Global Markets Recap

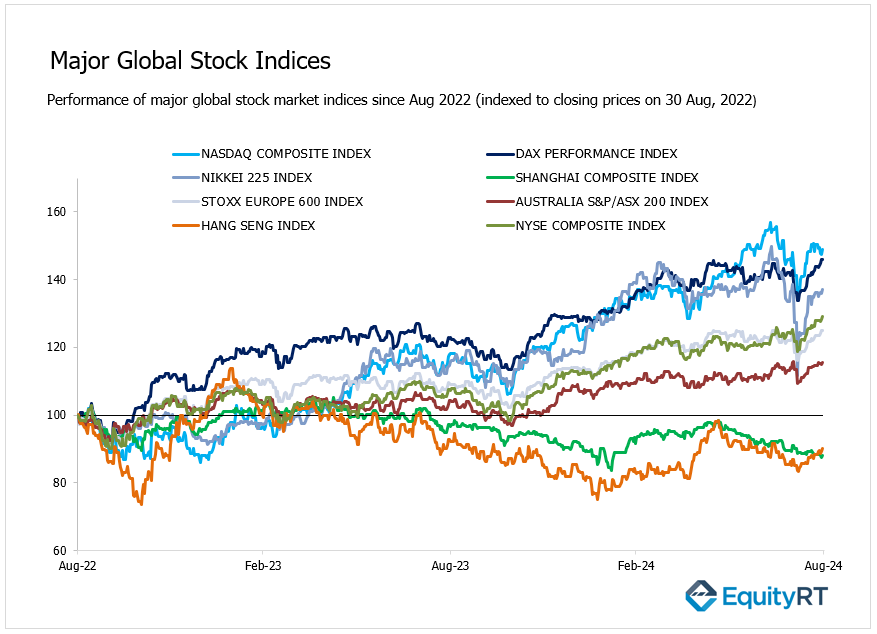

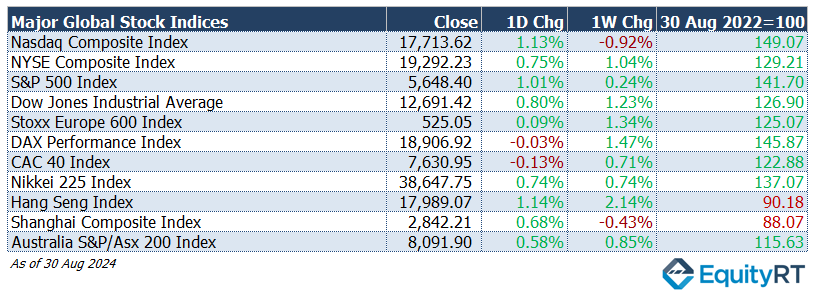

Last Friday, Wall Street indices closed higher mainly due to economic data that supported expectations of a soft landing for the U.S. economy. The Fed’s preferred inflation measures, the headline and core PCE deflator for July, came in as expected, easing concerns about inflation. Additionally, consumer confidence showed improvement, and short-term inflation expectations were revised downward.

U.S. markets is closed today for Labor Day.

European stocks also ended the week positively:

- STOXX Europe 600 rose 1.34%, closing at 525.05.

- Germany’s DAX increased 1.47% to 18,906.92.

- France’s CAC-40 gained 0.71%, ending at 7,630.95.

Asia-Pacific Markets traded mixed on Friday.

- Japan’s Nikkei-225 saw a 0.74% rise.

- China’s Shanghai Composite lost 0.43% to 2,842.21

- Hong Kong’s Hang Seng climbed 2.14% to 17,989.07.

- Australia’s S&P/ASX 200 edged up 0.85% to 8,091.90.

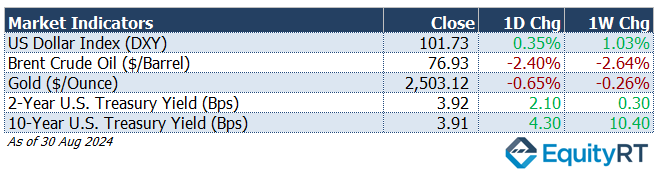

The Dollar Index (#DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed last week at 101.73 marking a 1.03% weekly gain.

The Brent crude oil (#LCO07) closed the previous week at USD 76.93 per barrel, reflecting a 2.64% weekly loss.

The price of gold (#XAU) closed last week with a 0.07% weekly gain settling at USD 2,509.63 per ounce.

The 2-year U.S. Treasury yield (#USGG2YR), particularly responsive to Federal Reserve policy rates, closed at 3.92% with a 0.30 basis points weekly gain.

The 10-year U.S. Treasury yield (#USGG10YR) completed the week with a 10.40 basis points loss, settling at 3.92%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

U.S. Economic Indicators: Last Week’s Highlights

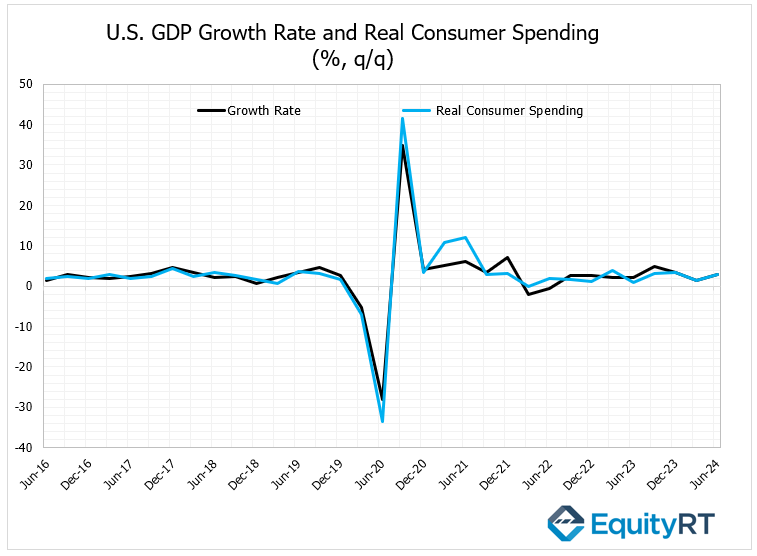

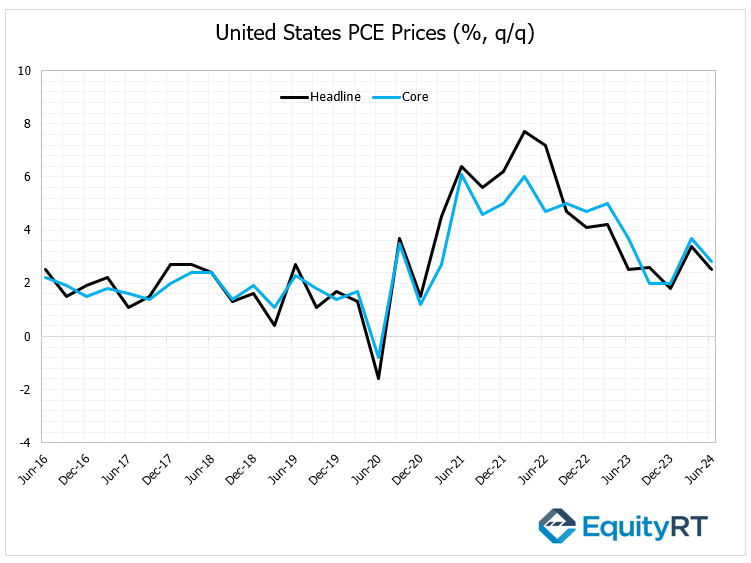

In the U.S., the annualized quarterly GDP growth for Q2 was revised up from 2.8% to 3%, exceeding expectations of 2.8%. This upward revision was largely driven by a significant increase in consumption expenditures, revised from 2.3% to 2.9%.

Additionally, the Fed’s key inflation measure, the annualized quarterly Personal Consumption Expenditures (PCE) price index, was revised slightly down for Q2 from 2.6% to 2.5%, while the core PCE was revised from 2.9% to 2.8%.

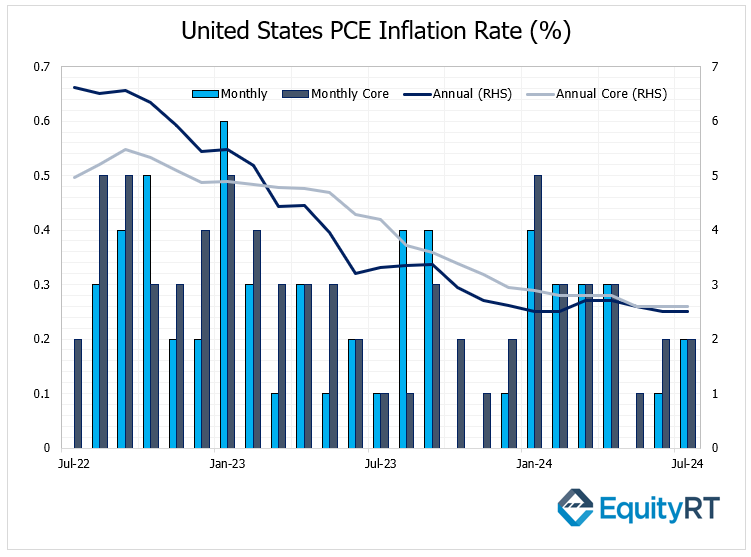

July’s monthly PCE deflator increased from 0.1% to 0.2% as expected, with the annual rate steady at 2.5%. Core PCE also matched expectations, with a monthly increase of 0.2% and an annual rate of 2.6%.

Personal income rose by 0.3% in July, beating expectations, while personal spending increased from 0.3% to 0.5%, in line with forecasts.

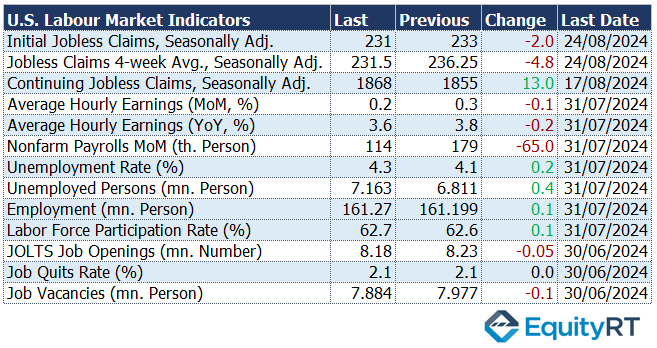

Initial jobless claims fell slightly from 233,000 to 231,000, remaining low by historical standards.

Finally, the Michigan Consumer Sentiment Index for August was revised up from 67.8 to 67.9.

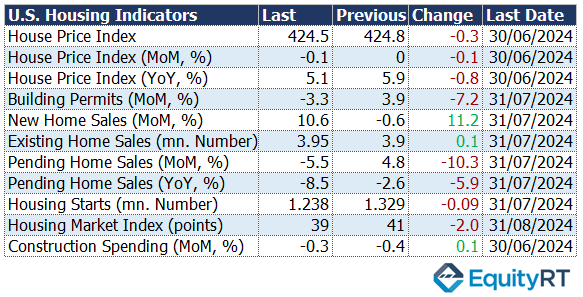

Pending home sales dropped by 5.5% in July after a 4.8% increase in June, with the annual decline accelerating from 2.6% to 8.5%.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming U.S. Economic Indicators to Watch This Week

In the U.S., the August S&P Global Manufacturing PMI and ISM Manufacturing data will be monitored for signals about economic activity.

- Construction Spending

On Tuesday, July construction spending data will be released. After a 0.4% decline in May, construction spending fell by 0.3% in June, indicating continued weakness in the housing market.

- Trade Balance and Durable Goods Orders

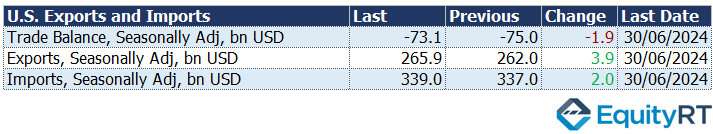

On Wednesday, July’s trade balance data will be announced. In June, the trade deficit decreased from $75 billion to $73.1 billion but was still above expectations. Imports rose by 0.6% to $339 billion, while exports increased by 1.5% to $265.9 billion.

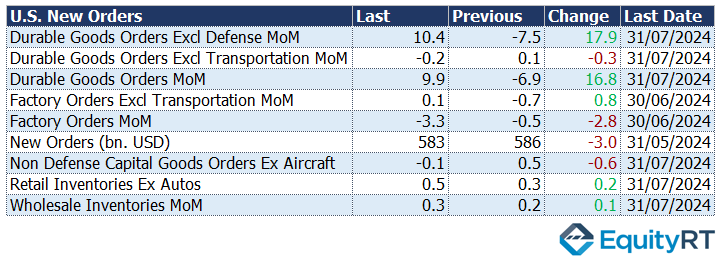

Also, July’s durable goods orders and factory orders data will be released. Durable goods orders saw a strong recovery in July, increasing by 9.9% from a significant 6.9% drop in June, against expectations of a 5% rise. Factory orders fell by 3.3% in June after a 0.5% decline in May, marking a second consecutive decrease.

- Employment Data

Employment data will be closely watched for insights into Fed policy.

On Wednesday, July’s JOLTS job openings will be reported, followed by August’s ADP private sector employment on Thursday, and weekly initial jobless claims.

On Friday, August’s non-farm payrolls, unemployment rate, and average hourly earnings will be tracked.

The June JOLTS job openings fell slightly from 8.23 million to 8.18 million, indicating a partial slowdown in labor demand. For July, job openings are expected to decline to 8.1 million.

The July ADP private sector employment increased by 122,000, the lowest in six months, with expectations around 150,000. The August ADP figure is expected to rise to 140,000.

Weekly jobless claims rose slightly to 232,000, remaining low historically. July non-farm payrolls increased by 114,000, below expectations of 175,000, and the previous month’s data was revised down to 179,000.

The unemployment rate rose to 4.3%, the highest since October 2021, while average hourly earnings increased by 3.6% year-on-year, a slower pace than expected.

For August, non-farm payrolls are anticipated to rise to 165,000, and the unemployment rate to decrease to 4.2%. Average hourly earnings are expected to increase by 0.3% month-on-month and 3.7% year-on-year.

- Canadian Central Bank Meeting

On Wednesday, the Bank of Canada will meet. The Bank is expected to further reduce the rate by 25 basis points to 4.25% in this week’s meeting.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

European Economic Trends: Last Week’s Market Insights

- Germany’s CPI

In Germany, the headline CPI decreased by 0.1% in August after a 0.3% increase in July, against expectations of a steady 0% change. On a yearly basis, the headline CPI fell from 2.3% in August last year to 1.9% in August this year, the lowest level since March 2021, falling below the ECB’s 2% target.

Germany’s core CPI decreased slightly from 2.9% to 2.8% year-on-year in August.

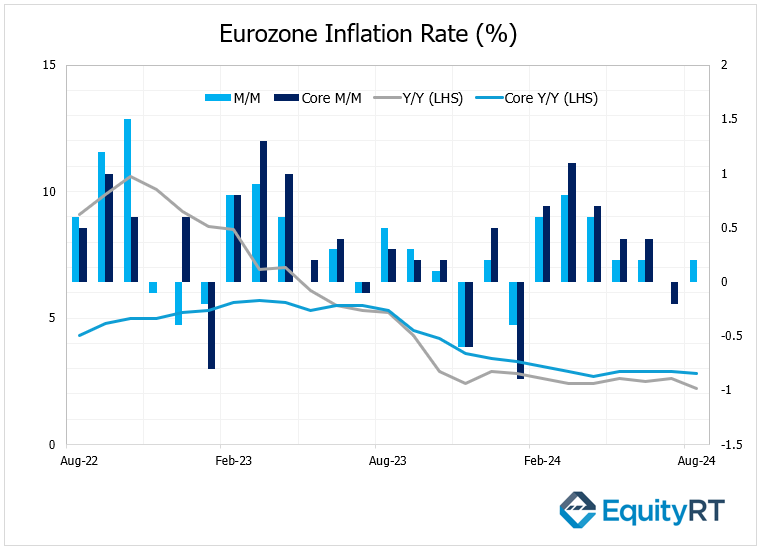

- Eurozone CPI Data

In the Eurozone, the monthly change in the headline CPI rose to 0.2% in August, matching expectations after a flat 0% in July. On an annual basis, the headline CPI decreased from 2.6% to 2.2%, the lowest level since July 2021. Core CPI in the Eurozone also declined slightly from 2.9% to 2.8% year-on-year in August, marking the lowest level in the past four months.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Market Insights

- Eurozone Producer Price Index

On Wednesday, the Eurozone’s Producer Price Index (PPI) for July will be released. The PPI in the region had increased by 0.5% in June after a 0.2% decrease in May, ending a seven-month decline. However, on an annual basis, the decrease slowed from 4.1% to 3.2%, continuing a fourteen-month downtrend. The increase in PPI in June was notably influenced by a significant rise in energy product prices (up 1.6%).

- Eurozone Retail Sales

On Thursday, Eurozone retail sales data for July, which signals internal demand trends, will be observed. Retail sales in the region fell by 0.3% in June after a 0.1% increase in May. On a yearly basis, retail sales showed a 1.3% decline in June after a 0.5% increase in May.

- Germany’s Factory Orders and Industrial Production

On Thursday, Germany’s factory orders data for July will be released, followed by industrial production data on Friday. Factory orders in Germany had rebounded with a 3.9% increase in June after a 1.7% decrease in May, ending a five-month decline. However, the annual decline in factory orders accelerated from 8.7% to 11.8% in June.

Germany’s industrial production increased by 1.4% in June after a 3.1% drop in May, marking the strongest monthly increase since February 2023. On an annual basis, the contraction in industrial production slowed from 7.2% to 4.1%.

- Germany’s Trade Data

On Friday, Germany’s June trade data will be reviewed. Exports in Germany fell by 3.3% in June, accelerating the decline and indicating weak external demand. Imports increased by 0.4% in June, falling short of expectations. The trade surplus decreased from 25.3 billion euros in May to 20.4 billion euros in June, the lowest monthly surplus since October.

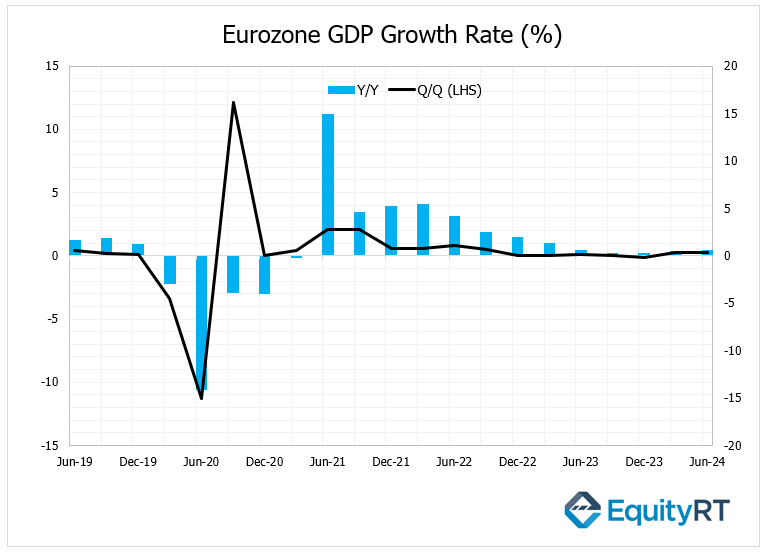

- Eurozone GDP Growth

On Friday, the final GDP growth figures for the Eurozone for Q2 will be released. According to revised data, the Eurozone economy grew by 0.3% quarter-on-quarter in Q2, consistent with preliminary figures and matching the growth rate of Q1. Year-on-year, growth in Q2 slightly increased from 0.5% to 0.6%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

In Asia, on Wednesday, the Caixin Services PMI for August will be monitored in China, providing insights into the activities of small and medium-sized enterprises.

Other key data releases in Asia for this week: include Japan’s household spending for July, foreign exchange reserves for August for Indonesia. Japan, and Hong Kong. India will also release several economic indicators, including bank loan growth and deposit growth. China will release balance of trade, exports, imports, and foreign exchange reserves for August.