Global Markets Recap

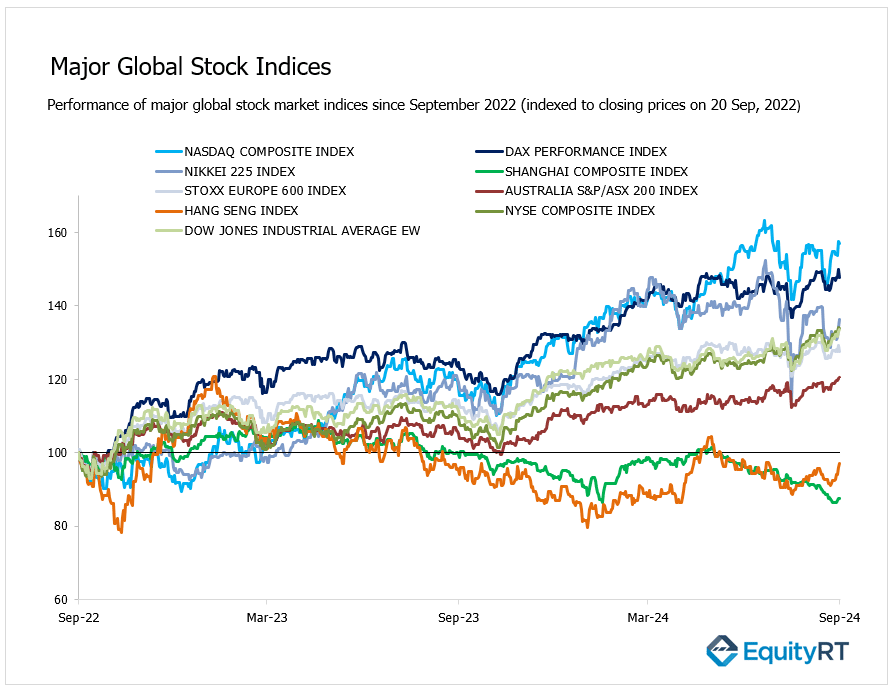

Wall Street indices ended Friday with slight losses after equities surged to record highs following the Fed’s substantial rate cut earlier in the week:

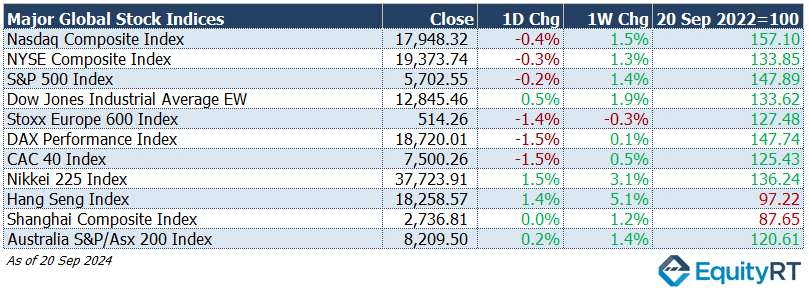

- Nasdaq Composite Index went down by 0.4%, closing at 17,948.32, up 1.5% for the week.

- NYSE Composite Index lost 0.30%, finishing at 19,373.74, with a weekly gain of 1.3%.

- S&P 500 Index went down by 0.2%, ending at 5,702.55, up 1.4% for the week.

- Dow Jones Industrial Average EW gained 0.5%, closing at 12,845.46, with a 1.9% weekly rise.

Europe’s major stock markets all closed lower on Friday:

- Stoxx Europe 600 Index lost 1.4%, finishing at 514.26, down 0.3% for the week.

- DAX Performance Index decreased by 1.5%, closing at 18,720.01, with a 0.1% weekly gain.

- CAC-40 Index fell by 1.5%, ending at 7,500.26, up 0.5% for the week.

Asia-Pacific stocks closed out the week mostly higher:

- Hang Seng Index rose 1.4%, finishing at 18,258.57, and up 5.1% for the week.

- Shanghai Composite Index showed a limited rise closing at 2,736.81, with a week gain of 1.2%.

- Nikkei 225 Index rose 1.5%, finishing at 37,723.91, and up 3.1% for the week.

- Australia’s S&P/ASX 200 Index increased by 0.2%, closing at 8,209.50, up 1.4% for the week.

Japan’s markets were closed due to a public holiday on Monday.

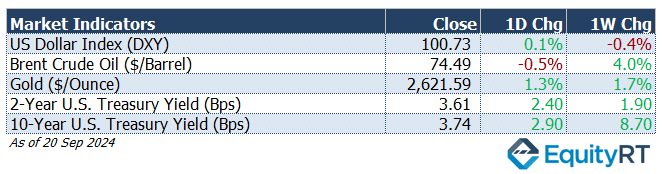

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 100.73, reflecting a daily gain of 0.1% and a 0.4% decrease over the week.

The Brent crude oil (#LCO07) the global oil price benchmark, ended at $74.49 per barrel, dropping by 0.5% on the day but rising by 4% for the week.

The price of gold (#XAU) ) finished at $2,621.59 per ounce, gaining 1.3% on the day and increasing by 1.7% over the week.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, rose by 2.40 basis points to 3.61%, registering a 1.90 basis point rise over the week.

The 10-year U.S. Treasury yield (#USGG10YR) rose by 2.90 basis points, closing at 3.74%, with a 8.70 basis point weekly decrease.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

U.S. Economic Indicators: Last Week’s Macro Highlights

- Fed Rate and FOMC Projections

The Federal Reserve unexpectedly cut the federal funds rate by 50 basis points last Wednesday, lowering it from 5.25%-5.50% to 4.75%-5.00%. Markets had anticipated a 25 basis point cut. This marked the first rate cut in four years.

The Fed also revised its interest rate projections for the next few years. The 2024 year-end forecast was adjusted to 4.4%, with further cuts anticipated through 2025 and 2026. In total, a 200 basis point reduction is expected over the next three years.

The U.S. growth forecast for 2024 was slightly revised down from 2.1% to 2%, while predictions for 2025 and 2026 remain at 2%.

The unemployment rate was adjusted upward for the next few years, with 2024 now expected to hit 4.4%, and 2025 and 2026 projected at 4.4% and 4.3%, respectively.

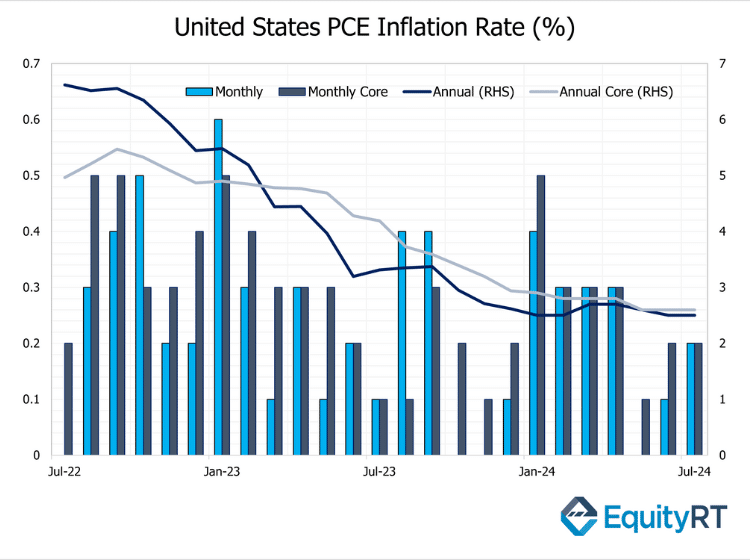

Inflation, measured by the PCE, was revised downward for 2024 and 2025, while remaining stable for 2026 at 2%. The Fed aims to reach its 2% inflation target by 2026.

- Labour Market

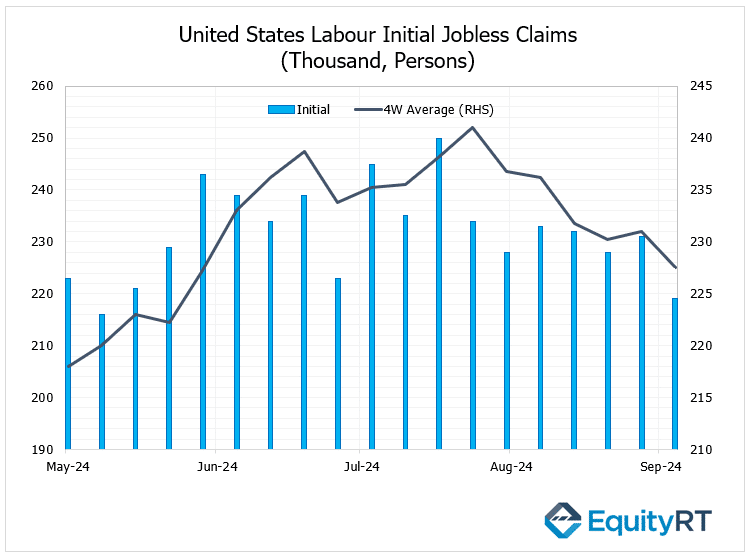

Initial jobless claims in the United States for the week ending September 14 fell to 219,000, marking a four-month low. This improvement came despite expectations for a flat reading, and jobless claims remain historically low.

The 4-week average of jobless claims dropped to 227.5 thousand on September 14, down from a revised 231 thousand the week before, reaching its lowest level in 14 months.

- Housing Market, Industrial Production and Retail Sales

Housing market data showed a decline in existing home sales in August, which dropped 2.5% following a 1.5% rise in July, exceeding expectations for a smaller 1.3% drop.

Industrial production rebounded in August, rising 0.8% after a 0.9% decline in July, beating expectations of a 0.2% increase.

Retail sales for August showed a modest 0.1% growth, slowing significantly compared to the 1.1% rise in July, although it was still better than the expected 0.2% decline. Core retail sales (excluding items like automobiles and gasoline) increased by 0.2%, aligning with forecasts, but showing a slight slowdown from July’s 0.4% growth.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming U.S. Economic Indicators to Watch This Week

- Growth Rate in Q2

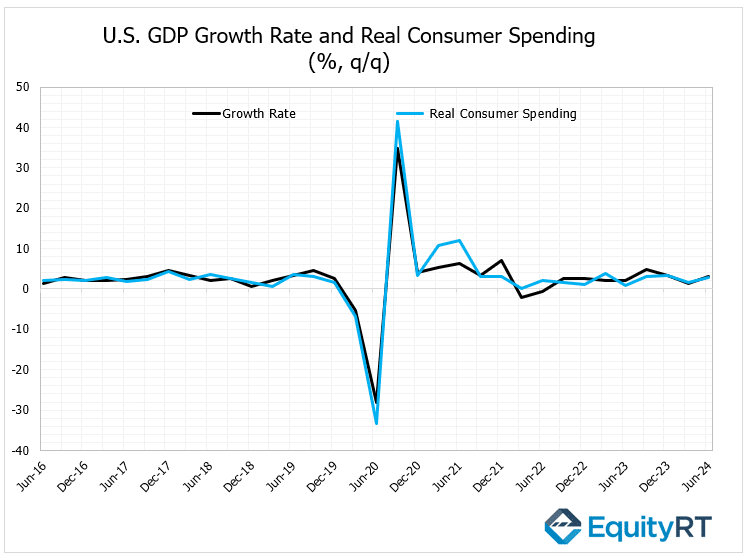

The final annualized Q2 GDP growth data will be released this Thursday. After the US economy grew by 1.4% in Q1, Q2 growth was revised upwards from 2.8% to 3%, exceeding expectations of 2.8%. This revision was largely driven by a notable increase in consumer spending, which was adjusted from 2.3% to 2.9%.

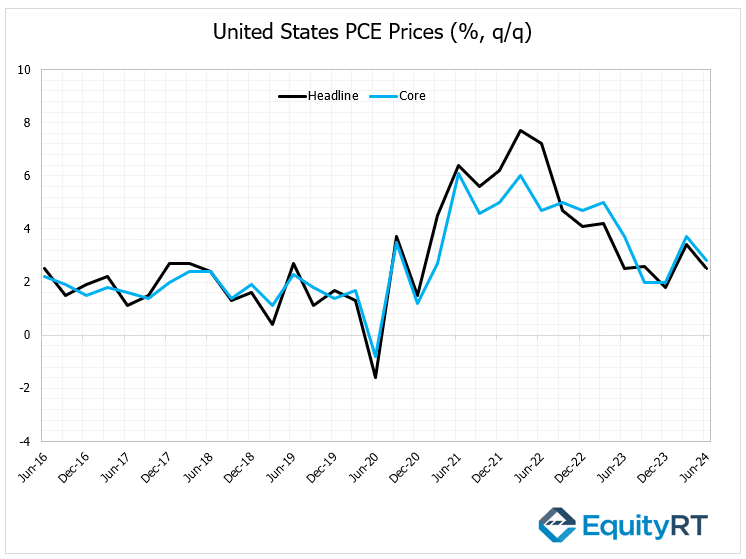

The final data for the annualized quarterly Personal Consumption Expenditures (PCE) price index, which is closely monitored by the Fed as a key inflation indicator, will be released on Thursday for Q2.

The annualized quarterly PCE price index was revised slightly downward from 2.6% to 2.5% in Q2, after registering 3.4% in Q1. The core PCE price index, which was recorded at 3.7% in Q1, was also revised down slightly from 2.9% to 2.8% in Q2.

On Friday, the PCE inflation report for August is set to draw significant attention in the US, with both the headline and core PCE price indexes projected to increase by 0.2%, consistent with the previous month.

In July 2024, the US personal consumption expenditure (PCE) price index rose by 0.2% month-over-month, an increase from 0.1% in June and in line with forecasts. The core PCE index, which excludes food and energy, also increased by 0.2%, matching the pace and expectations of June.

On an annual basis, the PCE inflation rate held steady at 2.5%, slightly below the anticipated 2.6%, while the core PCE inflation rate remained at 2.6%, also below the expected 2.7%.

Other important indicators include durable goods orders, CB Consumer Confidence, the Chicago Fed National Activity Index, the Richmond Fed Manufacturing Index, new and pending home sales. Additionally, the final Michigan consumer sentiment figures will be closely watched.

In Canada, monthly GDP figures will be released, while Brazil and Mexico will report mid-month inflation data.

The Bank of Mexico’s interest rate decision will also be a key focus.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

European Economic Trends: Last Week’s Macro Insights

The Bank of England (BoE) kept its interest rate at 5% in its latest meeting after lowering it by 25 basis points in August.

In the UK, inflation increased by 0.3% in August after a 0.2% drop in July. Core CPI rose to 3.6% annually, marking a four-month high.

In the Eurozone, final inflation data for August showed that headline CPI decreased to 2.2% annually from 2.6% in July, the lowest since July 2021. Core inflation slightly dropped to 2.8%.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

In Europe, flash PMI estimates will provide an update on September’s economic performance. Both the Eurozone and Germany are anticipated to experience continued contraction in the manufacturing sector, along with slower growth in services.

Germany’s Ifo Business Climate is expected to decline, while consumer confidence may show a slight improvement.

Unemployment figures for Germany will be released, along with data on loans to households and businesses, Eurozone business sentiment, and preliminary inflation numbers for France and Spain. In the UK, the week appears light, featuring only flash estimates for the S&P Global PMIs and the CBI Industrial Trends Orders.

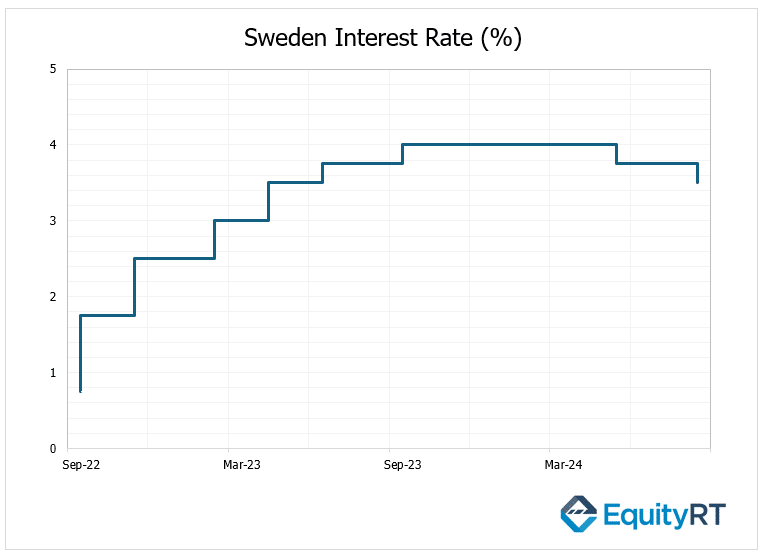

The Swedish central bank (Riksbank) will announce its monetary policy decision on Wednesday. Riksbank last lowered its policy rate by 25 basis points to 3.50% in August, signaling potential further cuts depending on inflation trends. The rate is expected to be reduced by another 25 basis points to 3.25% this week.

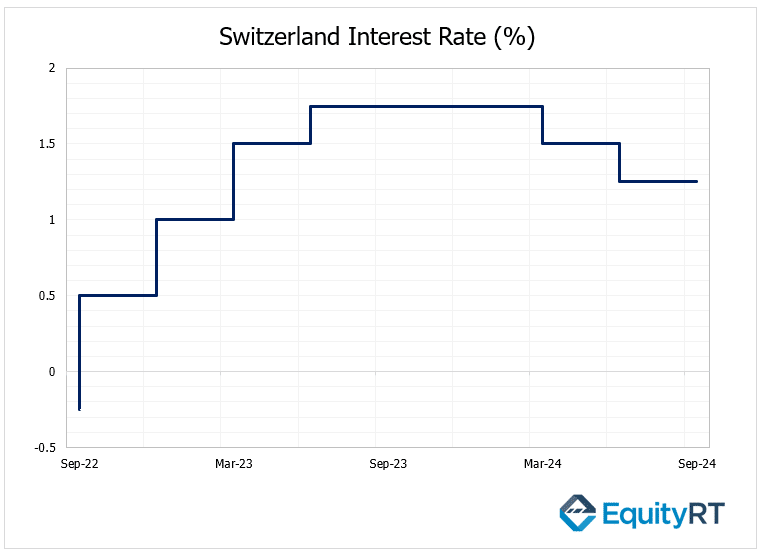

On Thursday, the Swiss National Bank (SNB) is projected to reduce interest rates by 25 basis points to 1% from 1.25% for the third consecutive meeting. The SNB had previously indicated that easing inflation pressures and the strength of the Swiss franc contributed to its decision to begin a rate-cutting cycle.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

The Bank of Japan (BOJ) maintained its policy rate at 0.25% in last week’s meeting, continuing its view that the economy is on a moderate recovery path. BOJ had previously raised the rate in July after ending negative rates in March, citing improved inflation prospects.

Similarly, the People’s Bank of China (PBoC) kept the 1-year Loan Prime Rate (LPR) at 3.35% and the 5-year LPR at 3.85%. After cutting rates in July to support economic activity, the PBoC chose to hold rates steady to watch the impact.

This week in Asia, other key economic releases are scheduled:

In China, a quieter week for economic data will feature industrial profits for the year up to August.

In Japan, attention will be on the flash PMIs for September and the minutes from the BoJ’s last policy meeting, which may provide insights into the timing and scale of potential rate hikes.

PMIs will also be a key focus in India.

In other regions, Malaysia will release its inflation rate, South Korea will provide new consumer confidence data, and Taiwan will update its export orders.

The Reserve Bank of Australia will also hold its meeting tomorrow. The bank has kept its policy rate steady at 4.35% for six consecutive meetings, though it remains open to further hikes if necessary to manage inflation. The market expects no change in this week’s meeting as well.