Weekly Market Recap

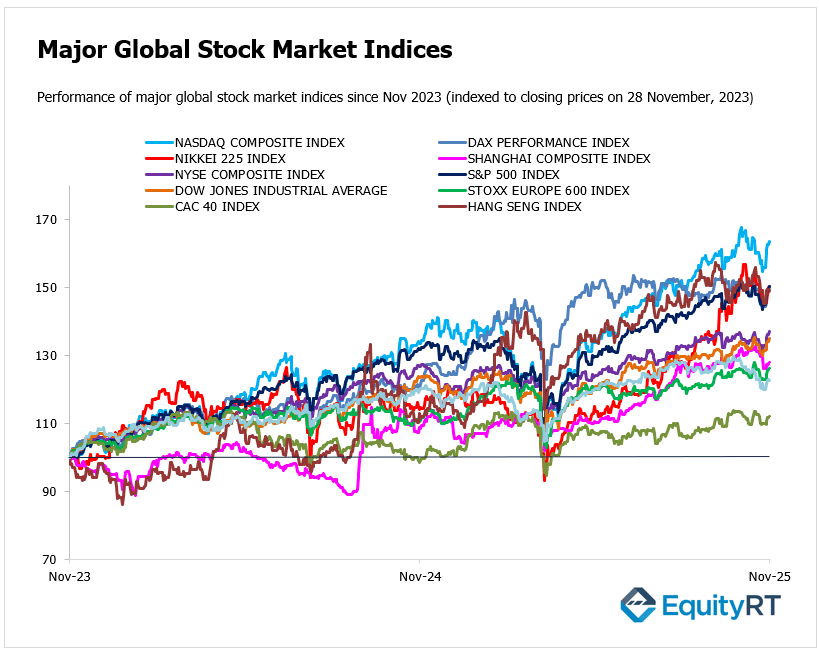

Global equities ended the week on a positive note, though performance varied considerably across regions.

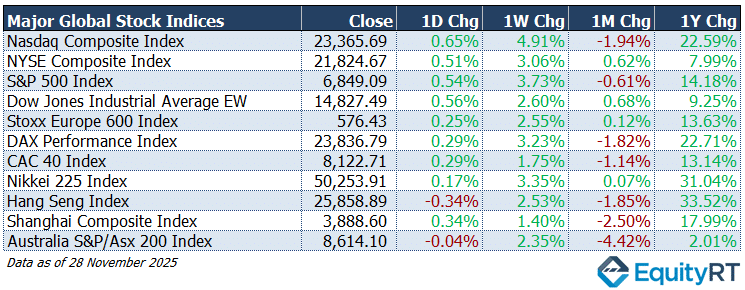

U.S. stock indexes finished the holiday-shortened week higher, the Nasdaq Composite gaining 0.65% and the S&P 500 rising 0.54%, extending their impressive year-to-date gains to 22.59% and 14.18% respectively. The Dow Jones Industrial Average EW added 0.56%, contributing to a solid 9.25% annual performance.

European markets posted modest gains, with the Stoxx 600 up 0.25% and both the DAX and CAC 40 rising 0.29%. These advances brought their year-to-date returns to 13.63%, 22.71%, and 13.14% respectively, reflecting resilient economic conditions across the continent.

Asian markets presented a mixed picture. The Nikkei 225 edged up 0.17%, maintaining its exceptional 31.04% year-to-date rally, while the Shanghai Composite gained 0.34% despite trailing with a more modest 17.99% annual return. In contrast, the Hang Seng declined 0.34%, though it remains the year’s top performer with a remarkable 33.52% gain. Australia’s ASX 200 slipped 0.04%, reflecting a more subdued 2.01% year-to-date performance.

The weekly and monthly trends reveal some near-term volatility, with several indices posting negative one-month returns despite strong year-to-date performance, suggesting investors are navigating heightened uncertainty as year-end approaches.

Global Equity Markets’ Year-to-Date Performances

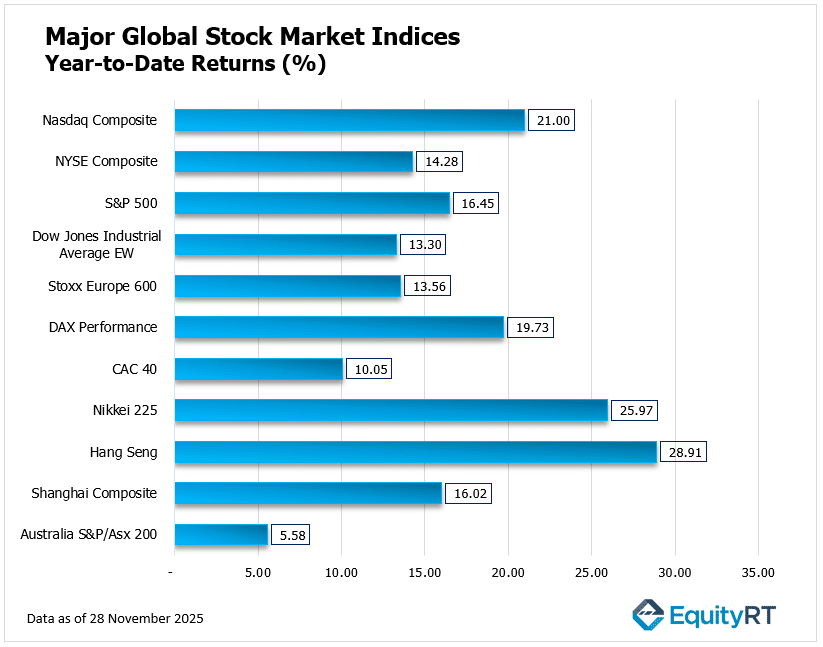

Despite recent volatility, global equities have posted solid, though uneven, gains year-to-date.

Asia continues to lead global equity performance in 2025, buoyed by liquidity support and policy tailwinds. The Hang Seng Index has surged 28.91%, reflecting a dramatic recovery driven by Chinese stimulus measures and improved investor sentiment. The Nikkei 225 has advanced 25.97%, supported by corporate governance reforms and yen weakness that has enhanced export competitiveness. The Shanghai Composite has gained 16.02%, though it trails its Hong Kong counterpart as mainland markets navigate a more cautious recovery path.

U.S. markets have delivered steady gains, driven by tech resilience and AI enthusiasm. The Nasdaq Composite leads domestic indices with a 21.00% advance, while the S&P 500 has risen 16.45%, powered by mega-cap technological stocks and robust corporate earnings. The NYSE Composite and Dow Jones Industrial Average EW have posted more moderate gains of 14.28% and 13.30% respectively, reflecting the performance of value-oriented and traditional industrial sectors.

European indices show moderate strength amid mixed regional economic signals. Germany’s DAX Performance Index has rallied 19.73%, outperforming peers on the strength of industrial exports and corporate profitability. The Stoxx Europe 600 has gained 13.56%, while France’s CAC 40 has advanced 10.05%, lagging its European counterparts amid domestic fiscal concerns and political uncertainty.

Australia lags amid rate pressures and commodity headwinds, with the S&P/ASX 200 posting the weakest performance among major markets at just 5.58%, constrained by elevated interest rates and softer demand for key commodity exports.

Market Summary: Dollar, Gold, Oil & U.S. Yields Update

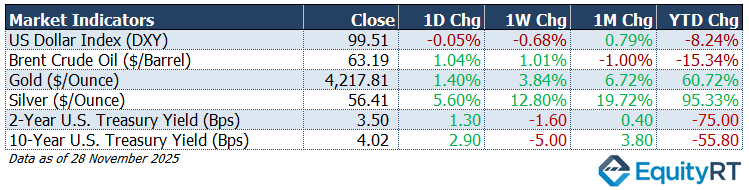

Last Friday, key market indicators signaled a decisive shift in the investment landscape driven by anticipated Federal Reserve rate cuts and heightened geopolitical uncertainty.

Precious metals have emerged as the year’s standout performers, with silver surging 95.33% and gold advancing 60.72%, propelled by safe-haven flows and expectations of monetary easing. The US Dollar Index has declined 24.24% year-to-date, reflecting dovish Fed rhetoric and diminished yield advantages for dollar-denominated assets.

Brent crude has lost 15.34%, pressured by demand concerns and geopolitical supply uncertainty surrounding OPEC+ production decisions and ongoing Russia-Ukraine peace negotiations.

Treasury yields have compressed significantly, with the 2-year falling 75 basis points and the 10-year declining 56 basis points, as markets price in December rate cut with nearly 90% probability.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Weekly Economic Outlook: A Data-Heavy Week That Could Reset Global Policy Expectations

Financial markets entered an important week as a packed global economic calendar brings fresh updates on inflation, manufacturing activity, and consumer demand across major economies. With policy expectations shifting and growth signals still mixed, the incoming data is set to play a central role in shaping market sentiment.

United States: Inflation and Activity Data in Focus

In the United States, attention will shift back to macro fundamentals after delays caused by the recent government shutdown. The PCE report for September is expected to show headline inflation accelerating to 2.8% year-on-year and 0.3% month-on-month, while core PCE is projected to remain steady at 2.9% year-on-year and 0.2% month-on-month.

Consumer demand may show signs of moderation, with personal spending likely cooling to 0.4% following August’s stronger print and personal income expected to maintain a similar pace. Business activity indicators are also due, and the outlook points to continued softness in the factory sector, with the ISM Manufacturing PMI expected to remain in contraction. The services sector appears to be holding up better, although the ISM Services PMI is forecast to show a slight loss of momentum. The labor market narrative may shift as well. The ADP employment report is expected to show private-sector job creation slowing sharply to around 20,000, reinforcing the view that hiring is gradually cooling. At the same time, preliminary Michigan consumer sentiment is likely to improve, and industrial production is projected to rise a modest 0.1%, matching August’s weak pace. A series of additional U.S. releases, ranging from Challenger job cuts to consumer credit, import and export prices, and the final S&P Global PMIs, will round out a week that could meaningfully reshape expectations for the Fed’s next steps.

Elsewhere in the Americas, investors will monitor Canada’s November employment figures alongside PMI updates from S&P Global and the Ivey Business School. Mexico will publish readings on business and consumer sentiment, shedding light on domestic demand conditions, while Brazil will provide a fuller picture of its economic trajectory with third-quarter GDP, industrial production, foreign trade data, and fresh PMI numbers.

In Europe Inflation Edges Higher Amid Industrial Weakness

Across Europe, the macro picture remains divided. Euro Area inflation for November is expected to edge higher, with headline CPI rising to 2.2% and core inflation picking up to around 2.5%. Despite this slight reacceleration, the labor market appears steady, with the unemployment rate likely holding at 6.3% for a fourth month. However, Germany’s industrial sector continues to weigh on the region’s outlook. Factory orders are expected to decline again, marking the fifth drop in six months and underlining persistent weakness in Europe’s largest economy.

PMI readings across the region should offer a more nuanced view.

The broader European calendar is filled with additional high-value indicators, including retail sales, industrial production, the French trade balance, and UK house price indices, all of which will help markets assess the region’s momentum heading into year-end.

China PMI Weakness and Broad Regional Data Flow

In the Asia-Pacific region, China dominates the outlook as the newly released November PMI figures offer a clearer read on the country’s economic trajectory. The official NBS Manufacturing PMI came in at 49.2, slightly above October’s 49.0 but still below the 50-point threshold for the eighth consecutive month.

Japan will deliver a cluster of important data, including final consumer confidence, household spending, and fresh capital spending figures, each offering further clarity on whether the economy is regaining traction.

In India, the Reserve Bank of India is expected to cut its policy rate by 25 basis points to 5.25%, signaling a further shift toward accommodation amid moderating inflation.

Australia faces an especially heavy slate of third-quarter results covering GDP, the current account, alongside October readings for trade and building permits, with the trade surplus expected to narrow as import demand picks up.

Across the broader region, South Korea and Indonesia will release trade data that will help investors assess supply-chain momentum, while inflation reports from South Korea, Thailand, the Philippines, and Taiwan will provide fresh insight into the region’s price dynamics.