Global Stock Market Performance Review

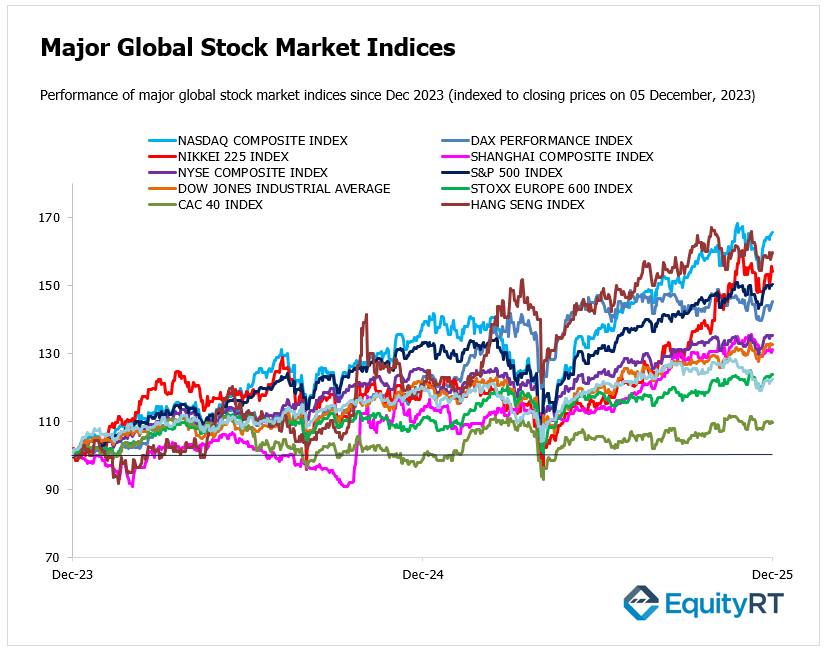

Global equity markets delivered a mixed to positive performance last Friday, largely driven by optimism in the United States following a tame inflation report that solidified expectations for a Federal Reserve rate cut in the coming week.

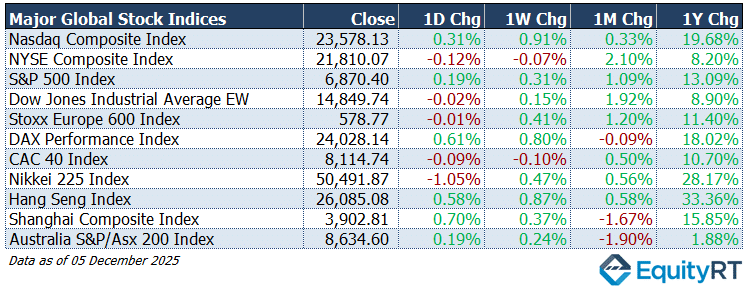

The US markets generally closed in positive territory, extending their weekly gains. The momentum was driven by positive sentiment surrounding the anticipated easing of monetary policy and strong performance in specific sectors. The Nasdaq Composite led the gains, rising by 0.2% to 0.3%. The benchmark S&P 500 also finished the day in the green, advancing by approximately 0.2% (closing near 6,870.40).

European markets were mixed but generally steady. The STOXX Europe 600 finished close to flat, supported by modest weekly momentum, while Germany’s DAX outperformed with a 0.6% rise, (closing near 24,028.14), marking its second straight weekly gain. France’s CAC 40 dipped slightly but remained firmly positive on a one-year basis.

Asia showed the widest divergence. Japan’s Nikkei 225 slipped just over 1%, weighing on the region, while the Hang Seng and Shanghai Composite both closed higher, signaling improving sentiment in Chinese and Hong Kong markets.

Australia’s S&P/ASX 200 posted a mild gain, recovering some ground after a softer month.

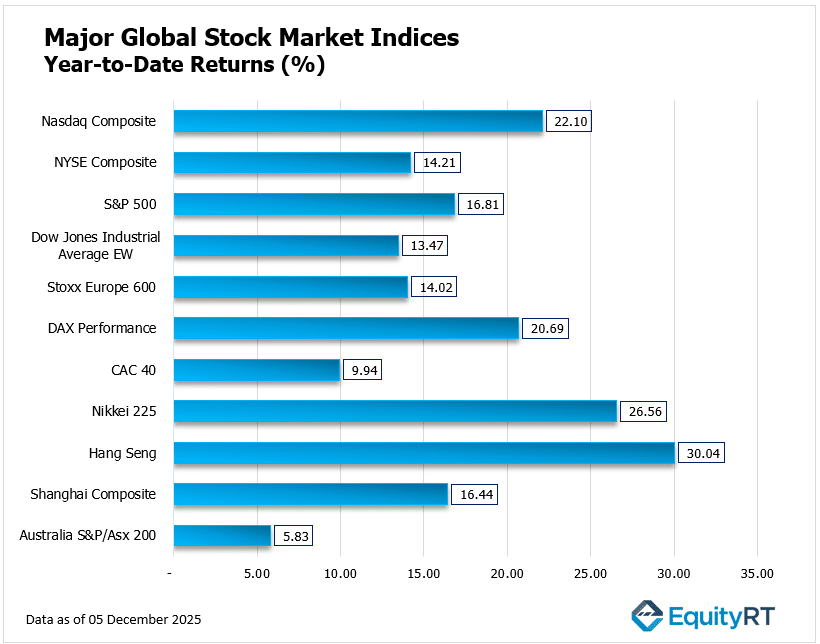

Year-to-Date (YTD) Performance Review of Global Stock Indices

Global equity markets have delivered strong year-to-date gains, but performance continues to vary widely across regions. The Hang Seng Index leads all major benchmarks with an impressive 30.04% YTD rise, reflecting renewed optimism toward Hong Kong and Chinese equities after a prolonged period of weakness. Japan’s Nikkei 225 follows closely at 26.56%, supported by corporate reforms, a weaker yen, and persistent foreign inflows.

In the U.S., performance remains robust. The Nasdaq Composite is up 22.10% YTD, driven by technology and AI-related momentum, while the S&P 500 has climbed 16.81%, showing broad-based strength. The NYSE Composite and the Dow Jones Industrial Average (EW) have also posted double-digit gains, up 14.21% and 13.47%, respectively.

European markets show steady but more moderate advances. Germany’s DAX has returned 20.69% YTD, benefiting from industrial and export-sector resilience. The STOXX Europe 600 is up 14.02%, and France’s CAC 40 has gained 9.94%, both signalling a stable regional backdrop despite uneven economic momentum.

Among major markets, Australia’s S&P/ASX 200 is the laggard, rising just 5.83% YTD, a reflection of softer commodity trends and cautious domestic sentiment.

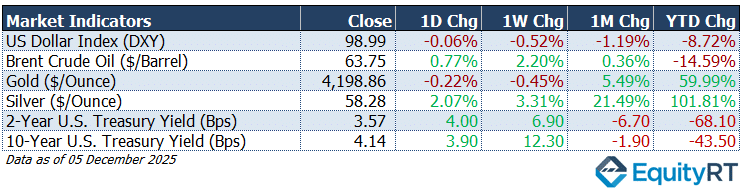

Market Summary: Dollar, Gold, Oil & U.S. Yields Update

Last Friday, markets showed mixed performance across major asset classes, reflecting a cautious yet active trading environment.

The U.S. dollar continued to soften, with the DXY edging down on the day and extending weekly and monthly declines. The index is now down nearly 9% year-to-date, underscoring broad dollar weakness as global risk appetite improved and expectations of future Fed easing persisted.

Brent crude oil traded firmer, rising almost 0.8% on the day and gaining more than 2% over the week. Despite the short-term rebound, oil remains depressed on a year-to-date basis, down roughly 15%, reflecting ongoing demand concerns and abundant global supply.

In precious metals, gold held near recent highs despite a small daily pullback. The metal remains one of the strongest performers of 2025, up an impressive 60% year-to-date, supported by safe-haven flows and declining real yields. Silver extended its bullish trend even further, surging more than 100% year-to-date, with strong monthly and weekly gains signaling persistent investor demand for alternative hedges.

U.S. Treasury yields moved decisively higher, with the 2-year yield rising 4 basis points on the day and the 10-year yield climbing nearly 4 bps. Both maturities posted strong weekly gains. Despite the recent upward movement, yields remain sharply lower for the year, down 68 bps on the 2-year and more than 40 bps on the 10-year, a sign of shifting rate expectations and a more dovish long-term market outlook.

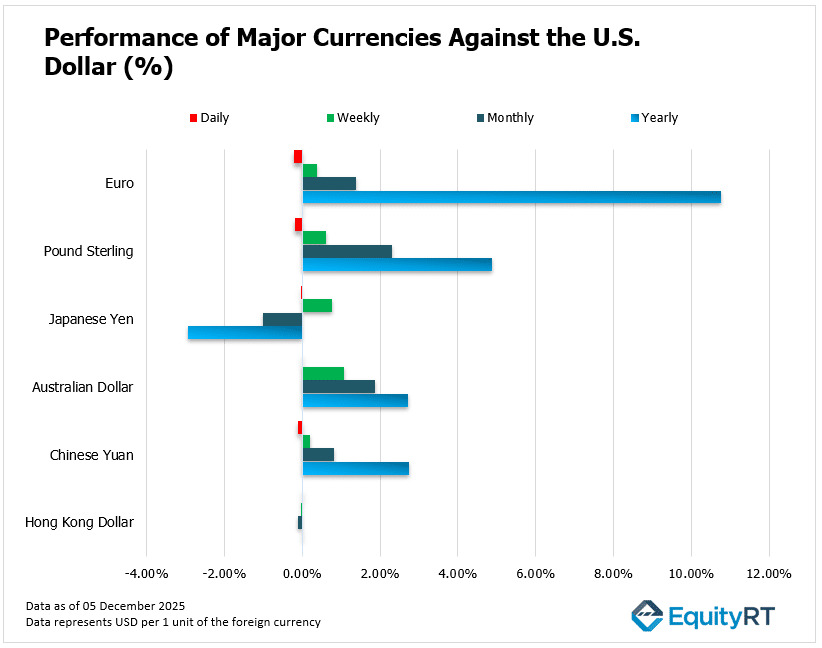

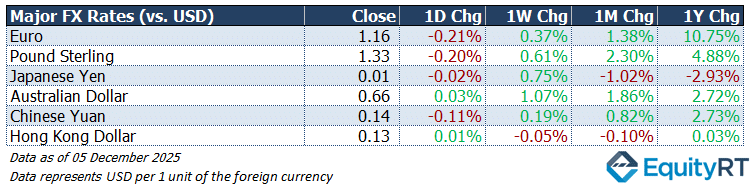

Summary of Major FX Rates vs. USD

Over the past year, most currencies have significantly appreciated the USD. The Euro (EUR) has been the strongest long-term performer, gaining 10.75% against the dollar, closing at 1.16 USD. The Pound Sterling (GBP) also showed strong appreciation, up 4.88% annually, closing at 1.33 USD.

Similarly, the Chinese Yuan (CNY) and the Australian Dollar (AUD) have both appreciated by over 2.7% over the last year. The Australian Dollar (AUD) stands out for its strong recent momentum, being the only currency to register gains across all timeframes.

The Hong Kong Dollar (HKD), trading at 0.13 USD, showed negligible movement, which is typical due to its currency peg to the USD. The notable exception to this strengthening trend is the Japanese Yen (JPY). The Yen has been the weakest currency in the group, showing a significant depreciation of 2.93% over the last year and a further loss of 1.02% over the last month. It closed at 0.01 USD.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Weekly Economic Outlook

Fed Decision and Labor Market in Focus

This week, attention in the US will center on the Federal Reserve’s final policy meeting of the year and the release of updated economic projections. Policymakers are widely expected to deliver a third consecutive rate cut on Wednesday, with markets assigning roughly an 87% probability to a 25bps reduction in the fed funds rate and pricing in a further two to three cuts next year as labor-market conditions continue to cool.

A backlog of key US economic data, previously delayed by the government shutdown, will also draw focus. These include JOLTs job openings for September and October, with September openings forecast at 7.2 million. The September trade deficit is expected to widen to $65.5 billion, while wholesale inventories likely edged up 0.1%. Other notable releases include the Q3 Employment Cost Index, November’s federal budget statement, consumer inflation expectations, the NFIB Business Optimism Index, and weekly indicators such as initial jobless claims and the ADP employment report.

On the earnings front, Broadcom and Oracle will report quarterly results.

Elsewhere in the Americas, the Bank of Canada is expected to hold interest rates steady, while Brazil’s central bank will also meet to set monetary policy. Markets will additionally track Canada’s September trade balance, Mexico’s CPI data, and Brazilian releases including inflation, business sentiment, and retail sales.

Inflation Signals Across Europe

This week will be busy for the UK, with a data-heavy Friday offering fresh insights into October’s economic performance. GDP is expected to edge up 0.1%, after a 0.1% contraction in September, while industrial production is seen rebounding by 0.8% following a 2% decline previously. Trade figures will also be in focus, and BoE Governor Bailey is scheduled to speak.

For the Eurozone, no major data releases are planned, but investors will closely monitor comments from ECB President Lagarde. In Germany, industrial production rose 1.8% in October after a downwardly revised 1.1% rise in September. The trade surplus is expected to hold near €15 billion.

Final inflation readings are due from Germany, France, Spain, and Sweden. In Switzerland, the central bank is expected to keep its key rate at 0%. Russia will also publish inflation data.

China’s November Data Set to Shape Regional Sentiment

This week, China will release a series of key economic indicators for November. China’s exports jumped 5.9% year-on-year in November, rebounding sharply from October’s 1.1% decline and beating expectations of a more moderate recovery. The improvement was largely driven by stronger demand from non-US markets. Imports also picked up, rising 1.9% after a 1.0% increase the month before, pushing the trade surplus to its highest level in five months.

CPI inflation is projected to rise 0.9% year-on-year, its strongest reading since February 2023, while PPI deflation is expected to remain unchanged at 2.1%. Monetary and credit data will also be closely watched.

Japan’s GDP shrank 0.6% quarter-on-quarter in Q3 2025, exceeding both the flash estimate of a 0.4% decline and market expectations for a 0.5% drop. The latest PPI print, expected at 0.3%, down from 0.4% in October.

In India, markets will focus on November inflation data. In Australia, the Reserve Bank is expected to hold its policy rate steady at 3.6%, while employment figures are expected to show the jobless rate rising to 4.4% from 4.3%. Business confidence and final building permits data will also be released.

Elsewhere in the region, the Philippine central bank is expected to cut rates by 50bps to 4.5%. Investors will track unemployment data from South Korea, the Philippines, and Malaysia, as well as trade figures from Taiwan.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Important Disclaimer

The information provided in this publication is for informational purposes only and is not, and should not be construed as, investment advice, financial advice, trading advice, or any other form of advice. You should not treat any information in this report as a specific solicitation to engage in any investment or financial activity. EquityRT is not responsible for any loss arising from any investment based on any material provided. Please consult with a qualified financial professional before making any investment decisions.