Global Markets Recap

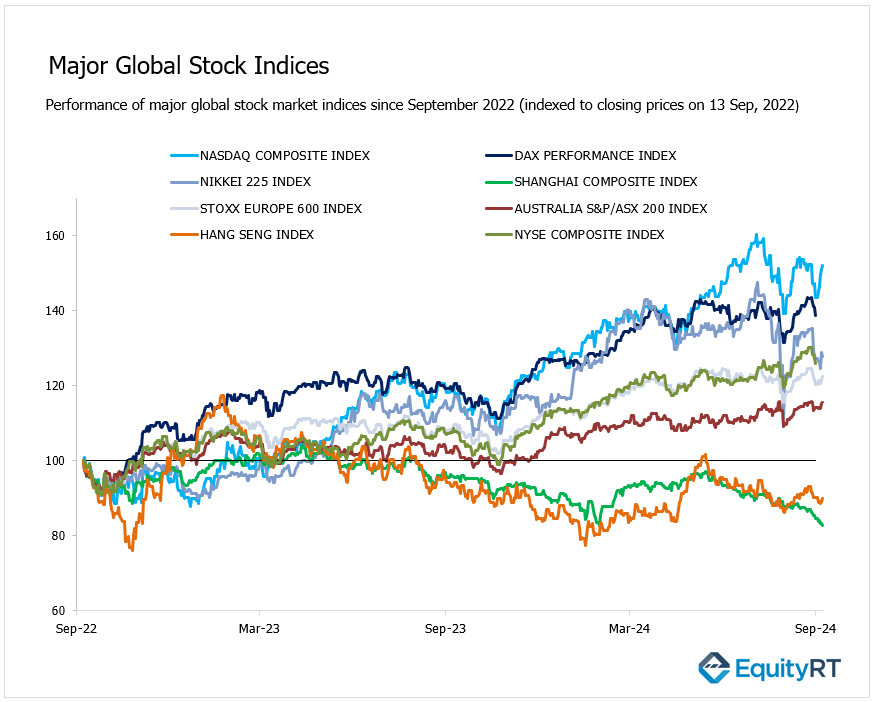

U.S. stock indices closed higher on Friday after the University of Michigan’s consumer sentiment index for September rose above expectations, reaching its highest level since May. Consumer short-term inflation expectations also declined, contributing to the positive sentiment.

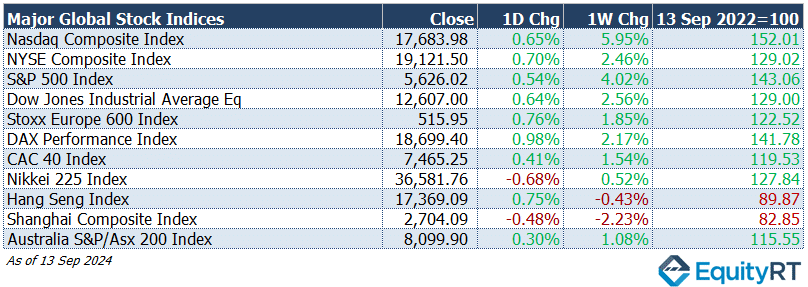

- Nasdaq Composite Index rose 0.65%, closing at 17,683.98, up 5.95% for the week.

- NYSE Composite Index increased 0.70%, finishing at 19,121.50, with a weekly gain of 2.46%.

- S&P 500 Index went up by 0.54%, ending at 5,626.02, up 4.02% for the week.

- Dow Jones Industrial Average EW gained 0.64%, closing at 12,607.00, with a 2.56% weekly rise.

European stocks also ended the week positively:

- Stoxx Europe 600 Index rose 0.76%, finishing at 515.95, up 1.85% for the week.

- DAX Performance Index increased by 0.98%, closing at 18,699.40, with a 2.17% weekly gain.

- CAC-40 Index rose 0.41%, ending at 7,465.25, up 1.54% for the week.

Asia-Pacific Markets traded mixed on Friday:

- Hang Seng Index rose 0.75%, finishing at 17,369.09, but down 0.43% for the week.

- Shanghai Composite Index fell by 0.48%, closing at 2,704.09, with a week loss of 2.23%.

- Australia’s S&P/ASX 200 Index increased by 0.30%, closing at 8,099.90, up 1.08% for the week.

Asian markets, including Japan and China are closed today due to holidays.

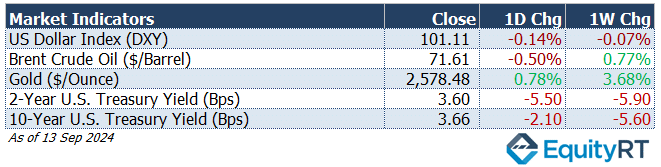

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 101.11, reflecting a daily decline of 0.14% and a 0.07% decrease over the week.

The Brent crude oil (#LCO07) the global oil price benchmark, ended at $71.61 per barrel, dropping by 0.50% on the day but rising by 0.77% for the week.

The price of gold (#XAU) ) finished at $2,578.48 per ounce, gaining 0.78% on the day and increasing by 3.68% over the week.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, fell by 5.50 basis points to 3.60%, registering a 5.90 basis point drop over the week.

The 10-year U.S. Treasury yield (#USGG10YR) declined by 2.10 basis points, closing at 3.66%, with a 5.60 basis point weekly decrease.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

U.S. Economic Indicators: Last Week’s Macro Highlights

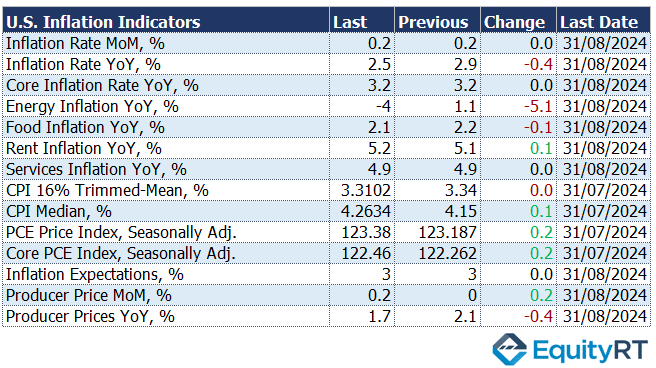

In the U.S., August’s Consumer Price Index (CPI) showed a 0.2% increase month-on-month, consistent with expectations, and an annual decrease from 2.9% to 2.5%, marking the lowest since February 2021. Core CPI rose 0.3% month-on-month, surpassing expectations, but remained steady at 3.2% annually.

Producer Price Index (PPI) for August also showed a monthly rise of 0.2%, exceeding forecasts, with an annual drop from 2.1% to 1.7%, marking a six-month low. Core PPI rose 0.3% monthly, also surpassing estimates.

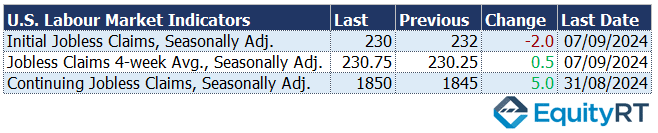

Jobless claims for the week of September 7 slightly increased to 230,000 but remained below historical averages.

Continuing Jobless Claims rose to 1.85 million for the week ending August 31, 2024, up from a revised 1.84 million the previous week.

The 4-week average of Jobless Claims climbed to 230,750 as of September 7, up from a revised 230,250 the previous week.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming U.S. Economic Indicators to Watch This Week

- Powell Hints at Possible Rate Cut Amid Inflation Confidence

The Federal Reserve is expected to cut interest rates this week for the first time in over four years. In his speech following the recent Fed meeting, Chairman Jerome Powell reiterated the Fed’s data-driven approach, noting that no decision had been made for the September meeting. However, he suggested that if confidence in inflation control continues to grow and the labor market remains strong, a rate cut could be considered.

Powell’s earlier speech at the Jackson Hole Economic Symposium also hinted at possible cuts, stating that inflation had dropped significantly, nearing the Fed’s 2% target, and that the time might be right to adjust policy.

Market participants are already pricing in a 25 basis point cut during this week’s meeting, with expectations of another 25 basis point reduction in November and possibly a 50 basis point cut in December.

- U. S. Industrial Production and Capacity Utilization

The U.S. industrial production and capacity utilization data for August will be released on Tuesday.

In July, industrial production fell by 0.6%, its sharpest drop in six months, after a 0.3% increase in June. The capacity utilization rate also dropped from 78.4% to 77.8%, marking a three-month low.

For August, analysts expect a slight recovery with no rise in industrial production and a marginal increase in capacity utilization to 77.9%.

- Retail Sales and Employment Data in Focus

Retail sales for August will be released on Tuesday. In July, retail sales surged by 1%, exceeding expectations, marking the strongest monthly gain since January 2023. Core retail sales rose by 0.3%, though the pace had slowed from June’s 0.9% increase.

For August, a 0.2% decline in retail sales is forecasted, with core retail sales expected to rise by 0.3%.

Labor market data, including weekly initial jobless claims, will be released on Thursday. The latest report showed a decline to 227,000 claims, the lowest in seven weeks and well below historical averages.

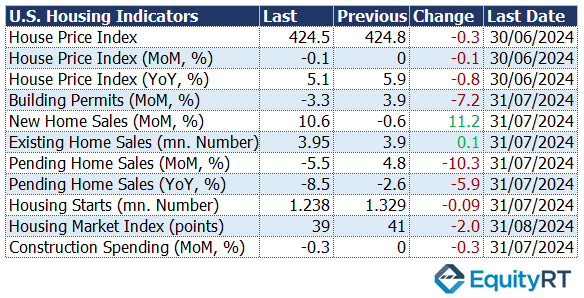

- Housing Market Insights

Housing starts and building permits for August are set for release on Wednesday, followed by existing home sales on Thursday.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

European Economic Trends: Last Week’s Macro Insights

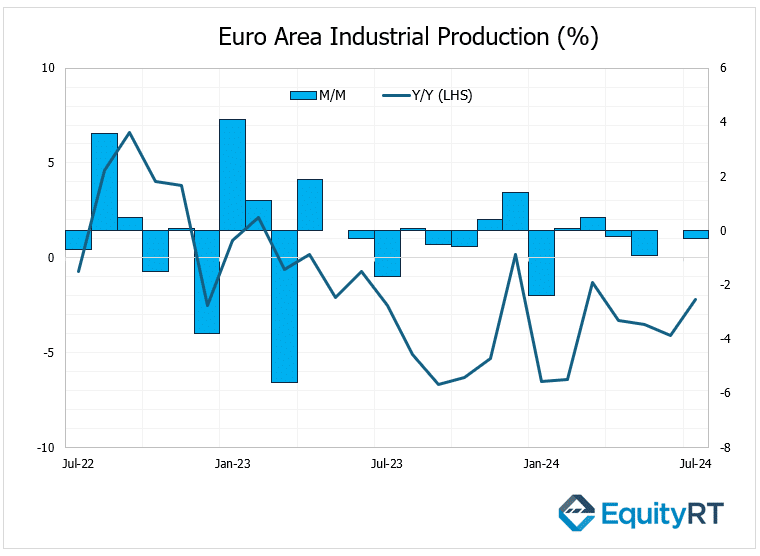

- Eurozone Industrial Production Declines for Fourth Month

In July, Eurozone industrial production continued its downward trend, falling by 0.3% month-on-month following a 0.1% drop in June. This marked the fourth consecutive month of decline, although it was less severe than the expected 0.5% decrease. Year-on-year, the contraction rate slowed from 4.1% in June to 2.2% in July.

- ECB Cuts Interest Rates Again

The European Central Bank (ECB) lowered interest rates for the second time this year. The main refinancing rate was cut from 4.25% to 3.65%, and the marginal lending rate was reduced from 4.50% to 3.90%.

The deposit facility rate also saw a reduction from 3.75% to 3.50%. Along with these cuts, a technical adjustment narrowed the gap between these rates, with the difference between the refinancing and deposit rates reduced to 15 basis points.

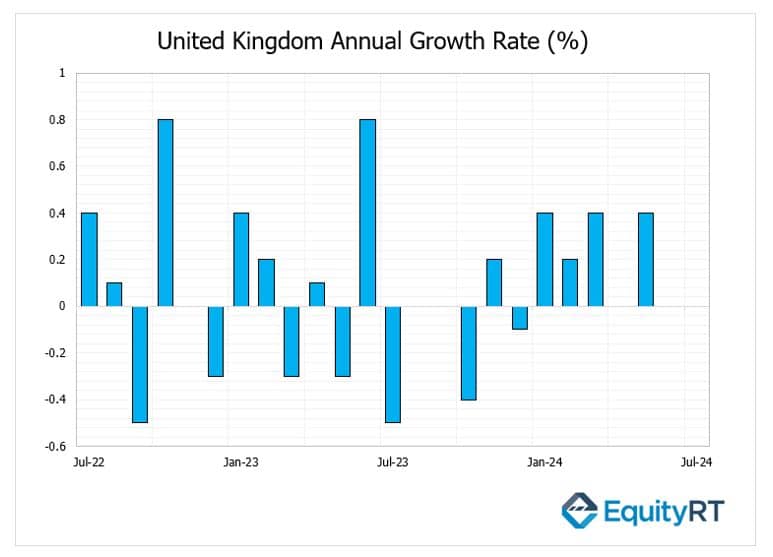

- United Kingdom’s Economy Stagnates in July

The UK’s GDP growth remained stagnant in July, maintaining a 0% growth rate after also showing no growth in June. This was below the expected 0.2% increase.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

- Euro Area Records A Trade Surplus in July

In July 2024, the Euro Area recorded a trade surplus of EUR 21.2 billion, exceeding market predictions of EUR 14.9 billion and showing a substantial increase from the EUR 6.7 billion surplus recorded in the same month the previous year. Exports rose by 10.2% year-on-year to reach EUR 252 billion, while imports grew at a more modest pace of 4%, totaling EUR 230 billion.

- Euro Area and the UK Inflation Rates

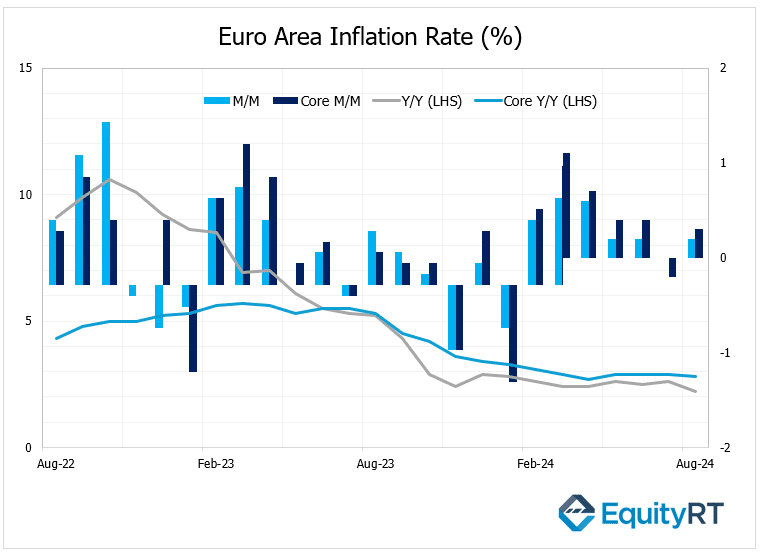

Euro Area final inflation data (CPI) for August will be closely monitored on Wednesday. Preliminary data indicated that the headline CPI rose by 0.2% month-on-month, up from 0% in July, in line with expectations.

On a yearly basis, the headline CPI dropped to 2.2% from 2.6%, marking the lowest level since July 2021. The core CPI also dropped to 2.8% from 2.9%, the lowest in four months.

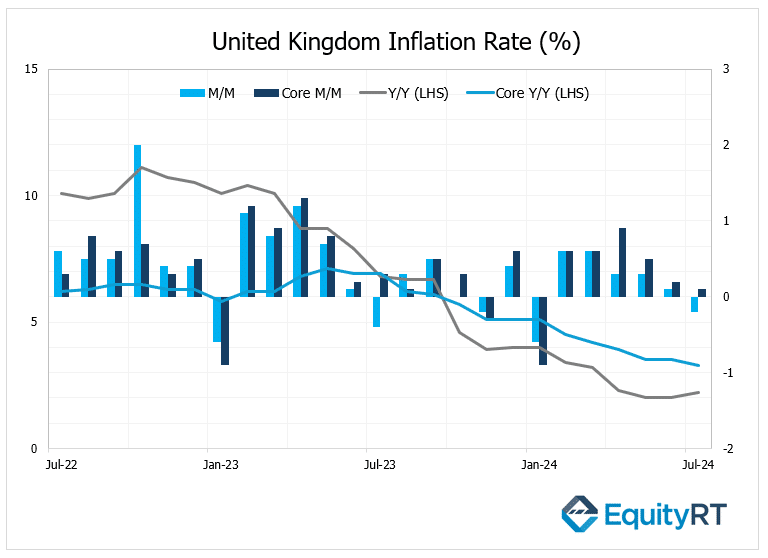

In the UK, inflation data (CPI) for August will also be released on Wednesday, which is the key indicator for Bank of England’s (BoE) monetary policy.

In July, the headline CPI declined by 0.2% month-on-month, the first drop in five months, while annual inflation rose to 2.2% from 2%. This increase was below market expectations of 2.3%.

Core CPI slowed to 0.1% month-on-month in July, the weakest reading in six months. On an annual basis, core CPI fell to 3.3% from 3.5%, the lowest level since September 2021.

- Key Economic Events to Watch in Germany, the Euro Area, and the UK

This Friday, Germany’s Producer Price Index (PPI) for August will be closely followed. In July, the PPI showed a month-on-month increase of 0.2%, in line with expectations. On an annual basis, the rate of decline slowed to 0.8% from 1.6%, marking the 13th consecutive month of declines.

Also on Friday, the Euro Area’s September consumer confidence flash data will be released. Despite this improvement, consumer confidence continues to show weakness, staying in negative territory.

On Thursday, the Bank of England (BoE) will hold its next monetary policy meeting. After seven consecutive meetings where interest rates were held steady, the BoE lowered rates by 25 basis points in its August meeting, reducing the policy rate from 5.25% to 5.00%. The central bank is expected to keep rates unchanged at this week’s meeting.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

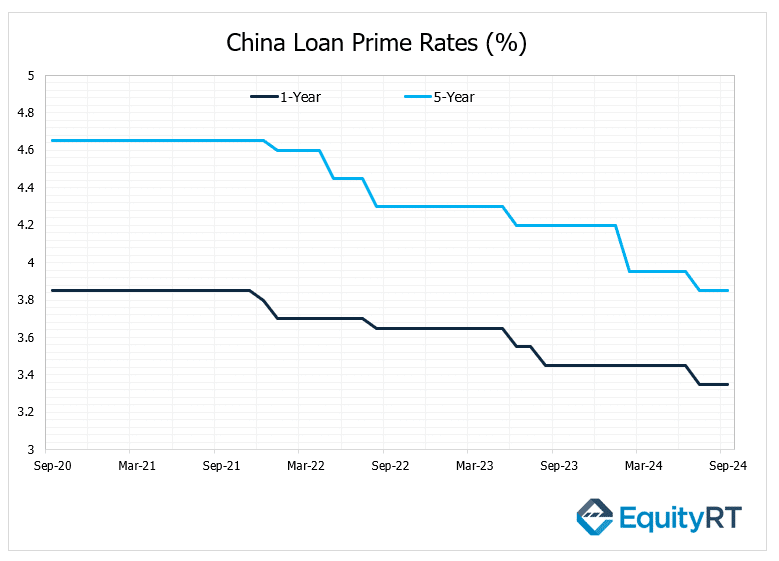

On Friday, the People’s Bank of China (PBoC) will hold its monetary policy meeting. In its previous meeting, the PBoC kept its 1-year Loan Prime Rate (LPR) unchanged at 3.35%, and the 5-year LPR, which is the benchmark for long-term loans such as mortgages, at 3.85%. The PBoC is expected to hold rates steady again in this week’s meeting.

Also on Friday, the Bank of Japan (BOJ) will have its meeting. Expectations for this week’s meeting are that the BOJ will keep interest rates unchanged.

This week in Asia, other key economic releases are scheduled:

Inflation data for August in Japan, India and Malaysia, trade data for Indonesia, Malaysia, India and interest rate decision for Indonesia.