How do rising interest rates in the U.S. affect the stock markets?

The U.S. Central Bank (the Fed) concluded its first meeting of 2023, last Wednesday afternoon by announcing a quarter-point rate hike.

Aligning with market expectations, the rate-setting Federal Open Market Committee (FOMC) boosted the federal funds rate by 0.25 percentage points, the smallest adjustment in nearly a year. That takes the benchmark rate to a target range of 4.5%-4.75%, the highest since October 2007.

The Fed repeats ongoing increases soar interest rate expectations so these signals mean more interest rate hikes than expected. Investors were looking to Wednesday’s meeting for signs that the Fed would be ending the rate increases soon contrary to soaring signals.

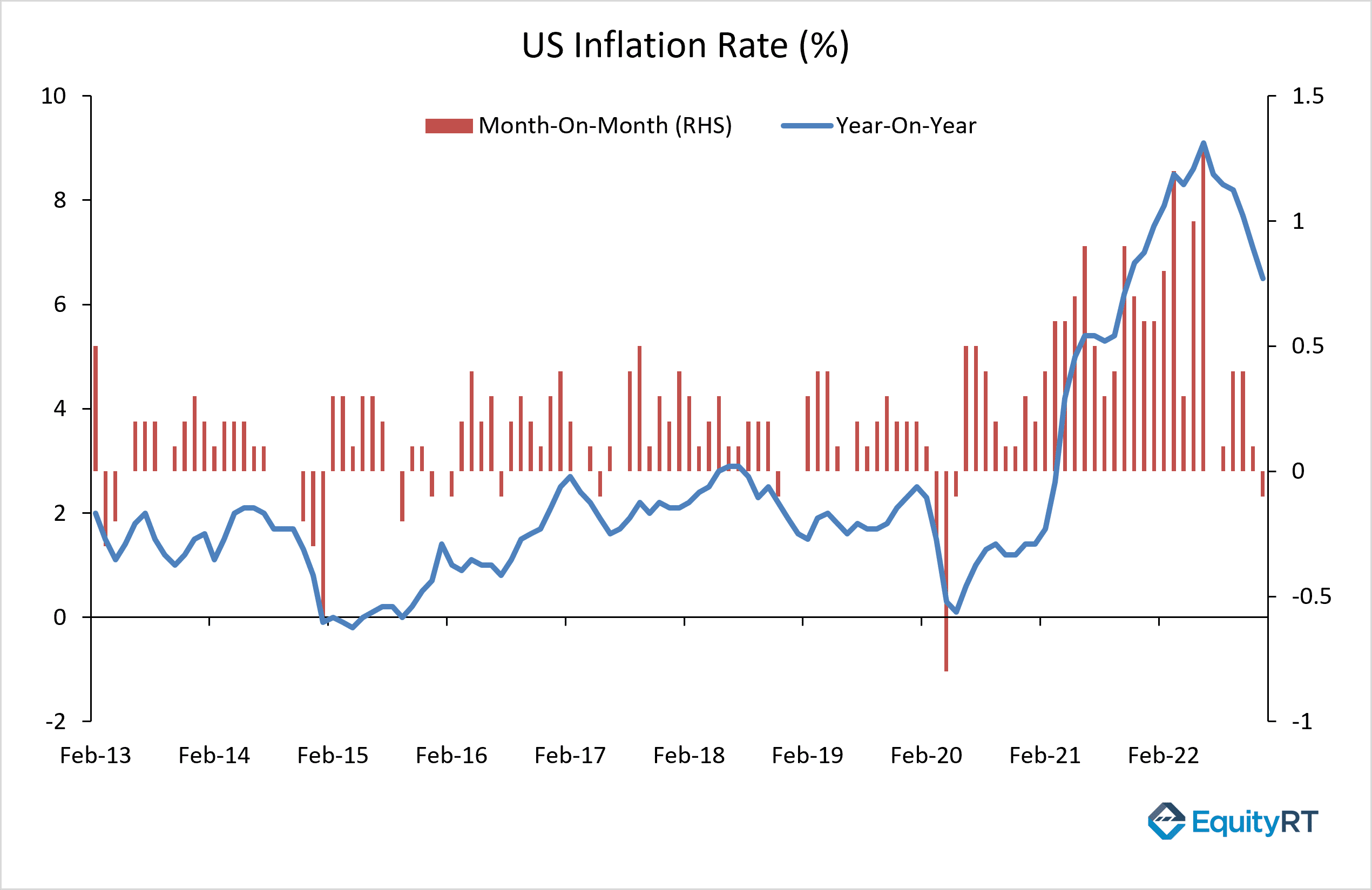

The U.S. inflation slowdown shows that the Fed’s rate hikes have started to achieve their goal. Even so, as Chair Jerome Powell stresses that it is too soon to declare victory over inflation. The inflation is still far above the Fed’s target level (2%). The risk is that with some sectors of the economy weakening, ever-higher borrowing costs could take the economy into a downturn later this year. The Fed’s rate hike will likely further raise consumer and business loans which makes it more expensive for consumers and businesses to borrow money.

Retail sales have weakened for two straight months, indicating that consumers are becoming more cautious about spending.

Manufacturing production has also decreased for two months, the most since February 2021. On the other hand, the job market in the United States remains strong, with the unemployment rate at a 54-year low of 3.4%.

In December, headline inflation eased to 6.5% from a year earlier, down from a four-decade peak of 9.1% in June. The decline has been supported in part by cheaper gas prices.

All the important information you need in one place. Add EquityRT to your toolkit for quality investment research.

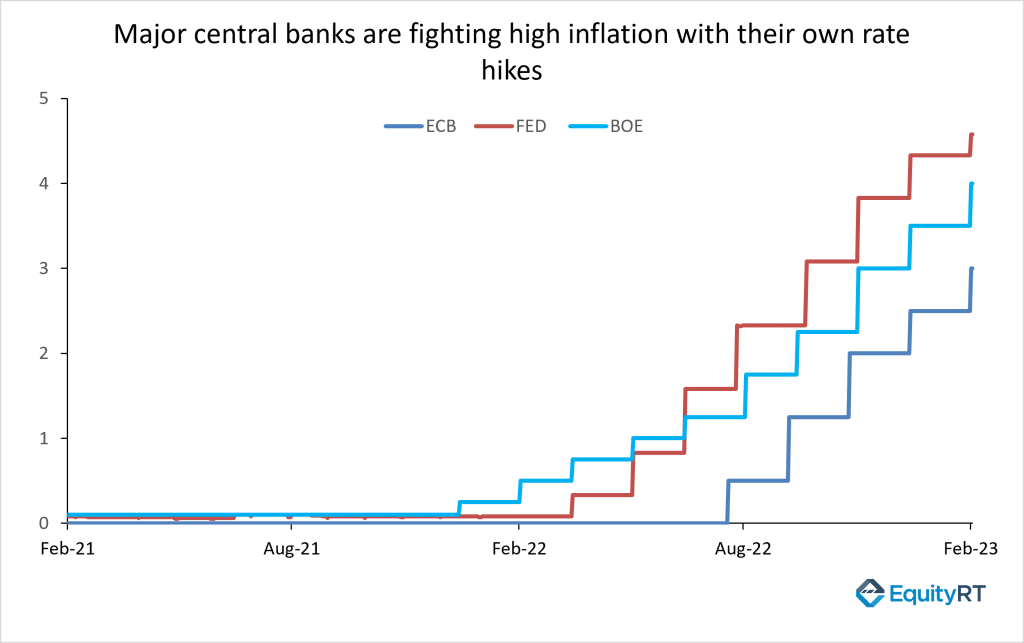

Other major central banks are fighting high inflation with their own rate hikes

The European Central Bank raised its policy rate by a half-point to 3%, during its February meeting last Thursday and vowed a similar move in the March meeting. Inflation in Europe, though slowing, remains high, at 8.5% y/y in January 2023.

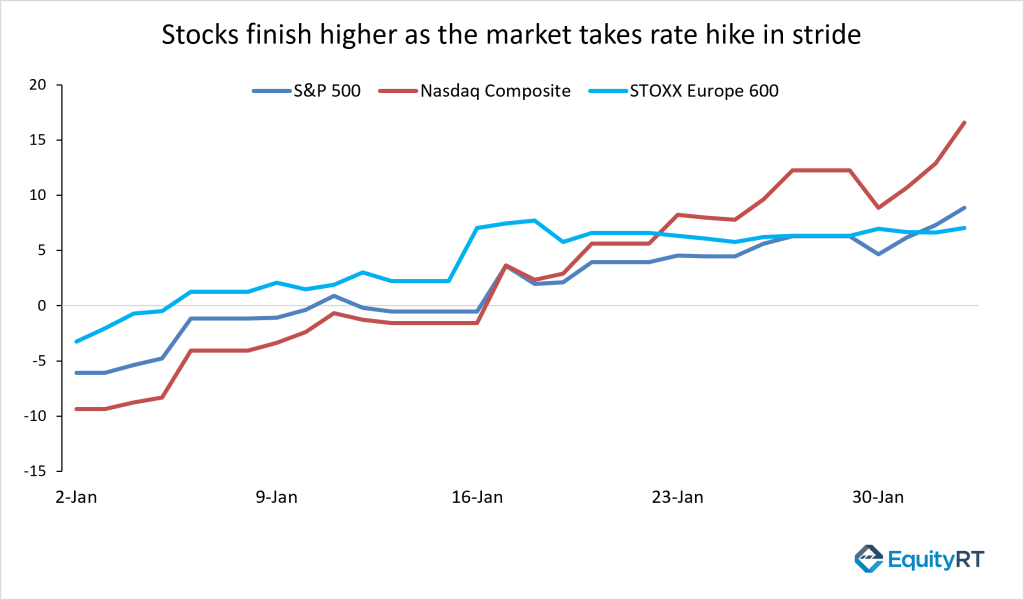

Stocks finish higher as the market takes rate hike in stride

As a result of aggressive signals from the Fed, US stocks railed: the Nasdaq Composite closed higher by 2% on Wednesday, marking a 16.57% YTD gain.

The S&P 500 closed higher by 1% at around 8.9% YTD return.

The USD Dollar is down way after the Fed decision, because markets were anticipating some hawkishness.

European markets closed 1.4% upon the day theEuropean Central Bank and Bank of England hiked interest rates. The European Stoxx 600 indexclosed 0.09% higher (7% up YTD), with sectors mostly positive.

Would you like to analyze the impact of the interest rate decision on the markets?

EquityRT financial analysis platform provides what you need to know about interest rates, when the Central Banks will raise them, and how your finances will be affected.

Request a free trial now!

About EquityRT

Portfolio managers, equity research analysts, economists, and many other investment professionals are constantly challenged to deliver quality research to guide the right investment decisions. Making the right decisions starts with having an optimum investment strategy in place.