Government Bond Yields

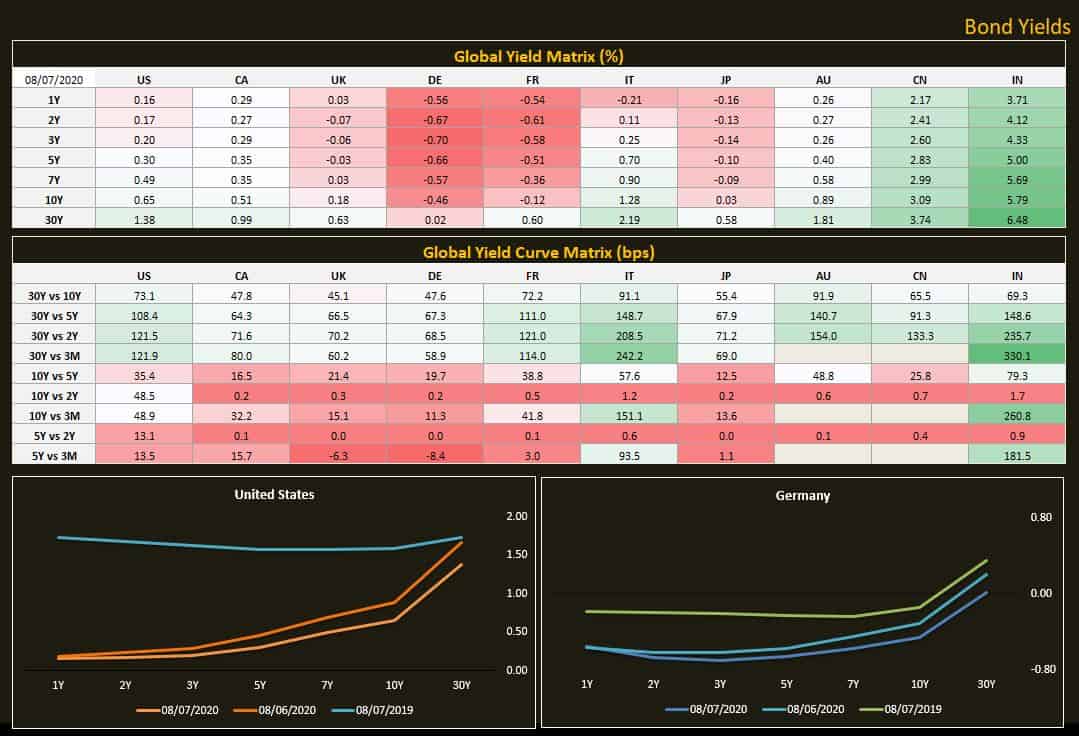

Daily yields on government benchmark bonds with maturity ranging from 1 month to 30 years, across countries around the globe

Bond rates and yield curves are key aspects of the financial markets and often tracked by investors, economists, mutual fund managers and policy makers along with the conventional indicators such as growth rates, central bank lending rates and inflation. Bond yields are considered as key means of gauging the well-being of a country’s economy.

Government securities may not have a direct effect on our personal finances however the yield curve can tell us on the direction in which the country’s economy is headed. They are crucial for stock selection to deciding when to refinance a mortgage.

Portfolio managers use top-down analysis to determine bonds that may rise in price due to favourable economic environment. For example, when emerging economies have become greater contributors of global growth in recent years, many government bonds in these countries have risen in price.

Benchmark yields are displayed in a single grid to facilitate one-stop comparison across countries and yields over time.

- Easily track the yields on a daily basis and compare the bond spreads of different maturities over time (US 10-year to Germany 10-year or 10-2 Year yield spreads etc.)

- Monitor how the shape of the yield curves changes over time as a hint to how far long the economy cycle matures.

- Create your own yield curve matrix by selecting the countries and bonds you want to track or use utilize our favourite global yield curve matrix template in Excel that retrieves the latest figures with a single click

- We provide medium-term estimates for the next four quarters inputs to your models

- View the daily historical rates through interactive charts and export data to Excel