Global Market Summary

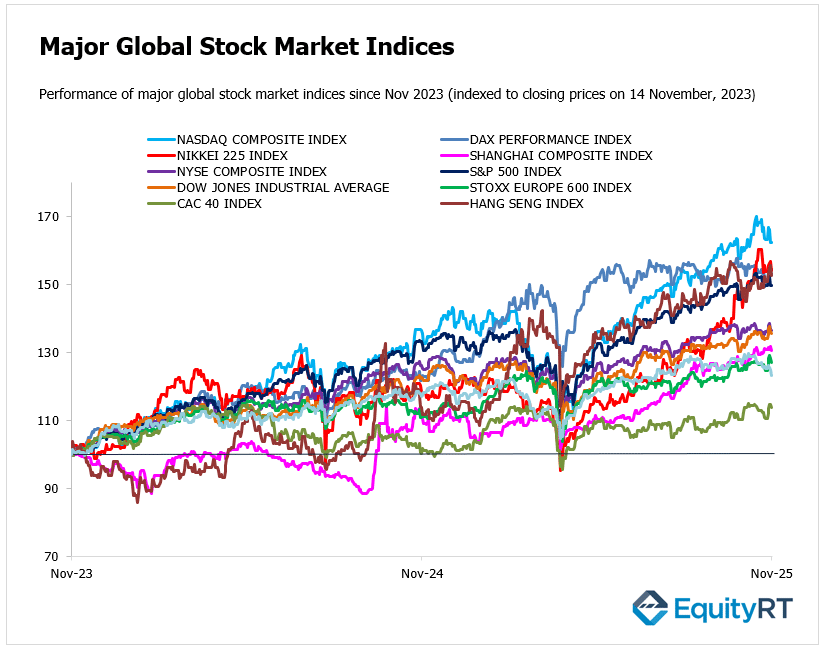

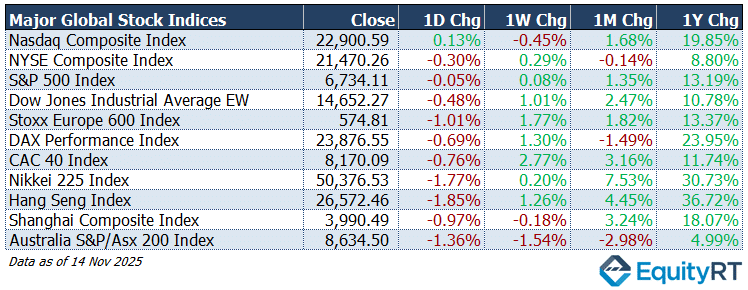

Global equities ended the week under pressure, with most major markets closing lower as investors reacted to fading hopes of near-term U.S. rate cuts and renewed concerns about global growth.

On Friday the U.S. market ended mixed, minor overall loss in the major broad indices, while the tech-heavy Nasdaq eked out a small gain. The day was characterised by a sharp early move down followed by recovery, reflecting a cautious mood more than a breakout or breakdown. The S&P 500 slipped around 0.1%, the Dow Jones Industrial fell 0.5%, while the Nasdaq managed a modest 0.1% gain as tech shares stabilized after early-session weakness.

European markets closed broadly lower. The STOXX Europe 600 dropped more than 1%, weighed down by losses in technology and industrial names. Germany’s DAX fell roughly 0.7%, while France’s CAC 40 ended down 0.76%,

Across Asia, indices also lost ground. The Nikkei 225 slid around 1.8%, pressured by declines in exporters and chip-related stocks. Hong Kong’s Hang Seng Index retreated by about 1.9%. In Australia, the S&P/ASX 200 fell sharply, dropping by 1.4%.

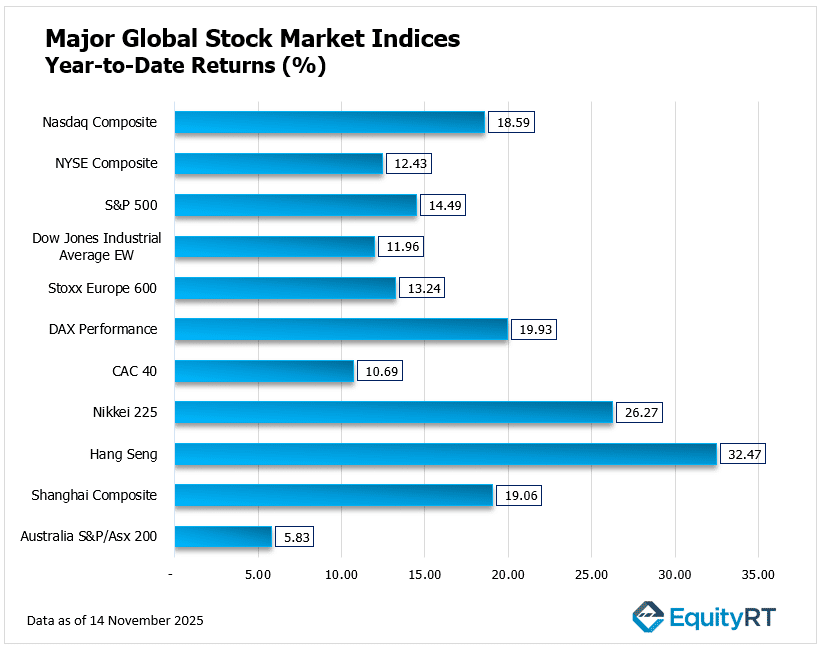

Global Equity Markets YTD Performance

Global stocks delivered strong but uneven gains year-to-date. Asia led in 2025, with Hang Seng (+32%), Nikkei 225 (+26%), and Shanghai Composite (+19%) outperforming on improved liquidity and policy support.

U.S. markets posted solid returns, driven by tech strength. The Nasdaq gained 18.6%, while the S&P 500 rose 14.5% over the period.

European indices also ended higher, with Germany’s DAX (+19.9%) outperforming, while the CAC 40 (+10.7%) and Stoxx 600 (+13.2%) reflected a softer economic backdrop.

The Australia ASX 200 lagged, rising only 5.8%, pressured by higher rates and weaker commodity prices.

The year-to-date picture showed Asia’s clear leadership, steady U.S. gains, and mixed performance across Europe and Australia.

Market Summary: Dollar, Gold, Oil & U.S. Yields Update

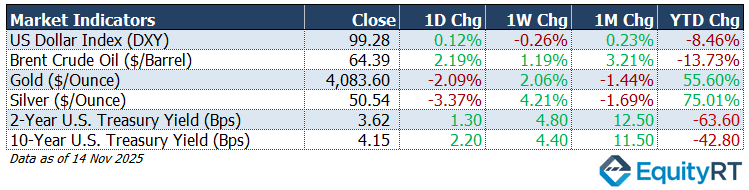

The latest market readings show a mixed tone across commodities, the U.S. dollar, and Treasury yields, reflecting shifting macro expectations and cross-asset positioning.

The U.S. Dollar Index (DXY) held steady, rising 0.1% on the day, though it remained down 8.5% year-to-date, signalling a broad weakening trend as markets priced in earlier Fed policy easing through much of the year.

Brent crude oil climbed 2.2% on the day and posted gains across the week and month, supported by supply constraints and stabilising demand indicators. Still, it remained 13.7% lower YTD, reflecting a year of softer global growth and easing geopolitical risk premiums.

Gold, despite a 2% daily drop, stayed up 55.6% year-to-date, highlighting its status as one of 2025’s strongest-performing assets amid volatility, lower real yields, and robust safe-haven flows. Silver mirrored this pattern, falling on the day but remaining an impressive 75% year-to-date, benefiting from both precious metal demand and industrial use.

In fixed income, U.S. Treasury yields moved sharply higher across the curve:

The 2-year yield jumped 1.3 bps on the day and 12.5 bps over the month, while the 10-year yield rose 2.2 bps on the day and 11.5 bps over the month. Despite these shorter-term increases, both yields remained significantly lower year-to-date, consistent with the large repricing earlier in 2025 when markets anticipated a sustained Fed easing cycle.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Global Market Outlook: What to Expect in the Week Ahead

After the prolonged government shutdown, President Trump approved the temporary budget bill, allowing the government to reopen on November 12. The delayed macroeconomic data will now be released as relevant public agencies work to update their schedules.

U.S. Data Resumes as Markets Seek Clarity

The end of the prolonged government shutdown brings much-needed clarity as federal agencies resume the release of official data. Investors have spent several weeks relying on private surveys and corporate commentary, so this week’s indicators carry extra significance.

In the United States, the week brings a series of indicators that will offer a clearer read on activity and sentiment across housing, manufacturing, and services.

Existing home sales are expected to show little change in October, while the NAHB Housing Market Index is seen edging lower amid ongoing affordability pressures. Regional manufacturing signals are likely to remain soft, with the New York Empire State Index expected to weaken further.

A broader view of activity will come from the S&P Global Flash PMIs, alongside the weekly ADP employment report and the final reading of Michigan Consumer Sentiment.

Additional insights from the Philadelphia and Kansas Fed manufacturing surveys will help round out the picture. Investors will also pay close attention to communication from the Federal Reserve, as a series of scheduled speeches and the release of the latest FOMC meeting minutes may offer further clues about the central bank’s next policy steps.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

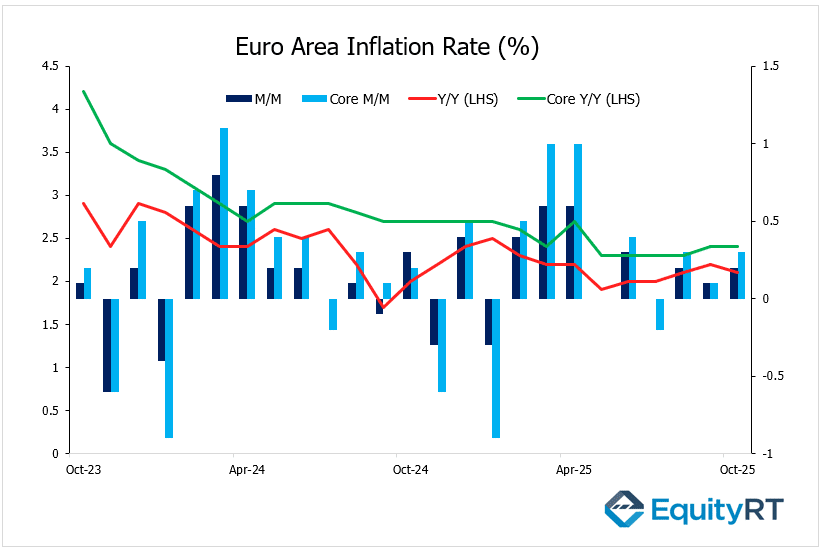

Inflation, Labour Costs, and Policy Signals in Eurozone

The key release to watch in the Eurozone this week (Wednesday) is the final reading of October inflation. Markets expect headline CPI to hold at 2.1%, confirming the earlier estimate and keeping inflation just above the ECB’s target.

While the headline number appears stable, the real question is whether price pressures are easing broadly or simply pausing. Recent data has shown slower momentum in energy and goods inflation, but services remain sticky, making this update especially important for assessing the underlying trend.

A confirmed 2.1% print would reinforce the narrative that the Eurozone is steadily moving through its disinflation phase, setting the stage for more nuanced policy discussions at the ECB as we approach 2026.

Also, this week, Eurozone’s Labour Cost Index (Q3 flash) will be released. The previous quarterly reading stood at 3.6%, and early expectations point to some easing toward 3.2%, although labour-market tightness remains a persistent concern for policymakers.

The remainder of the week is filled with official remarks from the ECB’s Governing Council members. The ECB will convene a General Council meeting, and construction output figures for September will be updated.

Germany will also feature prominently mid-week. The country will release October producer-price inflation. Annual PPI previously stood at -1.7%, with expectations for this week pointing toward a more moderate decline. The month-on-month reading, previously construction figures -0.1%, is expected to stabilise after several months of negative prints

Inflation, Producer Prices, and Retail Performance for United Kingdom

The United Kingdom enters the week with a set of closely watched releases that will help shape expectations for the path of prices and household conditions. The October inflation report will be the main highlight, with headline CPI expected to remain at 3.8% year-on-year, unchanged from the previous month and slightly above the market consensus of 3.6%. Producer-price trends will be released alongside the CPI data, offering a fuller picture of pipeline cost pressures.

Retail price indices for October are forecast at 4.3% year-on-year, with the monthly measure remaining soft at -0.4%, consistent with cooling trends across goods categories.

The week will conclude with updates on household sentiment and spending momentum. The GfK consumer confidence index, last recorded at -17, will provide further insight into how consumers are approaching the holiday period, while October retail sales will help clarify whether recent spending patterns are stabilising or still showing signs of strain after several uneven months.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Big Week for Asia: Japan’s Growth and Inflation Data Take Centre Stage

The Asia-Pacific region began the week with a broad mix of data that will help clarify whether regional momentum is strengthening or still uneven as the year approaches its close.

In China, the calendar is quiet next week with no major data releases scheduled. The focus will instead fall on the People’s Bank of China, which is widely expected to keep its loan prime rates unchanged, maintaining its current policy stance amid ongoing signs of gradual economic stabilization.

Japan’s economy contracted 0.4% in Q3, a milder decline than expected, as weak private consumption (0.1%) reflected persistent cost pressures. High-frequency data remained mixed: industrial production rebounded 2.6% monthly in September. Other key releases ahead include inflation, with core CPI expected to edge up toward 3%, as well as flash PMIs, machinery orders, and the latest trade figures. Markets are looking for a rebound in machinery orders, softer export momentum, and a possible pullback in imports.

In Australia, the release of the RBA meeting minutes will be closely watched after wage growth stayed firm at 0.8% quarter-on-quarter and 3.4% year-on-year, reinforcing expectations of a cautious policy stance ahead of Friday’s PMI updates.

In India, the week will bring the release of flash PMI readings, accompanied by updated figures on unemployment and infrastructure output, offering a timely snapshot of business activity and underlying economic momentum.