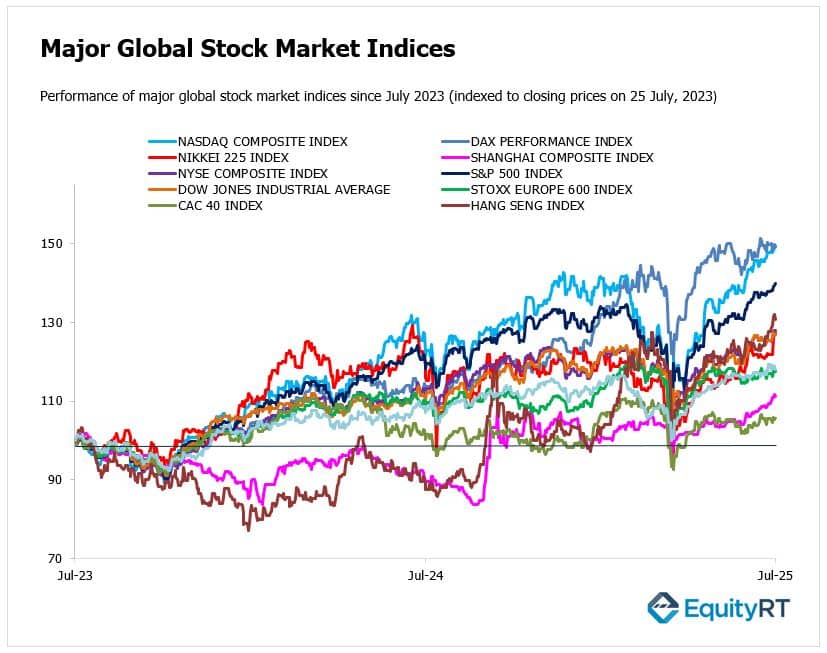

Global Stock Market Highlights

Last Friday, U.S. markets enjoyed broad-based gains fuelled by optimism over potential U.S.–EU trade progress and strong Q2 earnings.

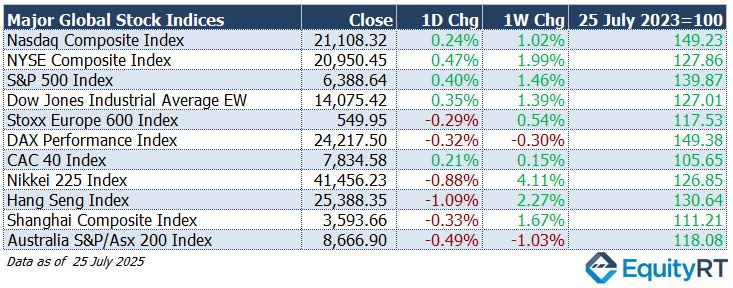

- Nasdaq Composite Index closed at 21,108.32, up 0.24% on the day and up 1.02% for the week.

- NYSE Composite Index closed at 20,950.45, up 0.47% on the day and up 1.99% for the week.

- S&P 500 Index closed at 6,388.64, up 0.40% on the day and up 1.46% for the week.

- Dow Jones Industrial Average EW closed at 14,075.42, up 0.35% on the day and up 1.39% for the week.

On Friday, in Europe, major benchmarks slipped modestly on concerns over earnings and trade uncertainty, though still held near weekly gains. U.S. President Trump announced that trade agreement talks with the European Union (EU) have been concluded. Under the deal, the U.S. will impose a 15% tariff on EU products, while the EU will not apply tariffs on U.S. goods and will fully open its markets to American products.

- Stoxx Europe 600 Index closed at 549.95, down 0.29% on the day but up 0.54% for the week.

- DAX Performance Index closed at 24,217.50, down 0.32% on the day and down 0.30% for the week.

- CAC 40 Index closed at 7,834.58, up 0.21% on the day and up 0.15% for the week.

In the Asia-Pacific region, markets closed lower, weighed down by Fed-related jitters and global risk-off sentiment, even as U.S. markets surged.

- Nikkei 225 Index closed at 41,456.23, down 0.88% on the day but went up 4.11% for the week.

- Hang Seng Index closed at 25,388.35, down 1.09% on the day but up 2.27% for the week.

- Shanghai Composite Index closed at 3,593.66, down 0.33% on the day but up 1.67% for the week.

- Australia S&P/ASX 200 Index closed at 8,666.90, down 0.49% on the day and down 1.03% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 97.67, up 0.19% on the day, but down 0.80% for the week and 9.94% year-to-date.

- The Brent crude oil, the global oil price benchmark, settled at $68.44 per barrel, down 1.07% on the day, 1.21% for the week, and 8.31% year-to-date.

- The Gold ended the session at $3,337.60 per ounce, declining 0.91% on the day and 0.40% for the week, but up 27.18% year-to-date.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, rose to 3.94%, up 0.90 basis points on the day, 6.00 basis points for the week, but down 31.20 basis points year-to-date.

- The 10-year U.S. Treasury yield, an indicator of long-term borrowing costs, fell to 4.39%, down 1.00 basis point on the day, 3.10 basis points for the week, and 18.40 basis points year-to-date.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

This week marks the height of the U.S. earnings season, with tech giants Microsoft, Meta, Apple, and Amazon in the spotlight. They’ll be joined by a wide range of high-profile names reporting results, including Boeing, PayPal, Spotify, Visa, Mastercard, UnitedHealth, Starbucks, Qualcomm, Ford, AbbVie, S&P Global, ExxonMobil, and Chevron.

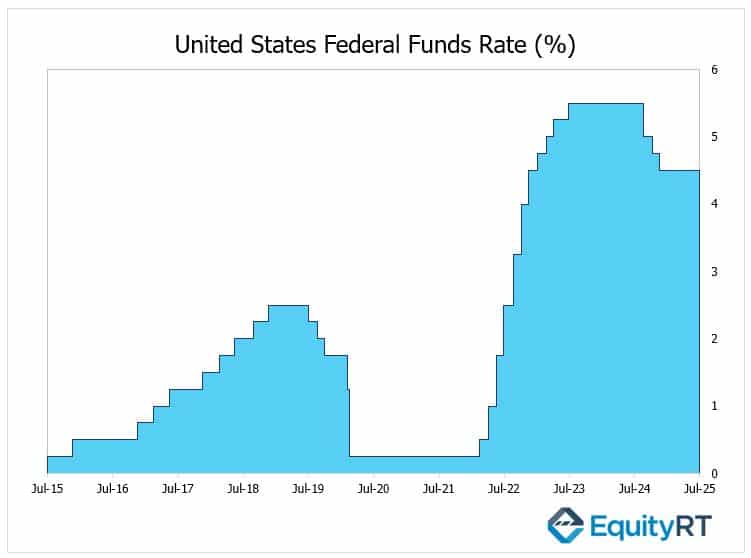

At its upcoming meeting on July 29–30, the Federal Open Market Committee (FOMC) is widely expected to keep the federal funds rate unchanged in the 4.25%–4.50% range. Market expectations suggest little chance of a rate cut this month. Despite mounting political pressure from President Trump for deeper rate reductions, along with criticism of Chair Powell, most Fed officials remain cautious and committed to a data-driven approach.

The Fed continues to stress patience as it assesses the outlook for inflation, particularly considering recent tariffs. While a rate cut is still seen as likely later in the year, possibly in September or December, the July meeting is expected to result in no change in policy.

Markets will also be closely watching the advance estimate of second-quarter GDP, which is projected to show a solid rebound to 2.5% growth following a 0.5% contraction in Q1.

The July jobs report is expected to point to cooling momentum in the labor market, with nonfarm payrolls forecast to rise by just 102,000, the slowest pace since February, and the unemployment rate likely to edge up to 4.2%.

The economic calendar is packed with other key indicators. The June PCE Price Index, a key gauge of inflation for the Fed, is expected to post a 0.3% monthly increase. Investors will also be tracking the ISM Manufacturing PMI for signs of industrial activity. Labor data will be further supplemented by the JOLTs job openings and ADP employment reports. On the trade and inventory front, markets await updates on the goods trade balance and wholesale inventories. Case-Shiller home prices and pending home sales will offer insight into housing trends. The employment cost index will provide a look at wage pressures, and regional business activity will be assessed through the Chicago and Dallas Fed Manufacturing Indexes.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

This week is set to be critical for European markets as investors digest a wave of high-impact data releases. The preliminary estimate for second-quarter GDP in the Euro Area is expected to reflect a stagnant economy. Germany, the region’s largest economy, is likely to report a 0.1% contraction, while modest growth in France (+0.1%), Italy (+0.2%), and Spain (+0.6%) may help offset the drag.

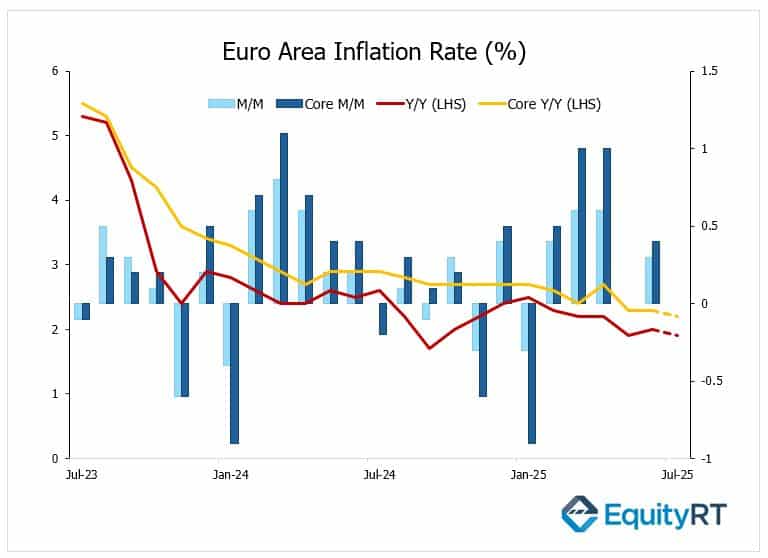

The flash estimate for July 2025 Euro Area inflation is set to be released on August 1. Although the precise figure is not yet known, flash estimates suggest inflation remains close to the European Central Bank’s (ECB) 2% target.

In June 2025, annual inflation in the Euro Area edged up to 2.0% from 1.9% in May, largely due to a 0.7% monthly rise in services prices, which pushed the year-on-year rate for services to 3.3%. This persistent strength in services inflation has contributed to the ECB’s cautious policy stance, even as overall inflation appears to be stabilizing around the target.

Looking ahead, policymakers broadly expect the July print to confirm that inflation is settling near the ECB’s desired range. While a slight drop below 2% is seen as possible, it would likely be temporary and not, on its own, sufficient to justify further interest rate cuts. ECB officials continue to emphasize that only a significant and unforeseen economic slowdown would prompt reconsideration of easing as early as September.

The unemployment rate in the Euro Area is forecast to hold steady at 6.3%. Germany and Italy are both expected to record unemployment rates of 6.4%, with Germany reaching a five-year high.

Retail sales figures from Germany and Italy will provide a gauge of consumer resilience, while manufacturing PMI data from Italy and Spain are expected to reflect the ongoing improvement in industrial conditions.

In the UK, attention will turn to the housing and retail sectors. Markets will closely monitor the latest mortgage approval figures, and the Nationwide house price index for fresh clues on consumer behavior and housing market dynamics.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

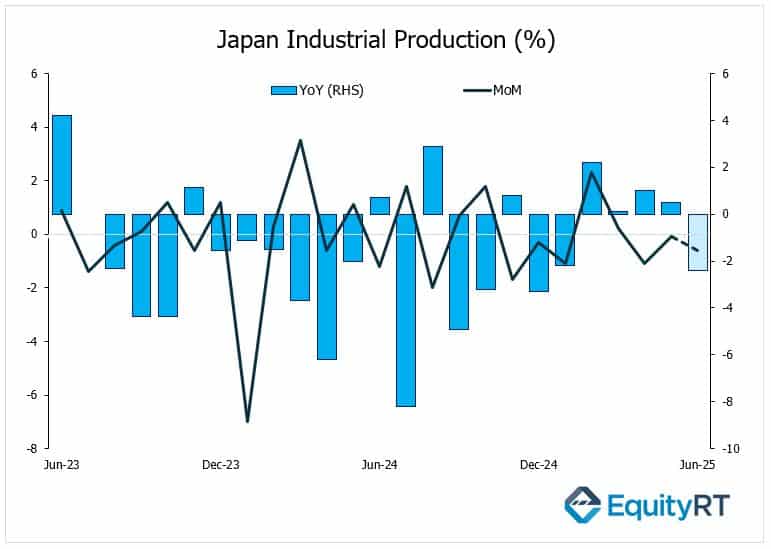

This week, market attention will turn to the Bank of Japan, which is broadly expected to maintain its current policy stance. A series of key economic indicators from Japan, such as industrial production, retail sales, consumer confidence, and the unemployment rate, will provide further insight into domestic conditions as the central bank continues to navigate its cautious policy path.

Japan’s industrial production for June 2025 is projected to decline by 0.7% month-over-month, following a slight decrease of 0.1% in May. The manufacturing PMI improved to 50.1, marking an end to a 13-month contraction, though it still reflects weak demand.

In China, the latest readings from the NBS Manufacturing and Non-Manufacturing PMIs, along with the Caixin Manufacturing PMI, are likely to confirm the persistence of sluggish momentum. Industrial profits will also be closely watched for any signs of stabilization amid ongoing structural pressures.

India is anticipated to show a modest improvement in its industrial output, with June’s growth expected to accelerate to 2.4%, up from 1.2% previously.

Australia’s Q2 inflation is projected to soften slightly to 2.2%, adding to expectations that price pressures are easing. Retail sales and private sector credit are forecast to expand by 0.2% and 0.5%, respectively, suggesting moderate consumer and lending activity.

Elsewhere in the Asia-Pacific region, investors will keep a close eye on trade figures from Hong Kong, South Korea, Indonesia, and the Philippines, as markets assess the broader impact of evolving US trade policy on regional exports. Preliminary GDP data from both Hong Kong and Taiwan will also be key to understanding the resilience of these economies in the face of external uncertainties.