ECONOMIC RESEARCH

Get the complete frame on macro environment, understand economic cycles and interpret market conditions

Macroeconomic indicators are statistics that describe the economic conditions of a particular country, region or industry. All these indicators have different meanings and they are used to assess, measure and evaluate the overall state of the economy. The statistics are collected in the form of survey or census by government agencies, non-profit and private organizations and analysed further to generate economic indicators.

Economic indicators are generally grouped under three main categories- leading, coincident and lagging indicators.

Leading Indicators show early signs of change before the changes are materialized in the key lagging indicators. Leading indicators are often used as short-term predictions of the economy. Consumer and business surveys, new orders, money supply, building permits are the key examples of leading indicators.

Coincident indicators include, GDP and labour statistics, and tend to change simultaneously with the change in economic activity.

Lagging indicators such as inflation, interest rates and labour cost depend on the economy’s historical performance and they usually change after the changes of the whole economy.

Key Data Coverage in One Place

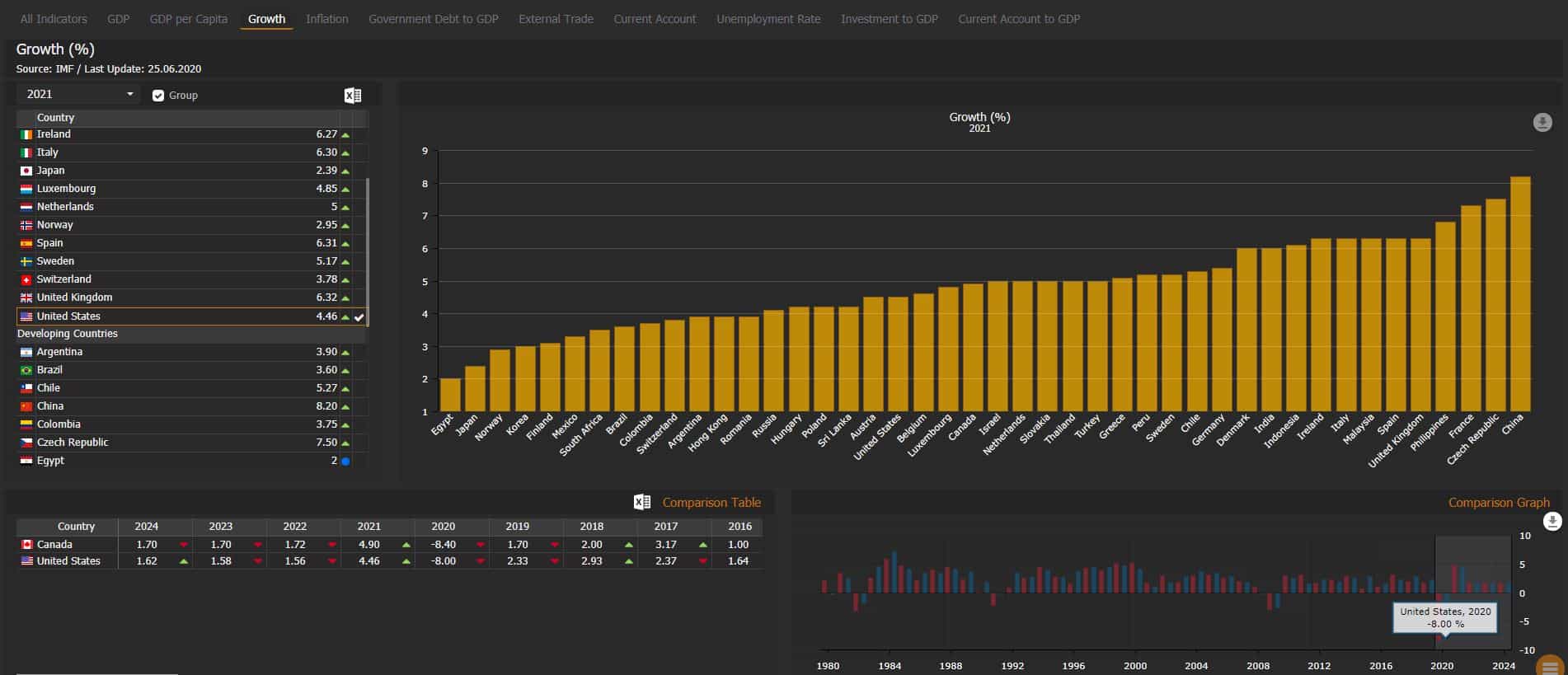

EquityRT MacroAnalytics, with a global economic coverage on +200 countries, provides single point access to hundreds of macro indicators intuitively categorized for each country, covering key areas of the economy including GDP, production, inflation, trade balance, confidence indices, policy rates, unemployment rate, along with short term estimates, and medium and long term forecasts essential to all user profiles tasked with tracking, analysing and interpreting economic environment.

Get the complete frame on macro environment, understand economic cycles and interpret market conditions.

- Effortlessly monitor worldwide macroeconomic trends and compare countries,

- Review the short-term predictions and long-term forecasts for all key indicators

- Ideal for the users who need a global perspective in today’s economic landscape

- A designated screen for each country to quickly access the key indicators

- Fast and regular updates on the worldwide economic releases (not limited to headlines)

- Customizable world economic dashboard as a reference table for a quick assessment on the current economic state of the countries through most recent figures.

Which economic topics and macroeconomic indicators do we cover?

All macro indicators are intuitively segmented into 15+ major economic categories depending on their relevancy degrees with the topic. The data is provided in different frequencies ranging from daily to yearly with an extensive history, dating 40 or 50 years back where possible.

- National Accounts- GDP by components, GDP per capita, public consumption, private consumption, fixed investment, growth rate, GDP deflator

- Production- Industrial production, manufacturing production, capacity utilization, electricity production, cement production, auto production, PMI figures

- Construction and Housing– Construction cost, dwelling prices, home sales, building permits

- Government and Public Finance- Fiscal balance, budget revenue, budget expenditure, government debt, government debt to GDP, public expenditure, public expenditure to GDP

- Labour Markets and Demographics Employment, unemployment rate, youth unemployment rate, hourly earnings, wages, labour costs, non-farm payrolls, productivity, population

- Domestic Trade and Households Consumer confidence, retail sales, retail turnover, services turnover, personal spending, personal saving, household debt to GDP

- Inflation– Consumer price index (CPI), headline inflation rate, food inflation, core inflation, producer price index (PPI), producer prices change

- External Trade and Balance of Payments- Trade Balance, Exports, Imports, Terms of Trade, Export Prices, Import Prices, contribution to world trade, competitiveness, current account, current account to GDP, capital flows, foreign direct investment (FDI)

- Monetary and Banking Statistics– Loans, consumer loans, private sector credit, deposits, foreign exchange reserves, money supply (M0, M1, M2, M3), reserves and liquidity, capital adequacy, central bank total assets, financial soundness ratios, loans to private sector

- Interest Rates and Foreign Exchange– Lending rate, deposit rate, policy rate, interbank rate, reel effective exchange rate (REER), daily fx rates and government bond yields,

- Investments–OECD Composite Leading Indicator, Ease of Doing Business Rating, Bankruptcies

- Energy- Petroleum production

- Health- Coronavirus cases, coronavirus deaths, coronavirus recovered, hospital beds, doctors

- Tourism and Transportation- Foreign arrivals, tourism revenues

- Economic and Business Surveys- Business Confidence, economic sentiment index, business climate index, Bankruptcies,

- Commodities-Agricultural production, Brent crude oil spot price, West Texas intermediate crude oil, commodity price indices (non-fuel, natural gas, metals, energy, industrial inputs, coal etc)

Sources of country-specific and comparable economics

Every country has its own national sources (government agencies, statistical offices, central bank and other public and private associations and institutions) who disseminate the most recent official data. Besides, international sources (organisations) publish both national and international indicators mostly in comparable form and updated regularly.

We collect and bring to together variety of macro data from national primary sources and reputable international organisations like International Monetary Fund (IMF), World Bank, Organisation for Economic Co-operation and Development (OECD) and Bank for International Settlements (BIS)

Facilitate access both to country-specific data and cross-country comparisons on macroeconomic aggregates.