A future threat emerged with the FED’s rate hike series; unemployment!

In an economy where interest rates are rising, we can see many economists and investors expecting unemployment to rise. So, are they right?

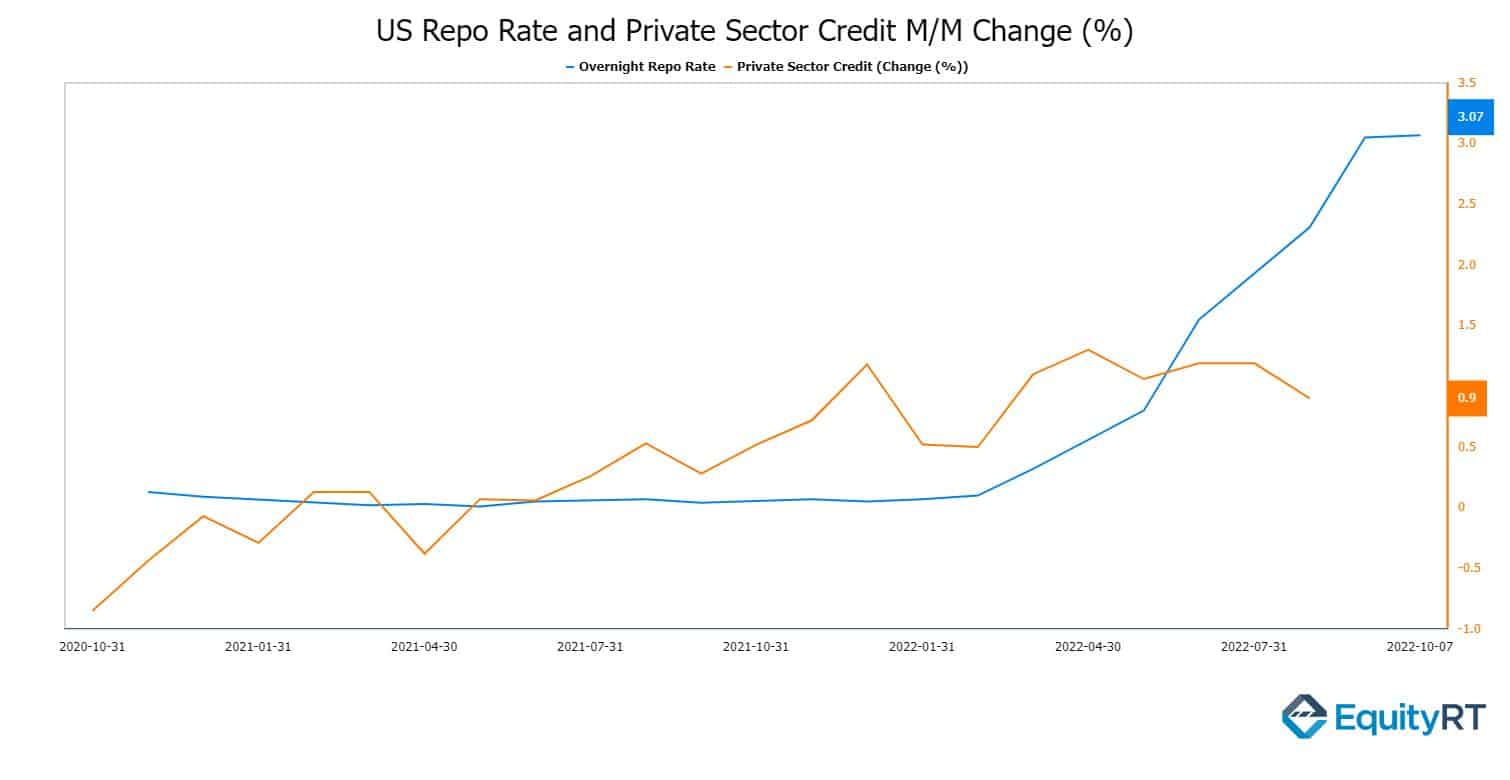

The fundamental idea is that any increase in the interest rate will cause an increase in savings and a decrease in investments. Therefore employment will slow down. As widely accepted; low-interest rate means; an increase in credit volume, expenditures, and production to meet the consumption created by this increase in spending.

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

So what happens when interest rates rise?

It becomes more difficult to meet the need for credit, capital flows to high-interest rates instead of the stock market, and companies that have already experienced a decrease in their sales due to high inflation begin to lay off their employees. This is actually a very dangerous double-edged sword. If there is a decrease in employment, there will also be a decrease in total consumption and therefore the largest resource required for production will be reduced (the consumers).

Will this happen?

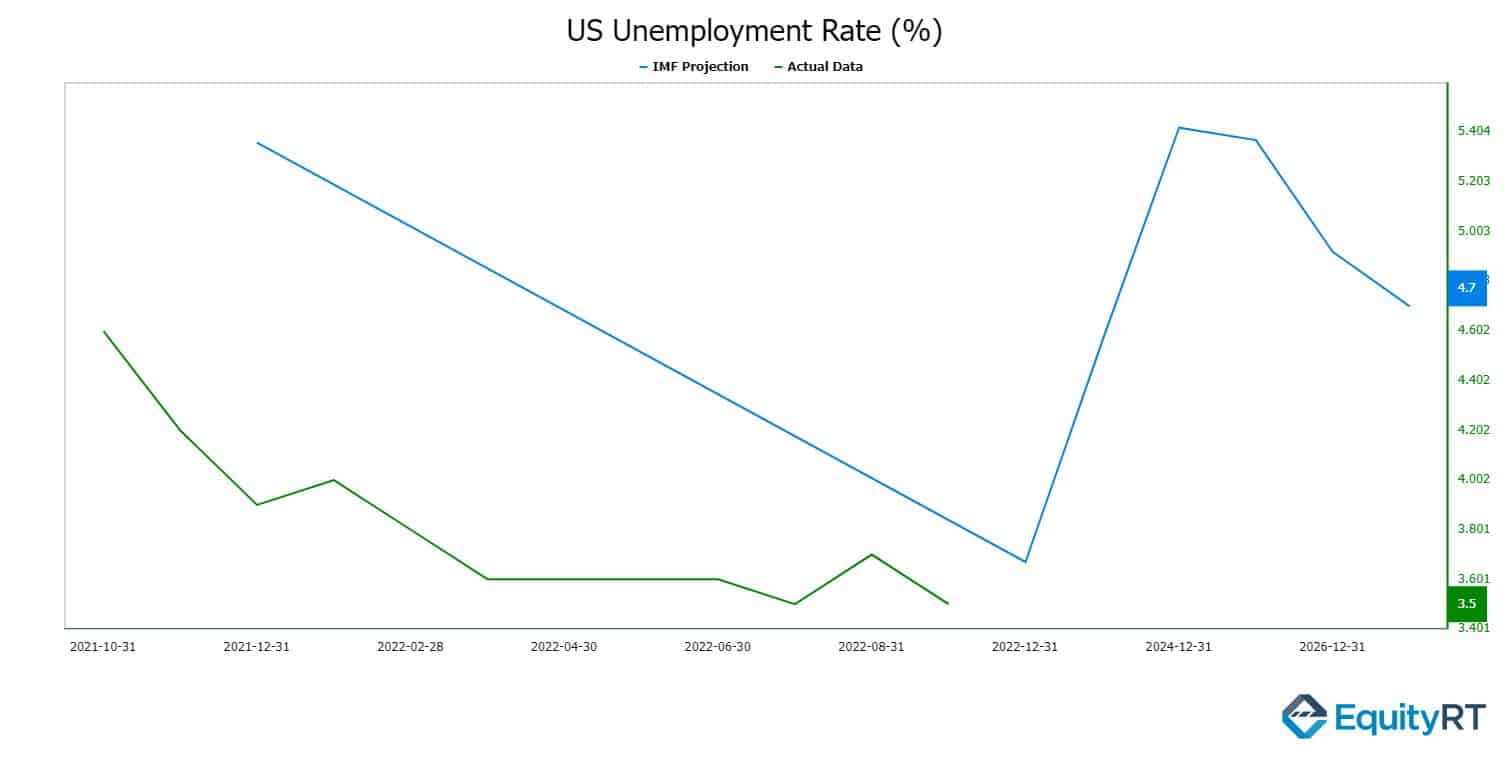

It is seen that there will be an increase in unemployment, albeit with a delay, and considering the IMF’s 5-year projection for the United States, it is estimated that unemployment will reach 4.6% at the end of 2023 and then further rise to 5.4% by the end of 2024. It should also be kept in mind that the FED will continue to increase interest rates until the end of 2022 and interest rate is targeted between 3.5% and 4%.

Unemployment is likely to turn into a threat to the United States in a period when the employment cost index, which shows the benefits provided to employees from the compensation period, wages, and salaries, increases from 1.0% to 1.4% in 2022.

EquityRT’s economic section provides relevant economic indicators including labor market, interest rates, IMF projections, and more indicators to those who would like to make a complete analysis of the U.S economy.

Charts are produced via EquityRT’s Chartpro, a quick and easy charting interface that helps users create custom ratios, and easily compare the market and economic data.

To further improve productivity, a meticulously designed “US Key Economic Indicator” Excel template is available for investment advisors, academicians, or economic research teams who need to track many indicators frequently.

After downloading the EquityRT Connect add-in, you can start using these templates, as they are, or customize them for your own purposes.

Please leave us a note for a demo or request a trial at https://equityrt.com/equityrt/free-trial-us/.