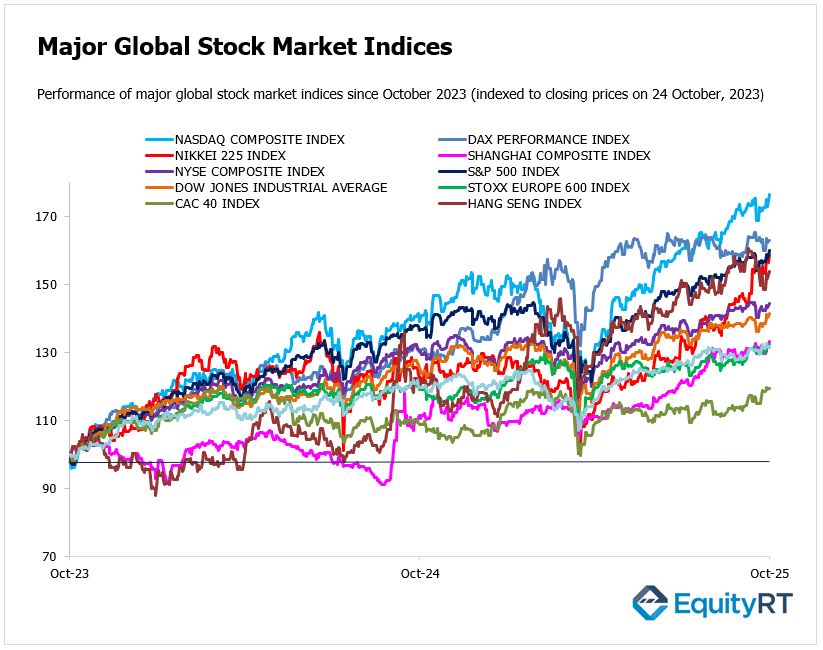

Global Stock Market Highlights

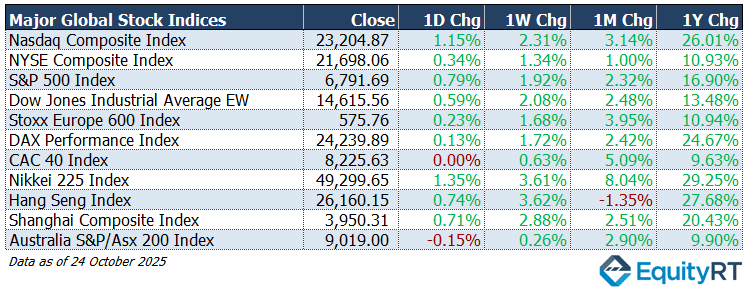

Last Friday, the U.S., stock indices rallied as investors cheered cooler-than-expected inflation figures, boosting hopes for imminent interest rate cuts by the Federal Reserve.

- Nasdaq Composite Index closed at 23,204.87, up 1.15% on the day, 2.31% higher for the week, 3.14% higher over the month, and 26.01% higher over the year.

- NYSE Composite Index closed at 21,698.06, up 0.34% on the day, 1.34% higher for the week, 1.00% higher over the month, and 10.93% higher over the year.

- S&P 500 Index closed at 6,791.69, up 0.79% on the day, 1.92% higher for the week, 2.32% higher over the month, and 16.90% higher over the year.

- Dow Jones Industrial Average EW closed at 14,615.56, up 0.59% on the day, 2.08% higher for the week, 2.48% higher over the month, and 13.48% higher over the year.

European markets, in contrast, edged slightly lower as profit-taking and cautious stance ahead of U.S. economic data weighed on sentiment.

- Stoxx Europe 600 Index closed at 575.76, up 0.23% on the day, 1.68% higher for the week, 3.95% higher over the month, and 10.94% higher over the year.

- DAX Performance Index closed at 24,239.89, up 0.13% on the day, 1.72% higher for the week, 2.42% higher over the month, and 24.67% higher over the year.

- CAC 40 Index closed at 8,225.63, unchanged on the day, 0.63% higher for the week, 5.09% higher over the month, and 9.63% higher over the year.

Asia-Pacific, markets benefitted from improved risk appetite, with Japan’s and Hong Kong’s stocks outperforming regional peers, driven in part by stronger corporate earnings and talk of a forthcoming summit between the U.S. and China that lifted confidence.

- Nikkei 225 Index closed at 49,299.65, up 1.35% on the day, 3.61% higher for the week, 8.04% higher over the month, and 29.25% higher over the year.

- Hang Seng Index closed at 26,160.15, up 0.74% on the day, 3.62% higher for the week, 1.35% lower over the month, and 27.68% higher over the year.

- Shanghai Composite Index closed at 3,950.31, up 0.71% on the day, 2.88% higher for the week, 2.51% higher over the month, and 20.43% higher over the year.

- Australia S&P/ASX 200 Index closed at 9,019.00, down 0.15% on the day, 0.26% higher for the week, 2.90% higher over the month, and 9.90% higher over the year.

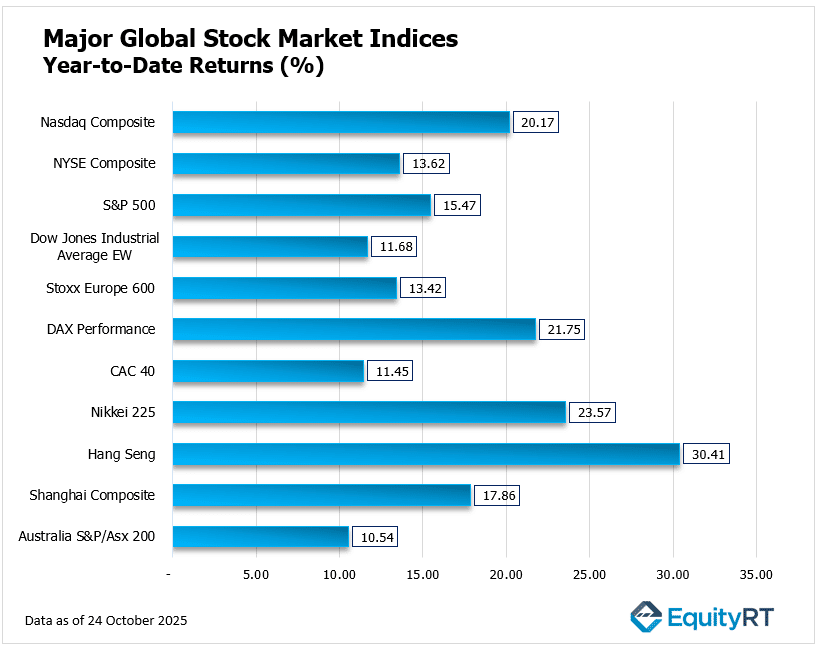

Stock Market Snapshot: Year-to-Date Performance Review

Global equity markets have posted strong year-to-date returns, led by Asian indices. The Hang Seng Index tops the list with a 30.41% gain, followed by Japan’s Nikkei 225 at 23.57%, reflecting renewed investor optimism in the region.

Among Western markets, Germany’s DAX Performance Index advanced 21.75%, while the Nasdaq Composite gained 20.17%, supported by continued strength in technology stocks. The S&P 500 and Stoxx Europe 600 posted moderate increases of 15.47% and 13.42%, respectively, highlighting a steady but selective rally in developed markets.

At the lower end, Australia’s S&P/ASX 200 and France’s CAC 40 rose 10.54% and 11.45%, underscoring a more measured performance in those markets.

Overall, 2025 remains a positive year for equities, with most major indices delivering double-digit returns despite ongoing global policy and growth uncertainties.

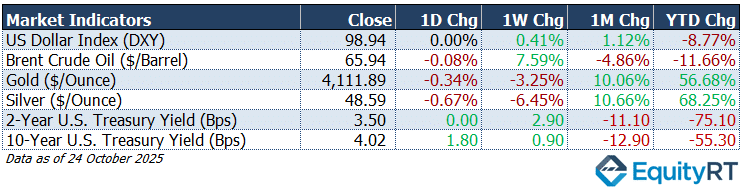

Market Snapshot: Dollar, Gold, Oil & U.S. Yields Update

U.S. Dollar Index (DXY) closed at 98.94, unchanged on the day, but up 0.41% for the week and 1.12% higher over the month. Year-to-date, the index remains 8.77% lower, reflecting continued softness amid a weaker dollar environment.

Brent Crude Oil settled at $65.94 per barrel, down 0.08% on the day but up 7.59% over the week. Despite recent gains, prices are 4.86% lower over the month and 11.66% down year-to-date, as supply concerns ease and demand outlook remains uncertain.

Gold closed at $4,111.89 per ounce, down 0.34% on the day and 3.25% lower for the week. However, it remains 10.06% higher for the month and up 56.68% year-to-date, supported by safe-haven demand and falling bond yields.

Silver finished at $48.59 per ounce, declining 0.67% on the day and 6.45% for the week. Still, it posted 10.66% monthly and 68.25% year-to-date gains, outperforming gold amid strong industrial demand.

The 2-Year U.S. Treasury Yield held steady at 3.50 bps, up 2.90 bps over the week but down 11.10 bps for the month and 75.10 bps lower year-to-date, reflecting expectations of further policy easing.

The 10-Year U.S. Treasury Yield rose to 4.02 bps, up 1.80 bps on the day and 0.90 bps over the week, but down 12.90 bps for the month and 55.30 bps year-to-date, as long-term inflation expectations moderate.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Weekly Macro Highlights

All Eyes on the Fed: U.S. Rate Cut and Big Tech Earnings in Focus

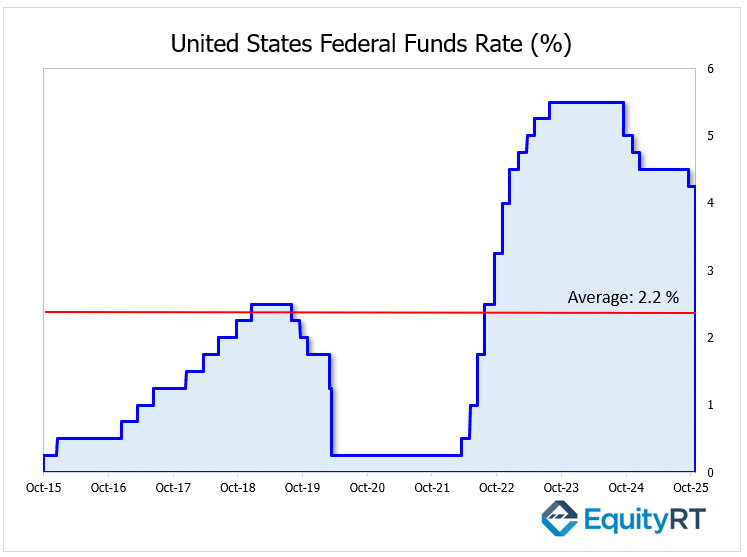

In the U.S., markets are focused on the Federal Reserve’s policy decision set for Wednesday, with a 25-basis point rate cut already priced in, lowering the federal funds rate to 3.75%–4%.

Attention will center on the Fed’s wording; investors will look for hints on whether this is a one-off “insurance” cut or the start of a broader easing cycle. While the cut itself is expected, the statement and Fed Chair’s comments will guide market sentiment in the months ahead.

Headline CPI rose 0.3% month-on-month in September, slowing from 0.4% in August and coming in below expectations of 0.4%. On an annual basis, inflation ticked up slightly from 2.9% to 3.0%, marking the highest level in eight months, though still below the market forecast of 3.1%. The data suggest that underlying inflation pressures are moderating despite temporary upticks in certain categories.

This week also marks a critical phase of the earnings season, with investor sentiment set to be shaped by results from Big Tech giants, Microsoft, Apple, Amazon, Meta, and Alphabet, alongside major corporations such as Visa, UnitedHealth Group, NextEra Energy, Booking, Caterpillar, Verizon, Boeing, Eli Lilly, Mastercard, Merck, Exxon Mobil, AbbVie, and Chevron.

The focus will be on profit margins and forward guidance, as companies navigate a softer demand environment and tighter financial conditions.

Political uncertainty continues to cloud the outlook, with the ongoing U.S. government shutdown, the second-longest in history, showing no sign of resolution. This fiscal impasse could weigh on short-term confidence indicators, even as investors await key economic data releases including regional manufacturing and services indexes (Dallas Fed, Richmond Fed), Case-Shiller home prices, pending home sales, and the Chicago PMI.

Elsewhere in North America, the Bank of Canada is expected to deliver another 25bps rate cut amid slowing growth, with monthly GDP figures providing further clues on economic momentum.

In Latin America, Mexico’s focus will turn to third-quarter GDP, trade, and labor market data, while Brazil’s jobless rate will be closely monitored. Politically, Argentina’s midterm legislative elections will take center stage, with President Javier Milei’s reform agenda facing a key public test as his administration pushes forward with its fiscal austerity program.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

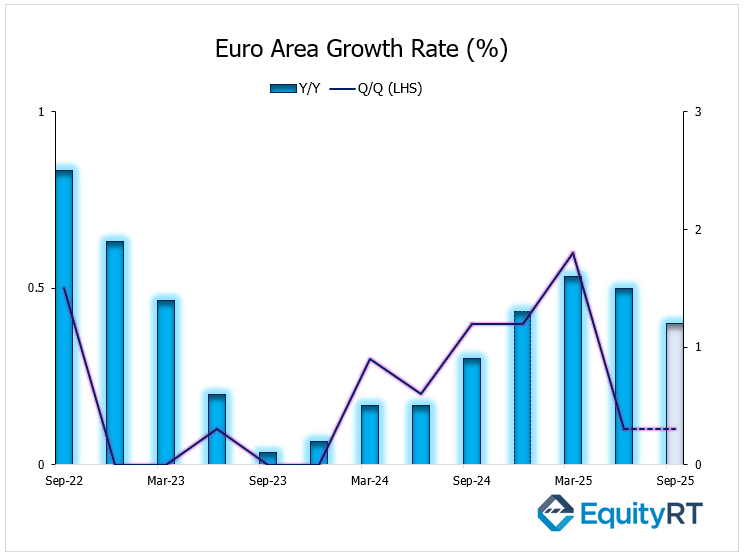

Europe Awaits ECB and GDP Data Amid Sluggish Momentum

In Europe, attention shifts to the European Central Bank, which is widely expected to keep rates unchanged at this week’s meeting. With inflation continuing to moderate and growth stagnating, the ECB is likely to maintain a data-dependent tone, emphasizing patience before any further policy adjustments.

Flash Q3 GDP figures from Germany, France, Italy, and Spain will provide a clearer picture of the region’s economic health. The Eurozone as a whole is expected to post a modest 0.1% quarterly expansion, mirroring Q2’s pace. Country-level data are likely to show Spain outperforming with 0.8% growth, while France is expected to see marginal gains and Germany likely flatlines, highlighting persistent weakness in Europe’s largest economy.

Inflation dynamics remain in focus as well: Germany’s CPI is projected to ease to 2.2% after a temporary spike in September, reinforcing the disinflation narrative. Business sentiment may see slight improvement, with the Ifo Business Climate and GfK Consumer Confidence Indexes both forecast to edge higher.

Elsewhere, the region will see a wave of labor market updates, with unemployment across the Euro Area expected to hold steady at 6.3%.

The UK enters a lighter data week, featuring mortgage approvals, Nationwide housing prices. Additional releases from across the continent include EU car registrations, German retail sales, and Swiss KOF and retail data.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Muted Optimism in Asia Ahead of U.S.–China Meeting

Across the Asia-Pacific region, investor attention is firmly fixed on China, where markets await the outcome of Thursday’s meeting between U.S. President Donald Trump and Chinese President Xi Jinping. Any progress toward easing trade tensions could inject much-needed optimism into regional equities.

On the data front, China’s official NBS PMI readings are expected to show little improvement, suggesting both manufacturing and services activity remain subdued.

Industrial profit figures rose 3.2% year-on-year in the first nine months of 2025, accelerating from 0.9% growth in the prior period.

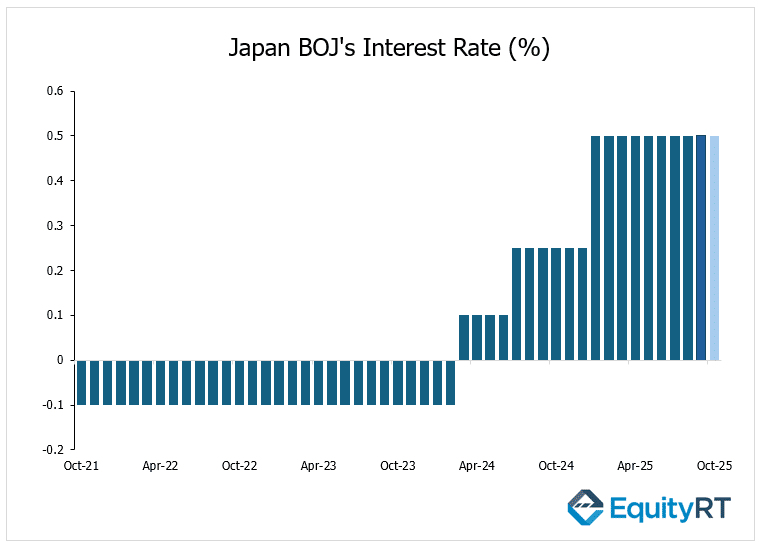

In Japan, the Bank of Japan is expected to hold its policy rate steady at 0.5%, even as inflation remains above target. A heavy data calendar includes Tokyo CPI, industrial production, retail sales, and housing starts, offering insights into whether domestic demand can sustain the economy amid a weak yen and elevated import costs.

Elsewhere in the region, India will release industrial production and fiscal deficit data, both of which will be scrutinized for signs of resilience amid global headwinds. Australia’s quarterly CPI report is projected to show inflation accelerating to 3% in Q3, the fastest pace in over a year, likely strengthening expectations that the Reserve Bank of Australia will keep policy restrictive for longer.

Regional growth updates will also feature prominently, with Q3 GDP figures due from South Korea and Hong Kong, alongside trade balance releases from Hong Kong, and the Philippines. The data will provide a timely snapshot of how Asia’s export-driven economies are coping with the evolving global demand cycle.