Commodity Prices

Key array commodities and concept coverage

Unprecedented highs and lows in commodity prices have become a fact in the global economy. Commodities and price fluctuations are of considerable concern to economists, investors, policy-makers and even to general public because countries where commodities are produced are highly affected by this volatility. Much of time is allocated to grasp how trends in commodity markets are likely to impact the economy; merchandise trade balance, inflation, fiscal balance and GDP growth in the short and long term.

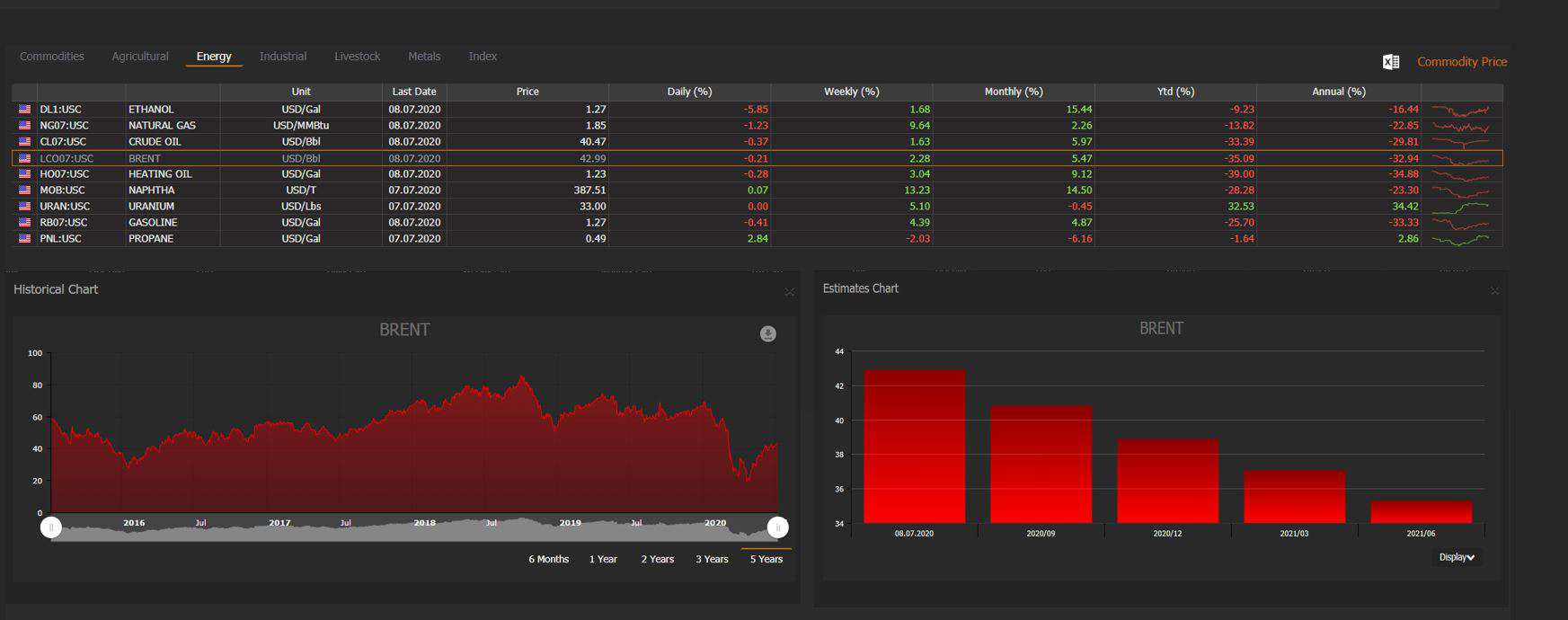

Access to historical, current and forecast prices on major soft and hard commodities

- Get the latest commodity prices for oil, gold, silver, copper etc. and the price variations at daily, weekly, monthly and yearly levels per commodity.

- Long price history for each commodity; either visualize it on a chart or download it to Excel for your own use.

- Watch commodity prices along with macro indicators and yields you select

- Quarterly price forecasts based on analyst expectations and models for planning and business operations.

Users can access daily reference prices of major commodity classes grouped under four commodity asset classes:

- Energy- West Texas Intermediate (WTI), crude oil, natural gas, ethanol, heating oil and uranium

- Industrial– Lead, aluminium, zinc, iron ore, coal, copper, steel, palladium, cobalt and bitumen

- Agricultural and Livestock– Wheat, corn, cotton, cocoa, coffee, lumber, palm oil, rice and live cattle

- Metals– Gold, silver and platinum

- Indices– S&P GSCI, Baltic Dry and London Metal Exchange (LME)