What are Bonds?

Bonds are debt securities issued by governments, business corporations, and other institutions to raise capital. When people buy a bond, they lend money to the bond issuer in exchange for regular interest payments, known as coupon payments, typically made annually or semi-annually. As a result, bonds do not represent ownership in a company; rather, investing in bonds means becoming a creditor to the issuer, typically a government entity. Each bond has a maturity date, when the issuer returns the principal investment, or face value.

Types of Bonds

As stated above, bonds can be issued by governments or corporations. This means that people have different types of bonds to choose from, according to the issuing institution.

Government bonds are debt securities issued by national governments to finance public projects and manage economic stability. They can be denominated in local currency, which protects domestic investors against currency risk. Government bonds can also be issued in foreign currency, which may attract international investors seeking yield but involves exchange rate risk. when evaluating government bond investments, Investors consider factors such as interest rates, inflation, and government credit ratings.

Corporate bonds are issued by companies to raise capital for purposes such as investments, or financing debt. They represent a loan from investors to the company, which agrees to repay the principal and interest over time. The risk associated with these bonds varies based on the issuer’s creditworthiness; strong credit ratings lead to lower risks and interest rates, while weaker profiles offer higher yields to attract investors. Investors evaluate factors affecting bond performance and returns such as the issuing company’s financial health, industry conditions, and market trends.

EquityRT ‘World Bond Yields’ Screen

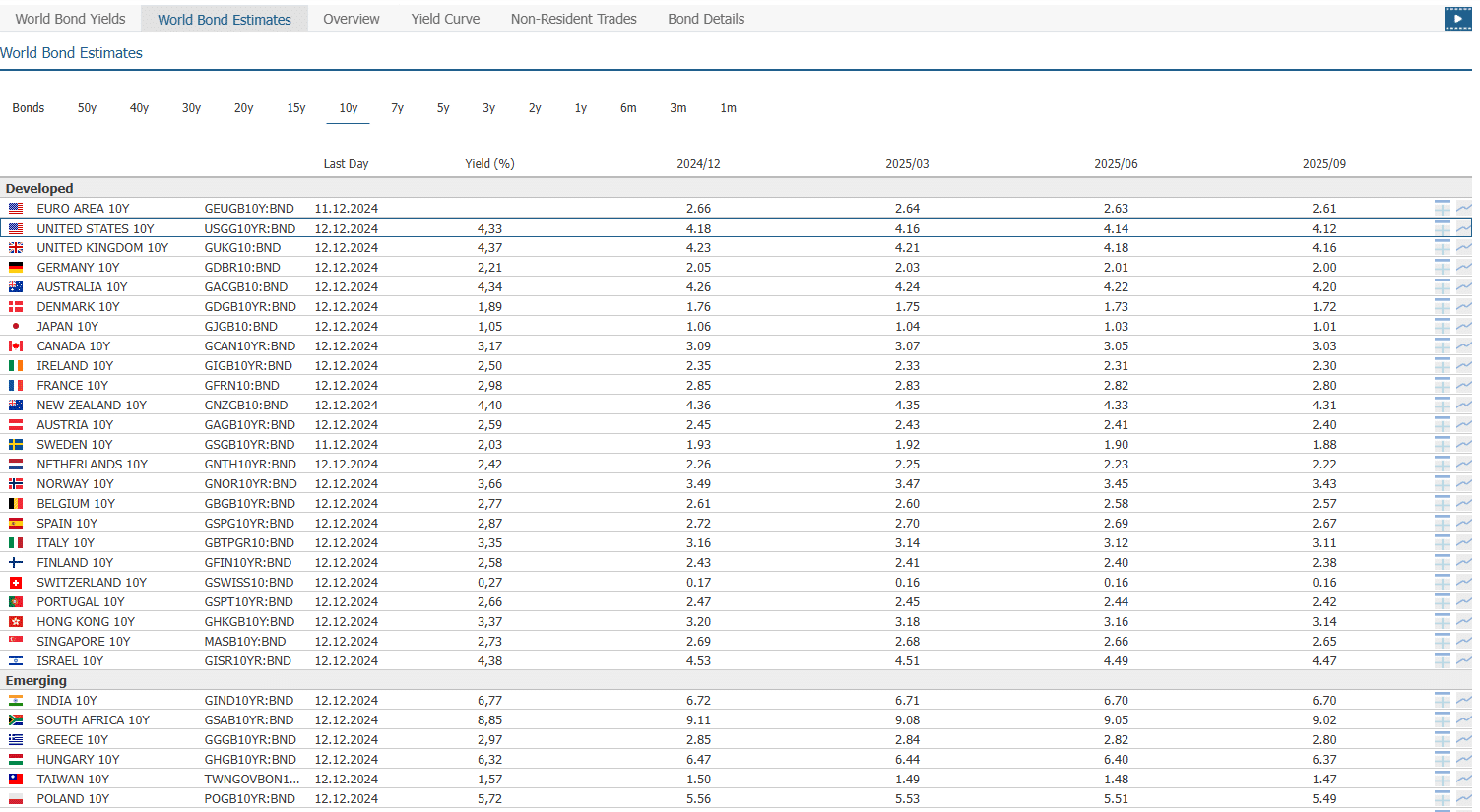

EquityRT platform provides tools for exploring government bonds categorized by maturity and market type, allowing users to compare yields across countries. By examining government bonds across different maturities, you can assess market stability and investor sentiment.

The ‘World Bond Yields’ page offers a grid view of government bonds in local currencies, allowing easy yield comparisons from 1 month to 50 years. Users can access detailed data on yield changes in basis points (bps) and activate bonds for Excel. Additional tabs organize benchmark bonds by maturity and market type, enhancing navigation and analysis. The sections are organized by maturity lengths and categorized into developed, and emerging markets, making navigation and comparison easier and timesaving. This structure allows users to quickly access and analyze bond market data according to their needs.

The ‘World Bond Estimates’ page offers an informative comprehensive overview of projected trends for government bonds, denominated in local currencies. From as short as one month to as long as fifty years, it offers a broad maturity range. It presents not only the current yield rates but also projections for the upcoming four quarters, efficiently classifying nations according to their individual bond maturities. Users’ decision-making process is improved by this dual presentation, which makes it simple to compare current yields with projected future rates.

Advanced Analytical Tools by EquityRT

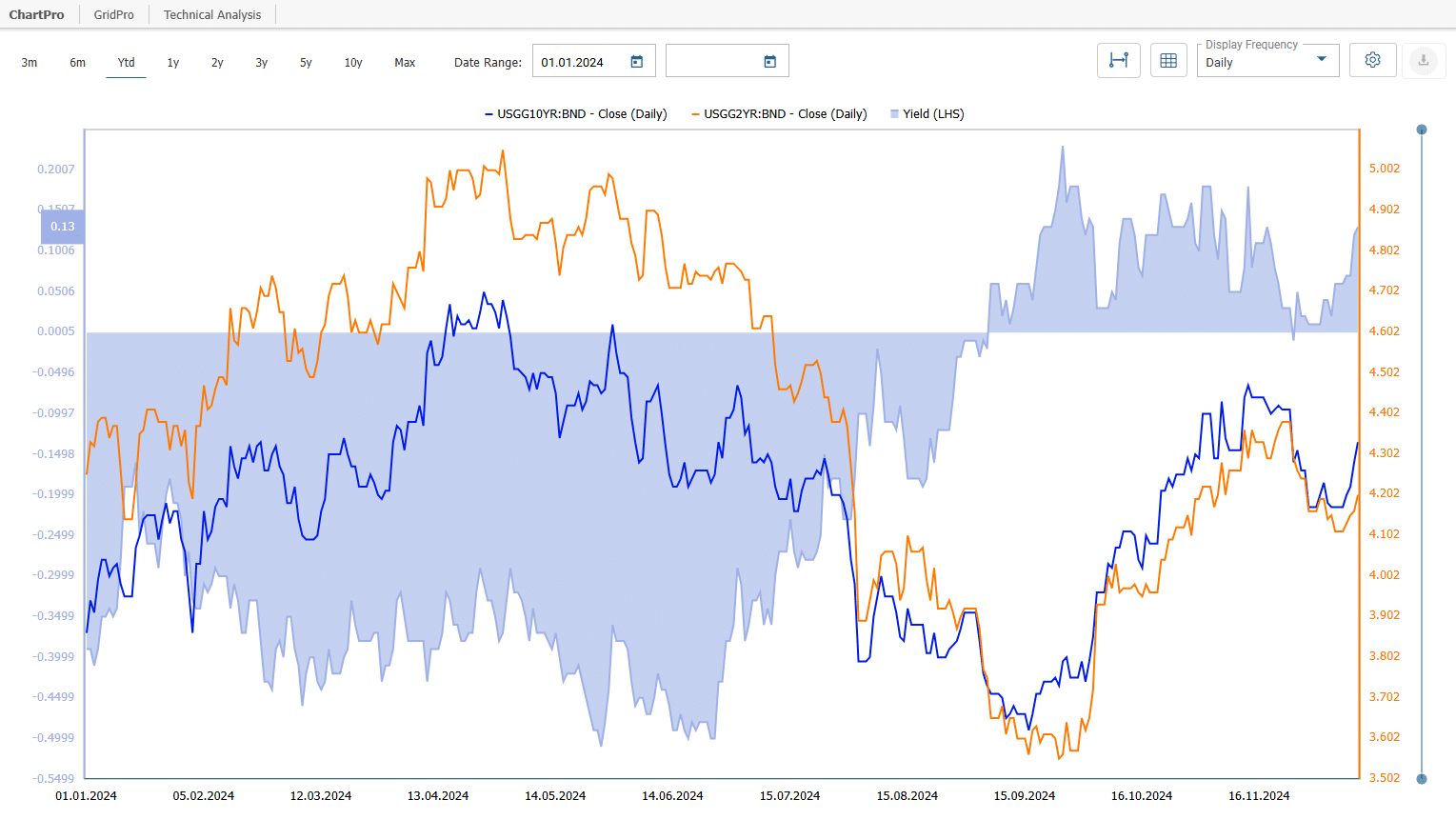

EquityRT platforms offers its users sophisticated analytical tools like GridPro and ChartPro, which are directly connected with each bond’s listing, for readers who are interested in further in-depth analyses. By giving users comprehensive insights, these tools expand their analytical capacities.

Additionally, an illustrative video on the upper right corner of the page is available to encourage user involvement and makes sure users can make the most of the platform.