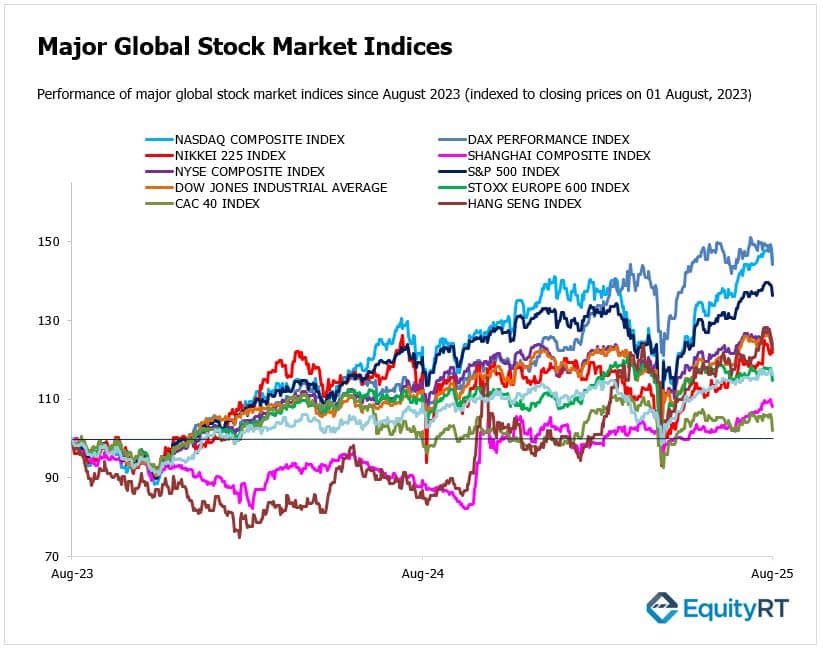

Global Stock Market Highlights

Friday marked the worst session for U.S. markets since May, with broad-based losses across sectors, particularly in tech. Rising recession concerns, triggered by poor hiring data, overshadowed resilience in tech and gains recorded earlier in July. Newly announced tariffs heightened uncertainty around trade and supply chains, compounding downside risk. Investors reacted by reassessing Fed rate trajectories, pushing long-dated bond yields lower and boosting expectations of a September interest rate cut.

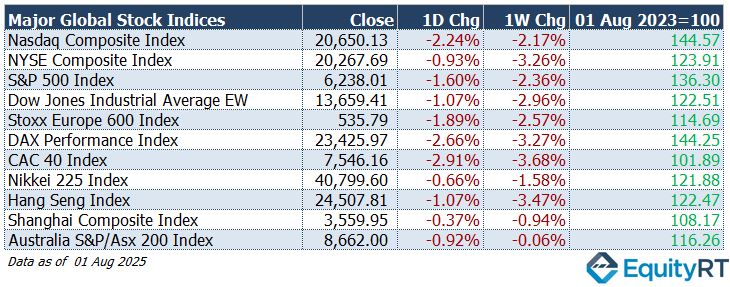

- Nasdaq Composite Index closed at 20,650.13, down 2.24% on the day and down 2.17% for the week.

- NYSE Composite Index closed at 20,267.69, down 0.93% on the day and down 3.26% for the week.

- S&P 500 Index closed at 6,238.01, down 1.60% on the day and down 2.36% for the week.

- Dow Jones Industrial Average EW closed at 13,659.41, down 1.07% on the day and down 2.96% for the week.

On Friday, in Europe, major benchmarks slipped modestly on concerns over earnings and trade uncertainty, though still held near weekly gains. U.S. President Trump announced that trade agreement talks with the European Union (EU) have been concluded. Under the deal, the U.S. will impose a 15% tariff on EU products, while the EU will not apply tariffs on U.S. goods and will fully open its markets to American products.

- Stoxx Europe 600 Index closed at 535.79, down 1.89% on the day and down 2.57% for the week.

- DAX Performance Index closed at 23,425.97, down 2.66% on the day and down 3.27% for the week.

- CAC 40 Index closed at 7,546.16, down 2.91% on the day and down 3.68% for the week.

In the Asia-Pacific region, markets closed lower, weighed down by Fed-related jitters and global risk-off sentiment, even as U.S. markets surged.

- Nikkei 225 Index closed at 40,799.60, down 0.66% on the day and down 1.58% for the week.

- Hang Seng Index closed at 24,507.81, down 1.07% on the day and down 3.47% for the week.

- Shanghai Composite Index closed at 3,559.95, down 0.37% on the day and down 0.94% for the week.

- Australia S&P/ASX 200 Index closed at 8,662.00, down 0.92% on the day and down 0.06% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, declined to 98.69, down 1.37% on the day, up 1.04% for the week, and down 9.00% year-to-date.

- The Brent crude oil, the global oil price benchmark, settled at $69.48 per barrel, falling 3.10% on the day, rising 1.52% over the week, and down 6.91% year-to-date.

- The Gold rose to $3,362.51 per ounce, gaining 2.25% on the day, 0.75% over the week, and 28.13% year-to-date.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, dropped to 3.70%, down 26.50 basis points on the day, 24.20 basis points for the week, and 55.40 basis points year-to-date.

- The 10-year U.S. Treasury yield, an indicator of long-term borrowing costs, declined to 4.23%, falling 15.00 basis points on the day, 16.70 basis points for the week, and 35.10 basis points year-to-date.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

The week will be shaped by developments in President Trump’s newly announced tariffs, a dense earnings calendar, and a series of key economic data releases. The U.S. earnings season continues with major reports from Palantir, Disney, Uber, Caterpillar, Pfizer, AMD, Amgen, McDonald’s, Eli Lilly, Arista Networks, Gilead, ConocoPhillips, and Vertex.

Economic indicators include the ISM Services PMI, which is expected to post its strongest reading in three months. Factory orders are forecast to decline by 5.2 percent in June, reversing the prior month’s 8.2 percent gain. The trade balance is likely to narrow as imports soften, and markets will also monitor Q2 productivity and labor cost data, as well as consumer credit figures. Following last week’s softer-than-expected labor market reports, comments from Federal Reserve officials will be monitored for clues on the future path of interest rates.

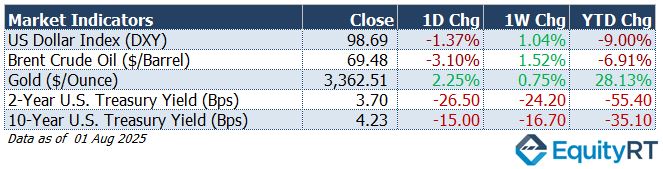

Weekly initial jobless claims data for August 2nd will be released on Thursday. In the fourth week of July, initial jobless claims in the US rose slightly by 1,000 to 218,000, remaining below the market forecast of 224,000 and close to recent lows.

Continuing claims stayed unchanged at 1.946 million, showing a modest decline from the highs recorded last month during the 2021 period.

The four-week moving average of initial claims dropped to 221,000 from 224,500 the previous week, indicating a labor market that remains robust despite a recent slowdown in hiring.

Although initial claims inched up slightly, they remain within historically low levels. The steady level of continuing claims points to some individuals experiencing longer periods of unemployment. The job market seems to be cooling gradually rather than weakening sharply, aligning with expectations of a soft landing.

In Mexico, Banco de México is widely expected to lower interest rates by 25 basis points. Canada’s calendar includes employment data, the trade balance, and the Ivey PMI. Brazil will release its latest trade figures.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

Upcoming Economic Indicators in Europe to Watch This Week

In Europe, the Bank of England is anticipated to deliver a 25-basis point rate cut to 4 percent amid weak growth prospects. UK economic data will be relatively light, with attention focused on the Halifax house price index.

Germany’s factory orders could show a moderate rebound, though industrial output might contract slightly. In France, industrial production is expected to improve, while Spain and Italy’s services PMIs are forecast to remain in expansion territory.

Swiss data will include manufacturing PMI, which may tick up modestly, while inflation is likely to remain unchanged at 0.1 percent.

Additional releases across the region include Eurozone retail sales, producer prices, French and Italian trade data, Swiss consumer sentiment, and unemployment data from Spain.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming Economic Indicators in Asia- Pacific to Watch This Week

In the Asia-Pacific region, China’s trade surplus is expected to decrease slightly to $103.5 billion. Other key data will include inflation numbers, the Caixin services PMI, and the current account balance.

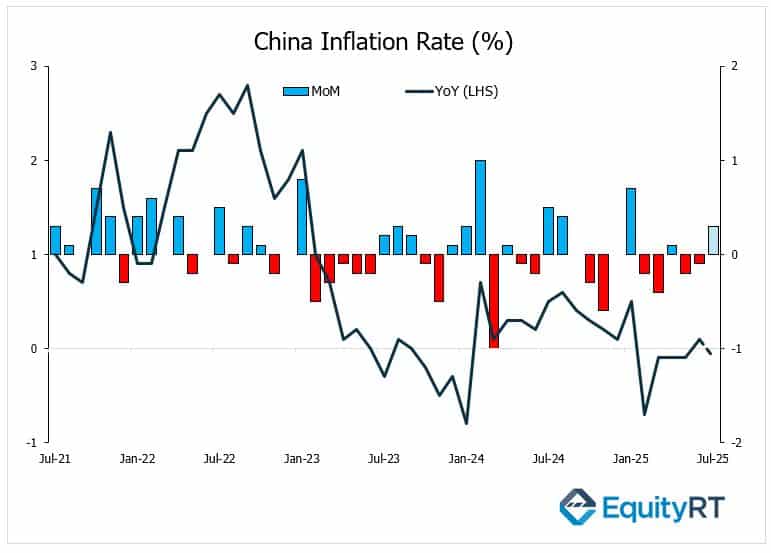

On Saturday, China will release its inflation rate for July 2025. In June, the Consumer Price Index (CPI) rose by 0.1% year-on-year, breaking a four-month streak of deflation. This modest increase was driven by a 0.1% rise in non-food prices, while food prices continued to decline, falling 0.3% year-on-year.

The Producer Price Index (PPI) contracted 3.6% year-on-year in June, marking the 33rd consecutive month of decline and the sharpest drop since July 2023. This ongoing deflation at the factory gate highlights persistent challenges, including overcapacity and weak domestic demand.

Analysts expect July’s CPI to remain subdued, with either a slight increase or little change. The PPI is forecasted to continue its downward trajectory, though possibly at a slower pace due to structural issues in the manufacturing sector. If deflationary pressures persist, the People’s Bank of China may consider additional monetary easing; however, any policy moves are likely to be cautious and dependent on incoming data.

Japan’s economic calendar features household spending, the Eco Watchers Survey, services PMI, and the minutes from the Bank of Japan’s latest meeting. India’s Reserve Bank is expected to hold interest rates steady at 5.5 percent.

In Australia, the trade surplus is likely to widen, while additional attention will be paid to household spending data and leading activity indicators.

Across the rest of Asia, inflation reports will be published by South Korea, the Philippines, Vietnam, Thailand, and Taiwan. Meanwhile, GDP figures are expected from both Indonesia and the Philippines.