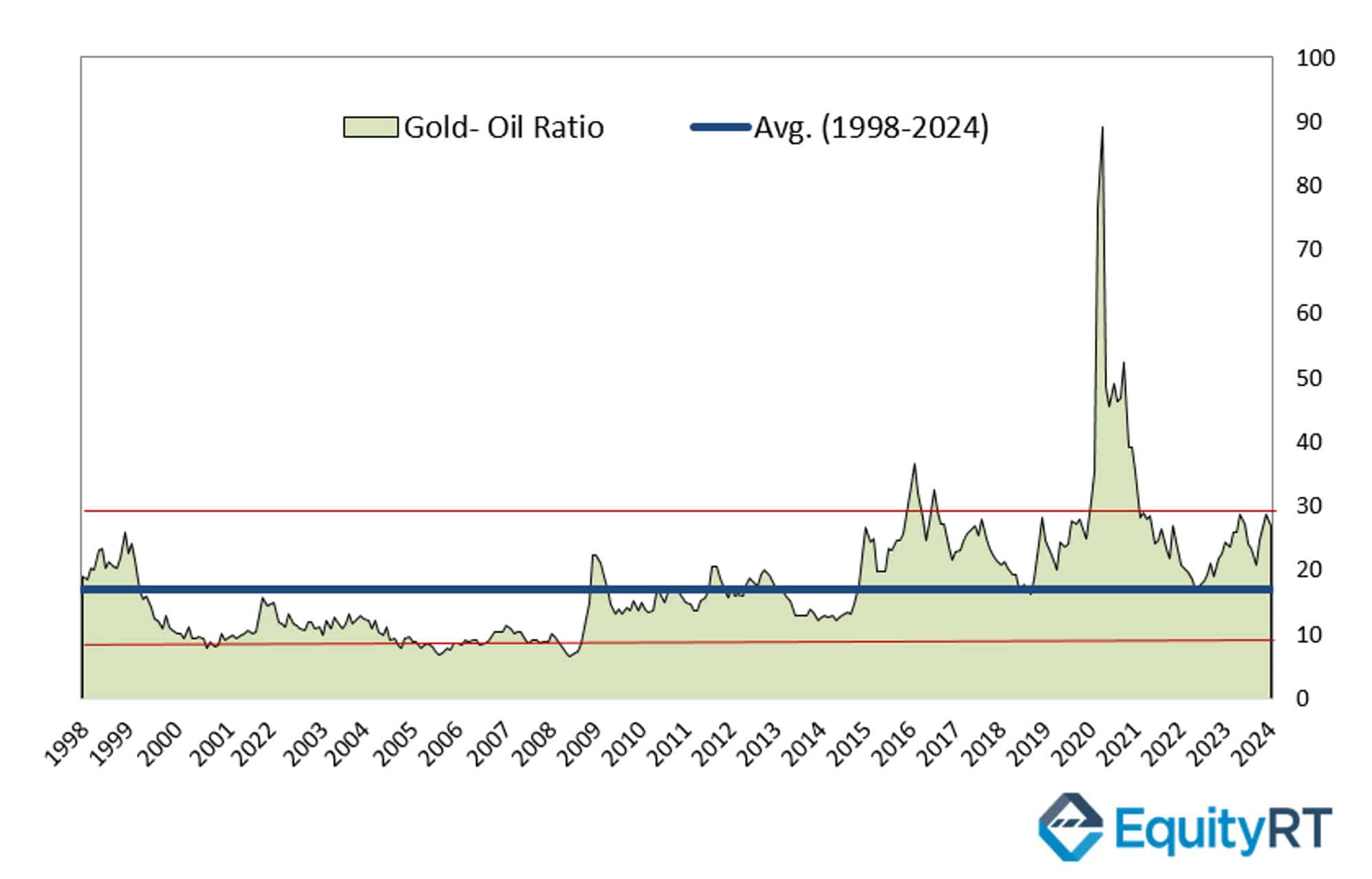

When oil prices fall and gold prices rise, indicating an above-average Gold-Oil Ratio, it may signal an impending economic downturn. In the long-term average, the Gold-Oil Ratio stands at 18:1, usually fluctuating between 10 and 30.

Over the past 20 years, several significant events have influenced the Gold-Oil Ratio. During the 2008 financial crisis, investors seeking safe haven assets increased demand for gold, leading to the ratio reaching its highest level since 1998. Similarly, during the 2014 collapse in oil prices due to oversupply and weak demand for crude oil, investors turned back to gold as they moved away from risky investments. This trend repeated in 2016.

Looking at the graph, during the COVID-19 turmoil (2019-2022) when financial markets were in turmoil, we see a sudden increase in the ratio to around 89.2. It’s an indicator that investors flocked to gold during that period of perceived stagnation. Excluding this period, the ratio is seen to be close to the norm of 30:1.

The current ratio of 28.9 indicates that gold is “relatively” valuable compared to oil prices. Rising energy prices, increased geopolitical tensions, and ongoing conflicts such as between Russia and Ukraine contribute to this. However, despite OPEC not planning a decrease in supply, expectations of strong economic growth in the US and other countries are boosting demand for oil, thus driving oil prices upward.

Can Changes in Commodity Prices Affect the Federal Reserve’s (Fed) Interest Rate Policies?

The answer to the question depends on the impact of changes in commodity prices on inflation levels. Despite higher-than-expected US inflation data at the beginning of the year, it did not alter the overall picture. Therefore, markets have been pricing in the possibility of the Fed cutting interest rates in the coming months until mid-April. This expectation parallels the increasing interest in gold from various central banks, as highlighted by the World Gold Council. In recent months, many central banks have raised their gold reserves to record levels.

The direction of commodity prices can potentially influence the Federal Reserve’s (Fed) interest rate policies, particularly considering their impact on inflation levels. While higher commodity prices may contribute to inflationary pressures, the response of central banks, including the Fed, remains a critical factor in shaping future monetary policies.

Recent remarks from Chairman Powell on interest rate adjustments have added a new layer of uncertainty. While delayed rate cuts might typically dampen gold’s appeal, other significant factors such as central bank actions and geopolitical concerns currently outweigh this influence.