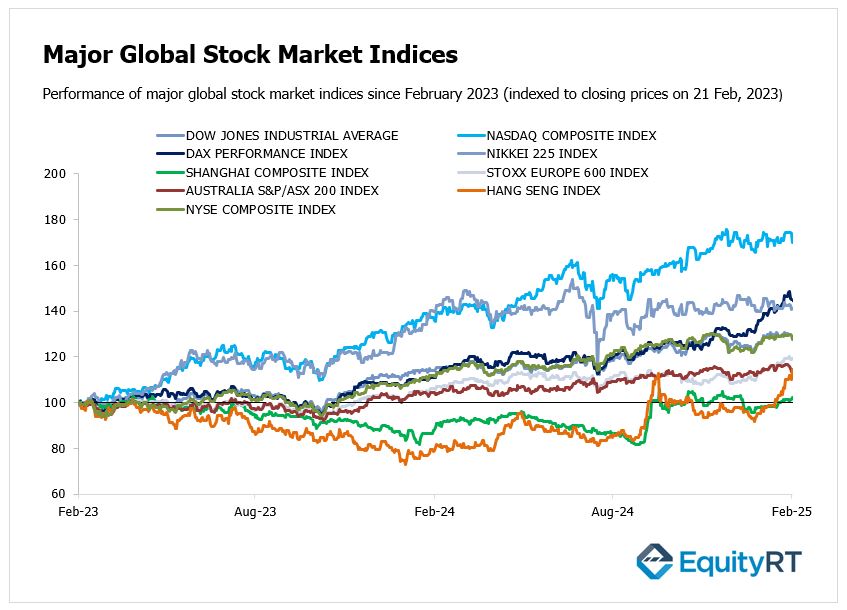

Global Stock Market Highlights

Last Friday, U.S. stock markets saw sharp declines, with major indices falling over 2%. The sell-off was driven by concerns over President Donald Trump’s policy moves, including new tariff threats, as well as weaker-than-expected consumer confidence and disappointing home sales data. Short-term inflation expectations remained high, while long-term expectations continued to deteriorate, adding to investor anxiety.

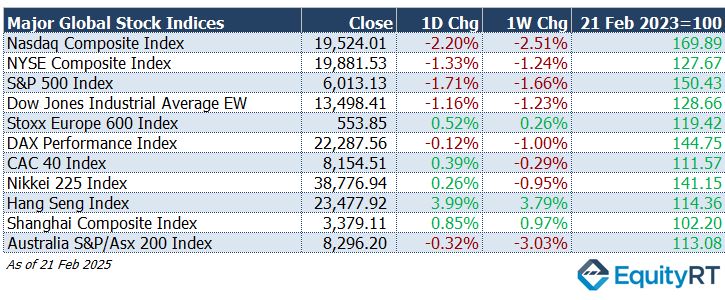

- Nasdaq Composite Index closed at 19,524.01, declining 2.20% on the day and 2.51% for the week.

- NYSE Composite Index closed at 19,881.53, down 1.33% on the day and 1.24% for the week.

- S&P 500 Index closed at 6,013.13, declining 1.71% on the day and 1.66% for the week.

- Dow Jones Industrial Average EW closed at 13,498.41, losing 1.16% on the day and 1.23% for the week.

European stock markets showed a mixed performance, driven by robust corporate earnings and encouraging economic data. Better-than-expected PMI figures signalled resilience in the Euro Area economy, even as inflation concerns persisted.

- Stoxx Europe 600 Index closed at 553.85, rising 0.52% on the day and 0.26% for the week.

- DAX Performance Index closed at 22,287.56, edging down 0.12% on the day and 1.00% for the week.

- CAC 40 Index closed at 8,154.51, gaining 0.39% on the day but slipping 0.29% for the week.

Asia-Pacific markets ended Friday with a mixed performance. Hong Kong stocks led regional gains, hitting a three-year high, as investors weighed Japan’s inflation data against concerns over U.S. tariff policies.

- Nikkei 225 Index closed at 38,776.94, up 0.26% on the day but down 0.95% for the week.

- Hang Seng Index closed at 23,477.92, surging 3.99% on the day and 3.79% for the week.

- Shanghai Composite Index closed at 3,379.11, rising 0.85% on the day and 0.97% for the week.

- Australia S&P/ASX 200 Index closed at 8,296.20, slipping 0.32% on the day and tumbling 3.03% for the week.

** The Japanese stock market was closed today due to a public holiday.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 106.65, rising 0.24% on the day but slipping 0.14% for the week.

- The Brent crude oil, the global oil price benchmark, settled at $74.43 per barrel, dropping 2.68% on the day and down 0.41% for the week.

- The Gold finished at $2,934.00 per ounce, declining 0.25% on the day but rising 1.85% over the week.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, dropped 8.30 bps on the day to 4.20%, losing 6.70 bps over the week.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, fell 8.10 basis points on the day, closing at 4.43%, with a 5.00 bps decline for the week.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

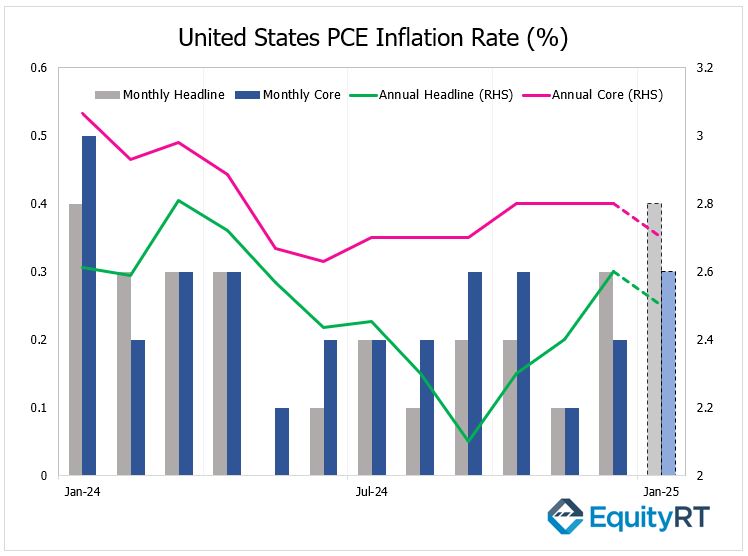

In the U.S., all eyes will be on the PCE report and comments from Federal Reserve officials, as markets seek further clarity on inflation trends and potential policy shifts.

On Friday, the U.S. will release its January PCE inflation data. With recent CPI and PPI figures surpassing expectations, the PCE price index will be critical in determining whether inflationary pressures are easing or continuing.

In December 2024, the PCE price index rose by 0.3% month-over-month, marking the highest increase in eight months.

Core PCE, which excludes food and energy, climbed 0.2%, both in line with forecasts.

Annual PCE inflation increased to 2.6% from 2.4%, marking its third consecutive rise, while core PCE remained unchanged at 2.8%, still above the Federal Reserve’s 2% target.

For January, the monthly PCE is projected to rise by 0.4%, with core PCE expected to increase by 0.3%.

On a year-over-year basis, PCE inflation is anticipated to reach 2.5%, with core PCE expected to set to 2.7%.

Personal spending is projected to have slowed to 0.2%, reflecting cautious consumer behavior, while personal income is expected to have grown by 0.4%, same as December’s pace.

Meanwhile, the second estimate of Q1 2025 GDP growth is likely to confirm an annualized expansion of 2.3%, reinforcing the view that the U.S. economy remains on a steady trajectory.

Consumer spending, which drives much of the economy, accelerated to 4.2%—its strongest growth in seven quarters. However, declines in investments and net exports contributed to the slowdown. Overall, GDP growth reached 2.8% in 2024, slightly down from 2.9% in 2023.

Durable goods orders are forecasted to rebound by 1.3%, recovering from December’s 2.2% drop, signaling potential strength in business investment.

The latest weekly jobless claims came in at 219,000, slightly above the 215,000 forecasts. Data from the first two months of 2025 indicates that claims remain low, signalling continued labour market tightness.

Additionally, investors will be monitoring a series of regional and national economic indicators, including CB Consumer Confidence, the Chicago Fed National Activity Index, and manufacturing reports from the Dallas, Richmond, and Kansas Federal Reserve branches. The goods trade balance and preliminary wholesale inventory data will also be key in assessing trade and inventory trends.

The housing market will be another focal point, with reports on home prices from FHFA and Case-Shiller, as well as updates on pending and new home sales.

On the corporate front, the earnings season continues, with major reports expected from Nvidia, Lowe’s Companies, and TJX Companies. Their results could provide further insights into consumer demand, retail performance, and technology sector trends.

Beyond the U.S., key economic data from the Americas will include Q1 GDP figures for Canada and Brazil, which will offer a broader perspective on regional economic conditions.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

In Europe, investor attention will be on the European Central Bank’s (ECB) January policy meeting minutes for clues on the central bank’s future actions. Inflation data will be a major focus, with preliminary figures for February due from Germany.

In Germany, headline inflation is expected to remain steady at 2.3%, while the harmonized rate may soften slightly to 2.6%. At the same time, the Euro Area will release its final inflation estimates for January.

Germany’s economic sentiment is forecast to improve, with the Ifo Business Climate Index set to rise for the second consecutive month, and the GfK Consumer Climate Indicator reaching a four-month high.

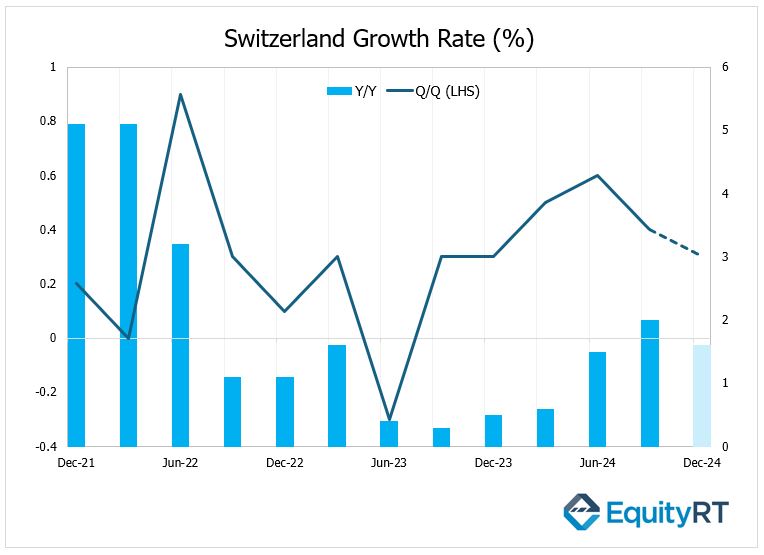

Additionally, key GDP updates will be released from Germany, France, Switzerland.

Germany’s economy contracted by 0.2% in Q4 2024, following a 0.1% growth in Q3, and falling short of forecasts that anticipated a 0.1% decline, according to preliminary estimates.

On a year-on-year basis, GDP also fell by 0.2%. Considering the full 2024, the economy shrank by 0.2%, following a 0.3% decline in 2023. The government has lowered its 2025 growth forecast to 0.3% from the previously projected 1.1%.

Labor market data from Germany will also be closely watched, with Germany’s unemployment rate expected to remain at 6.2%, its highest level since October 2020.

Switzerland’s Q4 2024 GDP data will be released on Thursday. In Q3 2024, GDP grew by 0.4% in quarter-on-quarter, a slowdown from the 0.6% growth in Q2, as anticipated.

Growth was mainly supported by sectors such as real estate, professional and technical activities, and trade, while manufacturing contracted by 1.1%.

On the expenditure side, both private and government consumption rose by 0.5%.

Year-on-year, GDP increased by 2% in Q3, up from 1.5% in Q2, surpassing market forecasts of 1.8%.

For Q4, quarterly growth is expected to be 0.3%, while annual growth is projected to slow down to 1.6%.

Further key reports include the Eurozone’s business survey, new car registrations, and wage growth, alongside Germany’s retail sales figures, the UK’s CBI distributive trades and Nationwide Housing Prices, Switzerland’s retail sales.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

Japan is set for a busy week of economic releases, with key data including retail sales, industrial production, and housing starts for January. Tokyo’s inflation figures for February will also attract attention, especially after hawkish signals from Bank of Japan (BoJ) officials have kept investors focused on the potential timing of the central bank’s next rate hike.

In India, the second estimate for FY2025 GDP will be followed, expected to confirm the economic slowdown experienced in the latter half of the year.

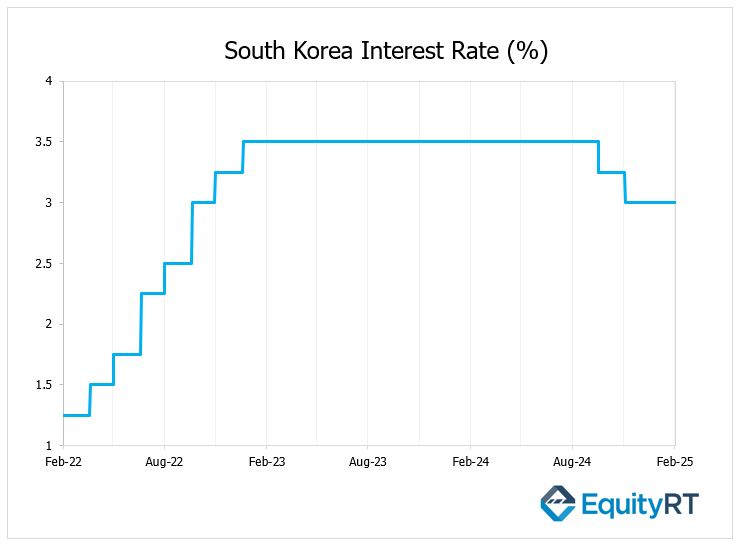

In its January meeting, the Bank of Korea kept its policy rate unchanged at 3%, defying expectations of a 25-basis point cut. It highlighted rising downside risks to growth and increased currency volatility due to unexpected political uncertainties. In tomorrow’s meeting, a 25-basis point cut to 2.75% is expected.

In Australia, attention will turn to capital expenditure and credit aggregates, amid surging government bond yields.

Additionally, the ANZ will release its key business confidence index for New Zealand.