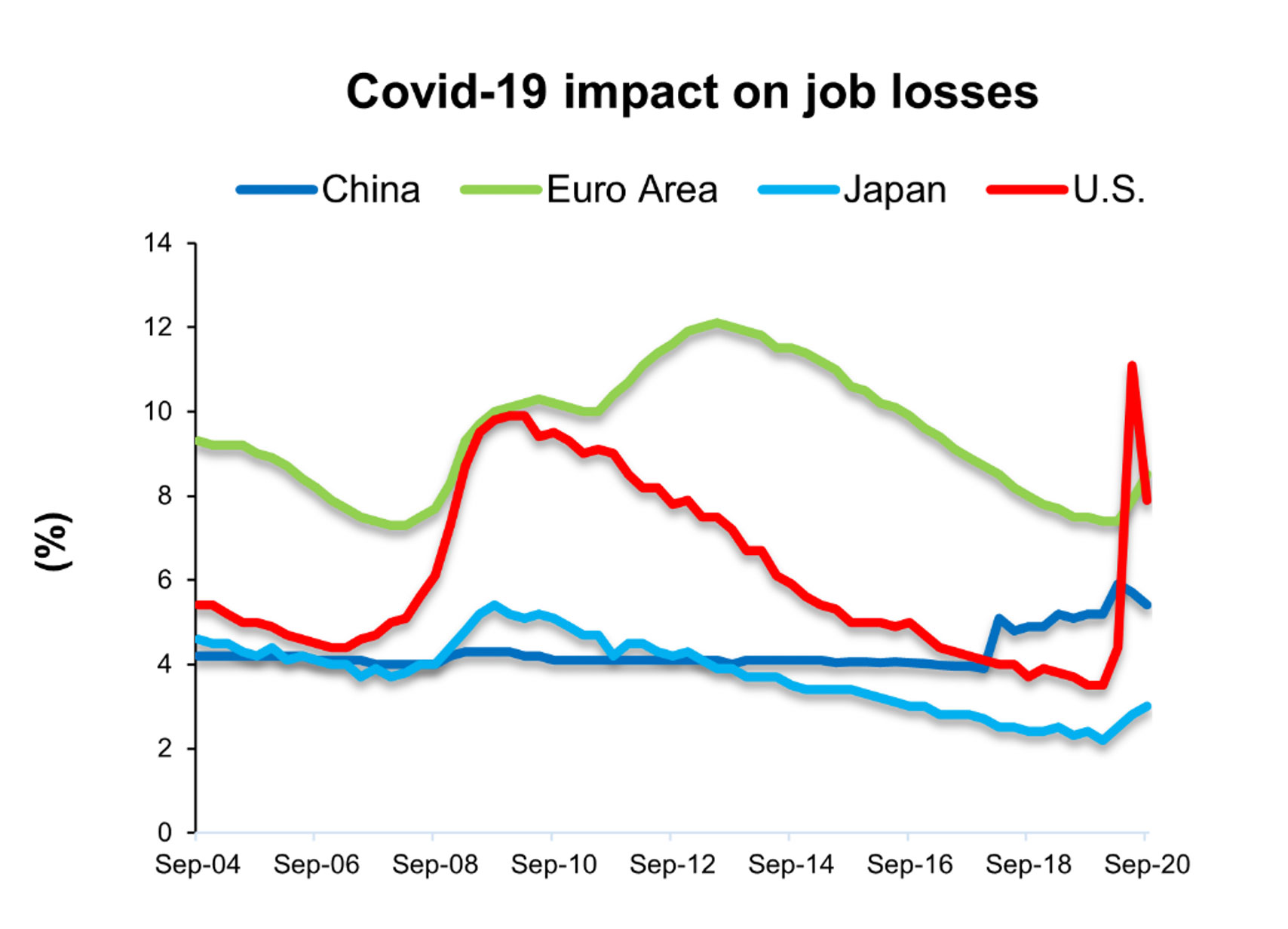

One of the most challenging years in modern history is finally over; leaving the world with serious political and social uncertainties that emerged due to the Covid-19 pandemic. Many countries were under strict lockdowns in 2020 against the spread of the Covid-19 which threatened social wellbeing, stalled economic activity in certain sectors, accelerated job losses, and pushed businesses toward bankruptcy.

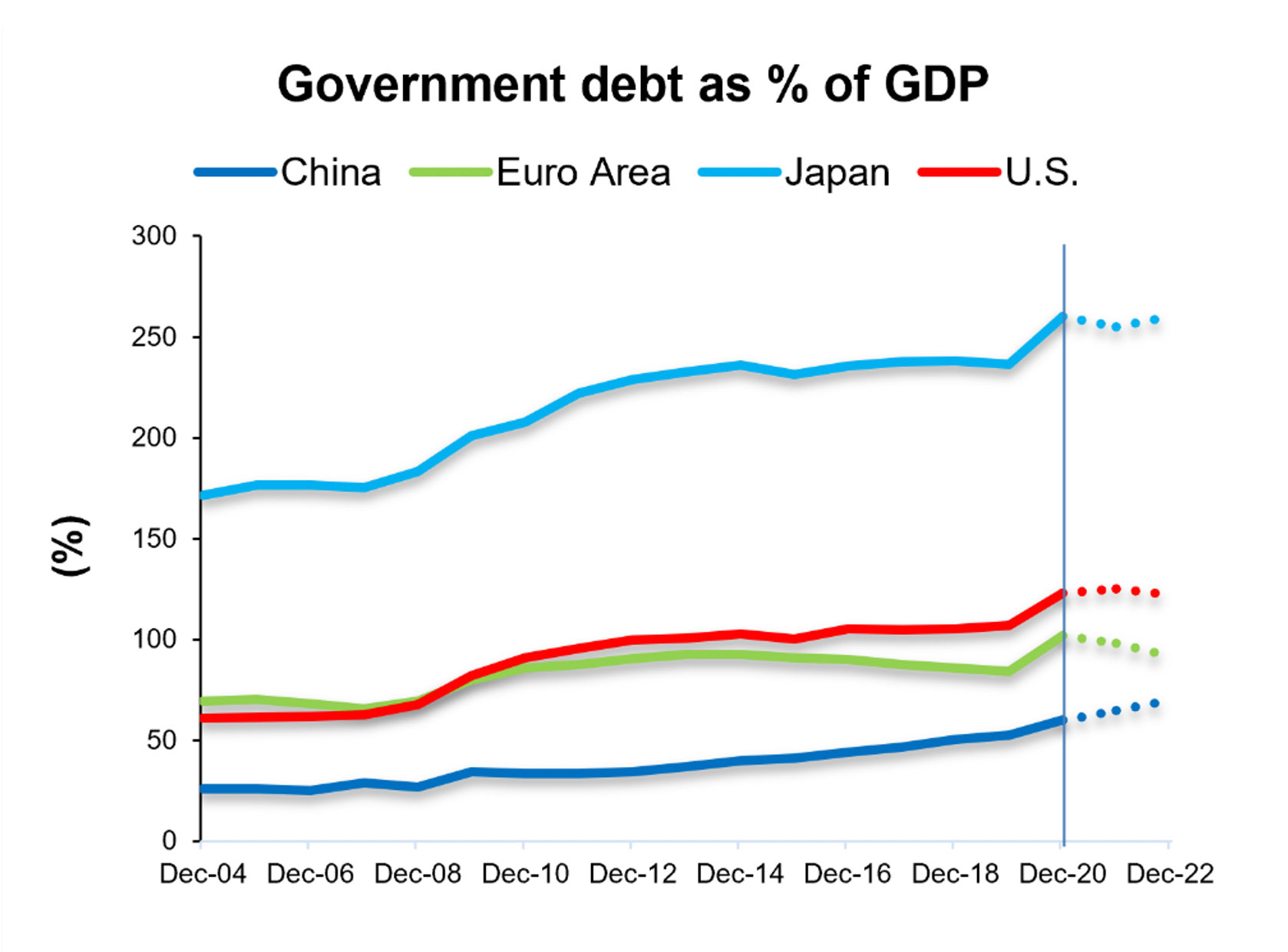

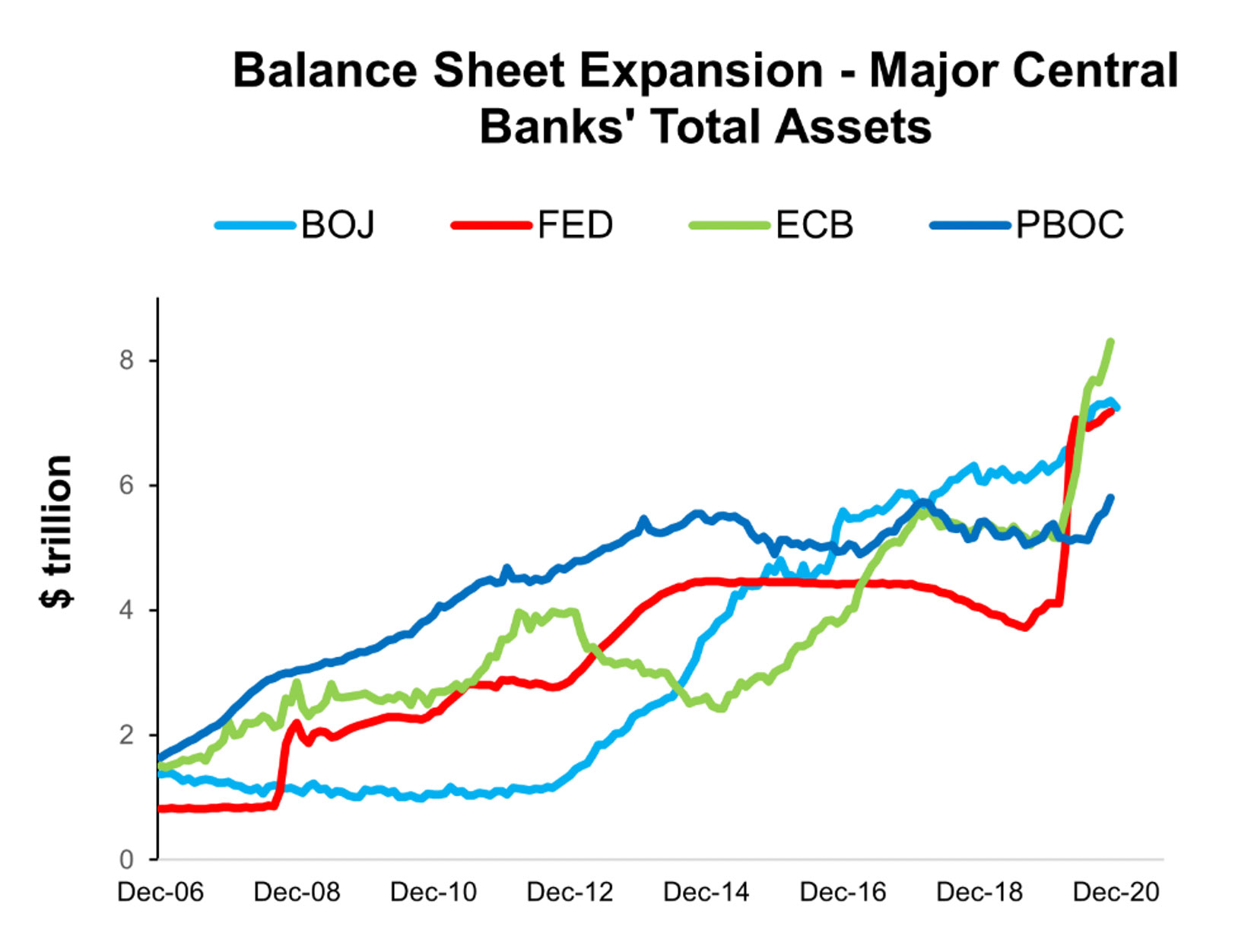

Governments launched massive stimulus packages, put in place numerous fiscal measures, and increased spending to mitigate at least some of the economic damage of the Covid-19 meanwhile central banks swiftly cut interest rates and introduced large-scale asset purchase programs. How governments will finance the widening budget deficit remains as a particular concern of 2021.

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

Uncertainties will not suddenly disappear with the arrival of the new year, nonetheless, the sentiment about medium-term growth forecasts seems to have improved as the rollout of coronavirus vaccines has brightened the global economic outlook.

While there has been much discussion over whether the recovery will take a V, W, U, or K shape, V-shaped economic recovery might be likely in 2021 with a rebound in these three factors: Private consumption, investments, and net exports.

China to lead the economic growth in 2021

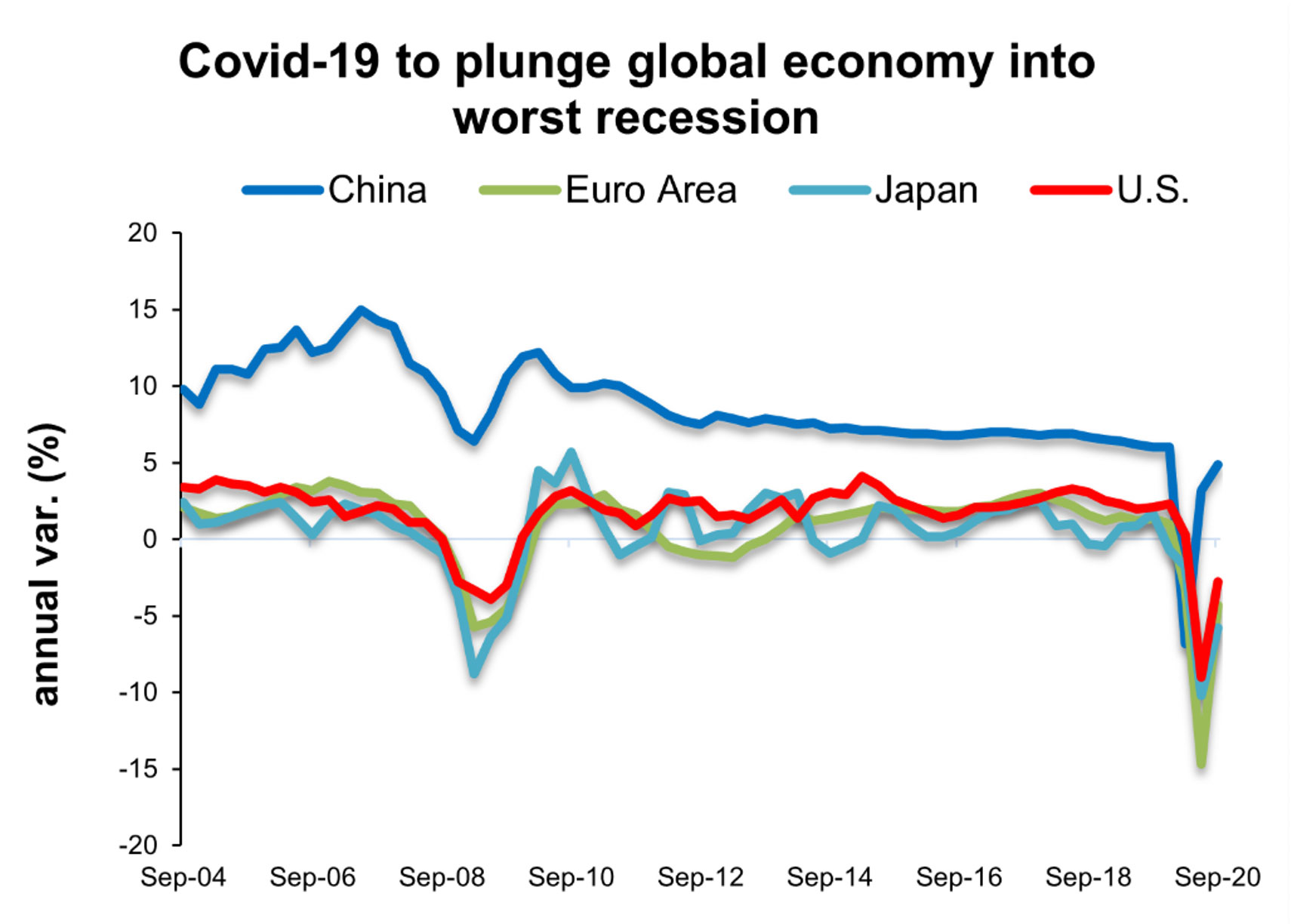

China, where the coronavirus first emerged, was successful in containing the spread of the Covid-19 pandemic in 2020 and staged an economic recovery earlier than other countries. Economic activity grew on the back of the manufacturing and services sectors by 3.2% year-on-year in Q2 after having fallen into negative territory (-6.8%) in Q1 2020. It advanced 4.9% from a year earlier in Q3 thanks to strong performances in exports and investments.

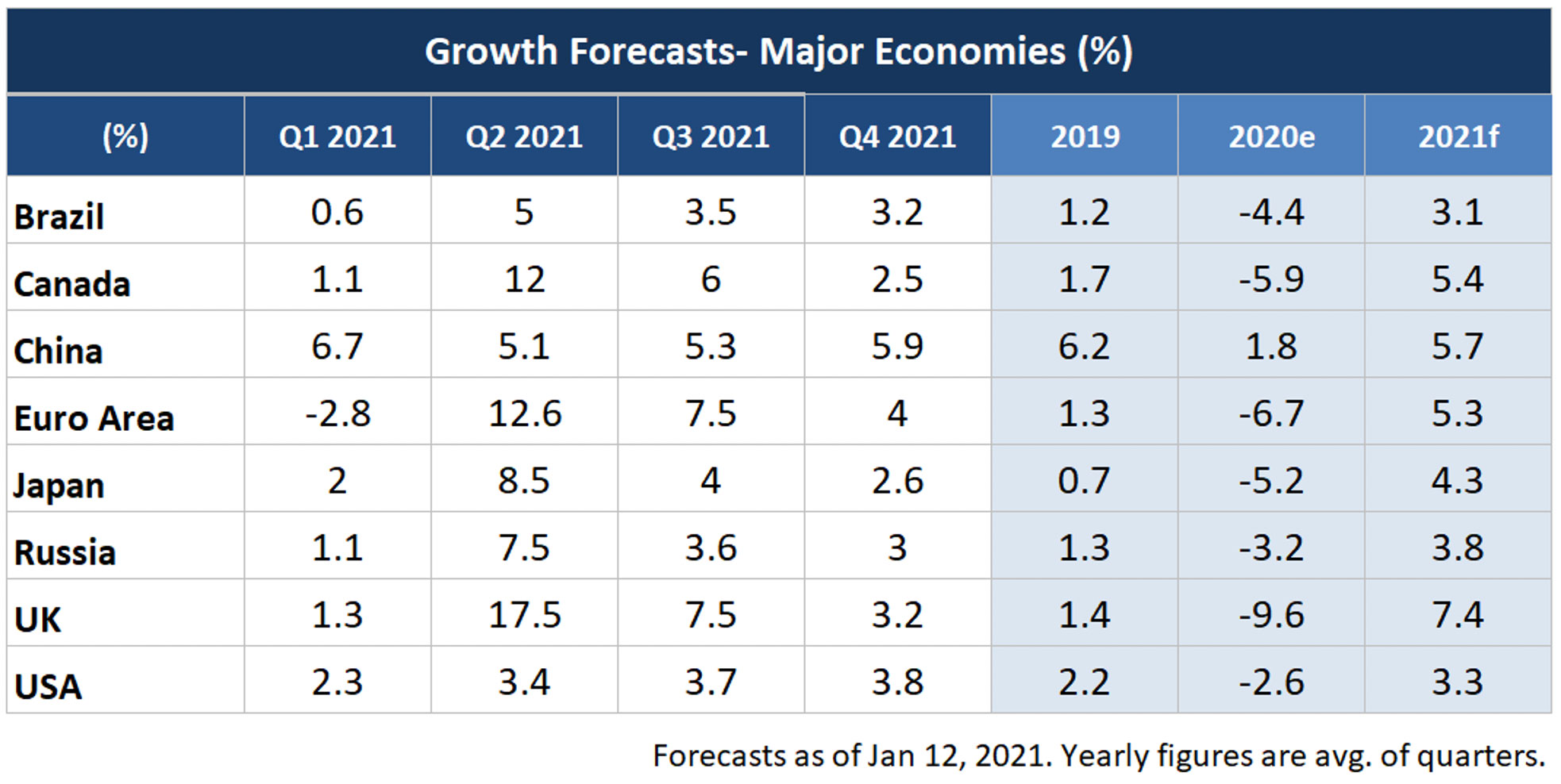

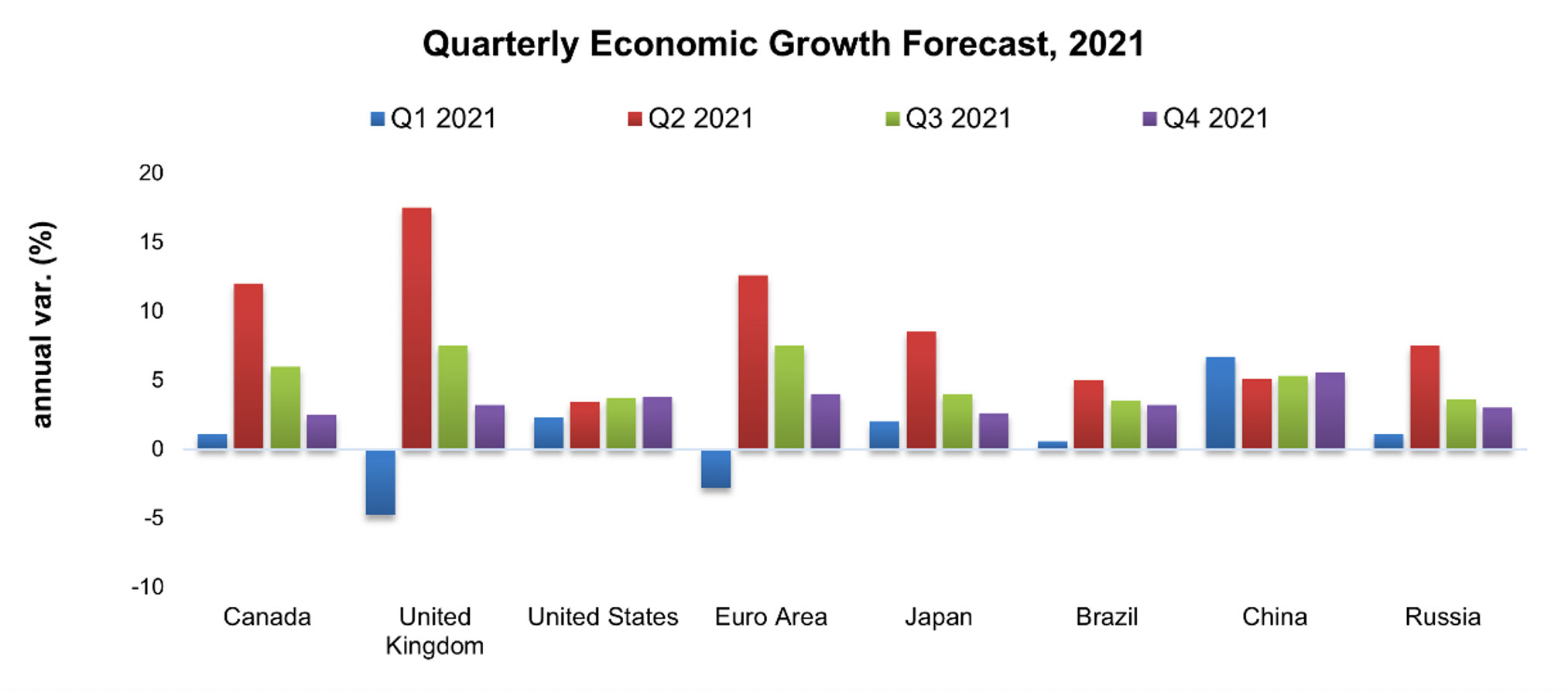

Economic expansion is expected to further accelerate to 5.9% year-on-year in Q4 2020 and close the year with 1.8% annual growth on average -making the country the first G20 economy that recovered from the pandemic with growth.

In 2021, the world’s second-largest economy is likely to grow 6.7% annually in Q1 and average to 5.7% in the full year of 2021. Global and domestic demand and credit availability via lower lending rates to businesses as well as tax cuts and lower interest rates will be the factors to sustain Chinese economic growth.

United States – Factors to determine the shape of the recovery in 2021

The Covid-19 pandemic created both public health and economic crisis in the United States. The economic impact has been largely turbulent, adversely affecting financial markets, labor markets, and industries.

The economy contracted by 5% at an annualized rate in Q1 2020, ending the longest economic expansion in its history. The GDP further shrank at a record-breaking 31.4% in Q2. Even after the third quarter’s rapid growth (33.4%) fueled by more than $3 trillion pandemic relief package, the growth estimates for the Q4 are mostly below a 5% rate.

The U.S. GDP growth is expected to slow by 2.6% in 2020 before expanding 3.3% in 2021. The stimulus package amounting to $900 billion will help aid the deteriorating economy but more spending will be needed during the year.

Factors to determine the shape of the recovery in 2021 will be the scale of the ongoing Covid-19 resurgence, the status of labor markets and consumer spending, size of monetary and fiscal stimulus, the promising news on vaccines, US-China trade tensions and effects on the consumer, and real sector confidence.

Euro Area – Economic activity to suffer a -6.7% drop in 2020 before a rise of 5.3% in 2021

Strong monetary policy response and fiscal stance put in place in March 2020 have avoided more devastating outcomes to the region’s economy. The growth performance (12.5%) in the three months to September (Q3) was much better, recovering from the steepest contraction of 3.7% in Q1 and an unprecedented slump of 11.7% in Q2.

Reimposing social restrictions in Europe set to finalize 2020 on a weak form. European economic contraction is forecast to be -6.7% in 2020 before rebounding by 5.3% in 2021.

Rising levels of public debt, global trade tension, and further social restrictions are the downside risks. Given its particularly deep recession in 2020, the Euro Area is unlikely to return to pre-pandemic levels of GDP until 2022.

Need access to global macro indicators to keep a pulse on the global economies? Please contact us at support@equityrt.com.

by Ozge Gurses I Macro Research at EquityRT

Source: National sources, Trading Economics forecasts via EquityRT