Debt levels in both advanced and developing economies have reached concerning levels in the post-pandemic period. According to the latest report by the International Institute of Finance (IIF), global debt rose by $2.1 trillion in the first half of 2024, reaching $312 trillion. Although this increase is lower than the $8.4 trillion rise during the same period last year, it highlights key concerns regarding economic conditions and borrowing dynamics.

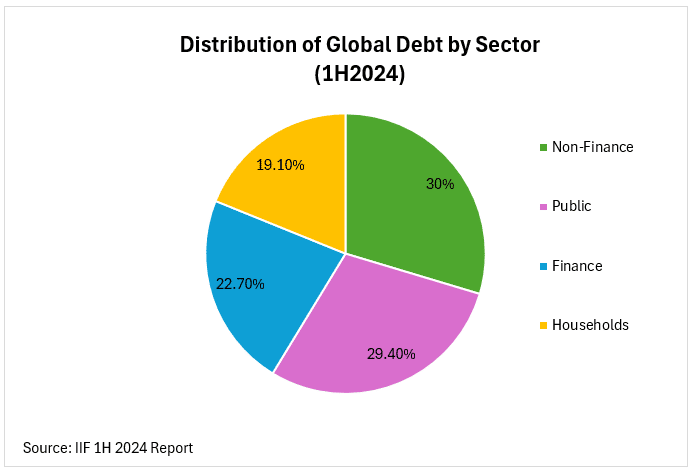

Around $211 trillion of this debt, or 70%, belongs to advanced economies, while the remaining 30% comes from developing economies, whose debt amounts to $101 trillion. When breaking down global debt by sector, non-financial corporations hold the largest share at 30%, followed by public debt at 29.4%. The financial sector accounts for 22.7%, and households hold 19.1%. This distribution suggests that more than half of the debt in advanced economies is concentrated in non-financial corporate and public debt.

Looking at debt-to-GDP ratios by sector, non-financial corporate debt dropped from 91.5% to 90.6% year-over-year in the second quarter, while public debt increased from 96% to 97.6%. Financial sector debt slightly decreased from 78.9% to 78.5%, and household debt declined from 62% to 60.9%.

Overall, the total global debt-to-GDP ratio stands at around 327%, revealing the burden on economies and raising questions about the long-term sustainability of this debt. The debt-to-GDP ratio is an essential metric for assessing how well an economy can manage its debt load, and this global figure suggests a need for careful monitoring.

Debt Dynamics in Advanced and Emerging Economies

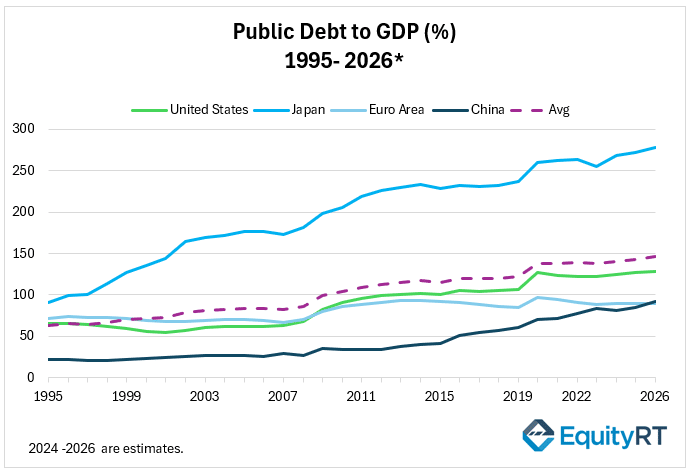

Global debt refers to the total monetary obligations of all public, corporate, and individual entities. Debt levels in advanced economies are typically higher than in emerging markets, but their stronger economies make these debts more sustainable. Developed countries like the U.S., Japan, and EU nations benefit from stronger credit ratings, lower borrowing costs, and larger domestic markets, which help manage debt more effectively.

In the U.S., for instance, the dollar’s reserve currency status offers significant advantages, particularly in keeping borrowing costs low. U.S. Treasury bonds are regarded as some of the safest investment vehicles globally, further lowering the cost of borrowing for the U.S. government. This privileged position allows the U.S. to sustain high levels of public debt without facing the same risks that emerging markets do. However, the growing federal debt remains a long-term concern, especially with rising interest rates potentially making debt service more expensive in the future.

Japan, despite high debt levels, manages to borrow cheaply from its domestic market due to long-standing low inflation and interest rates. The bulk of Japan’s debt is held by local investors, reducing external financing pressure. Japan’s government has maintained a policy of low long-term interest rates since the early 2000s, aiming to keep its debt manageable over time.

In the European Union, countries like Germany with strong export-driven economies and robust industrial sectors can finance higher debt levels effectively. The shared Euro currency within the Eurozone also provides member states with the advantage of accessing lower borrowing costs. However, public debt sustainability remains a challenge, particularly for southern European economies, which face higher debt burdens relative to their GDPs.

Private Sector Debt Vulnerabilities in Emerging Economies

Emerging markets, in contrast, face more volatile debt dynamics. According to the latest IIF report, debt in emerging economies was reported at $101 trillion in mid-2024, slightly down from $105.4 trillion in early 2024. Private sector debt plays a crucial role in these economies, fueling growth but also creating vulnerability to both internal and external shocks. High dependence on private sector borrowing has exposed these countries to risks such as currency fluctuations, higher interest rates, and increased borrowing costs. For example, economies like Brazil, China, India, and Türkiye have experienced rapid debt accumulation in their private sectors as they have pursued aggressive growth and industrialization strategies. While these borrowings have boosted investment capacities, they have also left these nations susceptible to financial instability during periods of economic stress.

Public sector debt is another critical factor for emerging markets, particularly in countries like Argentina, where frequent fiscal crises have led to high borrowing costs. These countries often find themselves relying on expensive debt to finance social programs, which can slow economic growth and contribute to long-term fiscal instability. The combination of high-risk premiums and political or economic uncertainty makes it difficult for emerging economies to manage their debt sustainably. This increased vulnerability, especially when compounded by global economic shocks or rising interest rates, makes debt management a precarious balancing act for many of these nations.

Although advanced economies are not immune to the challenges of high debt levels, they typically possess stronger institutional frameworks and more developed financial systems, which allow for better debt management. However, even in developed countries, unsustainable debt growth can lead to significant fiscal pressures. Rising interest payments could crowd out critical public investments and social spending, slowing economic growth while exacerbating the debt burden further. As such, even advanced economies need to carefully manage their debt to avoid undermining long-term fiscal health.

Debt management is crucial to maintaining financial stability in both developed and emerging economies. While debt can serve as a powerful tool for investment and growth, it can also pose severe risks if not properly controlled. The challenge for all economies, regardless of development status, lies in striking the right balance between leveraging debt for growth and preventing it from reaching destabilizing levels.

Causes of the Global Debt Surge

Since the 2008 financial crisis, debt levels have risen sharply, especially in developed economies. Central banks adopted expansionary policies, reducing interest rates and purchasing large amounts of government and corporate bonds to provide liquidity, driving rapid debt accumulation.

The COVID-19 pandemic intensified this trend, adding $54.1 trillion to global debt. Governments implemented massive stimulus packages, while private companies, facing income losses, also turned to borrowing. Low-interest rates initially made this manageable, but post-pandemic inflation and rising interest rates have now increased debt burdens.

In developing economies, high inflation and currency depreciation have worsened debt sustainability challenges, particularly for countries with foreign currency debt. Managing this debt amid economic uncertainty poses significant risks, threatening financial stability.

Despite higher debt levels, developed countries are better equipped to manage their debt due to their economic strength, while emerging markets face greater difficulties, potentially threatening long-term growth and stability.

Unlock Key Global Macro Indicators with EquityRT

EquityRT offers comprehensive macroeconomic data and powerful analytical tools that help users monitor essential indicators such as inflation rates, government debt, and bond yields.

With access to economic data from both developed and emerging markets, EquityRT equips investors and analysts with the insights needed to make better decisions across global markets. Request your free trial at info@equityrt.com.