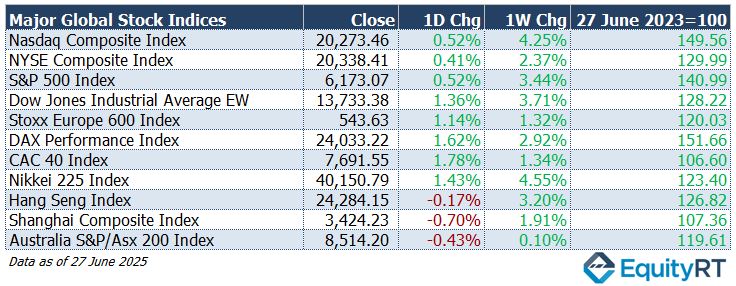

Global Stock Market Highlights

Wall Street closed by around 1% on Friday, supported by the positive impact of the US reaching a trade deal with China and signaling similar agreements with other countries soon. Easing Middle East tensions and a drop in US personal spending, despite higher-than-expected core PCE data for May, also boosted the gains.

- Nasdaq Composite Index closed at 20,273.46, up 0.52% on the day and up 4.25% for the week.

- NYSE Composite Index closed at 20,338.41, up 0.41% on the day and up 2.37% for the week.

- S&P 500 Index closed at 6,173.07, up 0.52% on the day and up 3.44% for the week.

- Dow Jones Industrial Average EW closed at 13,733.38, up 1.36% on the day and up 3.71% for the week.

European markets rallied strongly, buoyed by easing U.S.–China trade tensions and optimism over a potential U.S. interest rate cut. Here’s how they performed:

- Stoxx Europe 600 Index closed at 536.53, up 0.13% on the day and down 1.54% for the week.

- DAX Performance Index closed at 23,350.55, up 1.27% on the day and down 0.70% for the week.

- CAC 40 Index closed at 7,589.66, up 0.48% on the day and down 1.24% for the week.

Asia‑Pacific markets closed broadly higher, supported by global optimism on trade, easing geopolitical tensions, and growing expectations of a U.S. rate cut:

- Nikkei 225 Index closed at 40,150.79, up 1.43% on the day and up 4.55% for the week.

- Hang Seng Index closed at 24,284.15, down 0.17% on the day but up 3.20% for the week.

- Shanghai Composite Index closed at 3,424.23, down 0.70% on the day but up 1.91% for the week.

- Australia S&P/ASX 200 Index closed at 8,514.20, down 0.43% on the day but up 0.10% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 97.27, down 0.05% on the day, down 1.46% for the week, and down 10.31% year-to-date.

- The Brent crude oil, the global oil price benchmark, closed at $67.39 per barrel, down 0.50% on the day, down 12.49% for the week, and down 9.71% year-to-date.

- The Gold closed at $3,273.67 per ounce, down 1.65% on the day, down 2.83% for the week, but up 24.74% year-to-date.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, closed at 3.75 basis points, up 2.00 bps on the day, down 16.80 bps for the week, and down 50.40 bps year-to-date.

- The 10-year U.S. Treasury yield, an indicator of long-term borrowing costs, ended at 4.29 basis points, up 4.60 bps on the day, down 9.80 bps for the week, and down 29.10 bps year-to-date.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

In America, this week’s market focus will be shaped by a shortened US trading week due to the Independence Day holiday, but crucial economic data is still on the agenda.

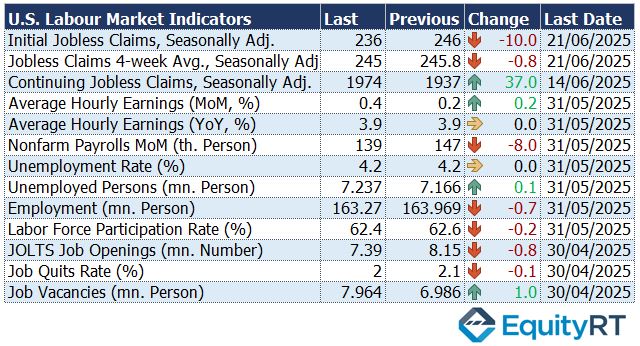

On Thursday, investors will focus on the release of the June jobs report, which is expected to confirm a gradual cooling in the U.S. labor market.

Nonfarm payrolls are forecast to increase by about 129,000, slightly below May’s gain of 139,000. The unemployment rate is likely to remain steady at 4.2%, while wage growth is expected to ease to 0.3%. Additional insights into labor market conditions will come from the JOLTS report, which may show job openings rising to 7.45 million, and the ADP private employment report, which is projected to reflect a mild rebound in private sector jobs.

Indicators suggest the labor market remains resilient but is slowing, a trend that could influence upcoming Federal Reserve policy decisions. The full report will provide more clarity on economic momentum moving forward.

Beyond jobs data, markets will look for signals on business conditions from the ISM Manufacturing PMI, which is expected to remain in contraction territory, while the Services PMI could hint at a modest recovery.

The US trade balance, final PMIs, factory orders, and regional Fed surveys will also be in focus. Elsewhere in the region, investors will monitor updated PMIs and trade figures for Canada, Brazil, and Mexico to gauge regional growth trends.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

In Europe, markets will focus on the ECB’s June meeting minutes, due Thursday. After cutting rates by 25 basis points in January, March, April, and again in June as expected, the ECB signaled it will continue a data-dependent approach given current uncertainty. President Lagarde said the latest cut puts the Bank in a strong position to tackle future risks and suggested the policy cycle may be nearing its end, while reaffirming the commitment to the 2% inflation target.

Besides this, all eyes will be on fresh inflation data from the Euro Area, which could influence the near-term policy outlook. Euro Area headline inflation is expected to tick back up to 2% after hitting an eight-month low, with core inflation likely staying close to 2.3%. Germany’s consumer prices are forecast to rise 0.2% month-on-month.

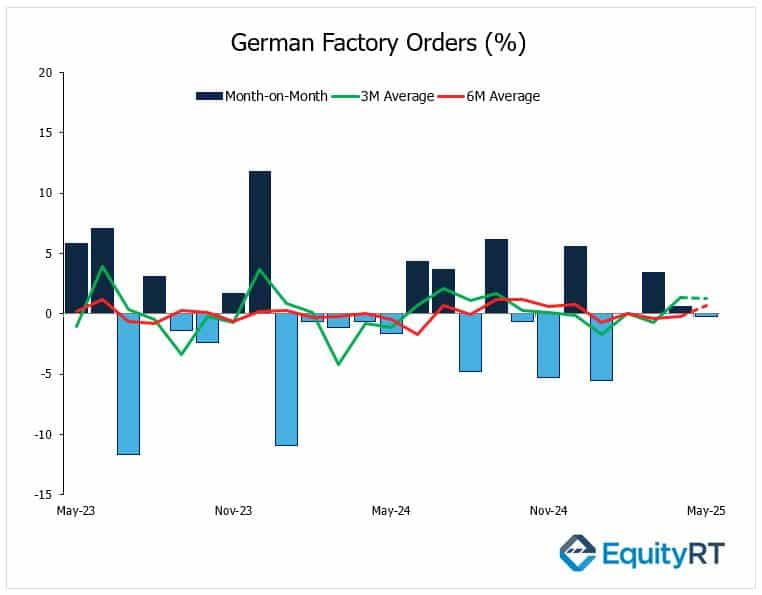

On Friday, May’s factory orders for Germany will be released. In April 2025, Germany’s factory orders unexpectedly rose by 0.6% month-over-month, defying market expectations of a 1.0% decline. This uptick was driven by a 2.2% increase in domestic demand, while foreign orders dipped slightly by 0.3%. The data suggests that, despite challenges, the German manufacturing sector may be experiencing a cyclical recovery. However, some analysts expect factory orders could post their first decline in four months in the coming period.

Manufacturing and services PMIs for Spain and Italy will also be closely watched for signs of growth momentum.

Labor market figures from the Euro Area, Germany, Italy, and Spain are due too, with the Euro Area’s unemployment rate expected to remain at a record low of 6.2%. In the UK, mortgage lending, final first-quarter GDP, and house price data will give clues on the state of the housing market.

France’s industrial output, Italy’s retail sales, and key Swiss figures, including the KOF leading indicator, CPI, retail sales, and unemployment will also be released.

Poland’s central bank will set interest rates, while Turkey’s inflation may ease to its lowest level since late 2021.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

Across the Asia-Pacific region, China’s manufacturing and services activity was in focus, with the official NBS surveys indicating that economic momentum remained subdued in June, reinforcing calls for further stimulus. The official NBS Manufacturing PMI rose to 49.7 in June 2025 from May’s 49.5, in line with expectations but marking the third straight month of contraction in factory activity

In Japan, markets will be focused on the Bank of Japan’s upcoming Tankan business sentiment survey, which is expected to show a slight decline in confidence.

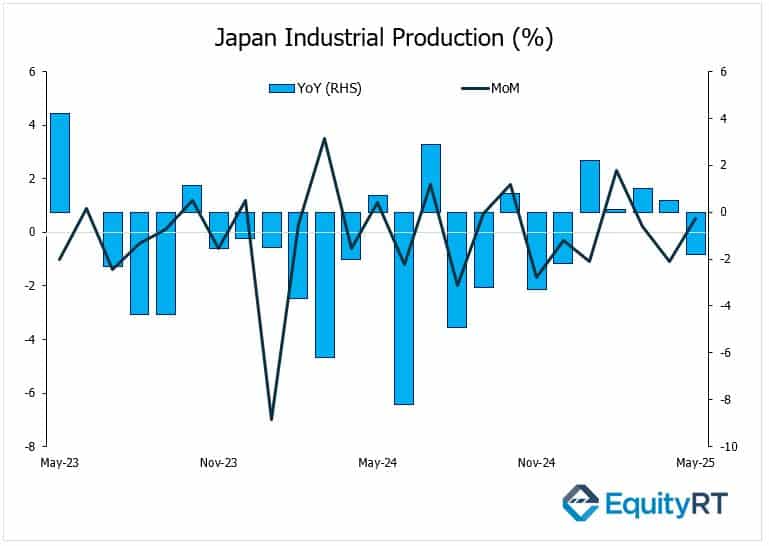

Official data showed that Japan’s industrial production fell by 1.8% in May 2025 compared to the same month a year earlier. On a monthly basis, output rose by 0.5% in May, recovering from April’s 1.1% decline but falling short of the 3.5% growth forecast.

Consumer confidence and household spending figures will also help gauge Japan’s domestic demand strength.

In Australia, the trade deficit is expected to have narrowed slightly, and retail sales may rebound by 0.3% after April’s small drop. Traders will also be watching new PMI readings and inflation and trade figures from South Korea and Indonesia for further signals on regional resilience.