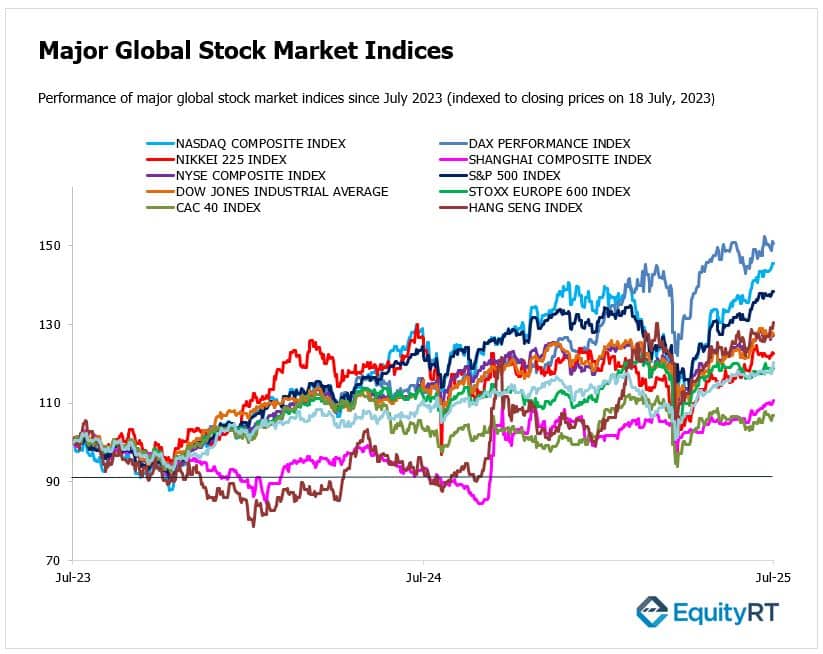

Global Stock Market Highlights

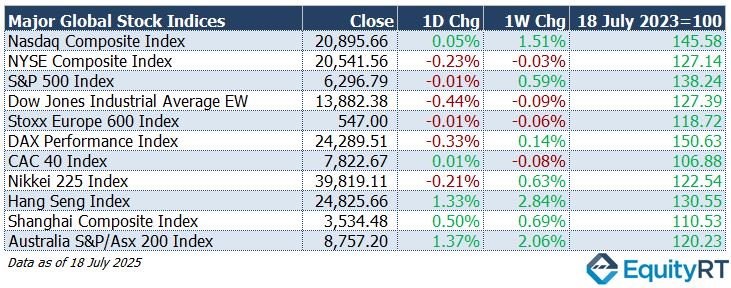

Last Friday, US stock markets were mixed but held close to record levels. The Nasdaq Composite managed a small gain, setting a fresh record as tech shares stayed resilient, while the S&P 500 dipped just slightly and the Dow Jones finished the day a bit lower. It was the third positive week in the last four for major US indices, showing that investor sentiment remains broadly steady despite some profit-taking.

- Nasdaq Composite Index closed at 20,895.66, up 0.05% on the day and up 1.51% for the week.

- NYSE Composite Index closed at 20,541.56, down 0.23% on the day and down 0.03% for the week.

- S&P 500 Index closed at 6,296.79, down 0.01% on the day but up 0.59% for the week.

- Dow Jones Industrial Average EW closed at 13,882.38, down 0.44% on the day and down 0.09% for the week.

In Europe, major benchmarks like the Stoxx Europe 600 and Germany’s DAX drifted sideways, closing flat to slightly down, as investors weighed mixed corporate earnings and shifting sector moves, strength in oil and industrials balanced weakness in parts of the healthcare sector.

- Stoxx Europe 600 Index closed at 547.00, down 0.01% on the day and down 0.06% for the week.

- DAX Performance Index closed at 24,289.51, down 0.33% on the day but up 0.14% for the week.

- CAC 40 Index closed at 7,822.67, up 0.01% on the day but down 0.08% for the week.

In the Asia-Pacific region, markets closed the week mostly higher. Hong Kong’s Hang Seng and mainland China’s CSI 300 both rose, lifted by stronger tech shares and a generally positive risk mood, pushing the regional MSCI Asia-Pacific index to its highest level since 2021. However, Japan’s Nikkei 225 lagged, ending slightly lower after some profit-taking and cautious sentiment around central bank signals.

- Nikkei 225 Index closed at 39,819.11, down 0.21% on the day but up 0.63% for the week.

- Hang Seng Index closed at 24,825.66, up 1.33% on the day and up 2.84% for the week.

- Shanghai Composite Index closed at 3,534.48, up 0.50% on the day and up 0.69% for the week.

- Australia S&P/ASX 200 Index closed at 8,757.20, up 1.37% on the day and up 2.06% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, fell to 98.46, down 0.19% on the day, up 0.60% for the week, but down 9.21% year-to-date.

- The Brent crude oil, the global oil price benchmark, settled at $69.21 per barrel, down 0.45% on the day, down 1.63% for the week, and down 7.27% year-to-date.

- The Gold climbed to $3,349.44 per ounce, up 0.32% on the day, down 0.22% for the week, but up 27.63% year-to-date.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, declined to 3.88%, dropping 3.30 basis points on the day, down 3.00 bps for the week, and down 37.20 bps year-to-date.

- The 10-year U.S. Treasury yield, an indicator of long-term borrowing costs, slipped to 4.42%, down 3.40 basis points on the day, up 1.10 bps for the week, but down 15.30 bps year-to-date.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

This week, investors will keep a close watch on trade negotiations and any progress toward agreements between the US and its main trading partners.

In the US, the investors agenda is dominated by a packed lineup of corporate earnings, with major tech players like Alphabet, Tesla, IBM, and Intel set to report.

Updates from the defense industry will come from companies such as Raytheon, Texas Instruments, and Lockheed Martin, while the spotlight will also fall on telecom heavyweights Verizon, AT&T, and T-Mobile. Other closely watched results will include Coca-Cola, Philip Morris, ServiceNow, and Blackstone. On the economic side, the calendar is lighter but still includes key releases:

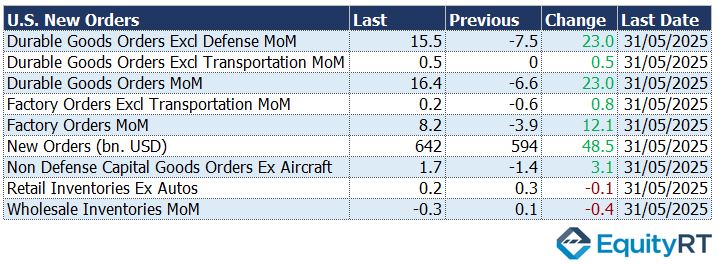

On Friday, durable goods orders for June are expected to give back much of May’s sharp gain, with forecasts pointing to a drop of about 11% month-over-month, following the previous month’s substantial 16.4% jump, which was mainly driven by a surge in aircraft orders.

A weaker headline figure would indicate a notable slowdown in demand for big–ticket manufactured goods, from household appliances to defense equipment, hinting that companies may be pulling back on large capital spending plans.

Core durable goods orders are expected to show a modest increase of around 1.1%, reflecting steady growth in demand for machinery, industrial equipment, and broader business investment outside the aerospace sector.

The latest S&P Global PMIs are likely to contribute to steady growth in private sector activity. Reports on new and existing home sales are forecast to show modest improvements, and markets will also follow fresh regional Federal Reserve surveys. A highlight for investors will be Fed Chair Jerome Powell’s speech at a banking conference, which could offer fresh clues on the policy outlook.

In Canada, the focus will be on a busier run of economic figures, including retail sales and new housing price data.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

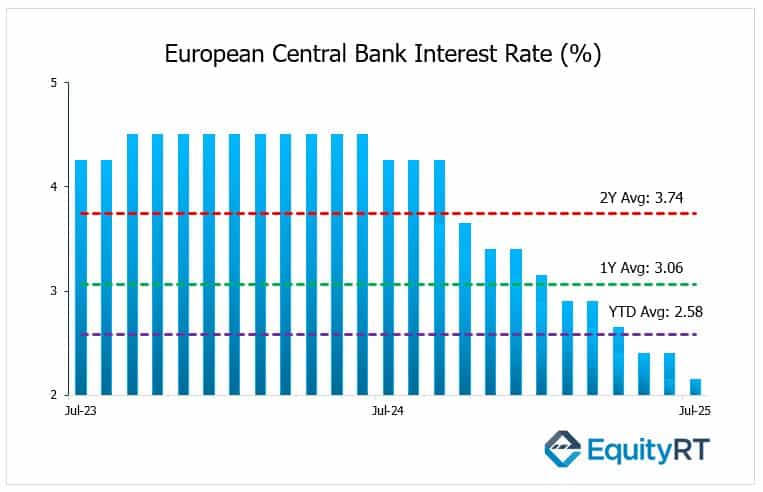

The European Central Bank (ECB) is widely expected to keep its key interest rates unchanged at 2% when it meets on Thursday, marking a pause after eight consecutive cuts.

The decision comes as Euro Area inflation has returned to the ECB’s 2% target in June, supporting the bank’s signal that it intends to hold fire on further easing for now.

Recent comments from ECB Governing Council members have reinforced the view that a pause this month is appropriate, with policymakers generally agreeing there is limited scope for additional rate cuts unless incoming data points to a clear economic slowdown.

Adding to the ECB’s cautious approach are external risks, including renewed trade tensions due to possible U.S. tariffs on European exports and the impact of a stronger Euro, both of which could dampen inflationary pressures going forward.

Markets will be listening closely to President Christine Lagarde’s remarks for any hints about the bank’s next steps, particularly whether another cut could be back on the table later this year if growth or price pressures weaken again.

Alongside the meeting, investors will watch for fresh PMI figures for the Euro Area, Germany, France, and the UK, which are projected to show slight improvements in both manufacturing and services activity.

In Germany, sentiment indicators are expected to paint a more upbeat picture: the GfK Consumer Climate is forecast to reach a nine-month high, while the Ifo Business Climate could climb to its strongest level since May 2023. The Euro Area’s flash consumer confidence and France’s business sentiment readings are also likely to edge higher.

In the UK, the Office for National Statistics will release retail sales data, with expectations shaped by a robust update from the British Retail Consortium, which reported stronger sales of electric fans and leisure goods thanks to warmer weather.

Russia’s central bank is anticipated to deliver a 100-basis point reduction in its benchmark rate.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

In China, the People’s Bank of China kept its one- and five-year loan prime rates steady this week. Investors will also be looking for industrial profit figures covering the first half of the year, which could provide further clues about the strength of the manufacturing sector.

In Japan, the focus will turn to the preliminary July PMIs, which are anticipated to show a modest pickup in manufacturing activity. Tokyo’s latest inflation numbers are also due and are expected to reveal a slight easing in core inflation. Political developments could add another layer of uncertainty, as traders keep an eye on the outcome of Japan’s upper house election, where the ruling coalition is projected to lose its majority, a result that could shake economic policy direction and potentially prompt more government spending.

In India, markets will look out for fresh infrastructure output figures alongside the latest PMI readings. Over in Australia, attention will center on the minutes from the Reserve Bank of Australia’s most recent policy meeting for hints on the rate path, as well as new July PMI data.

Elsewhere in the Asia-Pacific region, inflation updates are due from Singapore, Hong Kong, and Malaysia, while South Korea is set to publish an early estimate of its GDP growth.