Global Stock Market Performance Review

Global equities ended the last trading day of the week with mixed but generally positive performance, amid reduced participation as several markets remained closed or operated with limited hours due to the Christmas holiday.

U.S. markets recorded modest moves, supported by gains in technology and energy stocks. The S&P 500 slipped less than 0.1% to 6,929.94, and the Nasdaq Composite also declined marginally to 23,593.10.

European trading was thinner, with most exchanges closed. In Asia, performance was mixed, with gains in Japan and China offset by weakness in Australia.

Year-to-Date (YTD) Performance Review of Global Stock Indices

Global equity markets continue to display a clear dispersion in performance as the year draws to a close, with Asia and select developed markets leading gains, while others lag amid uneven macro and sector dynamics.

The Hang Seng Index stands out as the strongest performer, rising 28.71% year to date, reflecting a sharp rebound from earlier weakness and renewed optimism around China-linked equities and policy support expectations. Japan’s Nikkei 225 has also delivered strong returns, up 27.21%, supported by corporate governance reforms, improved earnings visibility, and sustained foreign inflows.

In the United States, equity markets remain firmly positive despite periods of volatility. The Nasdaq Composite has gained 22.18% year to date, continuing to benefit from the dominance of large-cap technology stocks. The S&P 500 is up 17.82%, while the NYSE Composite and the Dow Jones Industrial Average (equal-weighted) have risen 16.49% and 14.82%, respectively.

European equities have posted steady, albeit more differentiated, gains. Germany’s DAX Performance Index has climbed 22.26%, making it one of the strongest performers among developed European markets. The Stoxx Europe 600 is up 15.97%, while France’s CAC 40, with a 9.79% increase, has lagged regional peers, reflecting weaker momentum in certain heavyweight sectors.

Elsewhere in the Asia-Pacific region, performance has been mixed. The Shanghai Composite has advanced 18.26%, suggesting gradual stabilization rather than a full-fledged recovery, while Australia’s S&P/ASX 200 has underperformed with a 7.40% year-to-date gain, weighed down by softer commodity prices and a more subdued domestic growth outlook.

Market Summary: Dollar, Gold, Oil & U.S. Yields Update

As of last Friday’s close, the broader macro backdrop continues to be shaped by a pronounced weakening in the U.S. dollar and a strong bid for precious metals. The U.S. Dollar Index (DXY) closed at 98.05, marking a 9.6% decline year to date, reinforcing dollar softness as a key cross-asset theme into year-end.

This environment has provided a powerful tailwind for precious metals. Gold surged to $4,532 per ounce, extending its year-to-date gain to 72.7%. Silver has significantly outperformed, rising to $79.11 per ounce and posting an exceptional 173.9% increase year to date. The strong weekly and monthly advances highlight sustained demand for hard assets amid currency weakness and shifting rate expectations.

By contrast, energy markets remain under pressure. Brent crude oil closed at $60.64 per barrel, down 18.8% year to date, reflecting ongoing concerns around global demand and ample supply conditions despite short-term price stabilization.

In fixed income markets, U.S. Treasury yields remain lower on a year-to-date basis, reinforcing expectations of a gradual policy pivot. The 10-year U.S. Treasury yield ended the session near 4.14%, while the 2-year yield stood at 3.48%, both sharply lower compared with the start of the year. This downward adjustment in yields continues to signal growing market confidence that the Federal Reserve is moving toward a sustained easing cycle, providing a supportive backdrop for risk assets as markets transition into the new year.

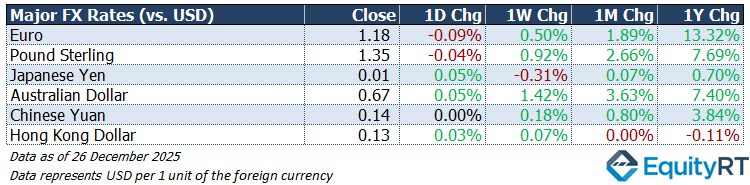

Summary of Major FX Rates vs. USD

Major currencies have broadly strengthened against the U.S. dollar in 2025, reflecting a sustained weakening trend in the greenback amid easing inflation pressures and growing expectations that the Federal Reserve will move toward a more accommodative policy stance.

The Euro stands out as the strongest performer, appreciating 13.32% year to date against the U.S. dollar. This gain reflects improving sentiment toward the Euro Area as inflation continues to cool and growth stabilizes, while interest-rate differentials have become less supportive of the dollar.

The British pound and the Australian dollar have also delivered solid performance, rising 7.69% and 7.40%, respectively. Sterling’s gains point to relative resilience despite slowing domestic activity, while the Australian dollar has benefited from improved risk appetite and selective support from commodity-related flows.

Across Asia, currency performance has been more mixed. The Chinese yuan has strengthened 3.84% year to date, signaling gradual stabilization rather than a strong rebound as policy support helps offset lingering structural challenges. The Japanese yen has posted only a modest gain of 0.70%, highlighting its continued underperformance relative to peers amid Japan’s still-accommodative monetary stance, despite ongoing discussions around gradual policy normalization.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Weekly Economic Outlook

Late-Year U.S. Data Refines Growth and Fed Expectations

In U.S., housing-related data will be a key focus early in the week. Updated S&P/Case-Shiller home price figures and broader house price index readings are expected to confirm ongoing cooling in the housing market, reflecting the lagged impact of higher mortgage rates. Investors will watch closely for signs that price pressures are stabilizing rather than accelerating, as this will shape expectations for housing demand in the first quarter of next year. Complementing this, MBA mortgage data later in the week will offer a timely snapshot of borrowing activity, with applications and purchase indices expected to remain subdued.

Business activity indicators will also be in focus, particularly at the regional level. The Chicago PMI and Dallas Fed Services Index are expected to remain in contraction territory, reinforcing the view that parts of the U.S. economy continue to experience soft demand conditions as the year ends.

Labor market data remains a critical anchor for market expectations. Weekly initial and continuing jobless claims will be monitored for any signs of deterioration in employment conditions. While claims are expected to remain relatively contained, any unexpected uptick could revive concerns about a sharper slowdown in early 2026.

From a policy perspective, the release of the FOMC meeting minutes will be closely monitored for further clarity on how Federal Reserve officials are balancing easing inflation pressures against still-resilient activity data. Markets will look for confirmation that policymakers remain comfortable maintaining a patient stance as they assess incoming data.

The final S&P Global Manufacturing PMI will provide a broader read on national manufacturing conditions. Investors will watch whether the final reading confirms expansionary momentum or signals renewed softness as the year draws to a close.

European Data to Test Inflation Progress and Industrial Stability

As markets approach year-end with reduced liquidity, attention in Europe and neighboring regions will turn to a compact but still informative set of releases spanning inflation trends, manufacturing momentum, labor market conditions, and credit growth. While several markets will operate with shortened sessions or remain closed around the New Year holiday, the upcoming data will help refine the macro narrative heading into 2026.

In the Euro Area, inflation dynamics will be in focus early in the week with preliminary core CPI readings and country-level inflation data from Spain. Markets will watch closely for confirmation that disinflation remains intact, particularly as Spanish CPI and HICP figures are expected to show only modest monthly increases and a gradual easing on a year-on-year basis.

Manufacturing activity across the region will also draw attention with the release of final HCOB manufacturing PMIs for Germany, France, Italy, Spain, and the Euro Area as a whole. While some readings are expected to remain below the 50-threshold, investors will look for signs of stabilization or narrowing contraction, particularly in Germany and France, where industrial weakness has been most pronounced. The S&P Global Manufacturing PMI for the UK will provide a parallel read on activity conditions outside the euro area.

In the UK, Nationwide house price data for December will be closely monitored for signs of housing market stabilization amid still-restrictive financial conditions.

Monetary and credit indicators will also be in focus. Euro Area M3 money supply and private-sector loan growth figures for November are expected to show modest expansion.

Several European markets, including Germany, Italy, France, Spain, and the UK, will observe New Year holiday schedules with early closes or full-day holidays, which is likely to limit trading volumes and amplify the impact of any data surprises.

Asia-Pacific Data Signals to Shape Early-2026 Expectations

In China, the focus will be on the official NBS PMI readings for December, including manufacturing, non-manufacturing, and the composite index. Markets will be watching whether manufacturing activity remains below the 50-threshold for another month, which would reinforce the view that industrial momentum remains under pressure despite recent policy support.

Alongside activity data, China’s current account balance will be monitored for signals on external demand and trade flows as global growth remains uneven.

In India, a series of monetary and financial indicators will be in focus. Updates on M3 money supply, bank loan growth, and deposit growth will offer insight into domestic liquidity conditions and credit transmission. Markets will also monitor RBI market borrowing operations, government budget data, and external debt figures for signals on fiscal positioning and external vulnerability as India continues to navigate strong growth alongside elevated financing needs. The HSBC Manufacturing PMI (final) will provide a timely read on activity momentum heading into the new year.

In Australia, attention will turn to the final S&P Global Manufacturing PMI, which will help confirm whether recent softness in activity persists or stabilizes. Dwelling price data will also be closely watched, as housing conditions remain a key transmission channel for monetary policy and consumer sentiment.

Elsewhere in the region, Indonesia will release both manufacturing PMI and inflation data. Markets will look to inflation readings for confirmation that price pressures remain contained, while PMI data will offer insight into the strength of domestic demand and export-linked activity. Additional indicators such as tourist arrivals will help assess recovery trends in the services and travel sectors.