Weekly Market Recap: Global Equities Under Pressure

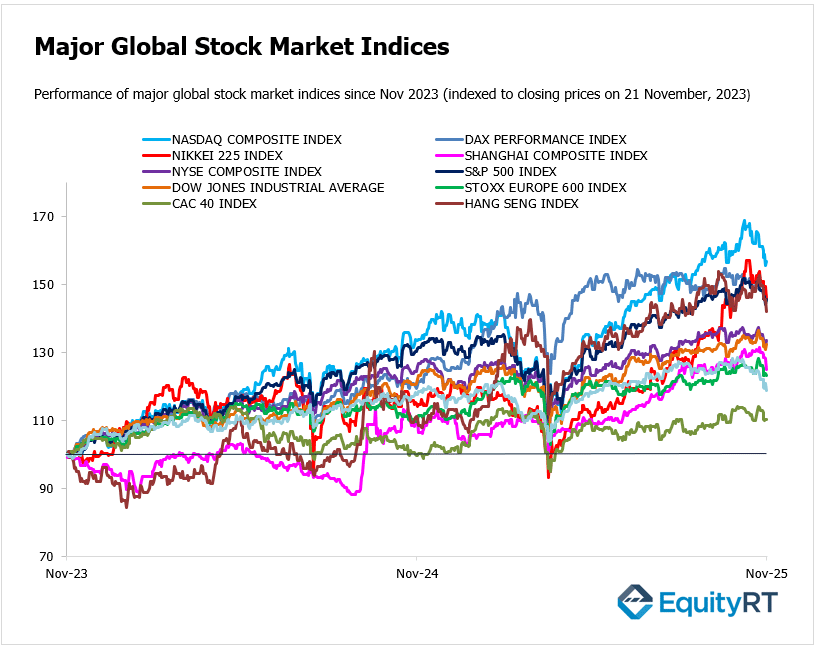

Global equities ended the week on a cautious note, with most major markets closing lower as investors reassessed the likelihood of near-term U.S. rate cuts and grappled with renewed concerns about global growth.

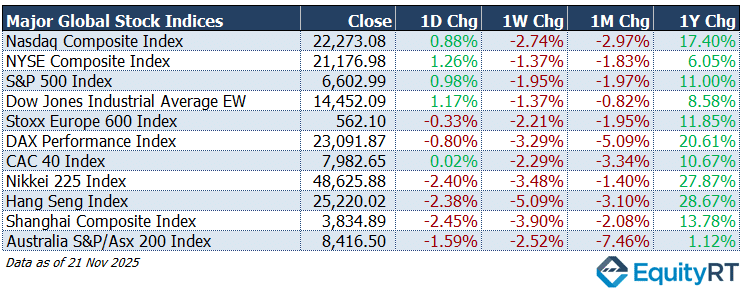

U.S. markets showed mixed results on Friday. The Nasdaq Composite gained 0.88%, while the S&P 500 slipped 0.1%. The session was influenced by some Fed members’ indications of support for a December rate cut and the University of Michigan consumer confidence index falling to its lowest level in 3.5 years, signalling economic deceleration.

European markets broadly declined. The STOXX Europe 600 fell 0.33%, dragged down by weakness in technology and industrial sectors. Germany’s DAX dropped 0.80%, and France’s CAC 40 edged down 0.02%, both reflecting a subdued sentiment across the region.

Asian indices also retreated. Japan’s Nikkei 225 slid 2.40%, pressured by losses in exporters and chip-related stocks. Hong Kong’s Hang Seng Index declined 2.38%, while China’s Shanghai Composite fell 2.45%. Australia’s S&P/ASX 200 dropped 1.59%, weighed down by rate concerns and commodity softness.

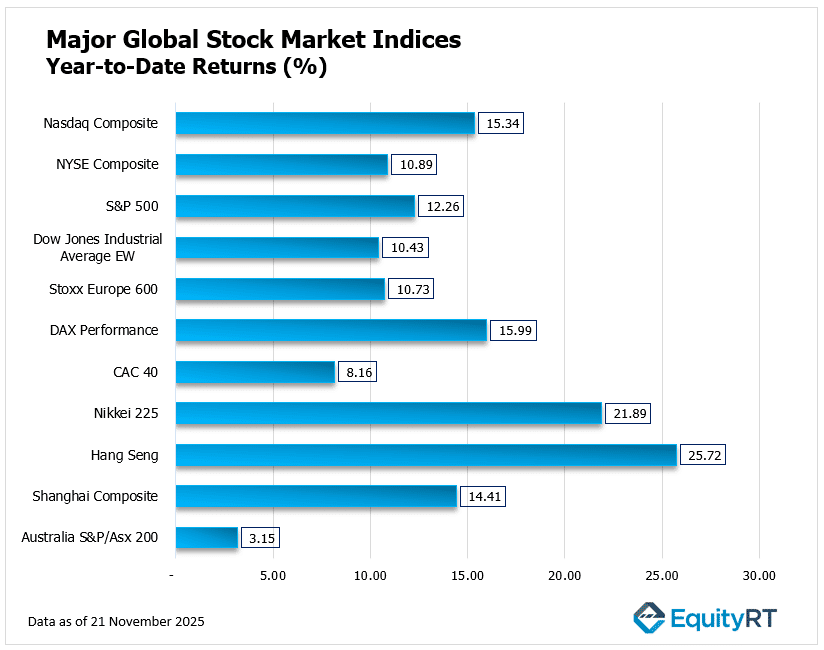

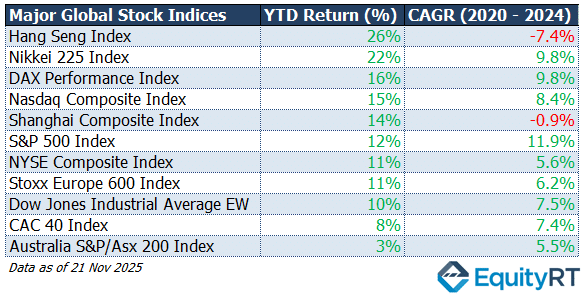

Global Equity Markets Year-to-Date Performance

Despite recent volatility, global equities have posted solid, though uneven, gains year-to-date:

Asia continues to lead global equity performance in 2025, buoyed by liquidity support and policy tailwinds. U.S. markets have delivered steady gains, driven by tech resilience. European indices show moderate strength, while Australia lags amid rate pressures and commodity headwinds.

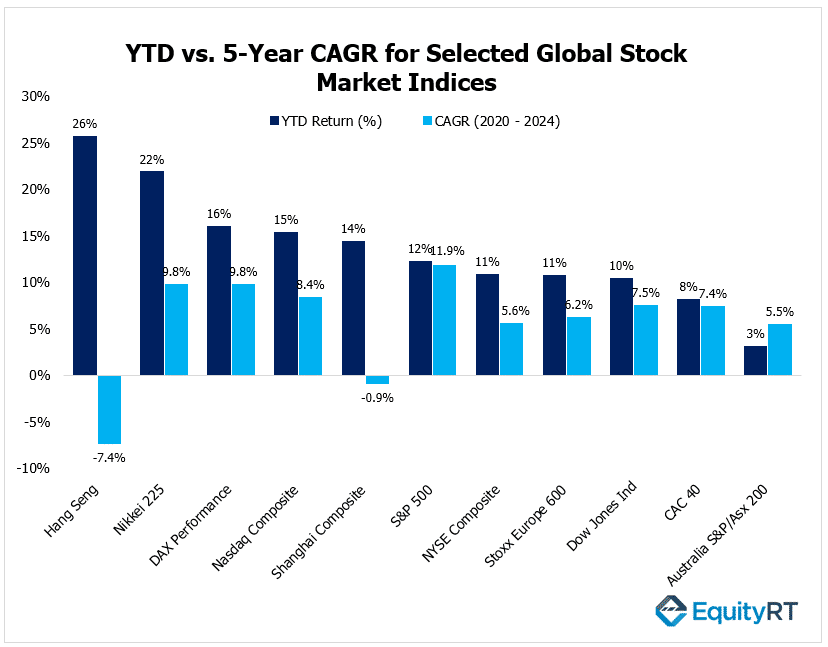

Momentum versus Consistency

Looking at the latest data as of November 21, 2025, global equities have posted strong gains year-to-date, though underlying momentum varies significantly across regions.

Asian markets have led year-to-date performance, with the Hang Seng advancing 29% and the Nikkei 225 rising 26%. However, longer-term returns paint a starkly different picture. The Hang Seng posted a 5-year CAGR of -7.4%, reflecting persistent structural headwinds in Chinese markets, while the Nikkei delivered a respectable 9.8% annualized growth over the same period. This contrast suggests that the Hang Seng’s recent strength reflects a cyclical rebound from depressed levels rather than sustained expansion, whereas the Nikkei’s gains are built on more solid foundations.

Germany’s DAX remains a standout, combining a 20% gain this year with 9.8% annualized growth over 5 years, supported by robust industrial competitiveness and strong export performance. U.S. equity benchmarks continue to demonstrate steady resilience, with the Nasdaq and S&P 500 rising 21% and 16% year-to-date respectively, and maintaining impressive long-term growth rates of 8.4% and 11.9%, underscored by ongoing strength in technology and corporate earnings. Europe’s Stoxx 600 has delivered a solid 14% gain this year with a respectable 6.2% CAGR, while France’s CAC 40 shows 10% year-to-date gains alongside a healthy 7.4% five-year annualized return. Australia’s ASX 200 has posted modest gains of 6% year-to-date with a 5.5% CAGR, while China’s Shanghai Composite lags with 14% year-to-date gains but a slightly negative 5-year trend of -0.9%.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

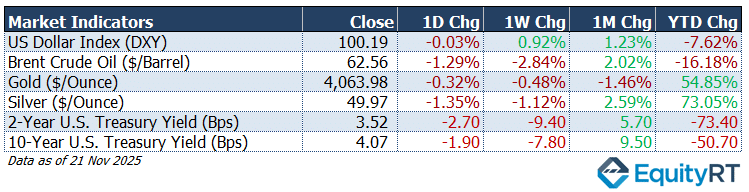

Market Summary: Dollar, Gold, Oil & U.S. Yields Update

The latest market data reflects mixed cross-asset movements, with investors balancing softer economic signals, rising geopolitical uncertainty, and shifting expectations around U.S. monetary policy.

The US Dollar Index (DXY) eased slightly on the day but posted a 0.92% gain for the week, supported by a rebound in U.S. yields and safe-haven demand. However, the dollar remains 7.62% lower year-to-date, reflecting a structural adjustment following the Fed’s rate-cut cycle earlier in the year.

Brent crude oil extended its decline, falling 1.29% on the day and 2.84% over the week, amid persistent concerns over global demand and elevated supply from non-OPEC producers. Brent’s 16% year-to-date drop highlights the broader weakness in the energy complex despite intermittent geopolitical risks.

Precious metals showed contrasting dynamics. Gold slipped modestly but remained near record highs, up 54.85% year-to-date, as investors continue to seek protection against economic uncertainty and falling real yields. Silver, despite a sharper daily decline, is still the standout performer with a 73% year-to-date surge, driven by both safe-haven flows and expectations of stronger industrial demand in 2026.

U.S. Treasury yields moved lower across the curve, with the 2-year yield dropping 2.7 bps and the 10-year down 1.9 bps. The weekly decline is more pronounced, consistent with rising expectations that the Federal Reserve may shift toward a more accommodative stance if labor-market softness persists. Both yields are sharply lower on the year, reflecting a significant repricing of the Fed’s path, the 2-year is down 73 bps year-to-date, while the 10-year has fallen 50 bps.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Global Economic Outlook: What to Expect in the Week Ahead

The coming week is shaping up to be an important one for markets, even if the U.S. trading calendar is shortened by Thanksgiving. In America, investors will be watching a batch of delayed reports on producer prices, retail sales, and durable goods. The Fed’s Beige Book, due Wednesday, should give a more human‑level snapshot of how businesses and households are coping with inflation and higher borrowing costs. With the Fed entering its pre‑meeting blackout period, the data will do most of the talking. If inflation looks sticky or consumer spending stays strong, bond yields could creep higher again; if the numbers soften, expect a sigh of relief across equities and rate‑sensitive sectors.

In the U.K., all eyes are on the Autumn Budget. The government is expected to emphasize fiscal discipline to reassure bond markets. That could be good news for gilts and the pound, but less exciting for domestic stocks that rely on stronger growth. Investors will be weighing whether the budget strikes the right balance between credibility and stimulus.

Europe’s focus will be on fresh inflation readings from Germany, France, and Spain, along with confidence surveys. Softer numbers would strengthen the case for the ECB to ease policy in early 2026, while any upside surprise could quickly unsettle bond markets and pressure equities that have been riding on the idea of lower rates.

Asia has plenty of data to digest too. Japan’s Tokyo CPI will be a key signal for the Bank of Japan, while China’s PMI surveys will show whether recent stimulus is translating into real activity. Australia’s inflation report and New Zealand’s rate decision round out the region.

Elsewhere, GDP updates from Canada and India will give a read on growth in commodity‑linked and emerging markets, while inflation reports from Brazil and Mexico will shape expectations for monetary policy in Latin America.

If inflation keeps easing without hurting demand, markets should stay steady into year‑end. If not, we may expect investors to rotate quickly into safer assets like defensives, bonds, and the U.S. dollar until the next catalyst arrives.