Global Stock Market Performance Review

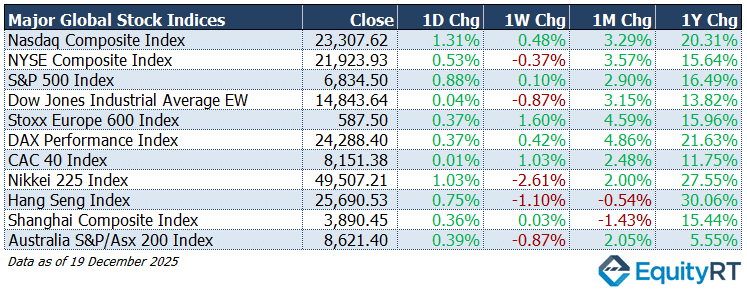

Global equity markets concluded the week ending Friday on a broadly positive note, staging a resilient rebound from the technology-led weakness observed in the prior week.

In the United States, major benchmarks successfully recouped losses as investor sentiment stabilized following cooler-than-expected inflation data. The S&P 500 Index advanced 0.88% to close at 6,834.50, while the tech-heavy Nasdaq Composite led the recovery with a 1.31% daily gain, reaching 23,307.62. These gains have solidified a strong annual performance for 2025, with the Nasdaq maintaining a robust yearly appreciation of approximately 20.4% and the S&P 500 remaining firmly in double-digit territory. This year-end momentum is increasingly driven by a transition in market focus from concentrated AI-driven volatility toward a broader cross-section of sectors, supported by a resilient labor market and moderating price pressures.

International markets mirrored this firmer tone, with European and Asian indices ending the week in the green. Germany’s DAX edged up 0.40% to 24,288.40, continuing its record-breaking year with a year-over-year gain of 21.6%. In Asia, Japan’s Nikkei 225 outperformed global peers, rising 1.03% to 49,507.21 and bringing its striking annual performance to over 30%. While the Hang Seng Index and mainland Chinese equities showed marginal gains of 0.75% and 0.36% respectively, they continue to navigate structural headwinds and uneven regional data. Overall, the global landscape reflects a strategic consolidation phase as investors price in a more accommodative monetary environment for 2026.

** US stock markets will operate on a half-day schedule on Wednesday due to the Christmas holiday and will be closed on Thursday. Across Europe, markets will also be open for a half day on Wednesday, while remaining closed on Thursday and Friday because of the Christmas holiday.

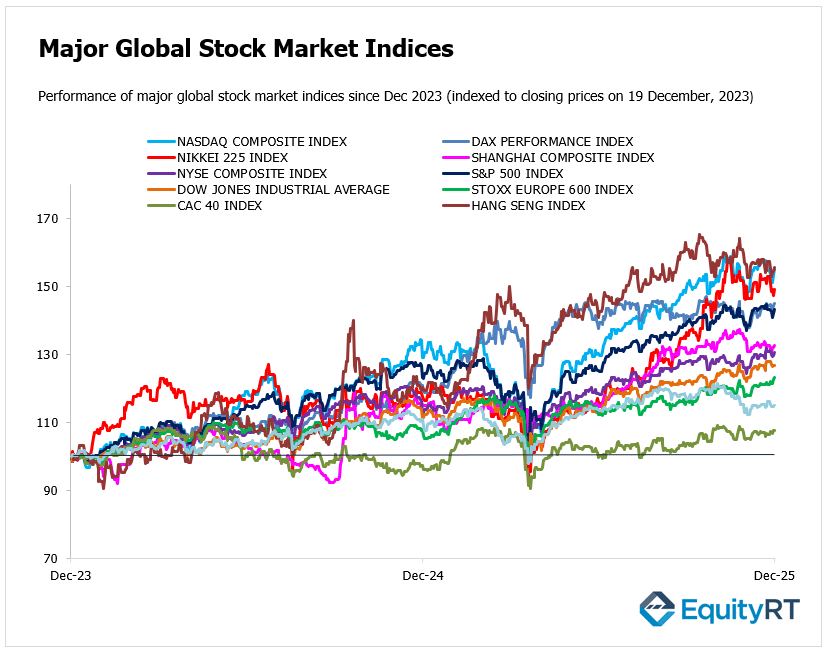

Year-to-Date (YTD) Performance Review of Global Stock Indices

Global equity markets continue to show a clear dispersion in performance as the year draws to a close, with Asia and select developed markets leading gains. The Hang Seng Index stands out as the strongest performer, up 28.07% year to date, reflecting a sharp rebound from earlier weakness and renewed optimism around select China-linked sectors. Japan’s Nikkei 225 has also delivered robust returns, gaining 24.10%, supported by corporate reforms, improving earnings visibility, and sustained foreign inflows.

In the United States, equity markets remain firmly positive despite recent volatility. The Nasdaq Composite is up 20.70% year to date, continuing to benefit from the dominance of large-cap technology stocks. The S&P 500 has gained 16.20%, while the NYSE Composite and the Dow Jones Industrial Average (equal-weighted) have risen 14.80% and 13.42%, respectively, indicating healthy but slightly narrower market breadth compared with the tech-heavy Nasdaq.

European equities have posted more moderate but steady gains. Germany’s DAX has climbed 22.00%, making it one of the strongest performers among developed European markets, while the Stoxx Europe 600 is up 15.74%. France’s CAC 40, with a 10.44% gain, has lagged regional peers, reflecting softer momentum in certain heavyweight sectors.

Elsewhere in Asia-Pacific, performance has been mixed. The Shanghai Composite has risen 16.07%, suggesting gradual stabilization rather than a full-fledged recovery, while Australia’s S&P/ASX 200 has underperformed with a 5.67% year-to-date gain, weighed down by commodity price weakness and a slower domestic growth outlook.

The 2025 equity landscape remains characterized by strong leadership from Asia and technology-driven U.S. markets, with Europe delivering solid but uneven returns.

Market Summary: Dollar, Gold, Oil & U.S. Yields Update

Based on market data as of last Friday’s close the broader macro environment remains defined by a significant retreat in the U.S. Dollar Index (DXY), which was trading near 98.72, reflecting an 8.97% year-to-date decline. This weaker dollar has served as a key tailwind for precious metals, with gold up more than 65% year to date and silver delivering an exceptional gain of over 132%.

By contrast, the energy sector remains under pressure. Brent crude oil, trading around $60.5 per barrel, is down nearly 19% year to date, amid ongoing concerns over global demand.

In fixed income markets, the downward adjustment in U.S. Treasury yields has continued. The 10-year yield held near 4.14%, while the 2-year yield stood around 3.49%, underscoring growing market conviction that the Federal Reserve is moving toward a sustained easing cycle, providing a supportive backdrop for risk assets heading into the new year.

Summary of Major FX Rates vs. USD

Major currencies have broadly strengthened against the U.S. dollar in 2025, reflecting a sustained weakening trend in the dollar amid easing inflation pressures and expectations of a more accommodative Federal Reserve stance.

The Euro stands out as the strongest performer, appreciating 13.29% year to date against the dollar. This move reflects improving sentiment toward the Euro Area as inflation continues to cool and growth stabilizes, while interest rate differentials have become less supportive of the U.S. dollar.

The British pound and the Australian dollar have also posted solid gains, rising 6.50% and 6.53%, respectively. Sterling’s performance suggests relative resilience despite slowing domestic activity, while the Australian dollar has benefited from improved risk appetite and selective support from commodity-linked flows.

In Asia, currency performance has been more mixed. The Chinese yuan has appreciated 3.48% year to date, indicating gradual stabilization rather than a strong rebound, as policy support offsets lingering structural concerns. The Japanese yen remains the notable laggard, still down 0.57% on a yearly basis, underscoring the persistent impact of Japan’s accommodative monetary stance relative to other major economies, despite recent speculation around gradual policy normalization.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Weekly Economic Outlook

Quiet Holiday Week in the U.S., Delayed Data in Focus

Christmas week is typically subdued in the U.S., with both equity and bond markets closing early on December 24 and remaining shut on December 25. Despite the shortened trading week, investors will still have several delayed economic releases to assess.

The second estimate of third-quarter GDP is expected to confirm that the economy expanded at an annualized pace of 3.2%. Corporate profits data are also due, while October durable goods orders are forecast to rise 0.4%.

The Federal Reserve will publish industrial production data for October and November, providing further insight into manufacturing momentum. Additional indicators to watch include Conference Board consumer confidence, the Richmond Fed Manufacturing Index, and the Chicago Fed National Activity Index.

Elsewhere in the Americas, attention will turn to Canada’s monthly GDP and producer price data, which should offer clues on domestic growth dynamics. In Latin America, investors will monitor mid-month CPI readings from Brazil and Mexico, as inflation trends remain central to regional monetary policy outlooks.

Light Calendar with Select Data Releases in Europe

The European economic calendar is relatively light, with no major policy events scheduled. In the United Kingdom, final Q3 GDP, business investment, and current account data were released. GDP expanded by 1.3% year-on-year in the third quarter of 2025, indicating a modest improvement in economic activity. The Euro Area will publish car registration figures, while Germany reports import prices.

Russia will release a batch of data including industrial production, unemployment, real wage growth, and retail sales.

Policy Watch and Key Activity Data in Asia

In China, markets will focus on the National People’s Congress Standing Committee meeting, scheduled for December 22–27. Lawmakers are expected to deliberate draft legislation related to environmental protection, national development planning, and foreign trade, which could have longer-term policy implications.

In Japan, investors will review the minutes from the Bank of Japan’s October policy meeting alongside Tokyo inflation data, with the core rate expected to ease to 2.5%. November industrial production is projected to decline 2% month-on-month, while retail sales are expected to grow 0.9% year-on-year and the unemployment rate to remain steady at 2.6%.

In Australia, attention will turn to the minutes of the Reserve Bank’s December meeting for signals on the policy outlook. Across the region, inflation data are due from Malaysia, Hong Kong, and Singapore, while Thailand and the Philippines will publish trade figures.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Important Disclaimer

The information provided in this publication is for informational purposes only and is not, and should not be construed as, investment advice, financial advice, trading advice, or any other form of advice. You should not treat any information in this report as a specific solicitation to engage in any investment or financial activity. EquityRT is not responsible for any loss arising from any investment based on any material provided. Please consult with a qualified financial professional before making any investment decisions.