Global Markets Recap

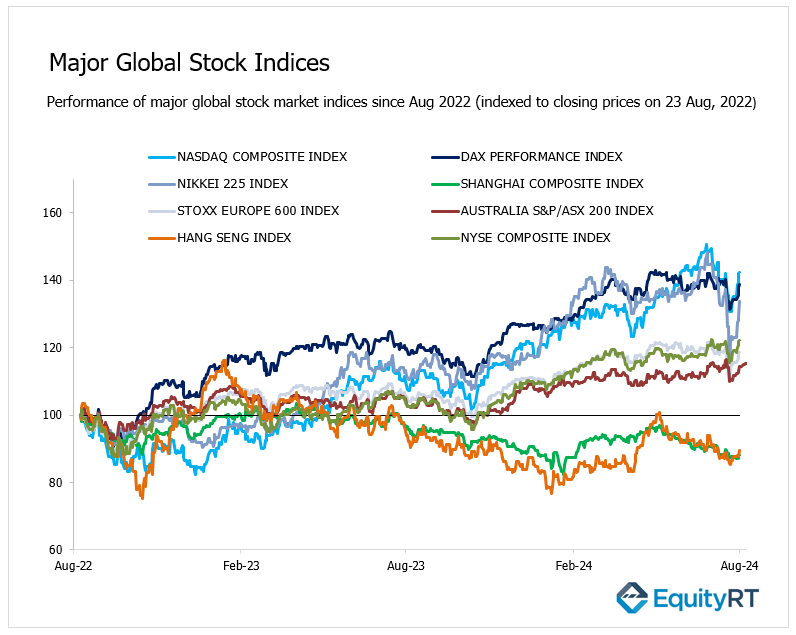

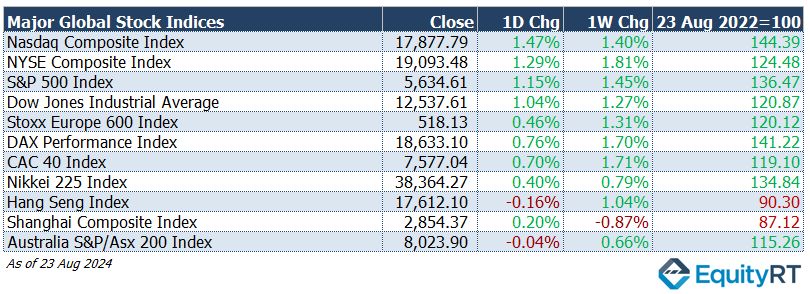

In his speech on Friday at the Jackson Hole Economic Policy Symposium, Fed Chair Powell indicated that inflation has moderated and that it might be time to adjust policy. Wall Street indices closed with gains of over 1%, driven by expectations of rate cuts starting in September in response to Powell’s comments.

European stocks also ended the week positively:

-

- STOXX Europe 600 rose 1.31%, closing at 518.13.

- Germany’s DAX increased 1.70% to 18,633.10.

- France’s CAC-40 gained 1.71%, ending at 7,577.44.

Asia-Pacific Markets traded mixed on Friday.

-

- Japan’s Nikkei-225 saw a 0.79% rise.

- Hong Kong’s Hang Seng climbed 1.04% to 17,612.10.

- Australia’s S&P/ASX 200 edged up 0.66% to 8,023.90.

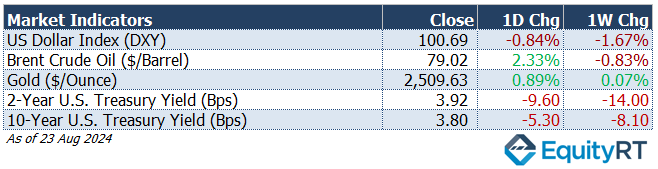

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 100.69 marking a 1.67% weekly loss.

The Brent crude oil (#LCO07) closed the previous week at USD 79.02 per barrel, reflecting a 0.83% weekly loss.

The price of gold (#XAU) closed last week with a 0.07% weekly gain settling at USD 2,509.63 per ounce.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, closed at 3.92% with a 14 basis points weekly loss.

The 10-year U.S. Treasury yield (#USGG10YR) completed the week with a 8.10 basis points loss, settling at 3.80%.

Key Points from Powell’s Speech

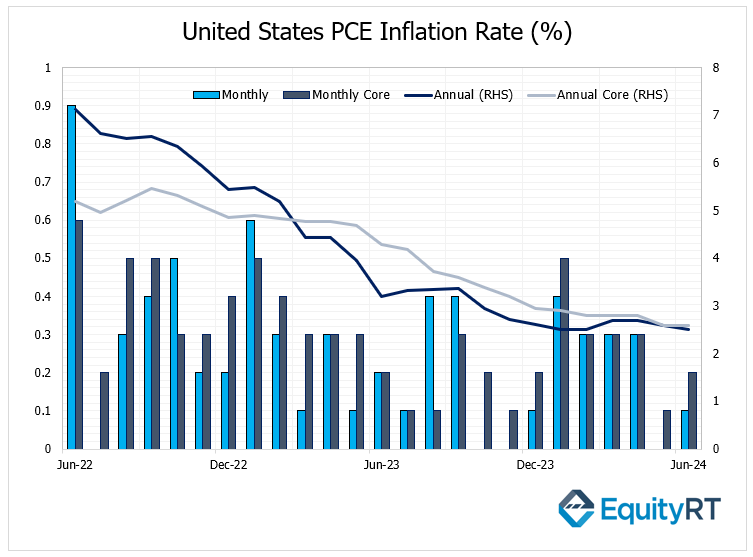

In his address, Powell mentioned that conditions have tightened somewhat, that the current interest rate level provides sufficient space, and that inflation has significantly decreased, getting very close to its targets. He expressed confidence that they will achieve the 2% target and indicated that it’s time to adjust the policy.

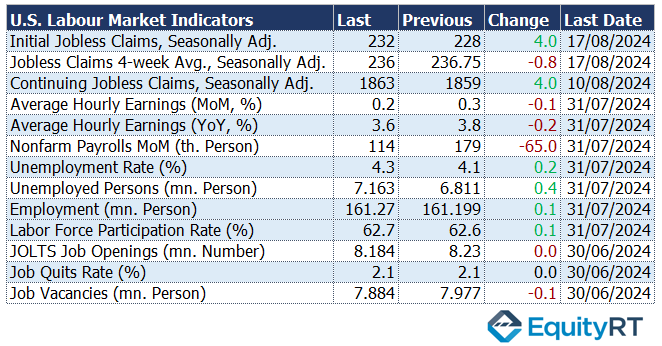

Powell emphasized that future economic data will dictate the pace and extent of rate cuts, while anchoring inflation expectations is crucial for disinflation. He noted that, although inflationary risks have lessened, employment risks are rising, though no major labor market slowdown is expected. Additionally, he highlighted a shift in consumer demand from goods to services.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

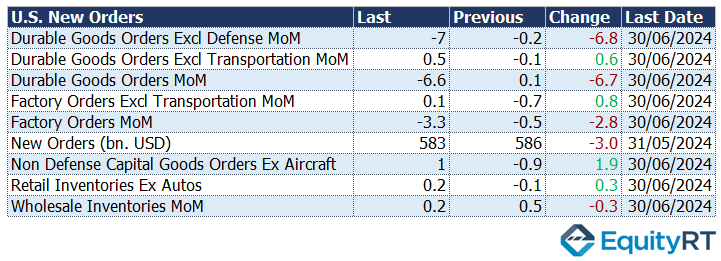

Today, the preliminary July durable goods orders data will be closely monitored for insights into the production outlook.

In June, durable goods orders saw a sharp decline of 6.6% after a 0.1% increase in May, ending a four-month growth streak. For July, preliminary data suggests a partial recovery, with durable goods orders expected to rise by 5% month-on-month.

On Tuesday, the Conference Board’s August consumer confidence index will be released.

In July, the index rose from 97.8 to 100.3, despite expectations of a slight decline. The index is expected to inch up to 100.6 in August.

On Thursday, the revised annualized quarterly GDP growth rate for Q2 will be announced.

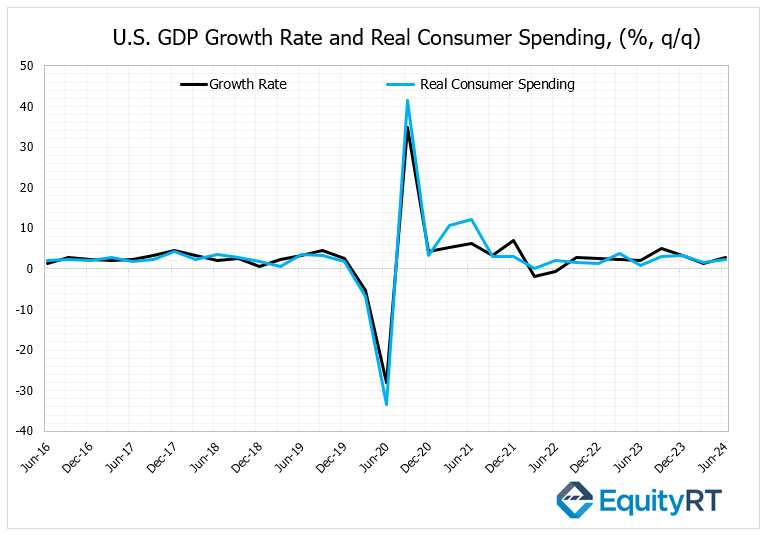

The U.S. economy’s growth rate accelerated from 1.4% in Q1 to 2.8% in Q2, surpassing expectations of 2%. On a quarterly basis, growth slowed from 3.1% to 2.3% in Q2. The stronger-than-expected Q2 growth, on an annualized quarterly basis, was mainly driven by a higher-than-anticipated increase in consumption spending, which rose from 1.5% to 2.3%.

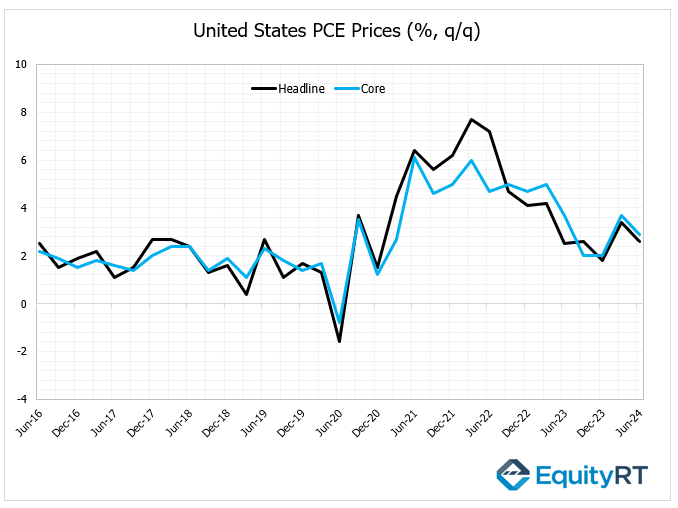

Also on Thursday, revised data for the personal consumption expenditures (PCE) price index, a key inflation indicator monitored by the Fed, will be released.

Preliminary data showed that the annualized quarterly PCE price index slowed from 3.4% in Q1 to 2.6% in Q2, coming in below expectations of 3%. The core PCE price index also slowed from 3.7% to 2.9% in Q2, slightly exceeding expectations of 2.7%.

The weekly initial jobless claims data will be tracked on Thursday. The most recent data showed a slight increase from 228,000 to 232,000, in line with expectations but still below historical averages.

This increase continues the trend of a softening labor market, reinforcing expectations that the Federal Reserve will implement rate cuts at all remaining meetings this year.

Tomorrow, the S&P/Case-Shiller 20-City Home Price Index for June will be released, followed by the pending home sales data for July on Thursday.

On Friday, the July PCE deflator and personal income and spending data will be released. The PCE deflator is expected to rise from 0.1% to 0.2% month-on-month and from 2.5% to 2.6% year-on-year.

The core PCE deflator is expected to remain steady at 0.2% month-on-month and to increase slightly from 2.6% to 2.7% year-on-year.

Personal income growth is expected to remain stable at 0.2% month-on-month, while personal spending is expected to increase from 0.3% to 0.5%.

On Friday, the final August Michigan University consumer sentiment index will be released. The preliminary August index rose from 66.4 to 67.8, exceeding expectations.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Market Insights

On Wednesday, Germany’s GfK consumer confidence data for September will be closely monitored. The GfK consumer confidence index for September is expected to remain at -18.4, like the previous month.

On Thursday, the Eurozone’s final consumer confidence data for August will be released. The preliminary data for August showed a slight decline from -13 to -13.4, maintaining its highest levels since February 2022, yet still indicating weak sentiment in the negative territory.

Also on Thursday, preliminary inflation (CPI) data for August will be released in Germany, followed by the Eurozone on Friday.

In July, Germany’s headline CPI increased by 0.3% month-on-month, the highest level in three months, up from 0.1% in June. Year-on-year, the CPI slightly rose from 2.2% to 2.3%.

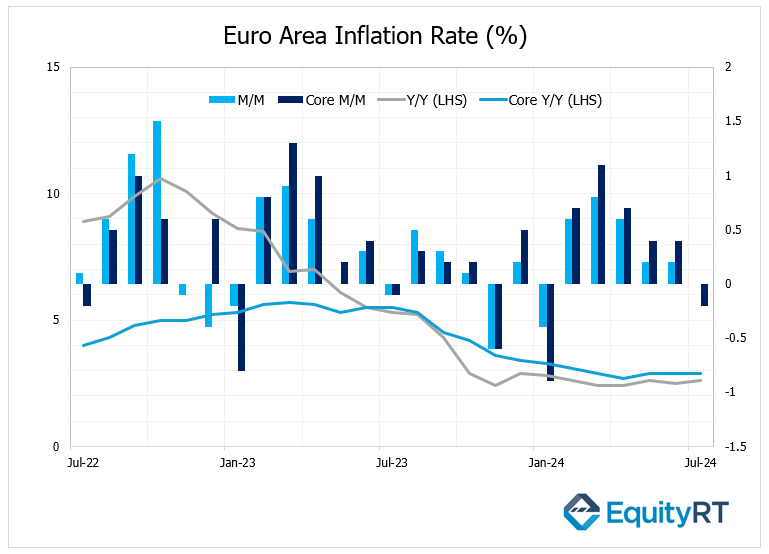

In the Eurozone, the headline CPI remained flat (0%) month-on-month in July, down from 0.2% in June, marking the lowest level in six months. However, the annual CPI edged up from 2.5% to 2.6%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: Last Week’s Highlights and This Week’s Outlook

The People’s Bank of China kept key lending rates unchanged in August, with the one-year loan prime rate at 3.45% and the five-year rate at 3.85%, both remaining at record lows following July’s unexpected cuts.

Japan’s annual inflation rate remained steady at 2.8% in July 2024, marking the third consecutive month at this level, the highest since February. Electricity prices surged, posting the largest increase since March 1981.

The Bank of Indonesia held its interest rate steady at 6.25% during the August 2024 meeting, in line with market expectations, keeping borrowing costs at their highest level since the benchmark’s introduction in 2016.

On Monday, the People’s Bank of China (PBoC) kept the benchmark interest rate for one-year loans (Medium-Term Lending Facility – MLF rate) unchanged at 2.30%, opting to observe the impact of the 20 basis point cut made in July.

Other indicators to watch this week in Asia include China’s PMI readings for August,

Japan’s inflation rates, including Tokyo Core CPI and Tokyo CPI as well as industrial production, retail sales, and job market indicators and India’s GDP growth rate for Q2.