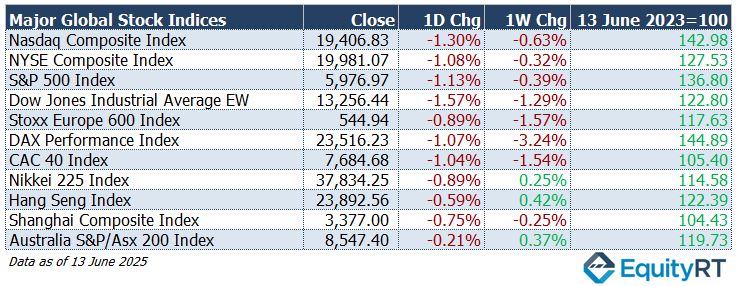

Global Stock Market Highlights

Last Friday, U.S. stock markets closed sharply lower as geopolitical tensions in the Middle East triggered a broad risk-off sentiment among investors. Technology and airline stocks led the losses, whereas defence companies and energy stocks, particularly oil giants like ExxonMobil, saw modest gains as investors shifted toward traditional safe-haven sectors.

- Nasdaq Composite Index closed at 19,406.83, down 1.30% on the day and down 0.63% for the week.

- NYSE Composite Index closed at 19,981.07, down 1.08% on the day and down 0.32% for the week.

- S&P 500 Index closed at 5,976.97, down 1.13% on the day and down 0.39% for the week.

- Dow Jones Industrial Average EW closed at 13,256.44, down 1.57% on the day and down 1.29% for the week.

European equities also came under pressure, extending a multi-day losing streak as global investors reacted to mounting conflict between Israel and Iran. The broader retreat reflected investor caution driven by geopolitical instability and a general move away from riskier assets.

- Stoxx Europe 600 Index closed at 544.94, down 0.89% on the day and down 1.57% for the week.

- DAX Performance Index closed at 23,516.23, down 1.07% on the day and down 3.24% for the week.

- CAC 40 Index closed at 7,684.68, down 1.04% on the day and down 1.54% for the week.

Asian markets mirrored the global trend, closing broadly lower ahead of the Western session. Investors in the region remained wary amid rising oil prices and concerns that Middle East tensions could further disrupt global trade and energy markets.

- Nikkei 225 Index closed at 37,834.25, down 0.89% on the day but up 0.25% for the week.

- Hang Seng Index closed at 23,892.56, down 0.59% on the day but up 0.42% for the week.

- Shanghai Composite Index closed at 3,377.00, down 0.75% on the day and down 0.25% for the week.

- Australia S&P/ASX 200 Index closed at 8,547.40, down 0.21% on the day but up 0.37% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 98.18, up 0.33% on the day, down 1.02% for the week, and down 9.47% year-to-date.

- The Brent crude oil, the global oil price benchmark, settled at $74.23 per barrel, surging 7.02% on the day, up 11.67% for the week, but still down 0.55% year-to-date.

- The Gold closed at $3,432.03 per ounce, rising 1.36% on the day, up 3.63% over the past week, and showing a strong 30.77% gain year-to-date.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, rose to 3.96%, up 4.00 basis points on the day, though down 8.70 bps for the week and 29.40 bps year-to-date.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, ended at 4.41%, climbing 3.80 basis points on the day, but still down 10.60 bps on the week and 17.00 bps since the start of the year.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

Geopolitical tensions in the Middle East, particularly following Israel’s strike on Iranian nuclear facilities, will likely remain a dominant theme in global markets. However, in the U.S., the focus shifts to both monetary policy and key economic data.

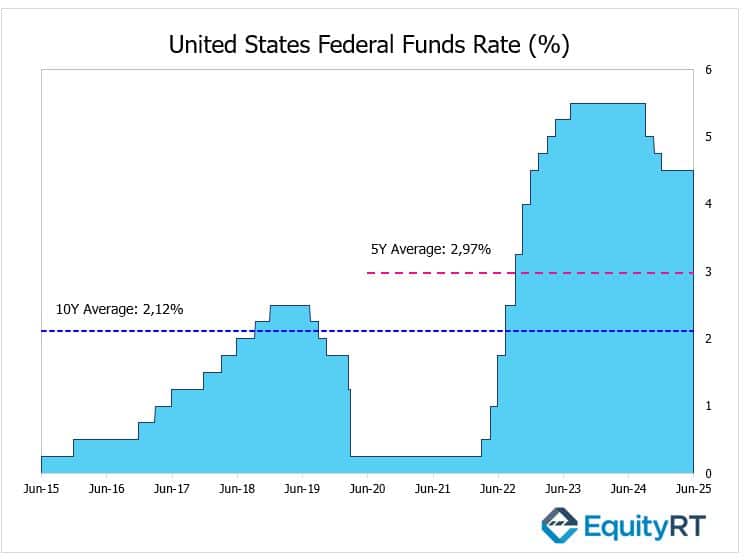

The Federal Reserve is widely expected to keep the federal funds rate unchanged at its upcoming meeting on Wednesday.

Market participants will pay close attention to the updated dot plot and economic projections for clues on how the Fed is interpreting recent signs of economic softness amid trade-related uncertainties. The path toward interest rate cuts appears to be clearing for the Federal Reserve, following signs of cooling inflation and softening labor market conditions.

While U.S. producer prices rose 2.6% in May, slightly above April’s 2.5%, economists estimate that core PCE inflation, the Fed’s preferred gauge, likely rose just 0.12% month-over-month.

Despite tariff-related inflation risks later this year, the near-term trend supports the Fed’s signal to begin easing.

On the data front, U.S. retail sales for May are projected to fall by 0.5%, marking the first monthly decline in four months, likely reflecting the early impact of new tariff announcements.

Industrial production is expected to rise only slightly, by 0.1%, following a flat reading previously.

Additional releases include building permits, housing starts, the NAHB housing market index, and regional manufacturing indexes such as the Empire State and Philadelphia Fed surveys. Also due are figures on import/export prices, business inventories, and capital flows.

Elsewhere in the Americas, Canada will publish data on retail sales, housing starts, and new housing prices. Meanwhile in Brazil, the central bank is expected to maintain the Selic rate at 14.75%, the highest level since 2006, signaling continued inflation vigilance.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

European markets will be driven by a combination of monetary policy decisions and macroeconomic data. In the Eurozone, flash consumer confidence is expected to improve slightly, and final CPI figures should confirm that annual inflation slowed to 1.9%.

In Germany, attention turns to the ZEW economic sentiment index, which is forecast to rebound modestly after plunging to a two-year low in April.

Several central banks are set to announce rate decisions:

The Swiss National Bank is widely expected to cut interest rates by 25 basis points, and speculation is growing over a potentially deeper cut that could reintroduce negative rates.

Similarly, Sweden’s Riksbank is expected to lower its policy rate by 25 bps, while Norway’s Norges Bank is likely to remain on hold.

In Turkey, the central bank is expected to leave its benchmark rate unchanged at 46%, though a symbolic adjustment to the lending rate may be on the table.

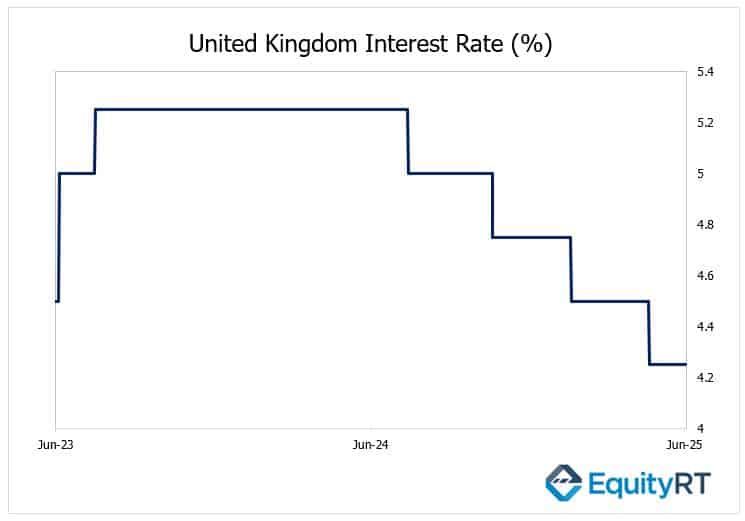

In the United Kingdom, the Bank of England is also anticipated to hold its Bank Rate steady at 4.25%. Ahead of the rate decision, the market will closely watch the May CPI report, which is expected to show a slight slowdown in headline inflation to 3.4%, down from the initially reported 3.5%. (This figure was later revised due to an error in vehicle excise duty data.)

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

In China, a broad set of high-frequency indicators—including industrial production, retail sales, fixed asset investment, and the unemployment rate were expected to point toward a further loss of momentum in May.

China’s unemployment rate edged down to 5.0% in May 2025, coming in slightly below both April’s 5.1% reading and market expectations. Meanwhile, fixed-asset investment grew by 3.7% yearly basis over the January–May period, missing the forecasted 3.9% increase.

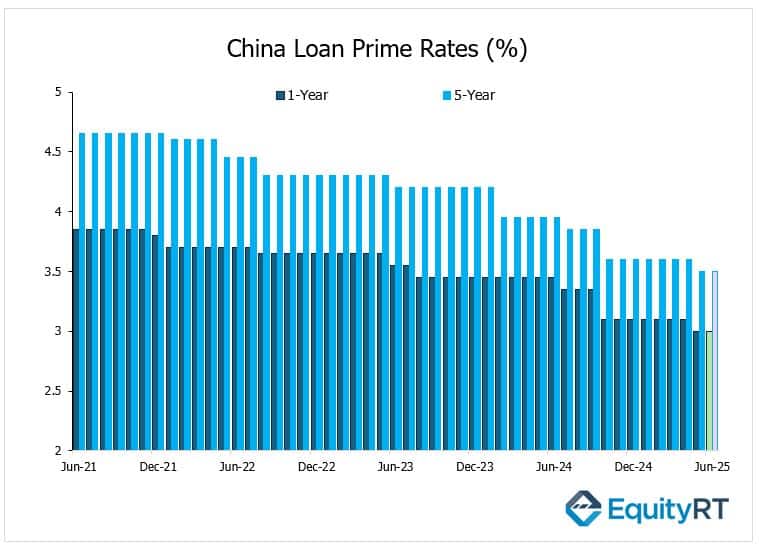

China’s central bank is widely expected to leave its key lending rates steady, 1-year and 5-year Loan Prime Rates (LPR), unchanged on Friday. The 1-year LPR is projected to remain at 3.00%, and the 5-year LPR at 3.50%, following last month’s 10 basis point cuts to both rates, now at their lowest levels since the LPR framework began in 2019.

While further easing is expected later this year, the People’s Bank of China is likely to pause for now, balancing support for growth with concerns over financial stability, bank margins, and external uncertainties, including trade tensions.

In Japan, the Bank of Japan is expected to maintain its current rate stance as policymakers assess the impact of U.S. tariffs on Japan’s export-driven economy. Trade data is expected to show sharp declines in both exports and imports, while machinery orders could plunge nearly 10%, reversing a strong gain in March.

Elsewhere in the region, India’s wholesale inflation is projected to ease slightly to 0.8%, from 0.85% in the previous month.

Australia will release its latest labor market data, with the unemployment rate expected to hold steady at 4.1%. Meanwhile, New Zealand will publish its Q1 GDP, with quarterly growth likely to come in at 0.7%, matching the pace of Q4 2024.

In addition, monetary policy meetings are scheduled in Indonesia, the Philippines, and Taiwan, with all three central banks expected to hold rates steady in the face of external uncertainties and fragile domestic recoveries.