Global Markets Recap

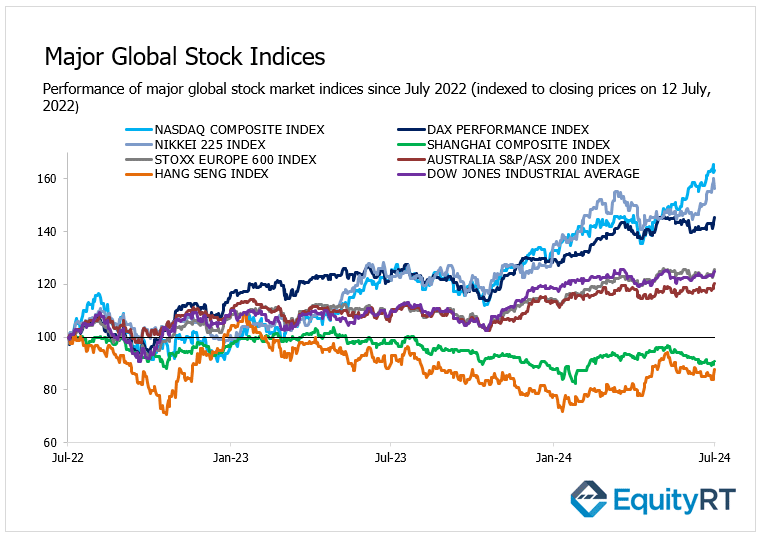

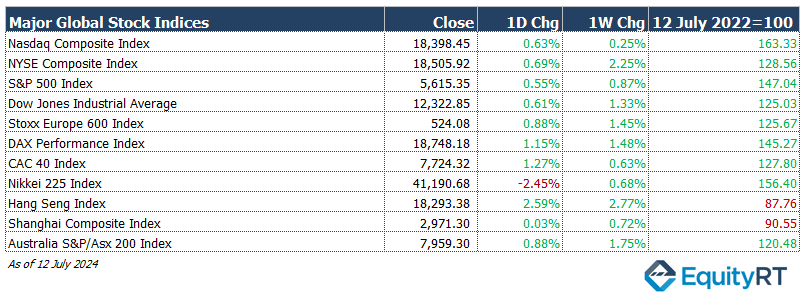

The Dow Jones Index almost set a new closing record, reaching an all-time high on Friday. This was driven by Wall Street banks reporting earnings above expectations, despite a slight increase in wholesale inflation.

European stock exchanges closed on a high note on Friday, as global investors assessed the U.S. producer price index.

The STOXX Europe 600, encompassing approximately 90% of the market capitalization of European markets across 17 countries, rose by 4.57 points, or 0.88%, ending at 524.08.

Germany’s DAX increased by 213 points, or 1.15%, to close at 18,748. France’s CAC- 40 was the standout performer of the day, surging 97 points, or 1.27%, to finish at 7,724.

Japan’s Nikkei dropped by over 2% as Asia-Pacific markets experienced mixed trading. Meanwhile, Australia reached a new closing high.

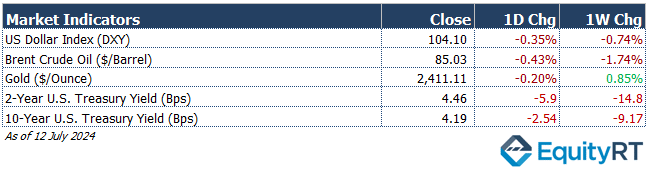

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 104.1 marking a 0.74% weekly loss.

The Brent crude oil (#LCO07) closed the previous week at USD 85.03 per barrel, reflecting a 1.74% weekly loss.

The price of gold (#XAU) closed last week with a 0.85% gain, settling at USD 2,411.11 per ounce.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, closed at 4.46% with a 14.8 basis points weekly loss.

The 10-year U.S. Treasury yield (#USGG10YR) completed the week with a 9.17 basis points loss, settling at 4.19%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Recent US Economic Indicators: Highlights from Last Week

Let’s take a look at the macroeconomic indicators and developments tracked in the US last week:

- US Consumer Price Inflation

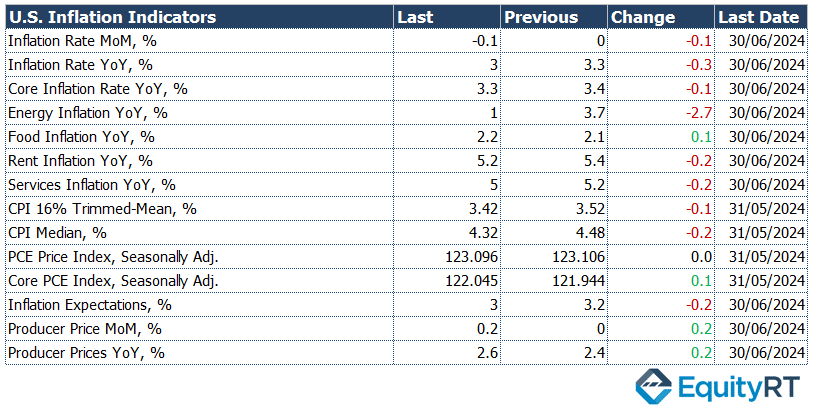

In the US, headline and core CPI data for June came in unexpectedly below expectations, signaling a slowdown. The headline CPI recorded a surprising 0.1% decline in June following a flat trend in May, marking the first decrease since May 2020, contrary to expectations of a 0.1% increase; on a yearly basis, it dropped from 3.3% to 3%, below expectations of 3.1%, hitting the lowest level since June 2023.

Excluding food and energy prices, core CPI saw a slowdown in the monthly growth rate from 0.2% to 0.1%, falling from 3.4% to 3.3% on a yearly basis, maintaining its lowest levels since April 2021; expectations were for a similar 3.4% level.

Following the June headline and core CPI data coming in below expectations, expectations strengthened for two 25 basis point interest rate cuts from the Fed this year.

- US Producer Price Inflation

In the US, producer price inflation increased by 0.2% month-over-month in June 2024, following an upwardly revised flat reading in May and surpassing forecasts of 0.1%. On a year-over-year basis, producer inflation rose to 2.6%, the highest since March 2023, up from an upwardly revised 2.4% in May.

The core producer price index, which excludes food and energy, saw a month-over-month increase of 0.4% and a year-over-year rise of 3%, both significantly above forecasts of 0.2% and 2.5% respectively. This compares to the previous month’s core rates of 0.3% and 2.6% respectively.

Federal Reserve Chairman Powell’s speech before the US Senate Banking Committee was closely followed. Powell indicated that recent data suggest modest progress in inflation and that further positive data would increase confidence in inflation moving towards the target.

Powell mentioned that inflation is not the only risk they face, emphasizing that too little or too late rate cuts would pose risks to the economy and the labor market, while early or excessive cuts could halt or reverse progress in inflation. Powell noted a significant cooling in the labor market compared to two years ago but stated that the labor market is strong without overheating, with the Fed’s restrictive stance seeking to better balance supply and demand. He also mentioned that acting swiftly in rate cuts could create unnecessary vigor in the economy and that the next policy move is unlikely to be a rate hike.

- US Employment Market Data

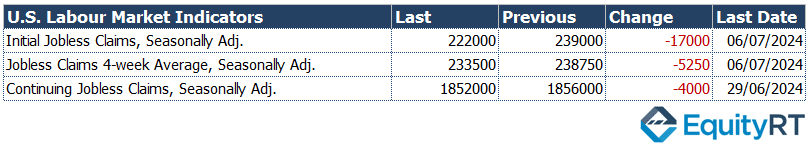

Regarding the US employment market data, weekly initial jobless claims for the week of July 6 decreased from 239,000 to 222,000, falling more than expected and marking the lowest level in the last 5 weeks. This indicates that the employment market is relatively tight and continues to hover at levels below historical averages.

In the week ending July 6, 2024, the 4-week moving average for initial jobless claims in the US, which smooths out weekly fluctuations, fell to 233,500 from the previous week’s revised figure of 238,750.

Meanwhile, continuing jobless claims, indicating the number of people receiving unemployment benefits, dropped to 1,852,000 for the week ending June 29, 2024, down from a revised 1,856,000 the prior week and below the expected 1,860,000.

- University of Michigan Consumer Sentiment

The University of Michigan consumer sentiment for the US dropped for the fourth consecutive month in July 2024, reaching 66, the lowest level since November. This decline from 68.2 in June was significantly below the forecast of 68.5, according to preliminary estimates.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Key U.S. Economic Indicators to Watch This Week

- Upcoming Earnings

Earnings season is set to gain momentum with reports from major companies, each boasting market caps over $100 million. Notable names include Novartis, Goldman Sachs, BlackRock, UnitedHealth, Bank of America, Morgan Stanley, Charles Schwab, Progressive, Johnson & Johnson, Elevance Health, ProLogis, Netflix, Abbott, Intuitive Surgical, Blackstone, Marsh & McLennan, Reliance, and American Express.

- US Economic Indicators

Retail sales in the US are expected to show no growth for the past month, following a slight 0.1% increase in May, signaling a potential slowdown in consumer spending.

Industrial production is projected to rise by a modest 0.3%, down from the revised 0.7% growth previously recorded.

Key housing market data, including building permits, housing starts, and the NAHB housing index, will be closely watched.

Additionally, the release of the NY Empire State Manufacturing Index and the Philadelphia Fed Manufacturing Index will provide further economic insights.

Investors will also pay attention to speeches from Federal Reserve officials, particularly Chair Powell at the Economic Club of Washington, D.C.

- Canadian Inflation Data and Retail Sales

In Canada, the Consumer Price Index (CPI) is expected to increase by 0.1%, lower than the 0.7% rise observed in May.

Retail sales are predicted to decline by 0.2% after a 0.7% increase previously.

Take the guesswork out of investing: Backtest your strategies with ease!

Key Economic Indicators From Europe Last Week

- German CPI Data

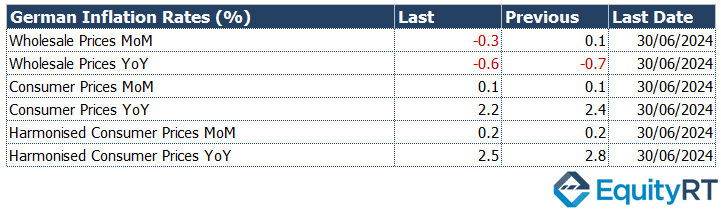

In Europe, final CPI data for June was released in Germany, which will guide the ECB’s monetary policy.

In June, headline CPI increased by 0.1% monthly, consistent with preliminary data, marking the lowest level in the last six months. Year-on-year, headline CPI slightly declined from 2.4% to 2.2%. Additionally, core CPI in Germany decreased from 3% to 2.9% year-on-year in June, reaching its lowest level since February 2022.

- Trade Data from Germany

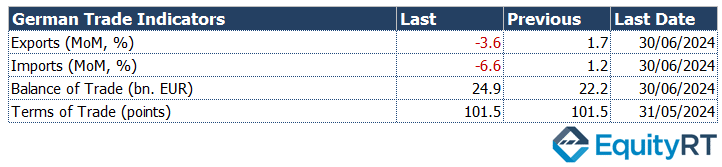

In Germany, monthly exports declined by 3.6% in May following a 1.7% increase in April, which was higher than the expected decrease of 2.8%, indicating weakening external demand.

Monthly imports also decreased by 6.6% in May after a 1.2% increase in April, surpassing the expected decline of 1%, signaling a slowdown in domestic demand.

Consequently, Germany’s monthly trade surplus slightly increased from EUR 22.2 billion in April to EUR 24.9 billion in May, driven by a larger decrease in imports compared to exports.

- UK GDP Growth Data

In the UK, monthly GDP growth data for May was monitored. Following a stagnant performance (0%) in April, the economy expanded by 0.4% in May, surpassing expectations of a 0.2% growth. Sector-wise, the manufacturing industry grew by 0.2%, the construction sector by 1.9%, mining and quarrying by 0.1%, and the services sector by 0.3% in May.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Market Insights

- ECB Monetary Policy Decision

In Europe, the ECB is convening to announce its latest monetary policy decision, with no expected changes following June’s rate cuts. Analysts will closely scrutinize the statement and press conference for indications on the timing of future rate adjustments.

- Economic Sentiment and Industrial Activity in Germany and Euro Area

Germany’s ZEW Indicator of Economic Sentiment is anticipated to decline after eleven consecutive months of growth.

Industrial activity in the Euro Area is expected to decrease for the second consecutive month.

- Key Reports from the UK

In the UK, key reports to watch include CPI, jobs, and retail sales data. Annual inflation is forecasted to remain at the BoE’s 2% target, with the core rate expected to drop to 3.4%.

Unemployment is likely to hold steady at 4.4%, while wage growth is expected to ease to 5.7%.

Retail sales are projected to decline, marking the fourth drop in the past five months.

- Additional Euro Area Data

Forthcoming data includes Euro Area’s final inflation figures, trade balance, and current account; Germany’s producer prices; and Switzerland’s foreign trade.

Take the guesswork out of investing: Backtest your strategies with ease!

Asian Economic Indicators

- China CPI and PPI Data for June

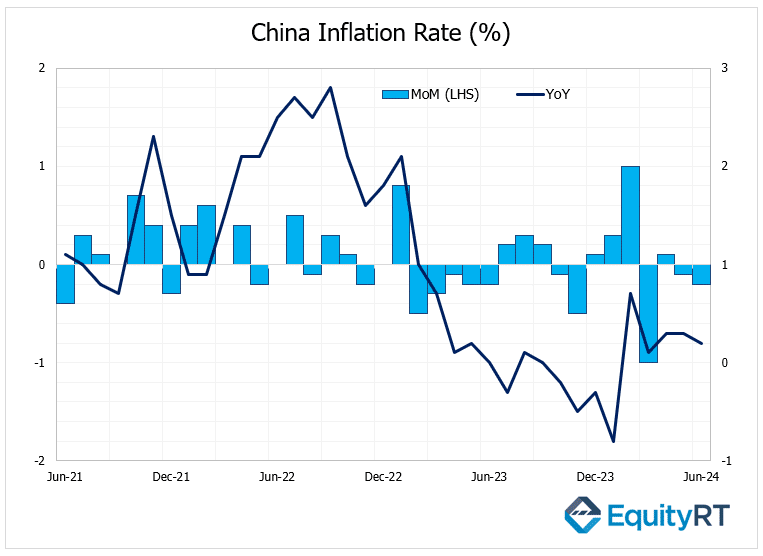

In China, monthly headline Consumer Price Index (CPI) showed a decrease of 0.2% in June, following a 0.1% decline in May, marking the second consecutive month of decline. Year-on-year, CPI growth slowed from 0.3% to 0.2% in June, reaching the lowest level since March but continuing its upward trend for the fifth consecutive month. Meanwhile, the core CPI, excluding food and energy prices, remained steady at 0.6% year-on-year in June, like the previous month.

Producer Price Index (PPI) in China declined by 0.2% month-on-month in June, following a 0.2% increase in May. Year-on-year, PPI decreased from 1.4% to 0.8%, marking the twenty-first consecutive month of decline and confirming the deflationary trend in producer prices.

- China Trade Data for June

China’s annual export growth rate increased from 7.6% to 8.6% in June, surpassing expectations of 8%, indicating a recovery in external demand. On the other hand, annual import growth slowed down from a 1.8% increase in May to a 2.3% decrease in June, signaling a acceleration of weakening domestic demand, while expectations were for a 2.5% increase.

- New Zealand Central Bank

The New Zealand Central Bank kept its policy interest rate steady at 5.50% for the eighth consecutive time, in line with expectations.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming Asian Data

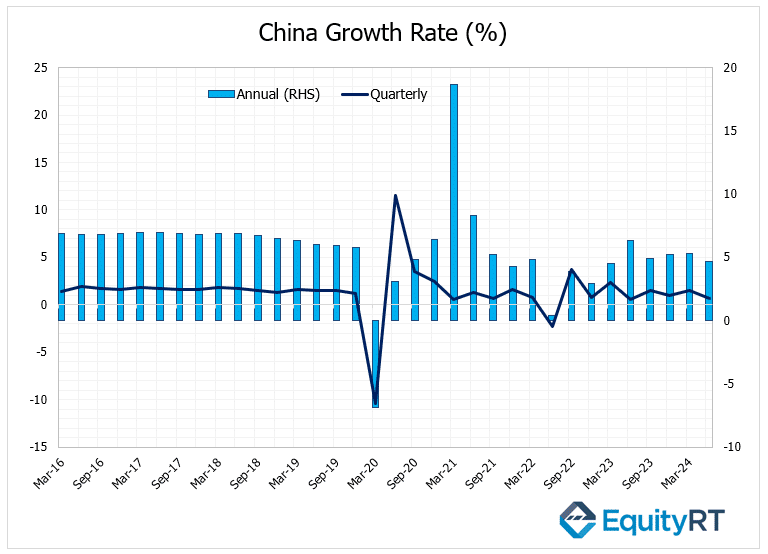

China will see a busy week of economic releases starting with second-quarter growth figures on Monday.

In Q2 2024, the Chinese economy grew by 4.7% year-on-year, falling short of market expectations of 5.1% and decelerating from the 5.3% growth observed in Q1.

This growth rate marked the weakest performance since Q1 2023, influenced by ongoing challenges such as a prolonged property downturn, sluggish domestic demand.

In Q2 2024, the Chinese economy expanded by a seasonally adjusted 0.7%, following a slightly revised 1.5% increase in Q1.

Other data that was released on Monday included industrial production, retail sales, the unemployment rate, house prices, and fixed asset investment for June.

The Central Bank of China (PBoC) maintained the rate on its 1-year medium-term lending facility unchanged.

- Japan and Other Asian Economies

In Japan, markets await June’s inflation rate, and trade balance. Elsewhere, India and Indonesia will release their trade balances for June, with Indonesia also set to decide on its policy rate.

Australia will unveil June’s unemployment data, and New Zealand will post its second-quarter CPI.