The Fed’s sharpest interest rate hike in almost 30 years

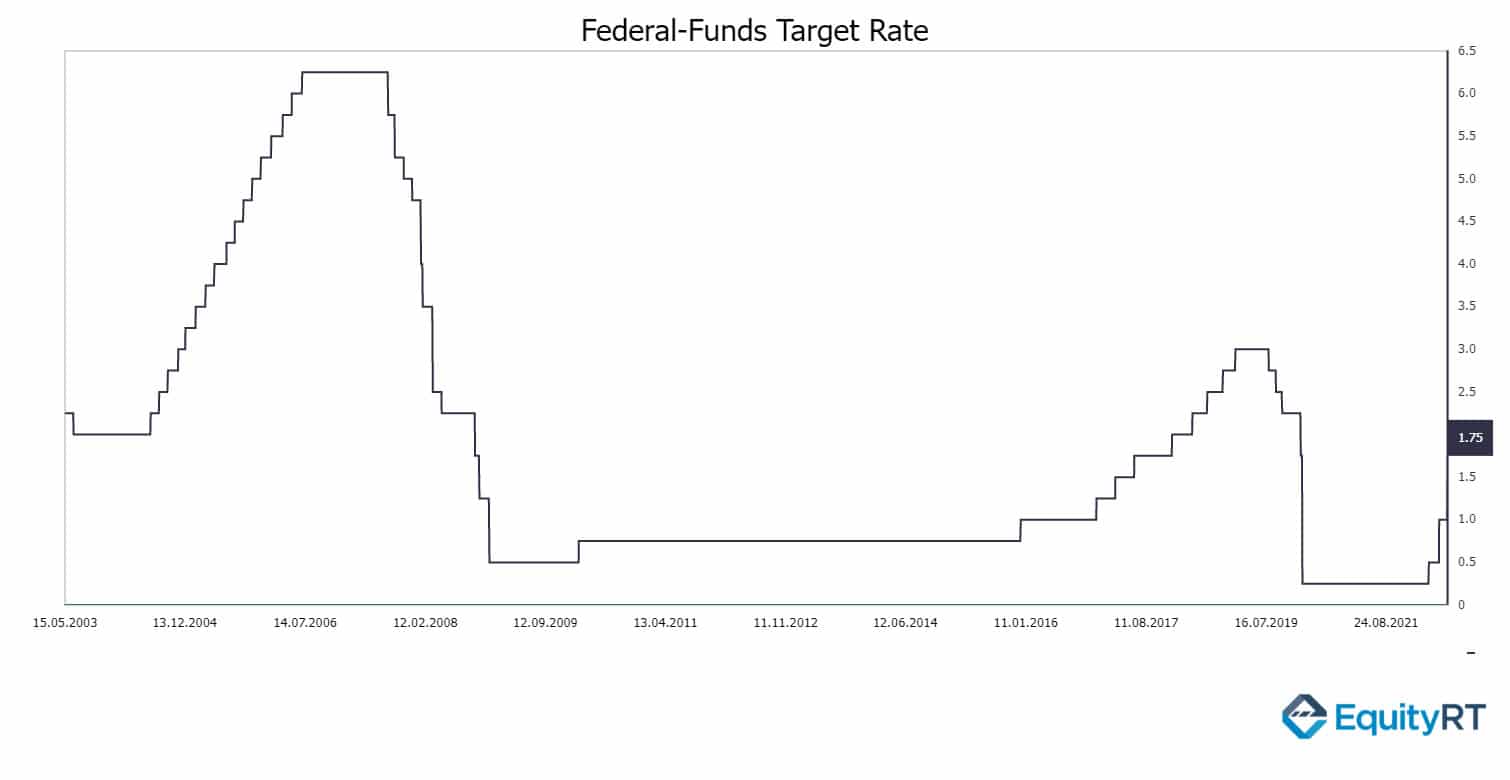

The U.S Federal Reserve policymakers approved the sharpest interest rate hike since 1994 and lifted the federal funds rate by 0.75 bps during the June 2022 meeting on Wednesday. The hike has taken the benchmark to a range between 1.5% – 1.75%.

The Fed’s latest median estimate predicts a benchmark rate of 3.4% at the end of 2022, and 3.8% at the end of 2023, with the rate falling to 3.4% in 2024.

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

The median forecast for GDP growth in 2022 was cut by 1.1 points to 1.7% in June compared with a 2.8% expansion projection in March.

Growth is likely to slow further next year, limiting the chance of a “soft landing” in which inflation falls without a recession.

Classically, when the Fed has had to increase rates rapidly, economic downturns were difficult to avoid.

Uncertainty about the monetary policy was the main source of the market volatility this year. More rate hikes are expected in the coming months adding to the uncertainty in the economy. Investors’ point of concern is that the Fed may slow the economy too much to reduce inflation and spark a recession.

The guidance the Fed provides about the direction of the interest rates is more important for the financial markets than the size of the rate increases.