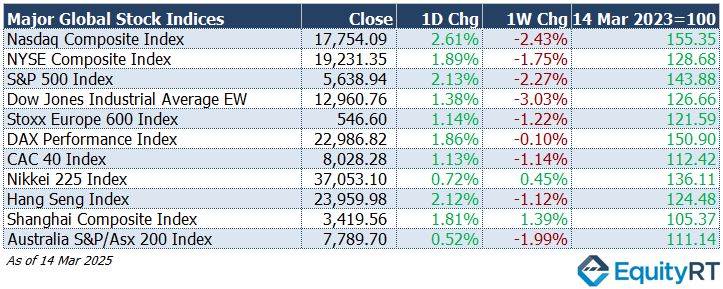

Global Stock Market Highlights

Last Friday, U.S. stock markets saw a strong rebound, driven in part by relief that a potential government shutdown was avoided, lifting investor sentiment. Despite this upswing, lingering worries over tariffs, inflation, and broader economic uncertainty continue to exert pressure on the markets.

- Nasdaq Composite Index closed at 17,754.09, gaining 2.61% on the day but declining 2.43% for the week.

- NYSE Composite Index closed at 19,231.35, rising 1.89% on the day but down 1.75% for the week.

- S&P 500 Index ended at 5,638.94, up 2.13% on the day while losing 2.27% over the week.

- Dow Jones Industrial Average EW settled at 12,960.76, increasing 1.38% on the day but dropping 3.03% for the week.

European stock markets experienced significant gains:

- Stoxx Europe 600 Index closed at 546.60, advancing 1.14% on the day but retreating 1.22% over the week.

- DAX Performance Index finished at 22,986.82, rising 1.86% on the day and almost unchanged, down 0.10% for the week.

- CAC 40 Index ended at 8,028.28, up 1.13% on the day but slipping 1.14% for the week.

Asia-Pacific stocks rose as easing U.S. shutdown fears lifted global sentiment, while Chinese shares gained on state-backed efforts to boost consumer spending.

- Nikkei 225 Index stood at 37,053.10, gaining 0.72% on the day and 0.45% for the week.

- Hang Seng Index closed at 23,959.98, climbing 2.12% on the day but declining 1.12% over the week.

- Shanghai Composite Index finished at 3,419.56, increasing 1.81% on the day and rising 1.39% for the week.

- Australia S&P/ASX 200 Index settled at 7,789.70, up 0.52% on the day but down 1.99% for the week.

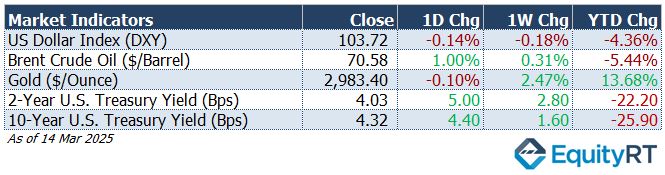

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 103.72, slipping 0.14% on the day and 0.18% for the week, bringing its year-to-date decline to 4.36%.

- The Brent crude oil, the global oil price benchmark, settled at $70.36, rising 1.00% on the day and 0.31% over the week, though it remains down 5.44% year-to-date.

- The Gold ended $2,983.40 per ounce, edging down 0.10% for the day but gaining 2.47% for the week, with a strong 13.68% year-to-date increase.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, closed at 4.03%, increasing 5.00 basis points on the day and 2.80 basis points for the week, though it has declined 22.20 basis points since the start of the year.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, stood at 4.32%, climbing 4.40 basis points on the day and 1.60 basis points for the week, but down 25.90 basis points year-to-date.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

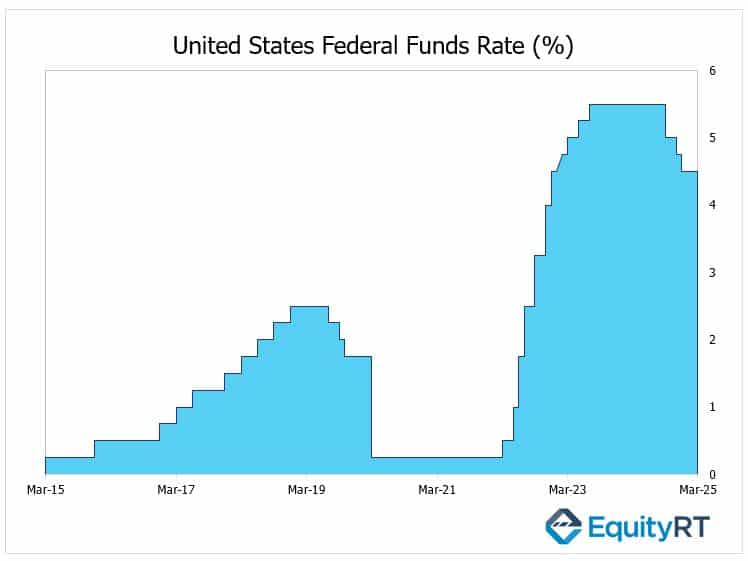

In the U.S., the Federal Reserve’s interest rate decision and Fed Chair Powell’s speech on Wednesday will be the key focus for markets. Alongside the decision, the Fed will release updated economic projections, covering GDP growth, inflation, unemployment, and interest rates.

In its January meeting, the Fed kept the federal funds rate steady at the 4.25%-4.50% range, in line with expectations. This marked a pause in the easing cycle following a total of 100 basis points in rate cuts—50 basis points in September, followed by two 25-basis-point reductions in November and December. According to the Fed’s macroeconomic projections released in December, a 50-basis-point rate cut is anticipated in 2025.

Recently, several Fed officials have suggested that any rate adjustments should be made after gaining clearer insight into the economic impact of Trump’s policies. The Fed is widely expected to keep interest rates unchanged at this week’s meeting.

Also on Wednesday, February’s industrial production and capacity utilization data will provide insights into the manufacturing sector’s performance. Industrial production had risen by 1% in December and exceeded expectations with a 0.5% increase in January.

Capacity utilization climbed from 77.5% to 77.8% in January, marking its highest level since August.

In February, industrial production is expected to rise by 0.2%, while capacity utilization is projected to remain steady at 77.8%.

Additionally, the New York Fed Empire State Manufacturing Index for March will be monitored. In February, the index jumped from 0 to 5.7, signaling a shift back to expansion as new orders increased. However, for March, it is expected to decline to -2, returning to contraction territory.

Retail sales data for February will also be released on Monday. In January, retail sales dropped by 0.9%, marking the steepest decline since March 2023, partly due to severe weather and wildfires in Los Angeles. Core retail sales also fell by 0.8%. February’s figures are expected to show a partial recovery, with a 0.7% increase in headline retail sales and a 0.3% rise in core retail sales. However, concerns remain over the potential impact of Trump’s tariff policies on inflation and consumer spending.

On Tuesday, housing market data will include February housing starts and building permits, key indicators of future demand. On Wednesday, existing home sales data will be released.

Thursday’s focus will be on the labor market, with weekly jobless claims data. The latest report showed claims unexpectedly dropping from 222,000 to 220,000, indicating continued tightness in the job market.

Other key releases include export and import prices, and the Q4 current account balance

Elsewhere in the Americas, Canada’s inflation rate is expected to rise to 2.1% from 1.9%, while central banks in Brazil and Mexico will announce their monetary policy decisions.

Investors will also keep an eye on Canada’s PPI and retail sales data.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

On Tuesday, Germany’s March ZEW Economic Sentiment Index will be released. In February, the ZEW current conditions index improved from -90.4 to -88.5, while the expectations index surged from 10.3 to 26, the highest level since July 2024.

The Eurozone’s January trade balance will also be announced on Tuesday.

On Wednesday, the focus will be on final February CPI data, which showed a 0.5% monthly increase in preliminary readings, the strongest in ten months, while the annual rate eased to 2.4%.

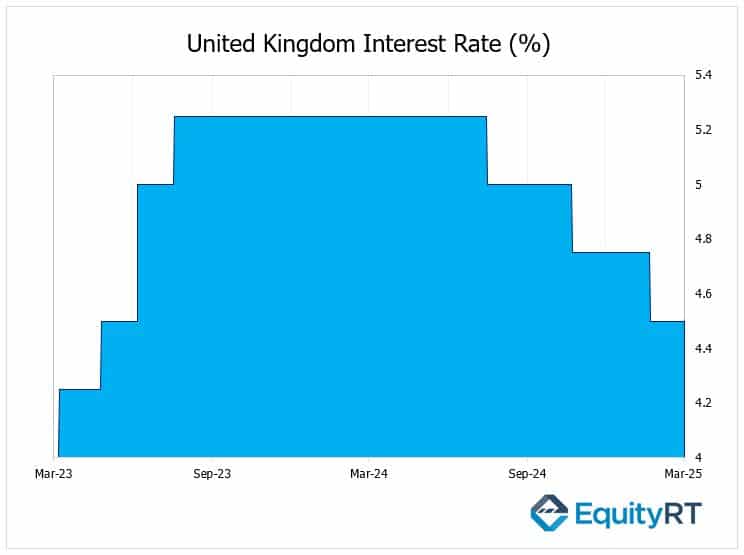

On Thursday, the Bank of England’s (BoE) rate decision will be monitored. BoE lowered rates by 25 bps to 4.50% in February, with most members supporting the move. The bank is expected to keep rates unchanged this time.

Sweden’s Central Bank (Riksbank) and Switzerland’s Central Bank (SNB) will hold policy meetings on Thursday. The Riksbank, which cut rates by 25 bps to 2.25% in January, is likely to keep rates steady, while the SNB, which lowered rates by 50 bps to 0.50% in December, is expected to cut them further to 0.25%.

On Friday, the Eurozone’s March consumer confidence index will be released, with expectations of a slight improvement from -13.6 to -13.3.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

China’s economic calendar was packed with key data, including industrial production, retail sales, and fixed asset investment, alongside property price figures reflecting monetary and fiscal stimulus effects.

Industrial production expanded 5.9% year-on-year in January-February 2025, surpassing market forecasts of 5.3%, though slightly below December’s 6.2% growth. Meanwhile, new home prices in 70 cities continued to decline, contracting 4.8% year-on-year in February, following a 5.0% drop in January—signaling ongoing weakness in the property sector.

Fixed-asset investment rose 4.1% year-on-year during the first two months of 2025, outpacing expectations of 3.6% growth, indicating steady capital expenditure. However, the surveyed unemployment rate ticked up to 5.4% in February, compared to 5.2% in January, exceeding market forecasts of 5.1% and suggesting persistent labor market pressures.

This week, the People’s Bank of China is expected to hold its loan prime rates steady, delaying cuts.

Similarly, the Bank of Japan is likely to keep its policy rate unchanged, with markets watching for signals on future hikes.

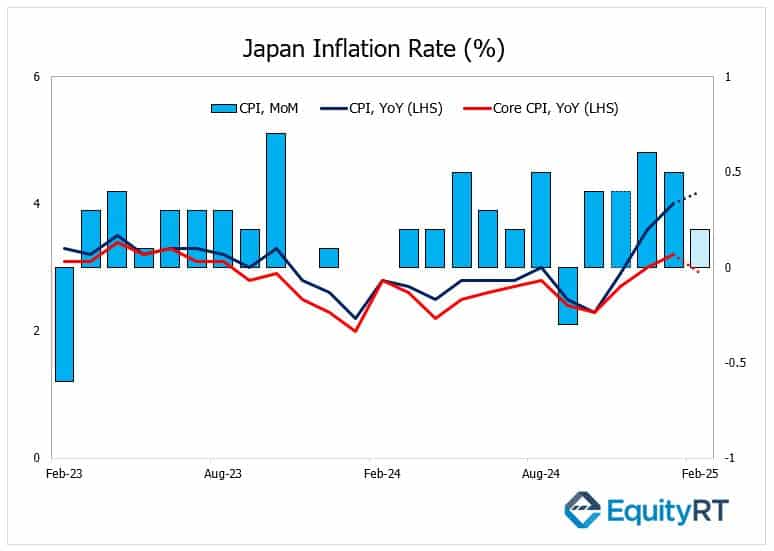

On Friday, Japan’s inflation rate for February will be tracked.

Japan’s annual inflation rate surged to 4.0% in January 2025, up from 3.6% in December, marking its highest level since January 2023. On a monthly basis, the Consumer Price Index (CPI) rose 0.5%, indicating persistent price pressures.

The core CPI climbed 3.2% year-on-year, accelerating from 3% in December and exceeding market expectations of 3.1%. This is the highest core inflation reading since June 2023, reinforcing concerns that inflationary pressures remain entrenched.

With core inflation hovering above the Bank of Japan’s 2% target for nearly three years, strong wage growth and sustained price increases prompted the BOJ to raise its policy rate by 25 basis points to 0.5% in January—the highest level in 17 years.

In February, Core CPI is projected to decline by 2.9% year-on-year, while headline inflation is expected to rise to 4.2%.

Rising prices support the BOJ’s plan to continue raising rates, with markets expecting a hike in the third quarter.

Japan will also release trade balance, and machinery orders data this week.

Elsewhere, monetary policy decisions are due in Indonesia, while India’s trade balance will highlight the rupee’s impact on foreign trade.

Australia’s labor report is expected to show continued job growth, and New Zealand’s Q4 GDP may indicate a modest economic rebound.