While economic turbulence has affected countries worldwide, the United States is notably on an upward trajectory. Surprisingly, it continues to exhibit a strong labor market, positive GDP growth, and stable economic performance with improved asset prices, despite global challenges.

Supporting Factors in the U.S. Economy: Labor, Growth Rate, and Fiscal Incentives

As quantitative easing came to an end, factors such as high commodity pricing and stagflation concerns, influenced by the pandemic and the conflict in Ukraine, were prevalent. Nonetheless, the U.S. economy has rebounded from adverse effects more swiftly, attributing its progress to three primary factors: fiscal incentives, GDP growth rate, and the labor market.

Momentum in Personal Consumption Expenditure Supports Growth

First and foremost, substantial fiscal incentives post-pandemic set the United States apart from Europe. Additionally, significant laws, such as the “Inflation Reduction Act” and the “Chip Act,” have triggered a significant boost in demand and consumption. Investment in manufacturing and construction sectors has almost doubled in recent years, and supply chain issues have eased. Consumers have moved beyond the economic slowdown during the pandemic and are now actively spending. This upswing in consumer spending, bolstered by substantial social assistance payments and income support, is a phenomenon unique to the United States and has emerged as a pivotal factor in explaining the contributions of American consumers to economic growth. In the U.S., the Personal Consumption Expenditure Price Index (PCE) has experienced a substantial annual increase, reaching its highest point in months.

All the information you need in one place. Add EquityRT in your toolkit for quality investment reaserch.

Divergence from Other Countries in Terms of U.S. GDP Growth Rate

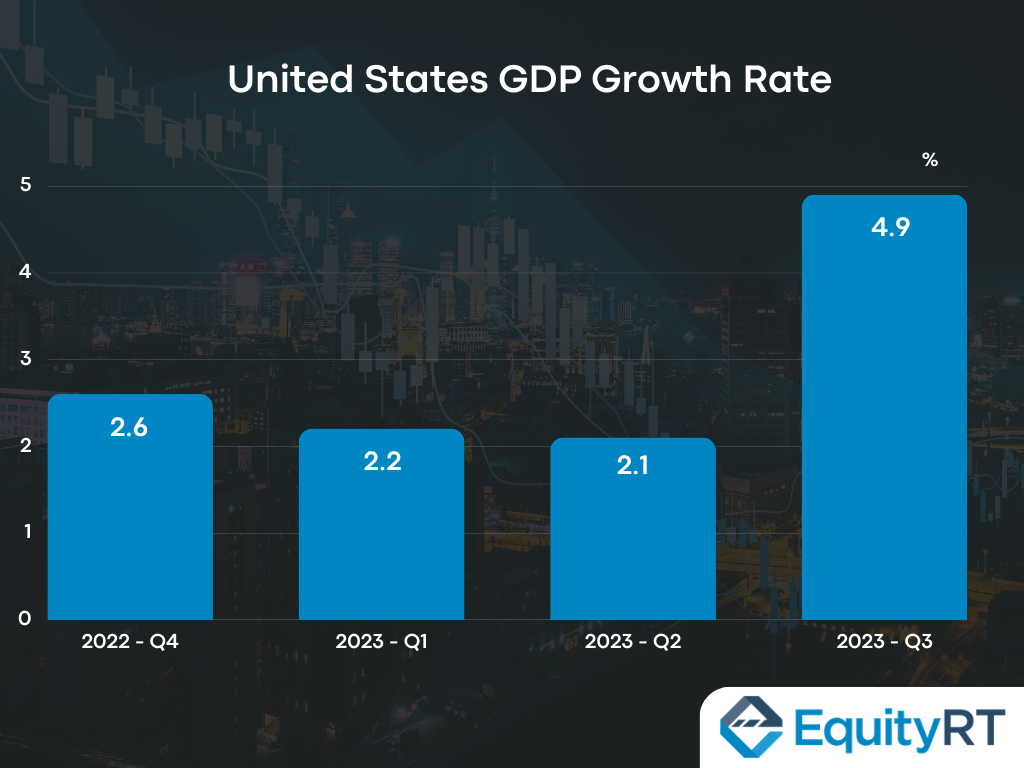

The U.S. economy saw a robust annualized growth of 4.9% in the third quarter of 2023, the highest since the final quarter of 2021, surpassing market expectations of 4.3% and a 2.1% expansion in the second quarter. This stands in stark contrast to other regions like the Eurozone, Japan, and the United Kingdom, which are grappling with challenges in terms of GDP growth.

The Labor Market in the United States is Resilient Despite a Slower Job Growth

The reason for the United States’ superior position compared to other countries is its labor market. Despite interest rate hikes, the U.S. labor market remains strong.

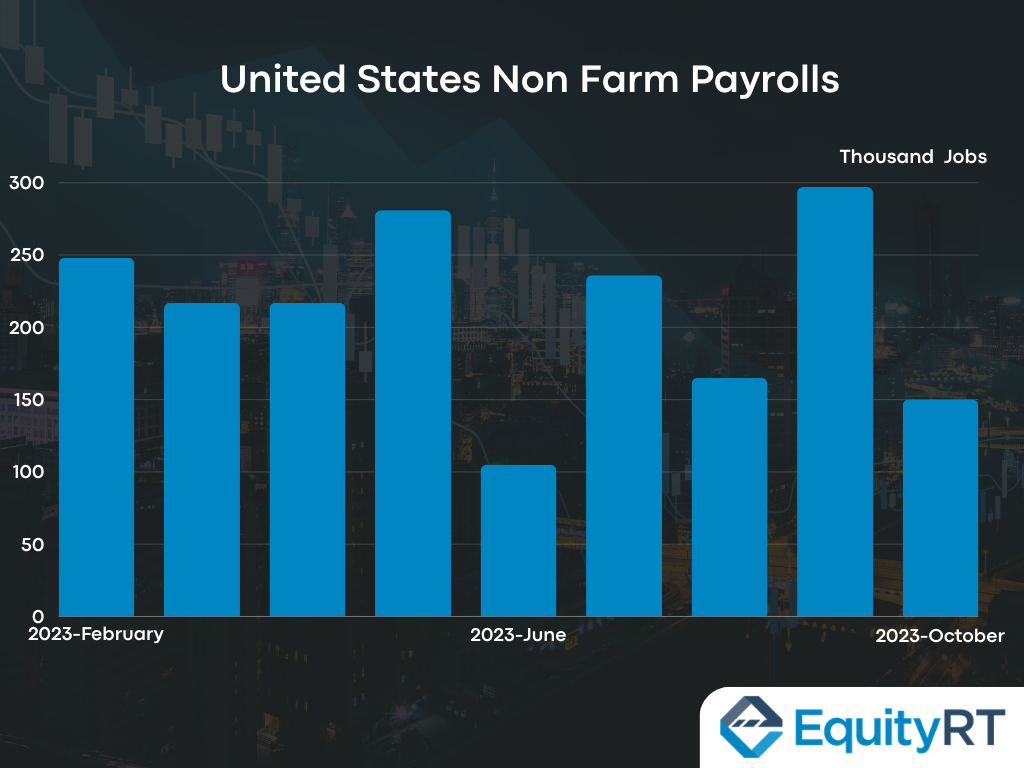

According to the latest data from the U.S. Department of Labor, non-farm employment in October 2023 below market expectations with a 150,000 increase and lower than the expected 180,000. in October 2023, employers across the United States reduced their pace of hiring, adding a moderate yet still satisfactory 150,000 jobs. This suggests that the labor market could be cooling down, but it remains robust, even in the face of elevated interest rates that have increased borrowing costs for both businesses and consumers.

While job growth in the previous month significantly declined from the strong 297,000 increase in September, it still indicates that numerous companies have a desire to hire, highlighting the continued strength of the economy.

The number of Americans filing for unemployment benefits rose by 5,000 to 217,000 in the week ending October 28, slightly above the expected 210,000. However, this figure remains close to the nine-month low observed two weeks ago, indicating a tight U.S. labor market. This aligns with the Federal Reserve’s perspective that interest rates will stay elevated for a while. On the other hand, ongoing unemployment claims increased to 1,818,000, the highest since mid-April and above the anticipated 1,800,000. This indicates that it’s taking longer for unemployed individuals to secure new employment.

The unemployment rate climbed to 3.9% in October, slightly exceeding market expectations and the previous month’s 3.8%. This represents the highest jobless rate since January 2022, with the number of unemployed individuals increasing by 146,000 to 6.51 million, while the count of employed individuals decreased by 348,000 to 161.2 million.

In terms of wage growth, monthly earnings increased by 0.2%, just below the expected 0.3%, marking the lowest level since February 2022. The annual wage growth rate also dipped from 4.3% to 4.1%, the lowest since June 2021. These wage figures suggest a slowdown in inflation pressures related to wages.

What Does the Strong Growth Rate Indicate?

Beyond these considerations, the Federal Reserve has underscored the trade-off between restraining inflation and sacrificing growth, leading to the implementation of tightening policies. Nevertheless, the anticipated strong trajectory for the third quarter signals a swift pace of expansion, prompting questions about the Fed’s battle against inflation. To resolve this conundrum, it is essential to delve into the factors behind the unexpectedly high GDP growth rate.

If this robust growth can be attributed to enhancements in supply conditions, such as favorable labor market trends and heightened productivity, it may not trigger inflationary pressures, potentially obviating the need for further tightening. However, global dynamics impact individual economies differently, and each nation’s economic response to these challenges is distinct. This scenario opens the door for a fresh post-neoliberal growth model for the United States, underpinned by GDP momentum propelled by employment.