The Covid-19 pandemic has caused a big shock to sub-Saharan Africa and led to its first downturn in 30 years- threatening to wipe out decades of economic progress. According to the IMF’s latest report, the region contracted by an estimated 2.6% in 2020. Lower private consumption and investment due to pandemic containment measures, sharp declines in services and industry heavily disturbed the economic activity.

The crisis confirmed that the impact is asymmetric across different country groups. The countries that rely on travel and tourism, and the countries that export commodities, particularly oil, were hit hardest.

The region is expected to grow by 3.2% in 2021 but at a much slower pace than elsewhere in the world. The growth will depend on the improvement in domestic consumption, investments, and pick up in both exports and commodity prices as the world gains optimism after the vaccine rollout.

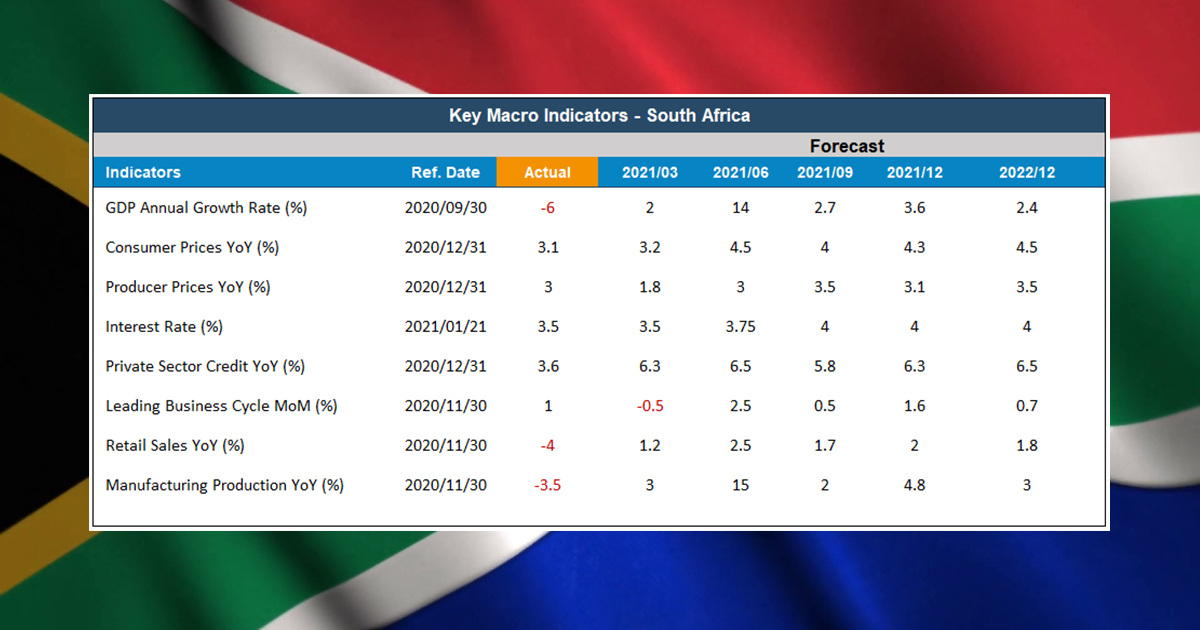

Below, we have put together the macro readings of the pandemic’s economic impact on South Africa, the second-largest economy in the region after Nigeria and Africa’s representative at the G20.

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

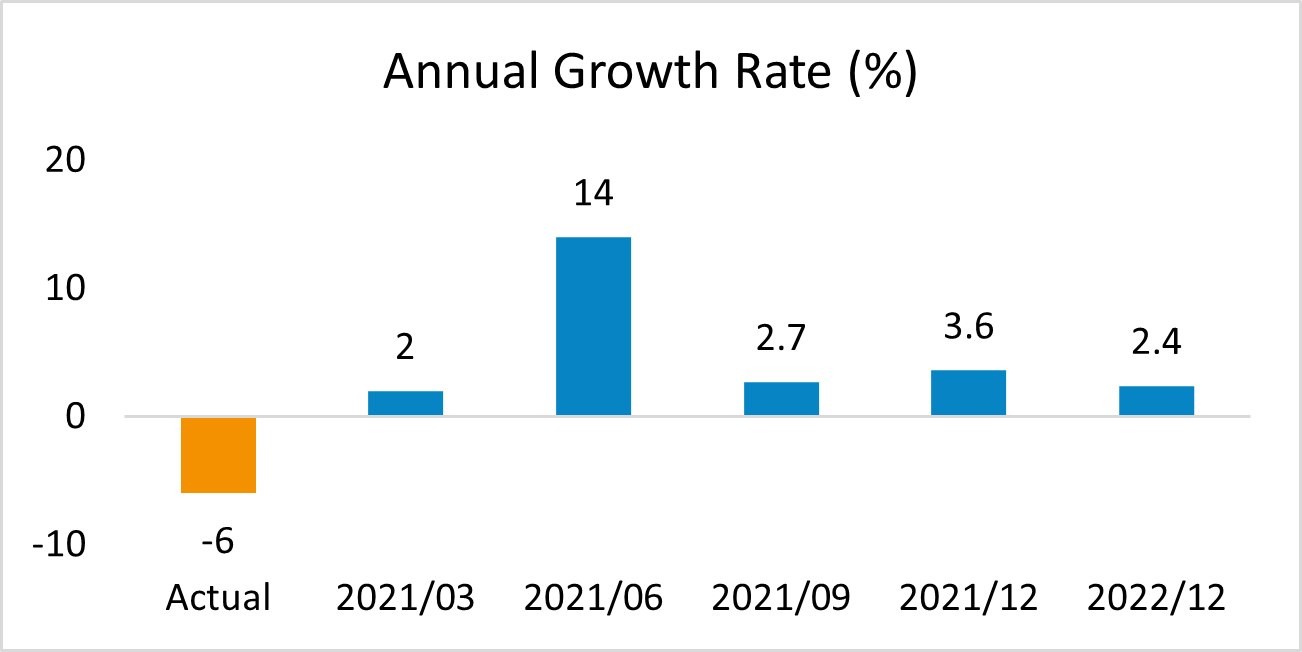

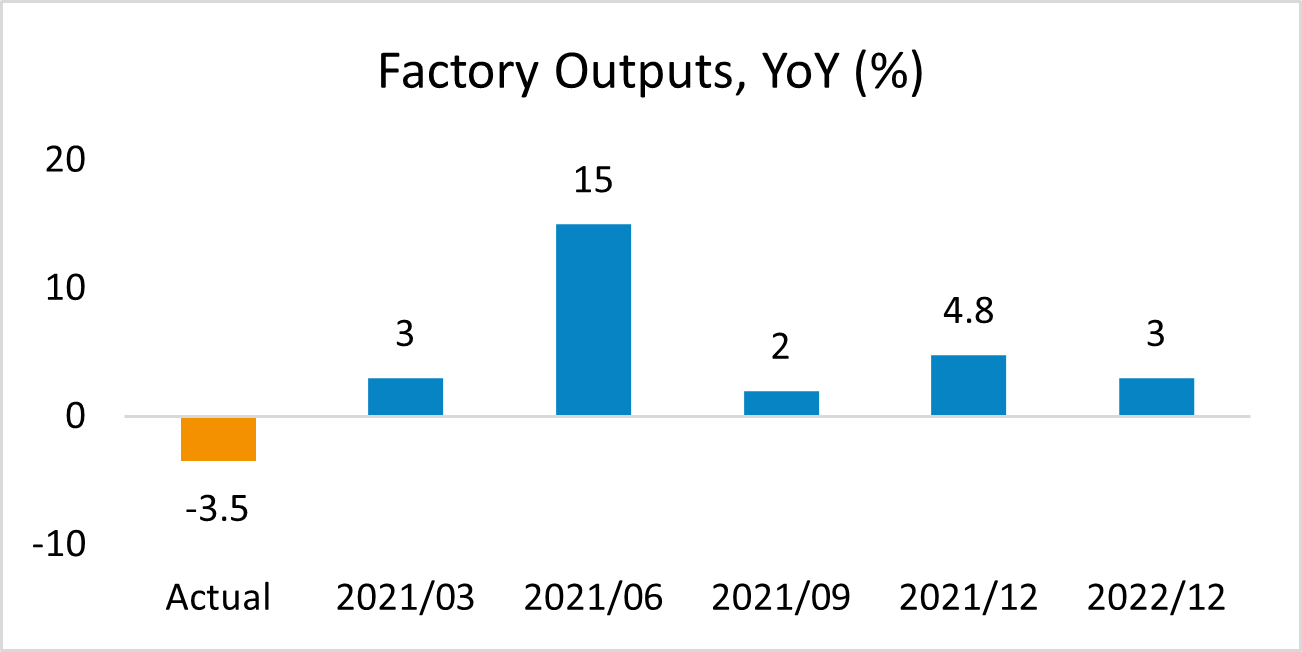

The degree of the lockdowns on economic activity and the likelihood of social restrictions on social mobility are the downside risks for the growth outlook. The annual growth forecast now stands at -4.8% for 2020 and domestic growth is expected to rise by 3.6% in 2021. The data for Q4 2020 will be out on March 09, 2021.

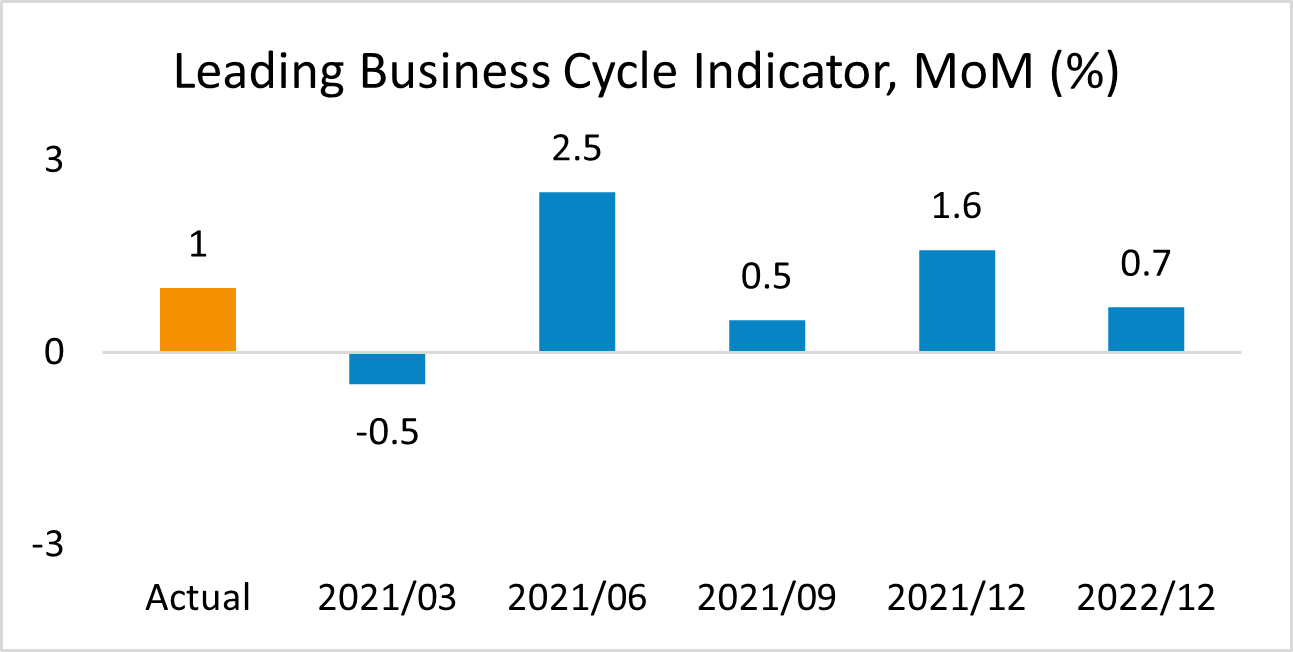

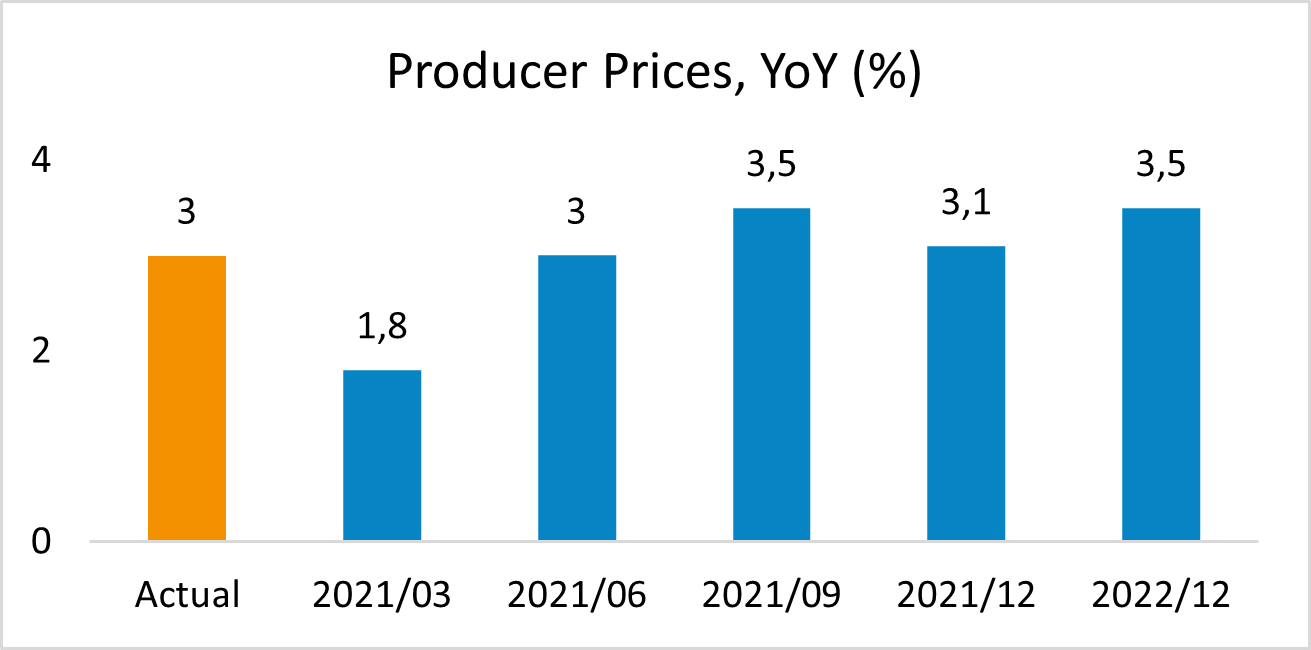

The main contributors to the increase were an improvement in the business confidence and an increase in the US dollar-denominated South African export commodity price index.

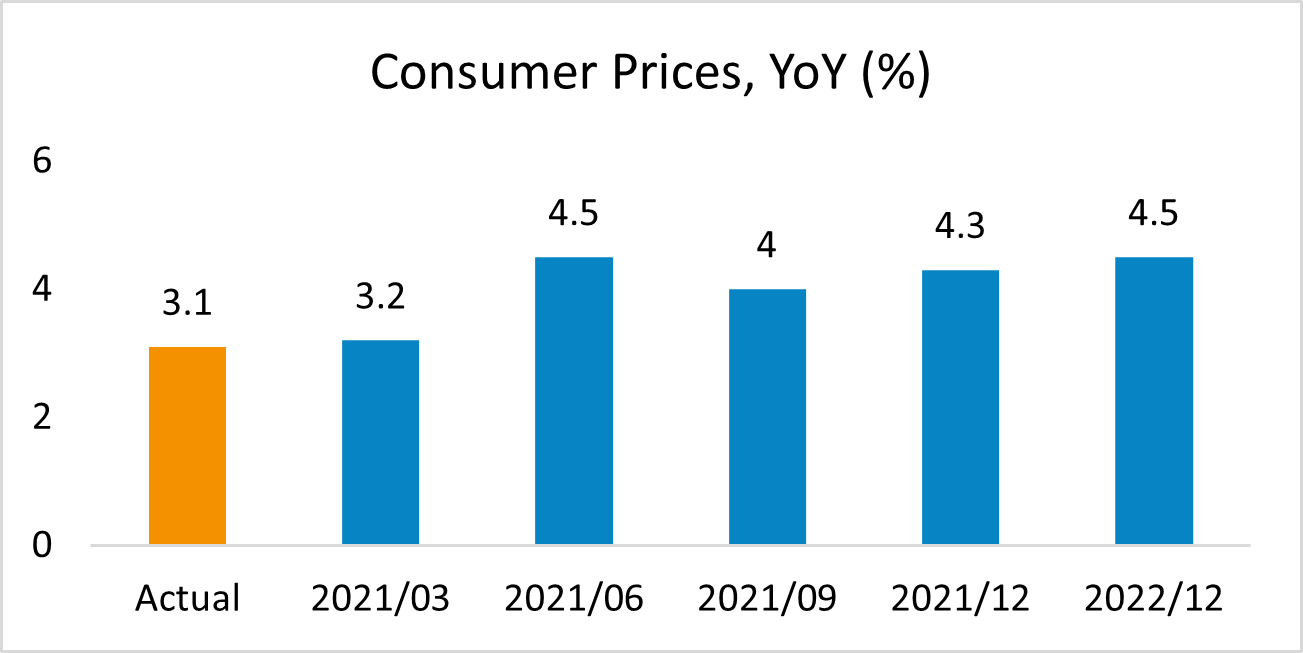

On the consumer side, the annual inflation finalized 2020 at 3.1% in December, moving closer to the lower band of the Reserve Bank’s target range of 3% – 6%. The reading indicated that the average consumer inflation in 2020 (3.3%) was the lowest since 2004. Despite that, food inflation climbed to a three-year high (6%).

Forecasts show that the consumer inflation will edge up to 4.3% while food prices are estimated to stand at 4% this year.

The data indicated that even Black Friday shopping was relatively muted compared to previous Black Friday sales. Looking forward, the annual change in retail sales is estimated to stand at 2% in 12 months.

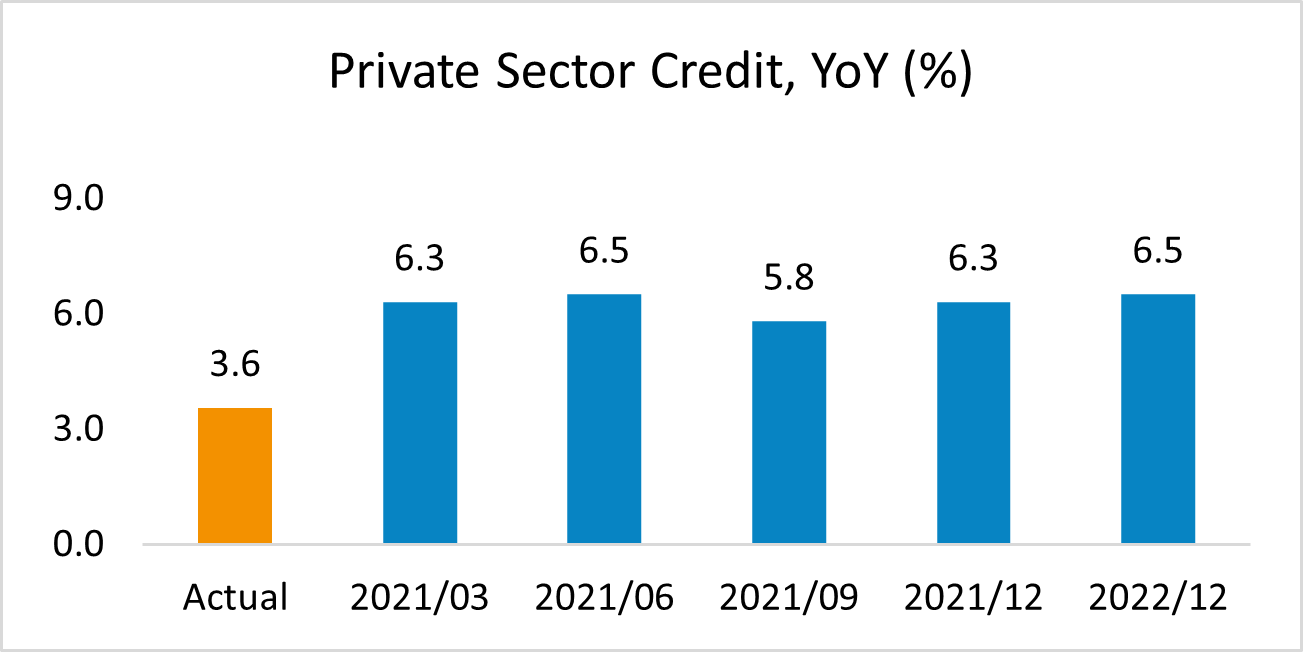

The low aggregate demand and prudent lending conditions of financial institutions are the main risks to the credit expansion.

The credit demand is likely to improve in 2021 if supported by low-interest rates and normalization of activity following the vaccine rollout.

On the other hand, manufacturing PMI continued to expand gradually to 50.9 in January 2021 even though the reading is lower than the average in the fourth quarter of 2020.

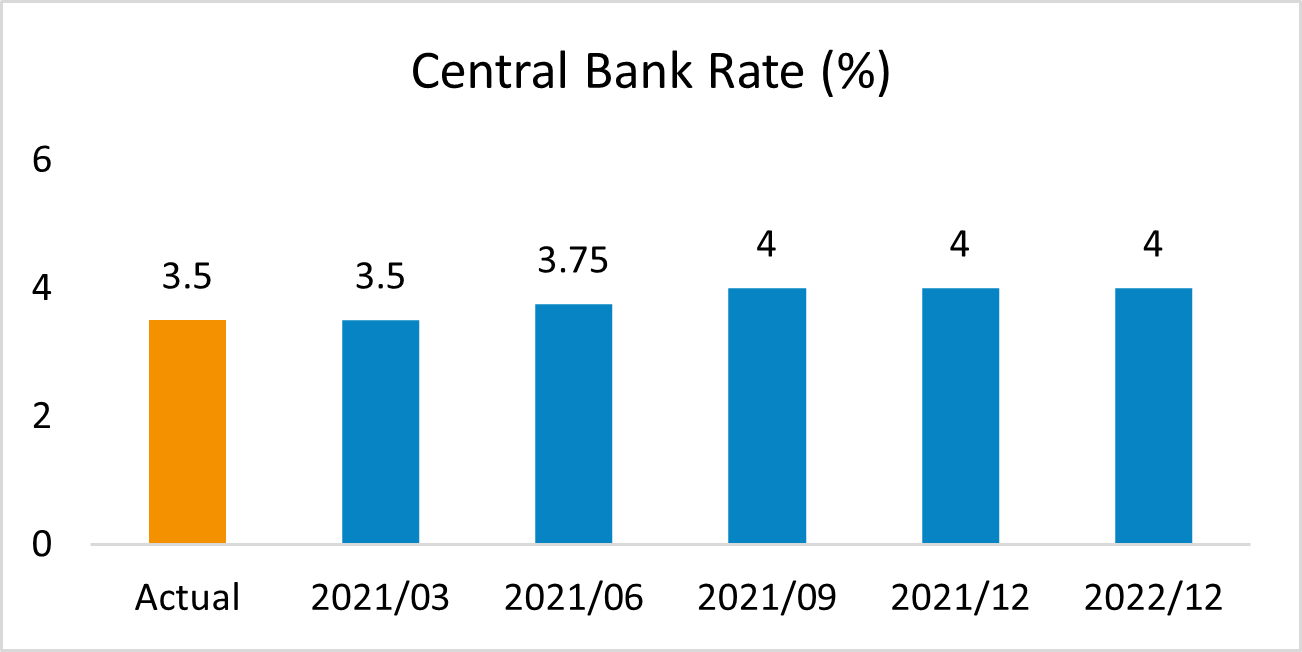

The Bank signaled that tightening may start sooner, indicating two increases of 25 bps in Q2 and Q3 of 2021, adding that the decision would be data sensitive.

The next monetary meeting will be held on March 25, 2021.

Data update cut off date: Feb 8, 2021.

Need access to global macro indicators to keep a pulse on the global economies? Please contact us at info@equityrt.com

by Ozge Gurses I Macro Research at EquityRT

Source: National sources, Trading Economics forecasts via EquityRT