In the financial markets, gold is usually attributed to the “commodities” category. Along with gold, other metals such as silver, platinum, copper are also ascribed to this asset class. Commodities comprise a wide range of products in the like of cocoa, cotton, crude oil, minerals, gas and others. All these asset groups are traded on specialized mercantile exchanges.

Commodities differ from stocks and bonds in a way that, they generally have significant importance for some industries. Copper is used in electrical equipment such as wiring and motors whereas crude oil is used as a base for transportation fuels. From a financial point of view, the main difference is that, unlike stocks or bonds, commodities do not provide investors with cash flows in the form of coupons, dividends or the principal. Commodities generate returns when their prices change in the direction investor bets on. The investors often examine the relationships between commodities to conclude whether prices of one commodity can affect prices of another.

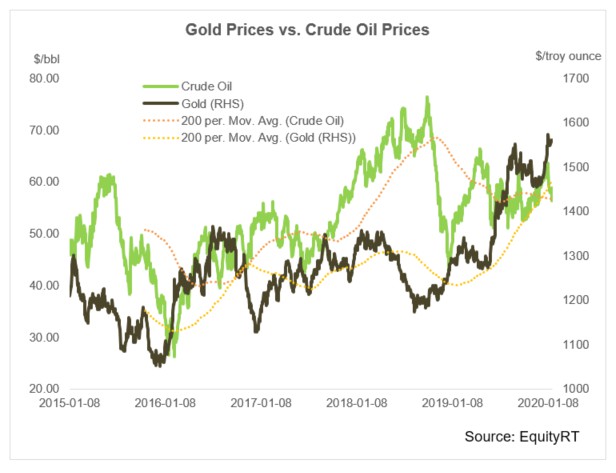

In the world, the most popular and actively traded commodities in financial markets are the gold and oil. It is generally argued that prices of gold and oil are positively correlated. They are two different assets, however, they do have inflationary relationship. Rising oil prices place upward pressure on inflation and the precious metals tend to appreciate with inflation rising. Eventually, the increase in the price of crude oil contributes to higher precious metal prices in financial markets

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

The price of crude oil is quoted in US currency and movement in the dollar or in the oil price generates an immediate impact on the related currencies. These movements are strongly correlated in economies that have significant reserves (Russia, Canada and Brazil) while less correlation is observed for economies with more diverse resources (Japan).

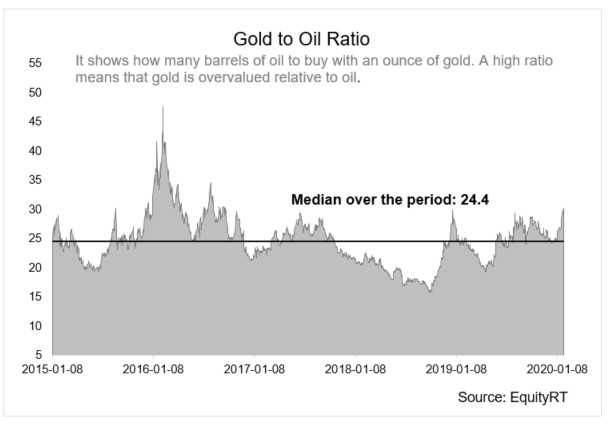

Gold-oil ratio determines the number of barrels of oil to buy with an ounce of gold. It means that the higher the ratio, cheaper the oil and the greater the purchasing power of gold.

Currently (Jan 30th) an ounce of gold will get you 30 barrels of crude oil. Over the past 5 years, on average, an ounce of gold has bought 24 barrels of crude oil. The highest gold-oil ratio was 47.6 in 2016 when oil was stuck in a severe slump while gold prices remained steady. The lowest ratio over the last 25 years was 6.3 in 2005 when demand–driven oil prices soared.

You can find the daily indicative prices of primary commodities, such like raw materials, fuels, base metals and indices and all details about financial markets on EquityRT, easily compare, chart and download the data.