Global Stock Market Highlights

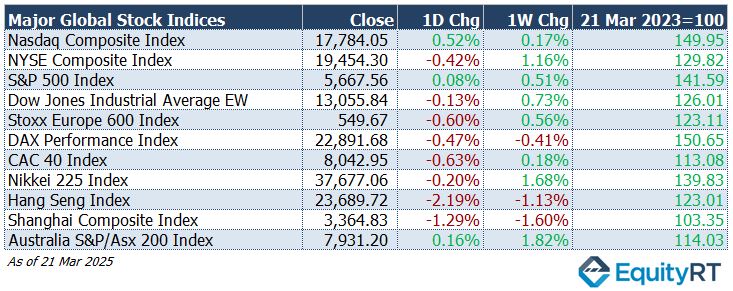

Last Friday, U.S. stock markets saw small gains, ending a four-week losing streak. The S&P 500 and Dow Jones Industrial Average rose by 0.1%, while the Nasdaq Composite increased by 0.5%. Despite ongoing worries about trade policies and possible tariffs causing market swings, stocks managed to close higher.

- Nasdaq Composite Index closed 17,784.05, gaining 0.52% on the day and 0.17% for the week.

- NYSE Composite Index closed at 19,454.30, declining 0.42% on the day but rising 1.16% for the week.

- S&P 500 Index ended at 5,667.56, edging up 0.08% on the day and 0.51% for the week.

- Dow Jones Industrial Average EW closed at 13,055.84, slipping 0.13% on the day but gaining 0.73% for the week.

European stock markets declined, mainly due to disruptions in the travel sector. The Stoxx Europe 600 Index ended at 549.67, down 0.60% for the day but up 0.56% for the week. The drop was largely driven by a fire at Heathrow Airport, forcing its closure and weighing on airline stocks.

- DAX Performance Index finished at 22,891.68, down 0.47% on the day and 0.41% for the week.

- CAC 40 Index ended at 8,042.95, dropping 0.63% on the day but rising 0.18% for the week.

Asia-Pacific stock markets fell amid rising geopolitical tensions and worries about potential U.S. tariffs slowing global economic growth.

- Nikkei 225 Index closed at 37,677.06, slipping 0.20% on the day but climbing 1.68% for the week.

- Hang Seng Index closed at 23,689.72, plunging 2.19% on the day and 1.13% for the week.

- Shanghai Composite Index finished at 3,364.83, declining 1.29% on the day and 1.60% for the week.

- Australia S&P/ASX 200 Index settled at 7,931.20, gaining 0.16% on the day and 1.82% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 104.09, rising 0.29% on the day and 0.36% for the week, but has declined 4.02% year-to-date.

- The Brent crude oil, the global oil price benchmark, settled at $72.16 per barrel, gaining 0.22% on the day and 2.24% for the week, yet remains down 3.32% year-to-date.

- The Gold ended at $3,023.65 per ounce, slipping 0.75% on the day but advancing 1.35% for the week, with a strong 15.21% gain year-to-date.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, ended at 3.97%, down 0.70 basis points on the day and 6.30 basis points for the week, with a 28.50 basis points drop year-to-date.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, closed at 4.26%, rising 2.30 basis points on the day but declining 5.90 basis points for the week and 31.80 basis points year-to-date.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

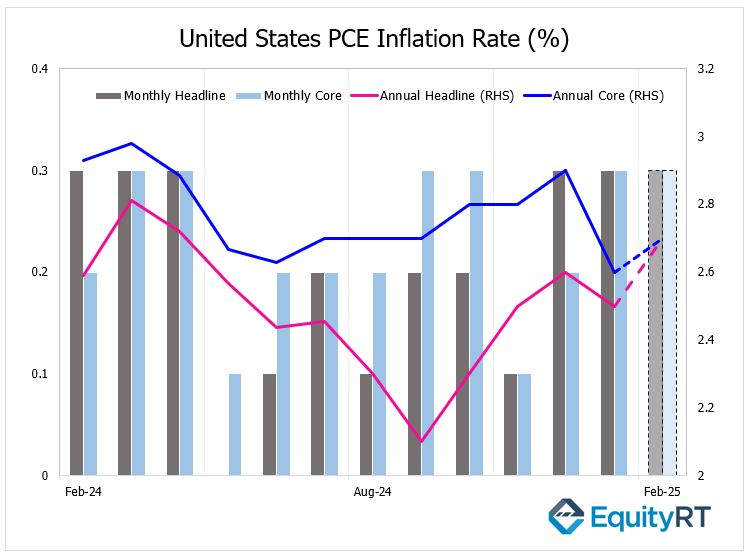

The spotlight in the US this week will be in February’s PCE report, following the FOMC’s downward revision of growth forecasts and an upward adjustment in prices. On Friday,

On Friday, the U.S. Bureau of Economic Analysis (BEA) will publish the Personal Income and Outlays report for February 2025. This report will include data on personal income, personal consumption expenditure (PCE), and the PCE price index, which is the Federal Reserve’s preferred measure of inflation.

In January 2025, the U.S. headline PCE price index increased by 0.3%, driven by a 0.5% rise in goods prices, while services prices grew at a slower pace of 0.2%.

The core PCE price index rose by 0.3% month-over-month, matching expectations and slightly up from 0.2% in December.

On a year-over-year basis, headline PCE inflation slowed to 2.5%, marking the first slowdown in four months, while core PCE inflation fell to 2.6%, the lowest in seven months.

Both the headline and core PCE price indices are projected to have increased by 0.3%, mirroring the previous month’s rise. Meanwhile, personal spending is expected to show a sharp rebound, rising from -0.2% to 0.6%, while personal income is anticipated to decline from 0.9% to 0.4%.

Additionally, the BEA will publish the final Q4 GDP estimate, with growth likely coming in at an annualized 2.3%. Other key economic data includes durable goods orders, which are forecasted to decline, and the trade deficit, which remains at a record high as businesses adjust to tariffs. Flash readings of the S&P PMI should reflect further expansion in economic activity.

In the housing sector, both new and pending home sales will aim to recover from last month’s downturn, while the S&P/Case-Shiller home price index may indicate an acceleration in home price growth.

Beyond the US, Canada’s monthly GDP is set to confirm early-year economic growth.

Meanwhile, Mexico faces a busy week of economic releases, including its trade balance—closely watched for tariff-related impacts—and the Bank of Mexico’s interest rate decision. Both Mexico and Brazil will also update their unemployment rates.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

The March Flash PMI data for the Eurozone was released this Monday. Fresh PMI figures showed that France’s results beat forecasts, while in Germany, both the composite and services PMIs came in below expectations, although the manufacturing PMI exceeded forecasts.

This week, Germany will see updates from Ifo and GfK surveys, providing insight into business and consumer sentiment amid developments in tariffs and the debt brake policy. Business confidence is expected to climb to an eight-month high, while consumer sentiment may improve from an 11-month low.

Germany’s unemployment rate is projected to remain at its highest level since October 2020.

Elsewhere in the Eurozone, France and Spain will release preliminary inflation data. Other key reports include the Eurozone’s business survey, French jobless and consumer data, Switzerland’s KOF leading indicators. Additionally, Norway, Hungary, and the Czech Republic will announce their interest rate decisions.

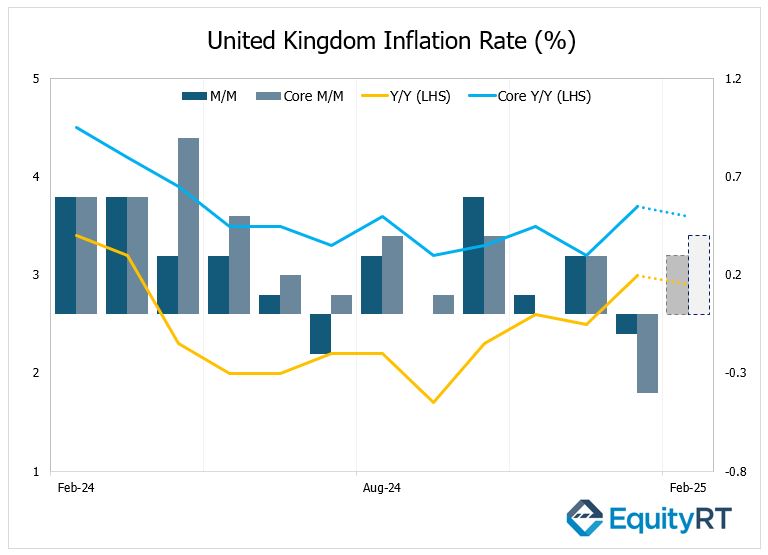

On Wednesday, the UK’s Consumer Price Index (CPI) data for February will be released, which will influence the Bank of England’s monetary policy. In the UK, the headline CPI decreased by 0.1% in January, following a 0.3% increase in December. On an annual basis, the headline CPI rose from 2.5% to 3%, surpassing expectations and reaching its highest level in the last ten months. As a result, the headline CPI has remained above the BoE’s 2% target for the past four months.

The core CPI decreased by 0.4% in January after a 0.3% increase in December, and on an annual basis, it rose from 3.2% to 3.7%, in line with expectations, marking its highest level since April.

In February, inflation in the UK is expected to ease slightly to 2.9%, down from January’s 10-month high of 3%, with core inflation slipping to 3.6% from 3.7%.

Retail sales have likely declined for the fifth time in six months, while PMI data should signal weaker manufacturing contraction alongside stronger services growth. The UK will also release its final Q4 GDP, trade balance, and current account figures.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

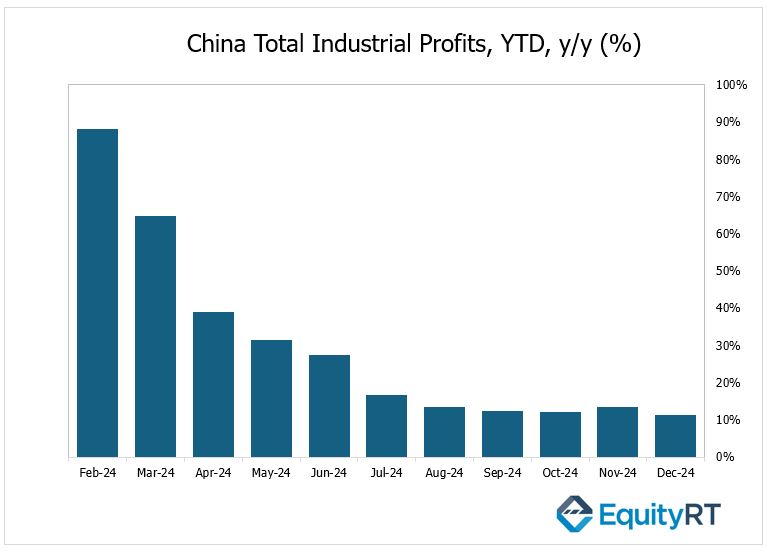

This week in China, markets will closely watch earnings reports from the country’s largest companies and balance sheet updates from state-owned banks, which will offer insights into how much fiscal and monetary stimulus has been absorbed and put into action. In 2024, China’s industrial firms saw a 3.3% year-on-year decline in profits to CNY 7,431.05 billion (USD 1.04 trillion), easing from a 4.7% drop in the first 11 months. State-owned firm profits declined at a slower pace (-4.6% vs -8.4%), while private sector profits rose by 0.5%. This marked the third consecutive year of declining industrial profits. However, in December, industrial profits surged by 11%, reversing November’s 7.3% decline.

Meanwhile, in Japan, flash estimates for March PMIs were released. The Au Jibun Bank Japan Manufacturing PMI dropped to 48.3 in March 2025, down from a final reading of 49.0 in February. This came in below the forecast of 49.2 and marked the lowest level since March 2024, according to flash data.

The Summary of Opinions from the Bank of Japan’s latest policy meeting, where it maintained its hold will be out on Friday. Additionally, the Tokyo CPI will be closely tracked for clues about the timing of the BoJ’s next possible rate hike.

In India, according to preliminary estimates, the HSBC India Manufacturing PMI rose to 57.6 in March 2025, up from 56.3 in the previous month.

Elsewhere, South Korea is set to release business and consumer confidence data. Australia, markets will focus on PMIs and the monthly CPI report, expected to show that annual price growth remained steady.