Capital markets always operate in a competitive environment due to their fast and constantly changing nature. Similar to how runners participate in separate categories for long and short marathons, the situation is not very different for company stocks. Some stocks are suitable for long-term races, while others are ready for shorter sprints. What is crucial for some stocks now may be preparing for future long-term races for others.

So, how do financial analysts distinguish this? For instance, is it possible to differentiate between long-distance and short-distance runners?

Can Ratios Predict the Future?

In fact, financial analysts do not possess the ability to foresee the future. Here, highly professional and trained individuals process the data they acquire (experience being a crucial factor), categorizing stocks through the analysis of this processed data and making predictions. Professionals in this field often provide recommendations such as buy, sell, or hold for stocks, aiming to generate profits for their portfolios and, naturally, for their clients.

Financial analysts frequently employ ratio calculations in making these predictions, revealing how stocks can be likened to different types of runners. While some stocks exhibit promising ratios for the future, others stand out with their current sales ratios and low debt levels. However, it is not accurate to classify all stocks as good or bad based solely on their displayed financial performance. Among them, there are stocks with ratios that could be considered average – neither exceptionally good nor bad.

It is essential to remember that, despite the significant importance of presentations made by professional analysts, they are human beings and do not possess the ability to predict the future; they make informed predictions.

All the information you need in one place. Add EquityRT in your toolkit for quality investment reaserch.

Which One is Better?

It would be a significant surprise to see all the runners finish the 100-meter race in the same time. At this point, runners typically have a ranking. Similarly, stocks can be ranked based on ratios that reflect their financial condition. Of course, the ranking should be made among logically selected options. Just as a comparison between a 100-meter sprinter and a marathon runner is not valid, stocks cannot be compared across different sectors. They are compared within their own sectors and even within their close regions or with stocks from countries with similar economic conditions.

Key Financial Ratios Every Business Should Know

The financial health of a company refers to its overall financial well-being and ability to meet its financial obligations, sustain its operations, and generate profits over the long term. It involves an assessment of various financial metrics, ratios, and indicators to gauge the company’s fiscal soundness and stability.

- Profitability:

-

- Evaluating the company’s sustained profitability is crucial. Key metrics involved in this analysis encompass net income, gross margin, operating margin, and both pretax and profit margins.

- Liquidity:

- Examining the company’s ability to fulfill short-term obligations is vital. This evaluation includes a scrutiny of the current ratio (current assets divided by current liabilities) and the quick ratio.

- Efficiency:

- Efficiency ratios provide insights into how well a company utilizes working capital to generate sales. Various efficiency ratios, such as asset turnover, payables turnover, and inventory turnover, offer comprehensive analyses.

- Leverage Ratios:

- Companies commonly utilize short and long-term debt for operational funding. Leverage ratios quantify the extent of a company’s indebtedness. Notable leverage ratios include the Debt Ratio and debt-to-equity ratio.

- Market Value Ratios:

- Market value ratios gauge the overall value of a company. While often utilized by external stakeholders like investors and market analysts, these ratios are also beneficial for internal management. Key market value ratios encompass Earnings Per Share (EPS) and the Price-to-Earnings (P/E) ratio.

Investors, creditors, and other stakeholders use an analysis of a company’s financial health to make knowledge-backed choices. A financially healthy company is generally better positioned to navigate challenges, pursue growth opportunities, and provide returns to its investors.Top of Form

Understanding what a ratio is and how it is calculated is crucial to grasp a robust ratio. After all, knowing that the lower the P/E ratio, the better, can prevent some wrong decisions, right?

All the information you need in one place. Add EquityRT in your toolkit for quality investment reaserch.

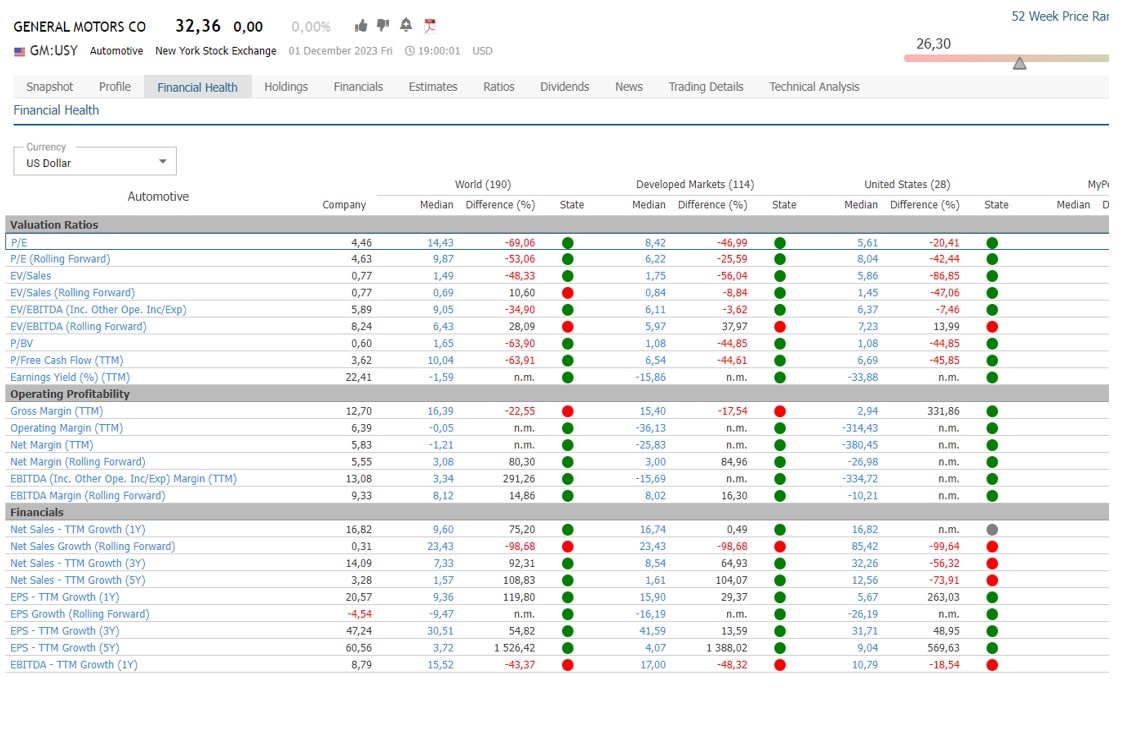

EquityRT Financial Health Screen: Effortless Insights and Sector Comparisons

The EquityRT Financial Health screen effortlessly provides a range of advantages. This section allows for a detailed comparison of selected or examined stock ratios with those of counterparts in the same sector on a national or global scale.

The listed metrics cover various aspects crucial for evaluating a company’s financial health and performance. Here’s a brief summary of their importance:

Valuation Ratios:

- P/E (Rolling Forward): Measures the stock’s valuation relative to its earnings, helping investors assess if it’s overvalued or undervalued.

- EV/Sales, EV/Sales (Rolling Forward), EV/EBITDA, EV/EBITDA (Rolling Forward): Evaluate the company’s valuation from different perspectives, considering sales and earnings.

Profitability Metrics:

- P/BV (Price to Book Value): Indicates whether a stock is priced fairly concerning its net asset value.

- Earnings Yield (%): Represents the earnings generated relative to the stock price, helping investors compare returns with other investments.

- Operating Profitability (Gross Margin, Operating Margin, Net Margin): Assesses the efficiency of operations and profitability at different stages of the income statement.

Financial Performance:

- Net Sales Growth (TTM, Rolling Forward, 1Y, 3Y, 5Y): Reflects the company’s revenue growth trends over various periods.

- EPS Growth (Rolling Forward): Measures the growth in earnings per share, indicating the company’s profitability trends.

- EBITDA Growth (TTM, Rolling Forward, 1Y, 3Y, 5Y): Evaluates the growth in earnings before interest, taxes, depreciation, and amortization.

Operating Efficiency:

- Quick Ratio, Current Ratio, Leverage Ratio: Gauge the company’s liquidity, solvency, and leverage positions.

- Working Capital (Net)/Sales (%), Receivables Turnover, Inventory Turnover, Payables Turnover, Cash Turnover, Total Asset Turnover: Indicate efficiency in managing working capital, inventory, and overall assets.

Financial Risk:

- Cash Earnings/Financial Expenses (TTM): Measures the company’s ability to cover financial expenses with cash earnings.

- Net Debt/EBITDA (TTM), Net Debt/Assets (%), LT Liabilities/Assets (%), ST Liabilities/Assets (%), Total Liabilities/Assets (%): Assess the company’s financial risk, leverage, and debt management.

Dividend Metrics:

- Dividend Yield (TTM, Rolling Forward, 3Y, 5Y): Indicates the dividend income relative to the stock price.

- Dividend Payout (TTM): Reflects the proportion of earnings distributed as dividends.

The screen’s green, red, and white circles rank stocks in the chosen sector worldwide based on ratio values, offering insights into their performance relative to the median value. With default region selections (Worldwide, Country’s Economic Class, and Domestic), as well as the “my peer” option, users can perform comprehensive comparisons within their chosen regions.

Unveiling Short and Long-Term Runners

Short-distance runners usually are riskier, but they consist of shares within the growing sector.

If you are looking for a short-term runner, the “Price/Earnings Ratio” should be the first thing to look at. In the Financial Health screen, this is an important ratio that indicates how cheap or expensive the stock is compared to other companies in its sector. In addition, “Profit Margins” and “Return on Equity (ROE)” are important indicators showing the company’s profitability and how efficiently it uses its equity.

If you are looking for a long-term runner, it is advisable to already look at “healthy”, reliable, and leading companies in the industry that have been established for a long time. These are generally lower-risk firms that can provide good returns over the long term. For a long-distance runner, “growth rates” are the most important ratios to consider. On the financial health screen, seeing how much faster the stock is growing compared to other companies in the sector, and how quickly the earnings per share are growing, will help you select a company that is likely to continue its success in the long term.

On the other hand, dividends, which are an important return on investment, are also a significant characteristic of long-term runners. Therefore, “dividend yield” and “dividend growth” in the financial health indicators are important criteria that will help you find the right long-distance runner.

In summary, the EquityRT Financial Health screen serves as a dynamic and user-friendly tool that not only simplifies the complexities of financial analysis but also provides a rich, visual interface for meaningful insights and sector-specific evaluations. It’s a valuable resource for anyone navigating the intricacies of the stock market and seeking a deeper understanding of company performance within specific sectors.