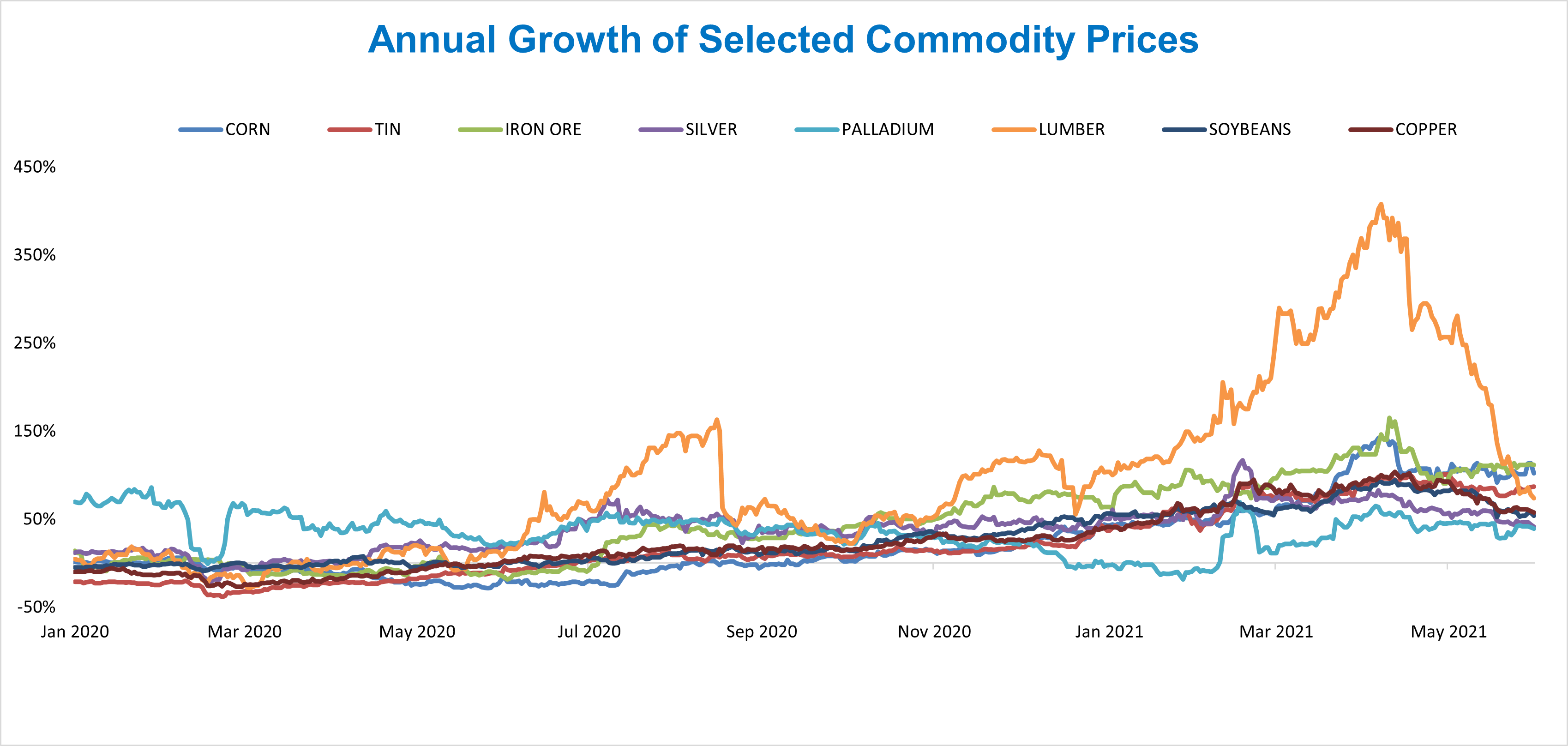

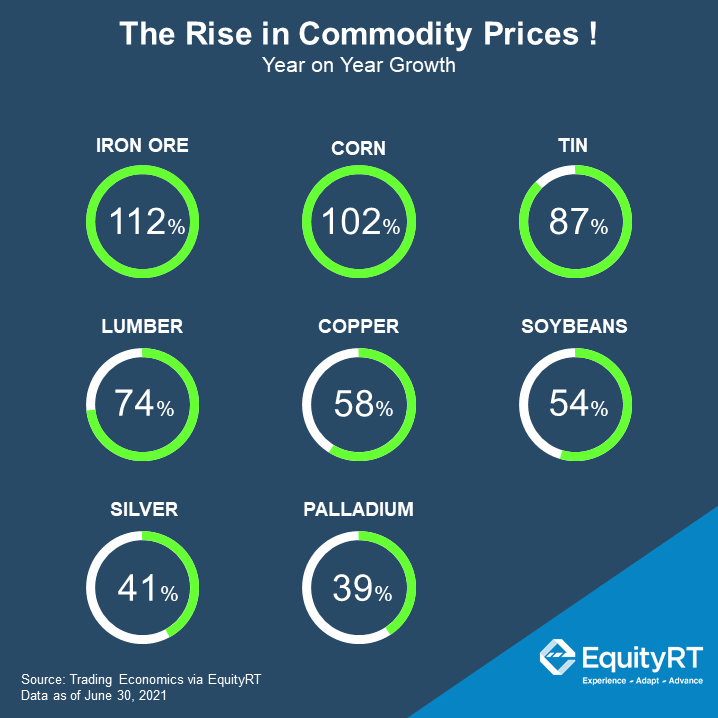

Commodity prices reached very high levels this year. A rebound in the world’s largest economies was driving demand for food, energy, and metals. The massive amount of liquidity injections along with the loose monetary stance and vaccine-driven optimism certainly supported the commodities demand.

From corn to iron ore and lumber, commodities across metals, energy, and agriculture sectors increased sharply.

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

The commodity prices tend to be the most volatile when compared to other prices in the economy because in the short term, supply and demand are relatively price inelastic. It takes time to increase commodity production.

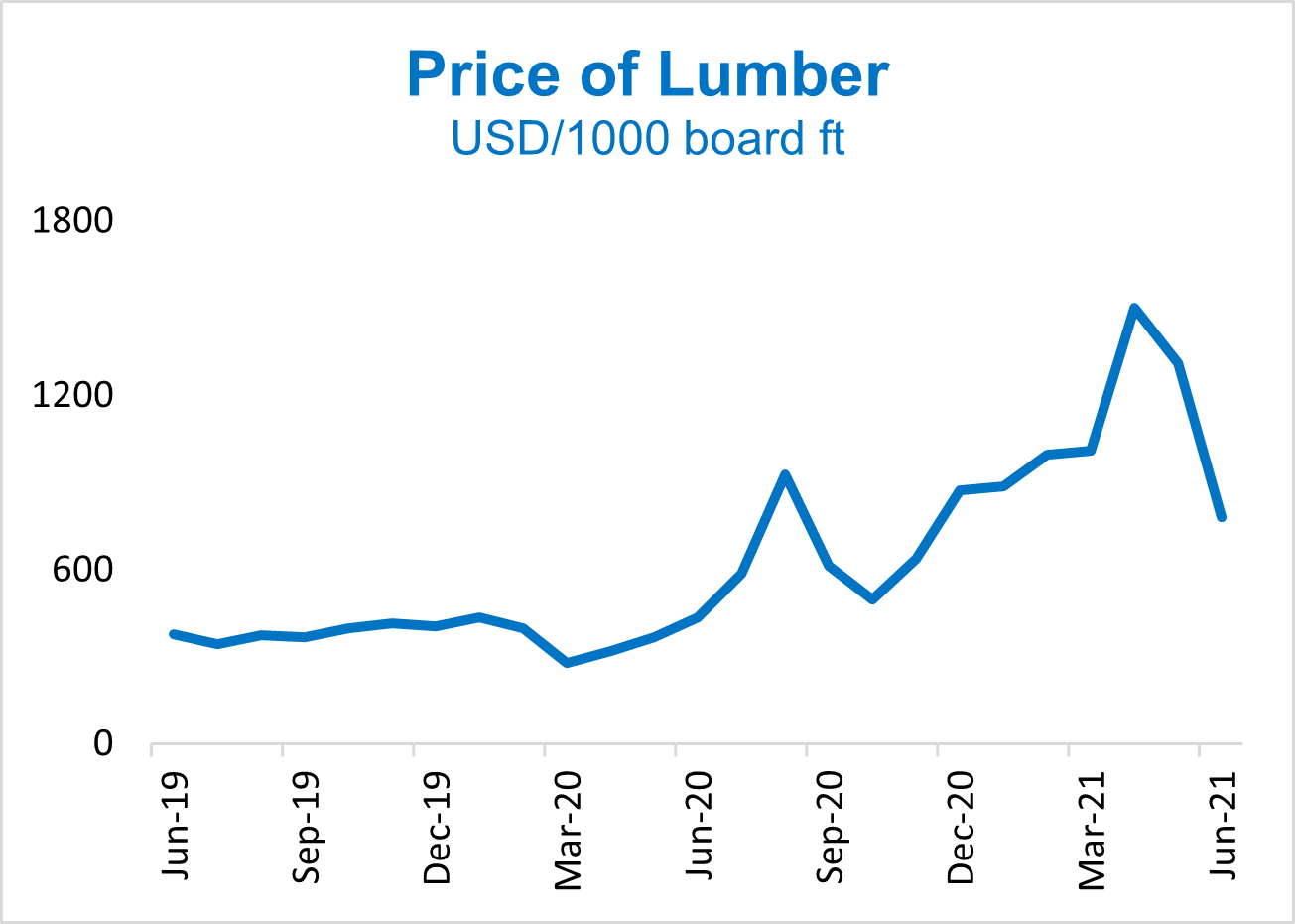

Among agricultural commodities, lumber prices soared over a year time and reached hyper highs as of 07 May 2021, increasing more than 400% compared to last year.

Lumber is the main material used to build most homes. According to estimates from the U.S. National Association of Home Builders (NAHB), construction on a new home has reached an average of about $36,000 dollars more than last year just because of lumber costs.

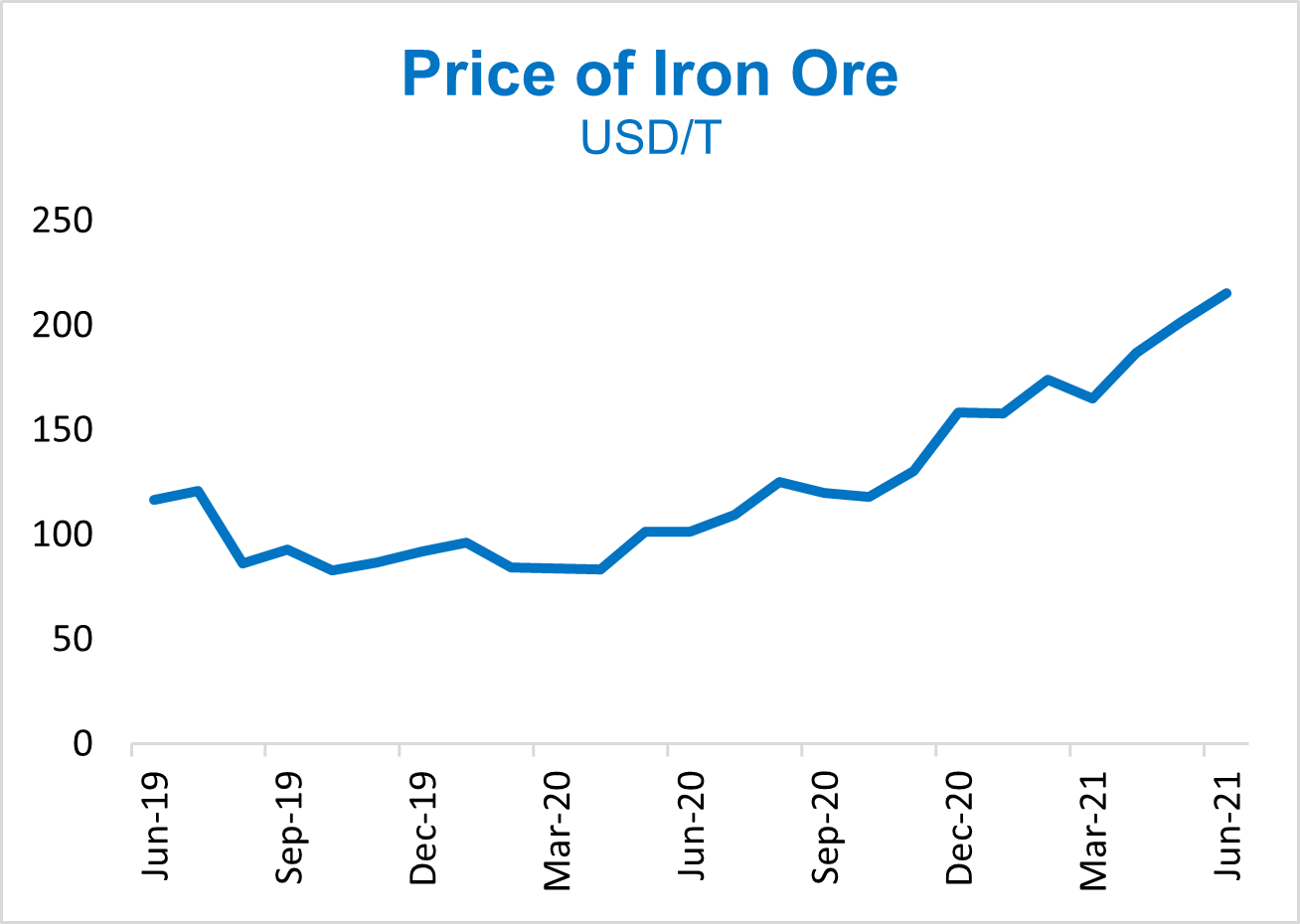

Iron ore stands out as the best performer among industrial commodities as a result strong demand from the Chinese steel industry and supply restrictions during the pandemic recovery period.

The primary use of iron ore is to make steel for infrastructure and other construction projects.

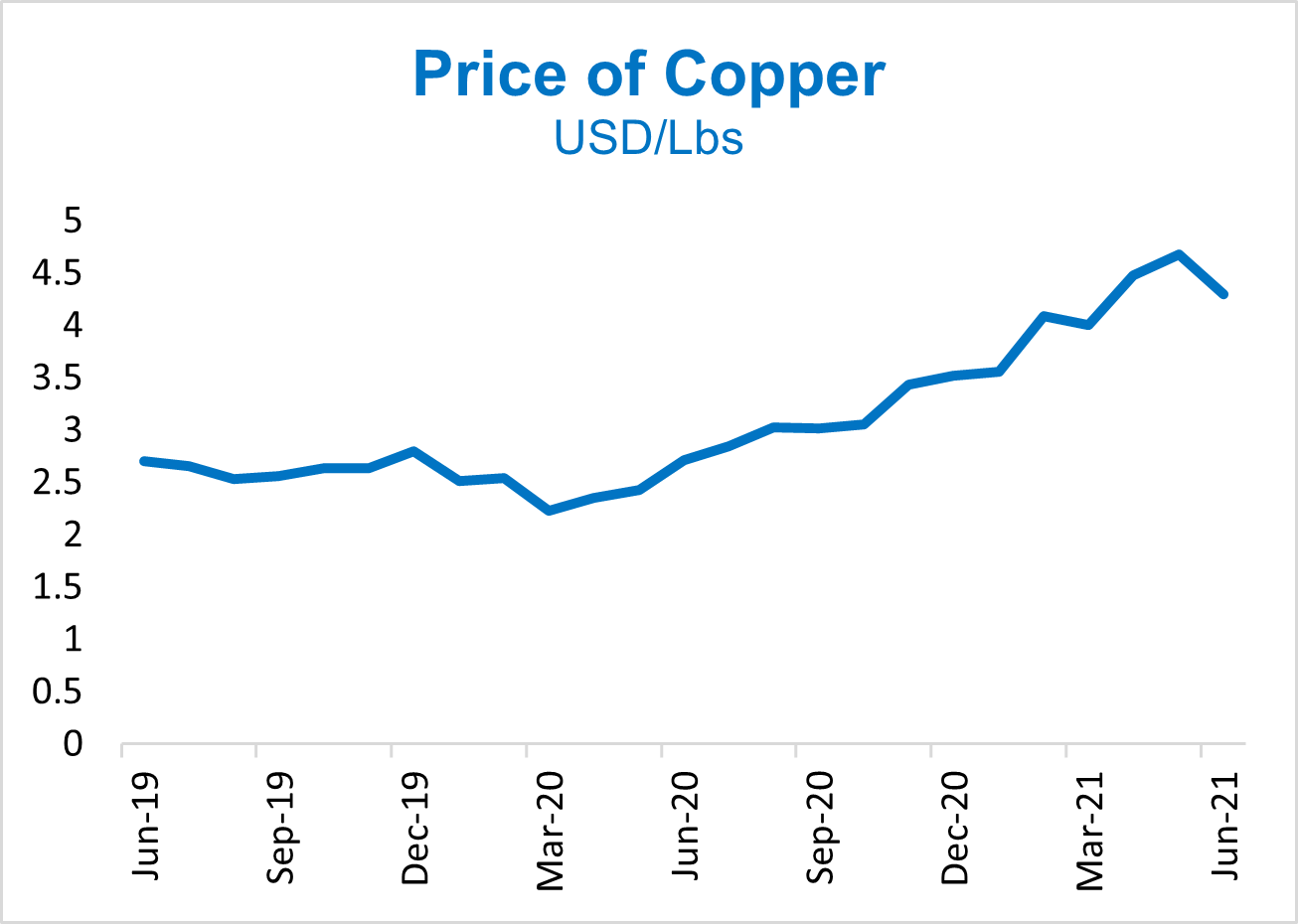

Copper‘s story is also similar to that of iron ore, where opening economies have been fueling demand for red metal by its major role in rapidly growing industrial sectors.

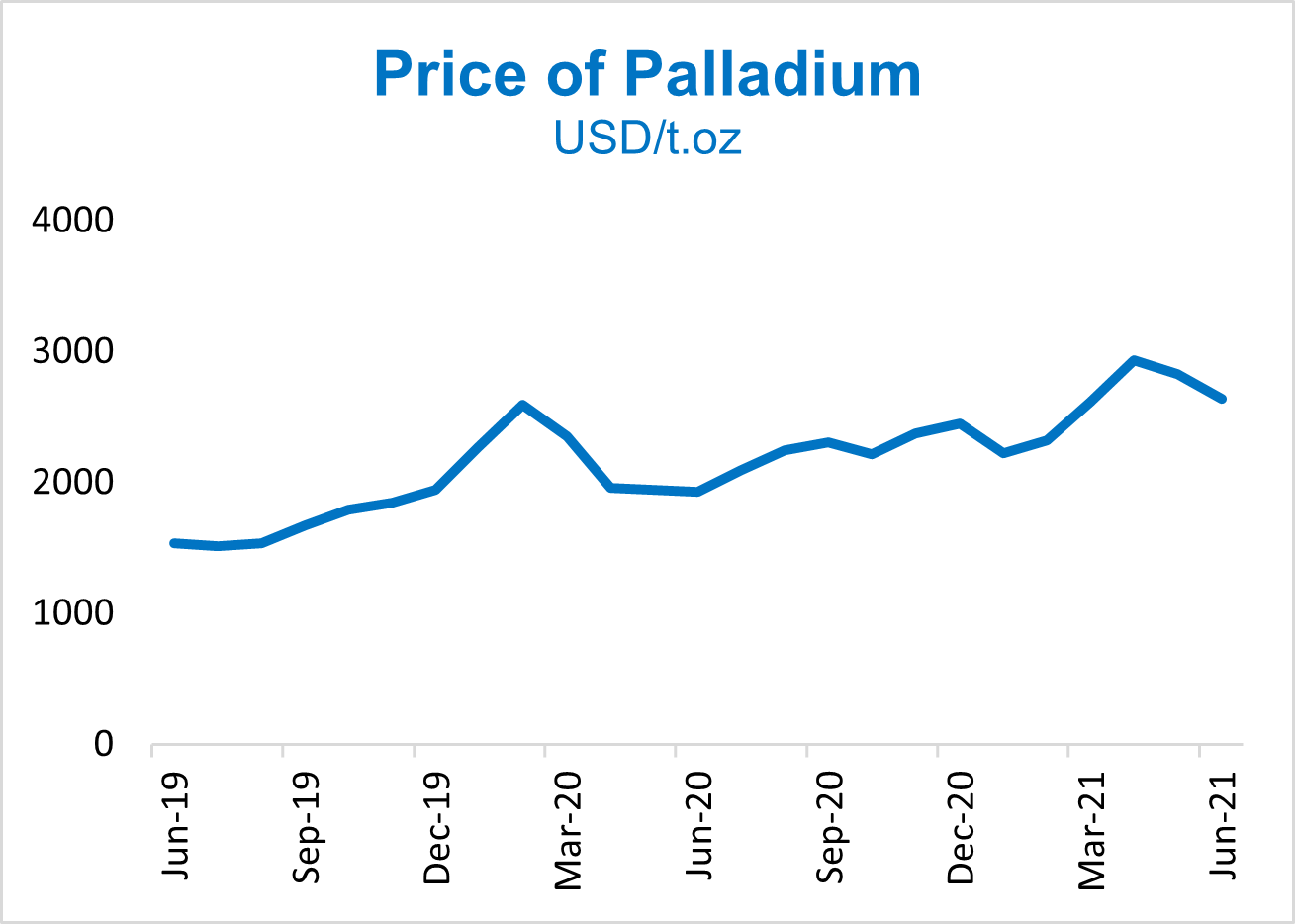

Tighter environmental standards imposed by many countries were pushing up automakers’ demand for palladium as this precious metal is a key input for catalytic converters which converts toxic substances into less harmful gases.

It is difficult to predict whether higher prices will ease or not. So, are we at the start of a new commodity supercycle or is this just a cyclical upswing triggered by the massive stimulus response to the pandemic?

A supercycle is defined as a period where prices rise above their long-term trends.

Rapid industrialization drives commodities into cycles where the squeezed supply takes prices above long-term trend lines and prices can not calm until growth slows down. A supercycle can last for decades.

History shows that supercycles are usually demand-driven and we would need to witness strong and sustainable demand growth in the years ahead.

Source: Trading Economics via EquityRT MacroAnalytics

Report by Özge Gürses | Macro Research at EquityRT

2021-07-12

Daily historical, current and estimated quarterly prices of key industrial commodities from metals to food products are available via EquityRT.

Contact us to get started with your free-trial of EquityRT MacroAnalytics.